This token isn’t available on the OKX Exchange.

USDT

USDTea price

AgLfYh...a132

$0.00051362

+$0.00025344

(+97.41%)

Price change for the last 24 hours

How are you feeling about USDT today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

USDT market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$492,191.77

Network

Solana

Circulating supply

999,999,918 USDT

Token holders

219

Liquidity

$48,670.33

1h volume

$5.80M

4h volume

$6.21M

24h volume

$6.21M

USDTea Feed

The following content is sourced from .

MEJ毛毛姐

As an old user who started using TRON from its early days, I have witnessed this chain evolve from its initial attempts to becoming one of the largest stablecoin settlement networks in the world. I just want to say one thing:

I am honored to have been here all along.

I still remember the early days when I bought TRX to engage with memes on the chain, when no one knew how far this chain could go. At that time, TRON was not recognized by the mainstream, and its ecosystem was far less rich than it is now. But it was this rhythm of "not waiting for others, not relying on hype" that made me see its unique value—a chain truly born for users and use cases.

Today's TRON:

✿ A low-cost network supported by TRX

✿ The main circulation of USDT stablecoin in the middle

✿ A flourishing developer ecosystem, cross-border payments, DeFi, and RWA at the bottom

It is no longer the "small public chain chasing trends" it once was, but a solid financial infrastructure system that is beating time.

On this seventh Independence Day, besides feeling emotional, I am more grateful.

🙏 Thank you @justinsuntron Justin Sun for always being at the forefront of promoting TRON over the years, from on-chain efficiency and asset circulation to its upcoming listing, bringing TRON to a whole new height.

This is not just storytelling or concept creation; it is the result of countless transactions, numerous upgrades, and the joint efforts of countless developers and users.

I am very proud and fortunate to have transformed from one of the first users into a true witness.

Seven years, walking together all the way.

Looking forward to the next seven years, with TRON still running, and I still by its side.

@justinsuntron @trondao @trondaoCN #TRON #TRONEcoStar

TRON DAO中文

🥳7 is the steadfast belief in working together, as well as the magnificent momentum that sweeps through the sky.

Independence Day is the declaration of the official launch of the TRON mainnet, and it is also the singularity of consensus within the TRON community.

In the 7-year journey, TRON has built a brand new on-chain world together with over 300 million users, a global financial infrastructure based on blockchain.

🥂Cheers to the 7 years we have walked together!

#TRONIndependenceDay7thAnniversary #TRON

336

0

Conor Ryder

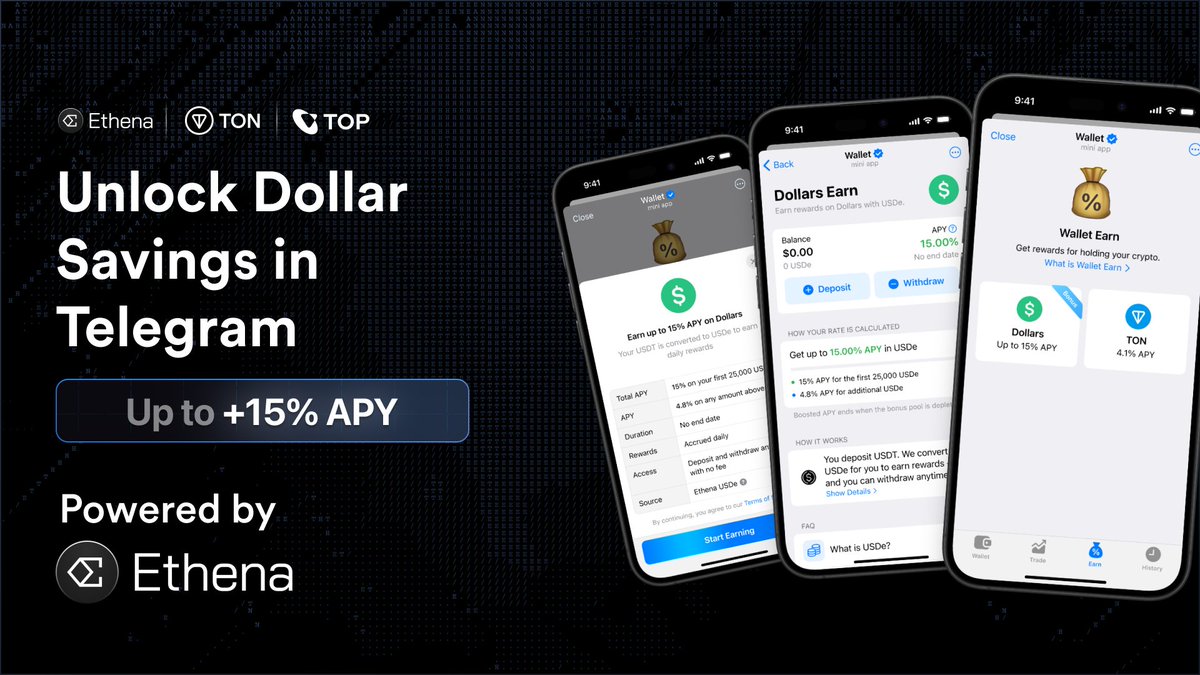

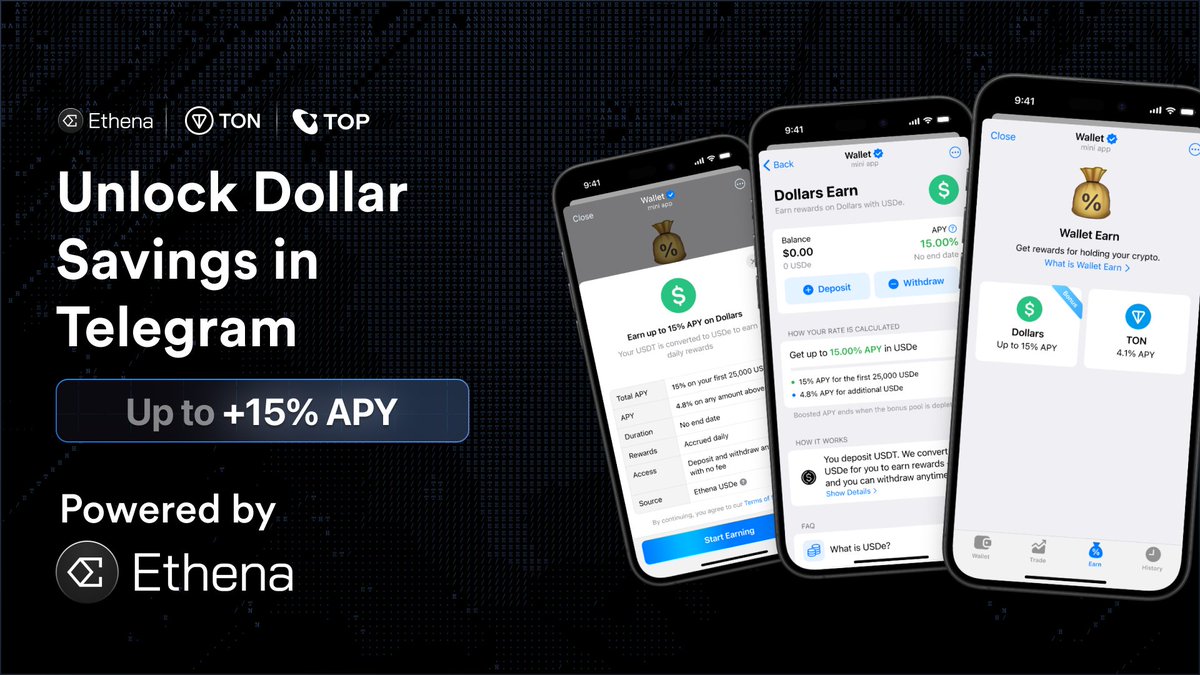

$700m dollars on TON, 90% of which is USDT and the majority only accessible via Telegram Wallet

When you give Telegram's 1 billion users the ability to earn on their dollars, that becomes one of the highest impact opportunities in the entire industry

Yesterday's Ethena x Telegram Wallet launch does just that, offering dollar earn functionality in Telegram Wallet for the first time

Ethena Labs

As of today, dollar holders can earn up to 15% APY via Wallet in Telegram @wallet_tg

This gives Telegram’s 1 billion users, and TON's ~$750m dollars on chain, direct access to savings functionality

Telegram users today primarily access crypto through Wallet in Telegram, with over 100 million signups to date

207

0

币世王

Who is the biggest beneficiary of the rise of global stablecoin payments?

In the era of stablecoins gradually moving towards compliance and corporate payments are fully embracing crypto finance, the first to eat dividends is not Circle, not Solana, but low-key TRON!

▰▰▰▰▰

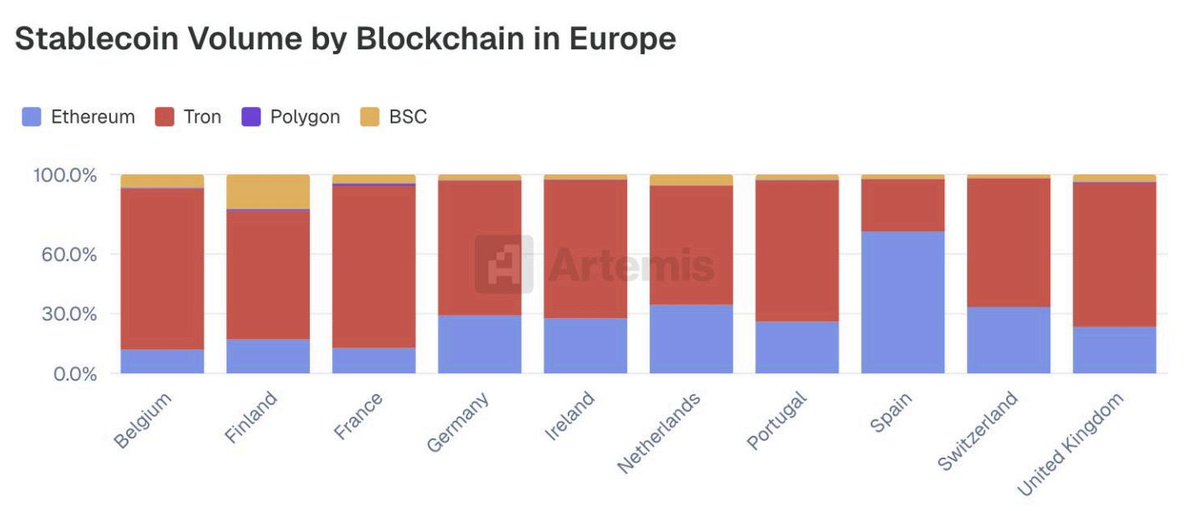

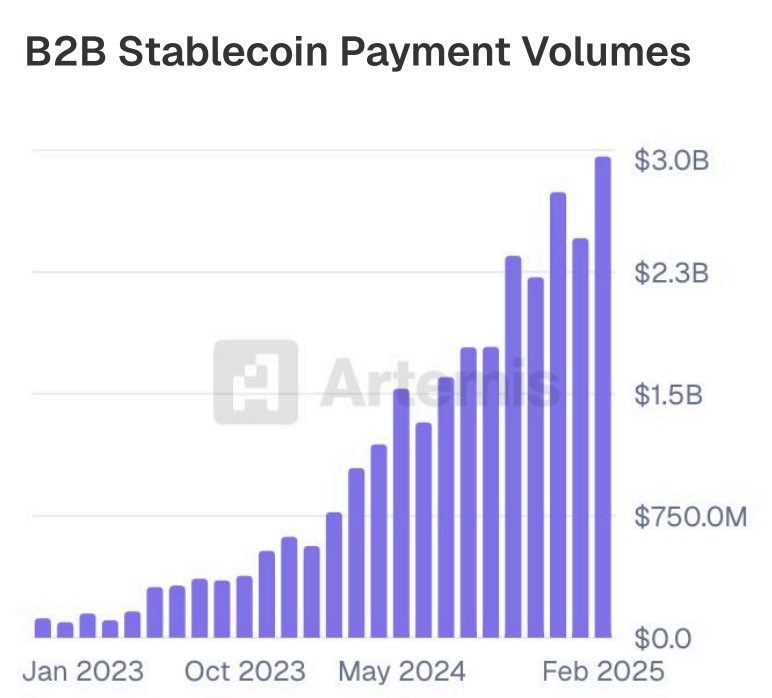

According to data published by Artemis,

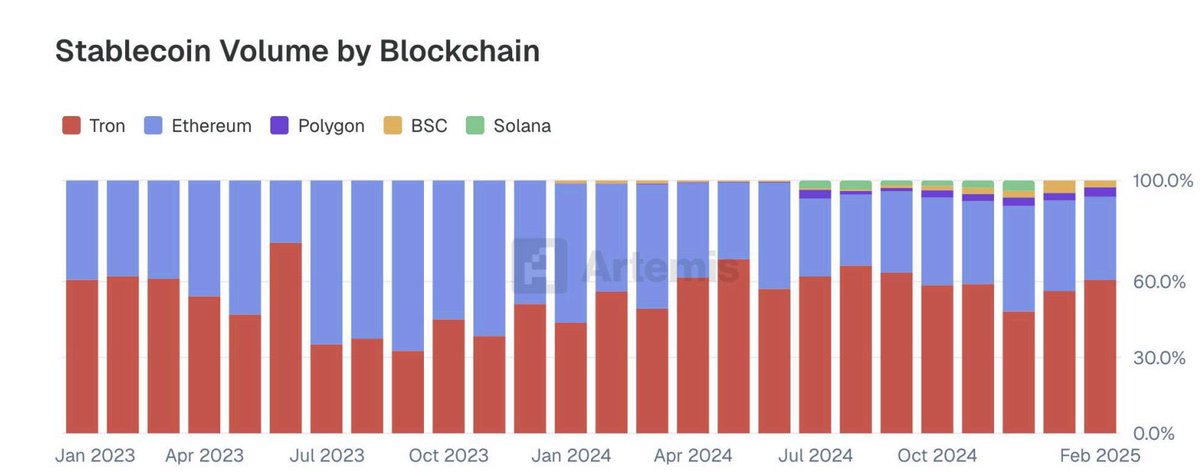

▪ TRON leads the world's strongest payment chains, not just in developing countries

In the past few years, we have always thought that USDT on TRON is a third world story, but from this picture, you will find that many developed countries in Europe; From Germany and France to Finland and Belgium, TRON is the largest public chain in terms of stablecoin payment volume, and its market share far exceeds that of Ethereum, BSC and Polygon!

▪ B2B payments are growing rapidly, and TRON is the biggest beneficiary

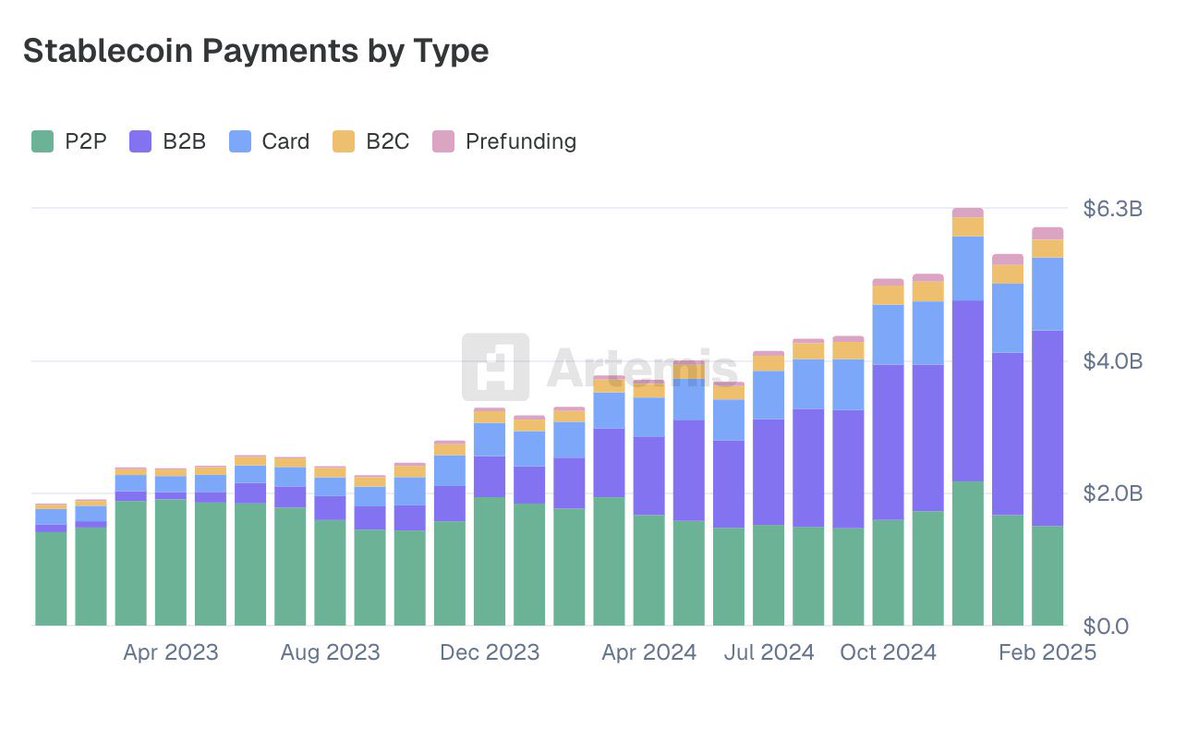

Since 2023, global stablecoin-based B2B payment transaction volume has grown by 215%, with monthly transaction volume surging from less than $2 billion to more than $6.3 billion. Of the data we were able to attribute, $9.42 billion was settled through the TRON network!

▰▰▰▰▰

What's more:

▪ Visa: The global B2B payments market is $145 trillion

This means that the market in which TRON operates today is only the tip of the iceberg. B2B stablecoin payments are less than 0.01%, and TRON has firmly established itself as the first public chain in the payment infrastructure of this emerging track!

▪ The market gives a signal, and the user gives an answer

➤ 2023~2025, 215% monthly growth in stablecoin payments

➤ TRON's market share continues to expand, far surpassing ETH and upstart Solana

➤ Even under regulatory and macro pressures, on-chain transaction stability remains >96%

➤ From Lebanon to Argentina, from Germany to Portugal, TRON is the dollar payment track used by countless ordinary people and businesses

▰▰▰▰▰

The first year of compliance began; Stablecoin legislation is coming

THE GENIUS BILL OFFICIALLY PASSED THE U.S. SENATE, AND STABLECOINS OFFICIALLY USHERED IN FEDERAL-LEVEL LEGISLATION. This is an anchor of trust and a door to legitimacy for public chains like TRON, which have long undertaken sovereign-level stablecoins such as USDT, USDD, and USD1!

In his statement, Trump said:

“This is American Brilliance at its best, and we are going to show the world how to WIN with Digital Assets like never before!”

In such a context, a strong dual-track cooperation system has been formed between TRON and Tether, with a chain-level stablecoin payment chain on one side and an asset-level USD stabilizer on the other!

▰▰▰▰▰

summary

TRON is already a hidden giant in the global stablecoin track! It doesn't rely on marketing, it doesn't rely on narrative, but every transaction on the chain is accumulating real market fruits. In the next 1~3 years, as the USD stablecoin becomes the new default channel for global B2B transactions, the chain that supports it all is called TRON!

@justinsuntron @sunyuchentron @trondao @sunpumpmeme #TRON #TRONEcoStar

Show original

3.24K

1

高老庄 -⭕️rdinals

Why can others profit from the same news while you can't?

For example, this morning around nine, while scanning group messages and news, I saw that Guotai Junan International was approved by the Hong Kong Securities and Futures Commission to trade virtual currencies like Bitcoin, Ethereum, and USDT, and even to issue and distribute derivatives!

I noticed that it was Guotai Junan International that got approved, and I immediately had Ai analyze the differences between it and Guotai Junan.

I also shared this in a small group to alert everyone ⚠️.

However, many people didn't pay attention and focused on the A-share Guotai Junan, missing out on this significant price surge.

Show original

3.18K

0

ChainCatcher 链捕手

By Josh Solesbury (ParaFi Investor)

Compilation: Azuma, Odaily Planet Daily

Catalyzed by Stripe's acquisition of Bridge and progress on the GENIUS Act, stablecoin-related headlines have exploded over the past six months. From CEOs of large banks to product managers at payment companies to high-level government officials, key decision-makers are increasingly referring to stablecoins and touting their benefits.

Stablecoins are built on four core pillars:

Instant settlement (T+0, significantly reducing working capital requirements);

Extremely low transaction costs, especially compared to the SWIFT system;

Global accessibility (all year round, internet connection only);

Programmability (currency driven by extended coding logic).

These pillars perfectly illustrate the benefits of stablecoins as touted in headlines, blog posts, and interviews. As a result, the "why do we need stablecoins" argument is easy to understand, but the "how to apply stablecoins" is much more complex – neither product managers at fintech companies nor bank CEOs currently have much specific information on how to integrate stablecoins into existing business models.

With this in mind, we decided to write this high-level guide to provide a primer for non-crypto businesses exploring stablecoin applications. The following sections are divided into four separate chapters, each corresponding to a different business model. Each chapter will analyze in detail: where the stablecoin can create value, what is the specific implementation path, and the schematic diagram of the product architecture after the transformation.

At the end of the day, headlines are important, but what we're really looking for is the large-scale adoption of stablecoins – enabling real-world business scenarios to use stablecoins at scale. Hopefully, this article will be a small building block for this vision to be realized. Now, let's dive into how non-crypto businesses can use stablecoins today.

To C Fintech Banking

For consumer-facing (To C) digital banks, the key to improving enterprise value is to optimize the following three levers: user scale, revenue per user (ARPU), and user churn rate. Stablecoins can now directly contribute to the first two metrics – by integrating partner infrastructure, digital banks can launch stablecoin-based remittance services that can reach new users and add revenue generation channels to existing customers.

With digital connectivity and globalization, two decades-old trends, today's fintech target markets tend to be transnational. Some digital banks have cross-border financial services at their core (e.g., Revolut or DolarApp), while others have embraced ARPU-enhancing modules (e.g., Nubank or Lemon). For fintech start-ups with a focus on expatriates and specific ethnic groups, such as Felix Pago or Abound, remittance services are in demand in the target market. All of these types of digital banks will (or have been) benefited from stablecoin remittances.

Compared to traditional remittance services such as Western Union, stablecoins allow for faster (instantaneous vs. more than 2-5 days) and cheaper (as low as 30 basis points vs more than 300 basis points). For example, DolarApp charges only $3 to send USD to Mexico, and it arrives instantly. This explains why the penetration of stablecoin payments has reached 10-20% in some remittance channels, such as the US-Mexico channel, and the growth momentum continues.

In addition to generating new revenue, stablecoins can optimize costs and user experience, especially as an internal settlement tool. Many practitioners are well aware of the pain point of closing on weekends: bank closures that delay settlements by two days. Digital banks seeking real-time service and the ultimate experience have had to fill the gap by offering working capital credit, which incurs both an opportunity cost of capital (especially in the current interest rate environment) and may force additional financing. The instant settlement and global accessibility of stablecoins completely solve this problem. Robinhood, one of the world's largest fintech platforms, is a case in point, with CEO Vlad Tenev making it clear on an earnings call in February 2025 that "we are using stablecoins to handle a large number of weekend settlements, and the scale of applications continues to grow."

So it's no surprise that consumer-facing fintech companies like Revolut and Robinhood are deploying stablecoins. So, if you work in a consumer bank or fintech company, how do you use stablecoins?

After the introduction of stablecoins in this business model, the practical scheme is as follows.

Real-time, round-the-clock settlement

Stablecoins such as USDC, USDT, USDG are used to achieve instant settlement (including holidays);

Integrate wallet service provider/coordinator combinations (e.g. Fireblocks or Bridge) to connect the banking system with the blockchain's USD/stablecoin flows;

Connect with fiat currency channel service providers (such as African Yellow Card) in specific regions to realize B2B/B2B2C exchange between stablecoins and fiat currencies;

Fill the fiat settlement window

During the weekend, stablecoins will be used as a temporary substitute for fiat currency, and reconciliation will be completed after the restart of the banking system;

It can cooperate with Paxos and other providers to build an internal stablecoin settlement loop between customer accounts and enterprises;

Counterparty funds are available instantaneously

Bypass the ACH/wire transfer process and quickly transfer funds to exchanges/partners through the above schemes or liquidity partners;

Automatic rebalancing of multinational entities

When the fiat currency channel is closed, the on-chain stablecoin transfer realizes the allocation of funds between business units/subsidiaries;

In this way, the headquarters can establish an automated and scalable global capital management system;

In addition to these basic functions, a new generation of banks based on the concept of "all-weather, real-time, and composable finance" can be envisaged. Remittance and settlement are just the starting point, and scenarios such as programmable payment, cross-border asset management, and stock tokenization will be derived in the future. Such enterprises will win the market with the ultimate user experience, rich product matrix and lower cost structure.

Commercial Banking & Corporate Services (B2B)

Currently, business owners in markets such as Nigeria, Indonesia, and Brazil must overcome many hurdles if they want to open a US dollar account with a local bank. Usually only companies with large trading volumes or special relationships are eligible – and this is subject to banks having sufficient USD liquidity. Local currency accounts, on the other hand, force entrepreneurs to bear both bank and government credit risks, and have to keep an eye on exchange rate fluctuations in order to maintain working capital. When making payments to overseas suppliers, business owners also have to pay a hefty fee for converting their home currency into mainstream currencies such as the US dollar.

Stablecoins can significantly alleviate these frictions, and forward-thinking commercial banks will play a key role in their adoption. With a compliant bank-managed digital dollar platform such as USDC or USDG, businesses can:

There is no need to establish multiple banking relationships to hold balances in multiple currencies;

Second-level settlement of cross-border invoices (bypassing the traditional correspondent bank network);

Stablecoin deposits earn interest;

This allows commercial banks to upgrade their basic checking account to a global, multi-currency treasury management solution that provides speed, transparency and financial resilience unmatched by traditional accounts.

After the introduction of stablecoins in this business model, the practical scheme is as follows.

Global USD/Multi-Currency Account Services

Banks host stablecoins for businesses through partners such as Fireblocks or Stripe-Bridge;

Reduced start-up and operating costs (e.g., reduced license requirements, elimination of FBO accounts);

High-yield products backed by high-quality U.S. Treasuries

Banks can provide yields at the level of the federal funds rate (about 4%) and have significantly lower credit risk than local banks (U.S. regulated money market funds vs. domestic banks);

Requires a connection to an interest-earning stablecoin provider (e.g., Paxos) or a tokenized Treasury partner (e.g., Superstate/Securitize).

Real-time, round-the-clock settlement

For details, please refer to the consumer finance sector plan above.

Global application scenarios that we are optimistic about (can be solved by stablecoin platforms/commercial banks)

The importer pays the US dollar payment in seconds, and the overseas exporter releases the goods immediately;

Corporate finance officers transfer funds in real time across multiple countries, get rid of the delay of the correspondent banking system, and make it possible for banks to serve super-large multinational groups;

Business owners in high-inflation countries use the U.S. dollar to anchor their balance sheets.

Product Architecture Example (Stablecoin-based Business Banking Services)

Payroll service providers

For payroll platforms, the greatest value of stablecoins is to serve employers who need to pay employees in emerging markets. Cross-border payments, or payments made in countries with poor financial infrastructure, can impose significant costs on payroll platforms – costs that are either absorbed by the platforms themselves, passed on to employers, or reluctantly deducted from contractors' compensation. For payroll service providers, the most obvious opportunity is to open a stablecoin payment channel.

As mentioned in the previous sections, cross-border stablecoin transfers from the U.S. financial system to contractors' digital wallets are virtually cost-free and instantaneous (depending on the fiat on-ramp configuration). While contractors may still have to complete fiat currency conversions themselves (which incur fees), they can receive instant payments for the world's most powerful fiat currency pegging. There is several pieces of evidence that demand for stablecoins is surging in emerging markets:

On average, users are willing to pay a premium of about 4.7% to acquire USD stablecoins;

In countries such as Argentina, this premium can be as high as 30%;

Stablecoins are becoming increasingly popular among contractors and freelancers in regions such as Latin America;

Freelancer-focused apps such as Airtm have seen exponential growth in stablecoin usage and user growth;

What's more, the user base is already formed: more than 250 million digital wallets are actively using stablecoins in the past 12 months, and more and more people are willing to accept stablecoin payments.

In addition to speed and end-user cost savings, stablecoins also have a number of benefits for corporate customers who use payroll services (i.e., paying customers). First, stablecoins are significantly more transparent and customizable. According to a recent fintech survey, 66% of payroll professionals lack the tools to understand their actual costs with banks and payment partners. Fees are often opaque and the process is confusing. Second, today's payroll process often involves a lot of manual work and consumes finance department resources. In addition to the payment execution itself, there are a range of other things to consider, from accounting to tax to bank reconciliation, and stablecoins are programmable and have a built-in ledger (blockchain), which significantly improves automation (e.g., batch timed payments) and accounting capabilities (e.g., automated smart contract calculations, withholding payments, and systems of record).

In this case, how should the payroll platform enable the stablecoin payment function?

Real-time 24/7 settlement

This has already been covered above.

Closed-loop payments

Partnering with stablecoin-based card issuance platforms such as Rain allows end-users to spend stablecoins directly, thus fully inheriting their speed and cost advantages;

Partner with wallet providers to provide stablecoin savings and yield opportunities.

Accounting & Tax Reconciliation

Leverage the immutable ledger nature of the blockchain to automatically synchronize transaction records to accounting and tax systems through API data interfaces, automating the withholding, bookkeeping, and reconciliation processes.

Programmable Payments & Embedded Finance

Leverage smart contracts to enable automated batch payouts and programmable payouts based on specific conditions, such as bonuses. It is possible to work with platforms such as Airtm or directly use smart contracts.

Connect DeFi underlying protocols to provide salary-based financing services in an affordable and globally accessible way. In some countries, it is possible to bypass local banking partners that are often cumbersome, closed, and expensive. Apps like Glim (and indirectly Lemon) are working to provide these features.

Based on the above solutions, let's further explain the specific implementation:

Payroll processing platforms that support stablecoins work with US fiat on-ramps (e.g., Bridge, Circle, Beam) to connect bank accounts with stablecoins. Funds are transferred from the customer's business account to the on-chain stablecoin account (these accounts can be held in custody with the aforementioned companies or institutions such as Fireblocks) before the payment date. Payments are fully automated, with bulk broadcasts to all contractors worldwide. Contractors receive USD stablecoins instantly, which can be spent via a Visa card that supports the stablecoin, such as Rain, or saved via tokenized Treasury bonds in an on-chain account such as USTB or BUIDL. With this new architecture, the overall cost of the system has been significantly reduced, the contractor's coverage has been greatly expanded, and the degree of system automation has been greatly improved.

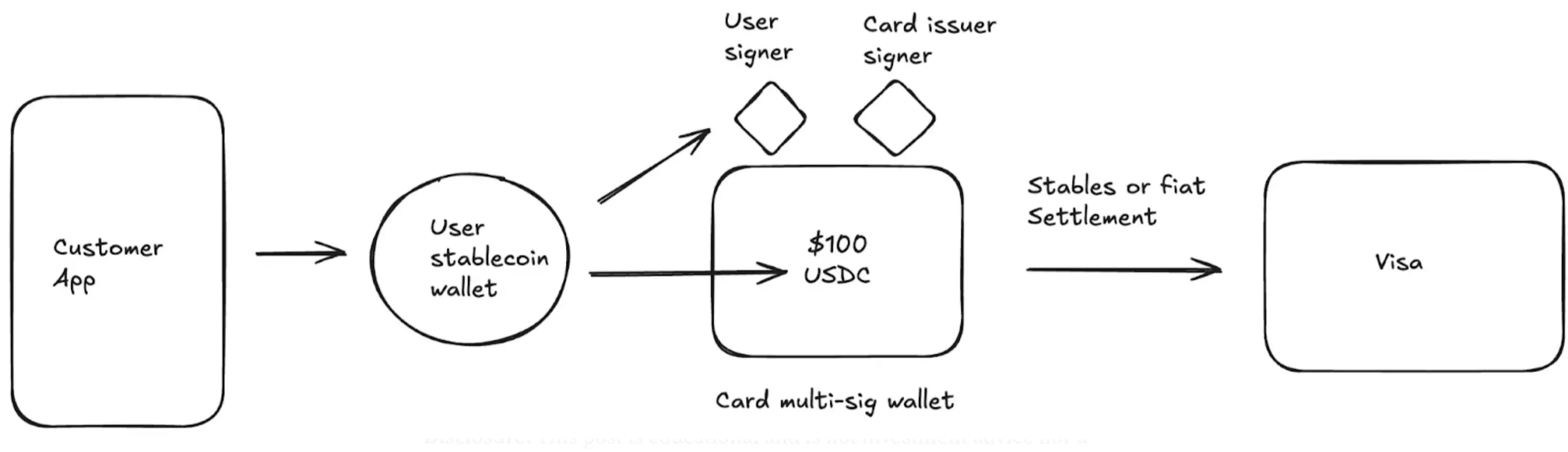

Card issuers

Many businesses are now generating core revenue through card issuance. For example, Chime, which just went public on June 12, has achieved more than $1 billion in annual revenue through transaction fees in the U.S. market alone. Despite Chime's large presence in the U.S., its partnership with Visa, banking partnerships, and technology architecture have done little to support overseas expansion.

Traditional card issuance requires a country-by-country application for a direct license from an institution such as Visa, or a partnership with a local bank. This cumbersome process is a serious hindrance to cross-regional expansion. Nubank, a listed company, for example, only began to expand overseas in the past three years after more than 10 years of operation.

In addition, card issuers are required to pay a deposit to card networks such as Visa to protect against the risk of default. In doing so, card networks promise merchants such as Walmart that cardholder payments will still be honored even if a bank or fintech company goes bankrupt. The card network reviews the last 4-7 days of transaction volume and calculates the amount of collateral to be paid by the issuer. This places a heavy burden on banks/fintechs and creates a significant barrier to entry for the industry.

Stablecoins have revolutionized the possibilities of the card issuance business. First, stablecoins are cultivating a new class of card issuance platforms, such as Rain, where businesses can leverage their primary membership with Visa to offer global issuance through stablecoins. Examples include enabling fintech companies to issue cards in Colombia, Mexico, the United States, Bolivia, and many other countries at the same time. In addition, a new class of card issuing partners can now settle over weekends thanks to stablecoins' 24/7 settlement capabilities. Weekend settlement dramatically reduces partner risk, effectively reduces collateral requirements and frees up funds. Finally, the on-chain verifiability and composability of stablecoins creates a more efficient collateral management system that reduces the working capital requirements of card issuers.

After the introduction of stablecoins in this business model, the practical scheme is as follows.

partnered with Visa and card issuers to launch a global U.S. dollar-denominated card issuance program;

Flexible card network settlement options;

Direct settlement with stablecoins (weekend and overnight settlements);

The card network generates a settlement report with bank account number and routing number every day, and the stablecoin address will be displayed after using the stablecoin;

You can also choose to exchange the stablecoin back to fiat currency and then settle with the card network;

Reduced collateral requirements (thanks to 24/7 settlement capabilities).

Here's an example process for a global card product architecture that supports stablecoins:

conclusion

Today, stablecoins are no longer the promise of a future that requires laborious imagination – they have become a practical technology whose usage is growing exponentially. The question now is not "if" to adopt, but "when" and "how". From banks to fintech companies to payment processors, developing a stablecoin strategy has become a necessity.

Companies that move beyond the proof-of-concept stage to truly integrate and deploy stablecoin solutions will outperform their competitors in terms of cost savings, revenue improvements, and market expansion. It is worth mentioning that these tangible benefits are supported by a number of existing integration partners and upcoming legislation, both of which will significantly reduce enforcement risk. There's never been a better time to build a stablecoin solution.

Show original

2.31K

0

USDT price performance in USD

The current price of usdtea is $0.00051362. Over the last 24 hours, usdtea has increased by +97.41%. It currently has a circulating supply of 999,999,918 USDT and a maximum supply of 999,999,918 USDT, giving it a fully diluted market cap of $492,191.77. The usdtea/USD price is updated in real-time.

5m

+44.15%

1h

-39.76%

4h

+97.41%

24h

+97.41%

About USDTea (USDT)

USDT FAQ

What’s the current price of USDTea?

The current price of 1 USDT is $0.00051362, experiencing a +97.41% change in the past 24 hours.

Can I buy USDT on OKX?

No, currently USDT is unavailable on OKX. To stay updated on when USDT becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDT fluctuate?

The price of USDT fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 USDTea worth today?

Currently, one USDTea is worth $0.00051362. For answers and insight into USDTea's price action, you're in the right place. Explore the latest USDTea charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as USDTea, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as USDTea have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.