X

X empire price

$0.000050380

+$0.00000

(-6.60%)

Price change from 00:00 UTC until now

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

X empire market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

24h high

$0.000056490

24h low

$0.000050330

All-time high

$0.00060000

-91.61% (-$0.00055)

Last updated: Nov 11, 2024, (UTC+8)

All-time low

$0.000032500

+55.01% (+$0.000017880)

Last updated: Nov 4, 2024, (UTC+8)

How are you feeling about X today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

X empire Feed

The following content is sourced from .

andrew.moh

Build easier and smarter on @Neo_Blockchain.

Neo N3 supports any language you prefer: C#, Python, Java, Go, JS, and more.

Why does multi-language support matter?

+ Onboarding Web2 developers unfamiliar with Solidity

+ Bridging the gap between Web2 and Web3 products

+ Reducing code complexity

Who is this for? Almost any builder with basic coding experience.

Neo is breaking barriers ➜ More projects coming ➜ Big party for users.

Neo eco is at its golden hour.

Find your place at:

Neo

Neo X is EVM… reinvented. Same tools. Fairer rules.

EVM dominates for a reason: massive user base, mature tooling, and a thriving ecosystem.

But is compatibility enough?

Neo X says no.

We went further, asking: “What do EVM developers actually need?”

Then we rebuild the experience from the ground up. ↓

1.93K

1

Ritesh

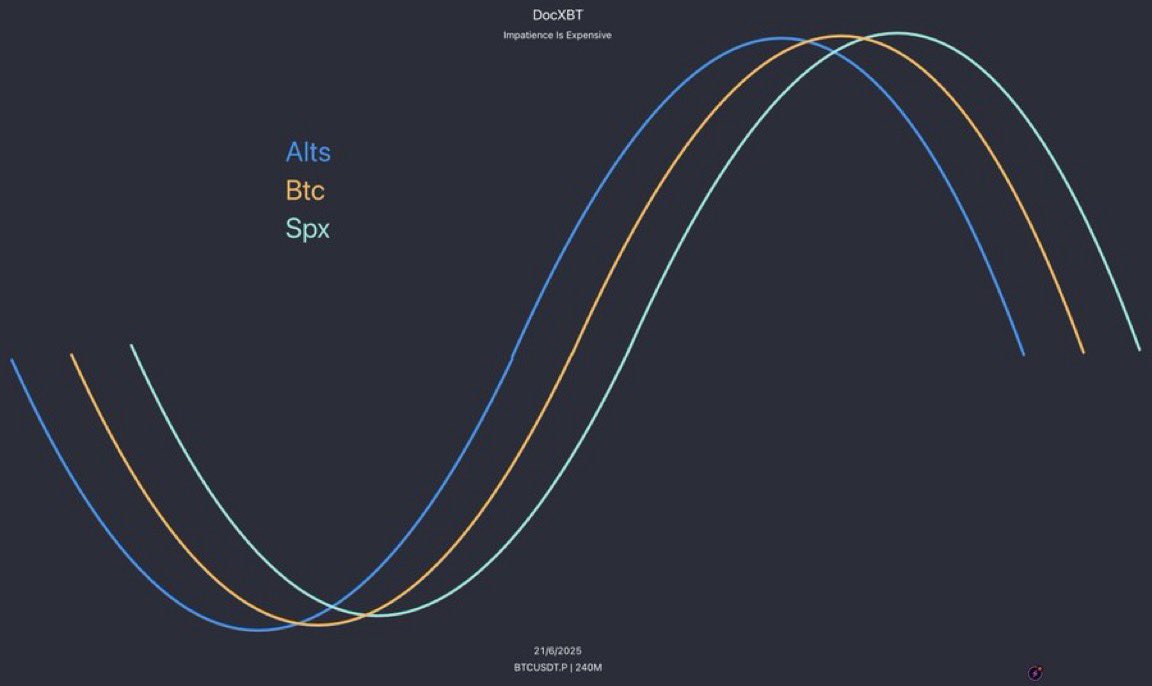

Prolly one of the greatest tweet regarding crypto this year

Let me dumb down to you guys

For the people who wants entry tp sl coz this entire space is filled with this

Whenever btc ranges wait

Whenever random alts pump wait

Whenever significant alt pumps with huge mindshare (ofcourse not your bags retards , some big memecoin or major ) then watch the price action

If they are doing higher low higher high with btc doing lower high and lower low then keep them in watchlist, filter what alts are doing the same

If btc breaking the trend then bid that alt --> that alt which showed strength which you monitored should never revisit h4 trend , previous range high which it broken out , should never give easy entry , people here asking what's the next x , imbalance leaving like a chad

Bid that fucking coin with all your portfolio

Exit when parabola ends

Cheers

Hash_C

Market Selloff Dynamics + Bottoming

The goal of this write up is to give you a bit of insight on how I spot HTF pivot points in markets. We want to understand the psychology behind risk unwinding and use that to our advantage to potentially spot bottoms.

1. Low Conviction Sells First

- When uncertainty hits, sellers dump what they least desire i.e., lower conviction coins will top first and bleed early.

- Think about it logically. If you're in a pinch and needed cash irl, you're not going to sell your prized possessions, you're gunna sell the crap you never use.

- Likewise, traders will sell what they’re least emotionally invested in to build cash when uncertain or want to decrease risk.

- It’s not a coincidence that this has happened every HTF top this cycle. Alts don't rally after, they rally during. They also top weeks before BTC even shows an ounce of weakness.

- It’s an early warning. Smart traders de-risk before the crowd even knows what's happening.

2. Risk vs. Quality

- Let's go back to the earlier metaphor. People will hold onto their quality prized possessions for as long as they possibly can. It's not until they're desperate that they will part with them.

- The most desirable coins, more often than not, will attempt to hold their gains for as long as possible. This is why BTC always looks fine and you see dozens of "Why is everyone panicking, BTC looks great" tweets weeks before sell offs.

In selloffs:

a) Junk sells early

b) Quality sells late

c) Everything sells eventually

Watch the order of events. It’s a map of stress flow.

3. Reflexivity Kicks In

- Early weakness causes more weakness.

- Once a whale starts to unload into exhausted demand they begin to induce weakness. Classic signs of distribution, absorption, exhaustion, trend loss etc.

- A character shift in a risk asset will make the first order of experienced traders reassess.

- "I didn't sell top, but the character of the trend has shifted. Time to reduce exposure/close"

- “If this is nuking, what else am I exposed to?”

Suddenly:

Rebalancing triggers more selling

This is reflexivity.

A feedback loop of diminishing risk appetite.

4. Volatility: The Dance

Before many big selloffs in BTC, markets go quiet. Volatility drops. Trends become ranges. Complacency peaks.

Then, boom.

Let's talk a bit about balance and imbalance.

- Balance is achieved once the market begins to agree on what's expensive and what's cheap. It's a dance. Equilibrium.

- Equilibrium is calm. What's known is known. Speculation diminishes. Volatility compresses.

- The dance continues until one party gets bored, tired or wants to go to the bar to get another drink. i.e. buyers or sellers get exhausted; changes to supply/demand.

- Equilibrium is damaged- and once it breaks: Imbalance.

- Price displaces violently. Value becomes unclear; volatility explodes. The market craves balance and will actively seek it.

- Price often returns to areas where recent balance was formed- hvn, orderblock, composite value etc.

- This is where you get the sharpest bounces.

"First test, best test"

- Subsequent tests will provide diminishing reactions. Things become structural. Price accepts its new home. Volatility compresses. Balance is found once again.

5. The Flow of a Selloff & Spotting Bottoms

Capitulation isn’t the beginning of the end; it’s the end of the middle.

a) Alts vs. Bitcoin

- This cycle alts often do the bulk of their selling before BTC capitulates.

- Recent example: Fartcoin sold off 88% from its top before the late February BTC capitulation. Since this is true, we can begin to use it as an edge when looking for exhaustion (bottoming)

- The strongest alts will begin to show relative strength (exhaustion) earlier as BTC is still being hyper-volatile and looking for new balance.

- In order words, look for good alts to begin to achieve balance as BTC is in the later stages of imbalance.

8.62K

15

X empire price performance in USD

The current price of X empire is $0.000050380. Since 00:00 UTC, X empire has decreased by -6.60%. It currently has a circulating supply of 0 X and a maximum supply of 0 X, giving it a fully diluted market cap of $0.00. At present, X empire holds the 0 position in market cap rankings. The X empire/USD price is updated in real-time.

Today

+$0.00000

-6.60%

7 days

-$0.00001

-14.31%

30 days

-$0.00004

-45.59%

3 months

-$0.00003

-40.16%

Popular X empire conversions

Last updated: 06/23/2025, 00:57

| 1 X to USD | $0.000050290 |

| 1 X to EUR | €0.000043640 |

| 1 X to PHP | ₱0.0028752 |

| 1 X to IDR | Rp 0.82564 |

| 1 X to GBP | £0.000037370 |

| 1 X to CAD | $0.000069060 |

| 1 X to AED | AED 0.00018469 |

| 1 X to VND | ₫1.3141 |

About X empire (X)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Learn more about X empire (X)

From Poverty to a $100M Empire. The Rise of Korea’s Top Crypto Trader

For years, the industry has been overshadowed by headlines of scams, rug pulls, and volatility. But behind the charts and the chaos are real people —individuals who have changed for the better through discipline, resilience, and the opportunities that crypto made possible. That’s what Stop Loss was built to spotlight. A where we go beyond profit screenshots and PnL flexing—into the hearts and minds of the traders who made it out of struggle, not just into profit, but into purpose.

May 30, 2025|OKX|

Beginners

X empire Launch: What's Driving the Hype Behind X

X Empire Hype: A Deep Dive into the X Empire Launch and Its Blockchain Innovation The cryptocurrency world is abuzz with the X empire hype , a token that has captured the attention of blockchain enthusiasts and gamers alike. As part of a revolutionary Tap-to-earn game on Telegram, X Empire combines blockchain innovation , artificial intelligence, and user-generated content to create a seamless entry into the Web3 ecosystem. This article explores the X empire launch , its unique features, and why it is being hailed as one of the trending tokens 2025 .

Mar 13, 2025|OKX

Is X empire Legit? A look at whether X is real or a scam

Is X Empire Legit? Exploring the Tokenomics and Community of X Empire X Empire has been making waves as a Tap-to-Earn game on Telegram, combining blockchain, AI, and user-generated content to create a unique Web3 experience. But is X Empire legit? This article delves into the background, economic model, and community engagement of X Empire to provide a comprehensive overview of this innovative project.

Feb 18, 2025|OKX

How to buy X empire X on CEX?

How to Buy X on CEX: Exploring X Empire's Innovative Tap-to-Earn Game X Empire is revolutionizing the gaming and blockchain space with its unique Tap-to-Earn game on Telegram. By combining AI, blockchain, and user-generated content, X Empire offers players an engaging way to earn in-game tokens that can be converted into $X tokens. This article will guide you through the essential details about X Empire, including when and where $X is listed, and how to buy X on CEX.

Feb 17, 2025|OKX

X empire FAQ

What is X Empire?

X Empire is a tap-to-earn Telegram mini-game where players build an empire to become billionaires. It launched in July 2024 on the TON ecosystem, and was originally called “Musk Empire”.

How do I earn X tokens in X Empire?

You earn X tokens by completing daily mini-games like virtual stock market investments and quests. You can also boost your skills to increase profits and unlock new game features.

What are X token vouchers?

X token vouchers are NFTs worth 69,000 X tokens. Launched in September 2024, they're traded on TON's GetGems.io marketplace.

When is the X token airdrop, and how do I qualify?

The X token is in its 'Chill Phase' following the completion of the first phase, with a Token Generation Event (TGE) on the horizon. X Empire also announced the airdrop will be happening on October 24, 2024. This event will reward the most loyal players based on several key factors.

To qualify, players need to focus on inviting friends to join the game — both the number and the engagement level of these friends will influence their chances. Additionally, players who have a higher profit per hour in the game, regularly complete quests, and actively level up their empire, will be rewarded.

Beyond in-game achievements, other criteria include connecting your wallet to the game and performing transactions on the TON blockchain. Making in-game purchases or donations can also boost your eligibility. Finally, having a Telegram Premium account can offer extra points towards qualifying for the airdrop.

OKX Code: What year was the OKX exchange established?

2017

OKX Code: When did OKX officially launch the VARA-licensed crypto exchange in Dubai?

20241010

OKX Code: In OKX 23rd Proof of Reserves snapshot, how many USDT are there in OKX account assets?

5862786772

OKX Code: How many employees does OKX have?

4800

OKX Code: As of July 2024, how many blockchains does the OKX web3 wallet support?

100

OKX Code: In what year did OKX sign a sponsorship deal with McLaren as a primary partner?

2022

How much is 1 X empire worth today?

Currently, one X empire is worth $0.000050380. For answers and insight into X empire's price action, you're in the right place. Explore the latest X empire charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as X empire, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as X empire have been created as well.

Will the price of X empire go up today?

Check out our X empire price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

ESG Disclosure

ESG (Environmental, Social, and Governance) regulations for crypto assets aim to address their environmental impact (e.g., energy-intensive mining), promote transparency, and ensure ethical governance practices to align the crypto industry with broader sustainability and societal goals. These regulations encourage compliance with standards that mitigate risks and foster trust in digital assets.

Asset details

Name

OKcoin Europe LTD

Relevant legal entity identifier

54930069NLWEIGLHXU42

Name of the crypto-asset

x_empire

Consensus Mechanism

Toncoin utilizes a Proof of Stake (PoS) model with the Catchain consensus algorithm to provide a secure, scalable, and efficient multi-chain environment. Core Components of Toncoin’s Consensus: 1. Proof of Stake (PoS) with Validators: Validator Role: Validators are required to stake Toncoin to participate in consensus. They validate transactions and secure the network by processing blocks and maintaining network integrity. 2. Catchain Consensus Algorithm: High Scalability and Speed: The Catchain consensus protocol is specifically designed for Toncoin’s multi-chain architecture, optimizing for fast and scalable operations across multiple shards. Multi-Chain Compatibility: Catchain supports a sharded environment, allowing different chains (or shards) to reach consensus efficiently. This approach enhances the network’s ability to process a high volume of transactions in parallel. 3. Byzantine Fault Tolerance (BFT): Fault Tolerance: The Catchain protocol is Byzantine Fault Tolerant (BFT), meaning it can tolerate some level of malicious or faulty behavior among validators. This BFT compliance ensures that the network remains secure and functional even when a minority of validators act maliciously. 4. Validator Rotation and Slashing: Regular Rotation: Validators are rotated regularly to enhance decentralization and security. This system prevents any single validator or group from maintaining control over consensus indefinitely. Slashing for Malicious Behavior: Validators who act maliciously or fail to perform their duties may be penalized through slashing, losing a portion of their staked Toncoin. This discourages dishonest behavior and promotes reliable network participation.

Incentive Mechanisms and Applicable Fees

Toncoin incentivizes network security, participation, and efficiency through staking rewards, transaction fees, and slashing penalties. Incentive Mechanisms: 1. Staking Rewards for Validators: Rewards for Securing the Network: Validators earn staking rewards for actively participating in the network’s consensus process and ensuring its security. These rewards are provided in Toncoin and are proportional to each validator’s staked amount, encouraging validators to maintain their roles responsibly. 2. Transaction Fees: Ongoing Income for Validators: Validators also receive a share of transaction fees from the blocks they validate, providing a consistent reward that grows with network usage. This additional income incentivizes validators to process transactions accurately and efficiently. 3. Decentralization through Validator Rotation: Fair and Balanced Participation: The frequent rotation of validators ensures that new participants can join the validator set, promoting decentralization and preventing monopolization of the network by a small group of validators. 4. Slashing Mechanism: Penalties for Dishonest Behavior: To maintain security, Toncoin enforces a slashing mechanism that penalizes validators who act maliciously or fail to fulfill their duties. This risk of losing staked Toncoin encourages validators to behave honestly and fulfill their responsibilities. Applicable Fees: Transaction Fees: Transaction fees on the TON blockchain are paid in Toncoin. These fees vary based on transaction complexity and network demand, ensuring that validators are compensated for their work and that resources are efficiently utilized.

Beginning of the period to which the disclosure relates

2024-04-20

End of the period to which the disclosure relates

2025-04-20

Energy report

Energy consumption

1376.25075 (kWh/a)

Energy consumption sources and methodologies

The energy consumption of this asset is aggregated across multiple components:

To determine the energy consumption of a token, the energy consumption of the network(s) toncoin is calculated first. Based on the crypto asset's gas consumption per network, the share of the total consumption of the respective network that is assigned to this asset is defined. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation.