Why Is Crypto Down Today? – July 29, 2025

In a complete reversal from yesterday, the crypto market is down today, with 98 of the top 100 coins per market turning red. The cryptocurrency market capitalization has dropped by another 5.5% over the past 24 hours and below $4 trillion, now standing at $3.97 trillion. At the same time, the total crypto trading volume is at $172 billion.

TLDR:

Crypto Winners & Losers

By the time of writing, all but one top 10 coin per market capitalization have dropped over the past 24 hours.

Bitcoin (BTC) decreased by 0.6% in a day, now trading at $118,808. This is the smallest drop on this list today.

At the same time, Ethereum (ETH) is down by 3.1% and is now trading at $3,807.

Dogecoin (DOGE) fell the most. It’s down 7.7% to the price of $0.2282.

Tron (TRX) is the only coin in the category that increased today: 2.3% to $0.3294.

As for the top 100 coins, two coins are up. Besides Tron, Conflux (CFX) increased by 27.9% to $0.2457.

On the other hand, Sky (SKY) fell the most. It has decreased by 10.2% to $0.08978.

Jupiter (JUP) is next, having dropped 9.4% to $0.5592.

This will be a very busy week in the US specifically, with a number of earnings and economic news set to hit the markets, including crypto. This includes additional trade and tariff deals, additional earnings reports from tech companies, second-quarter GDP data, the July jobs report, and the Federal Reserve interest rate decision.

‘BTC is Expected to be More Volatile Over the Next 90 Days’

Sean Dawson, Head of Research at onchain options platform Derive.xyz, said that prices have been largely stable across the board in the past 24 hours.

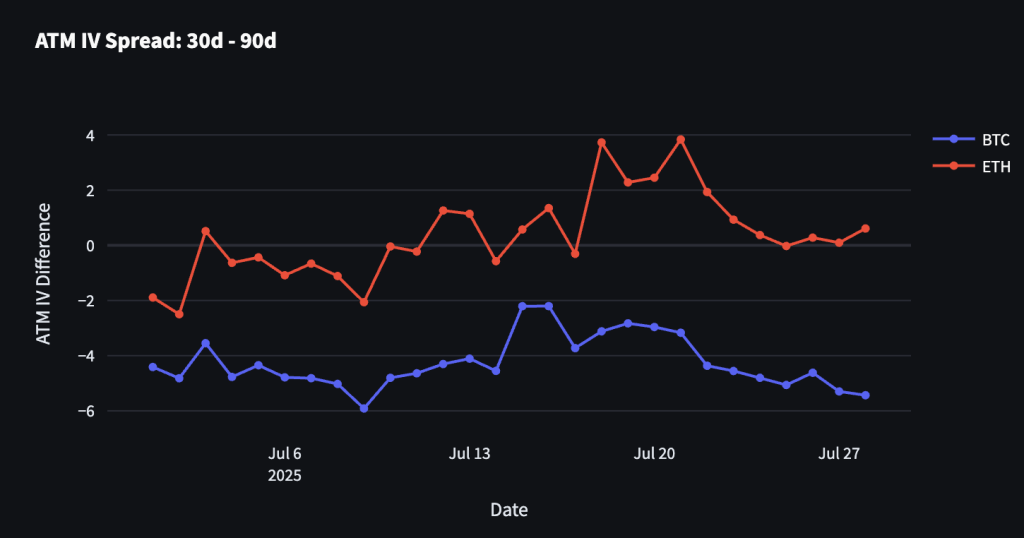

“BTC is expected to be more volatile over the next 90 days than the next 30. Meanwhile, ETH was predicted to have lower short-term volatility earlier this month, but this has since reversed,” Dawson writes.

BTC’s 30-day ATM volatility has dropped to its lowest level in two weeks, now sitting at 36%, down from a peak of 40%. “BTC’s 30-day ATM volatility has dropped to its lowest level in the last fortnight, now sitting at 36%, down from a peak of 40%,” he says.

Additionally, BTC’s chances of reaching $150,000 by August have stagnated over the past week, currently standing just below 20%. But the chances of ETH hitting $4,500 by 29 August jumped to 45% from 5% at the start of July.

“Since May, ETH has been on an absolute tear relative to BTC. The ETH/BTC ratio has almost doubled from 0.018 BTC per ETH to 0.0325,” Dawson says. “The rise of ETH treasury companies like Bitmine and Ethermachine signals growing institutional alignment and could mark the start of a new alt season heading into Q3 2025.”

Furthermore, blockchain data platform Glassnode found on Monday that BTC’s $117,000 level was still attracting demand.

“The $110,000–$117,000 range is gradually filling in. BTC is being accumulated on both sides – buyers stepping in on dips, while earlier buyers are now acquiring at higher levels,” they also wrote.

$BTC options skew shows an unusual divergence: 1M puts trade at a premium (+4.6%), while 1W skew lags.

— glassnode (@glassnode) July 28, 2025

This suggests near-term bullish sentiment, with traders using 1W calls, while 1M downside protection signals hedging or profit-taking on the rally. pic.twitter.com/QwJyWSdWXm

Meanwhile, Tom Bruni, VP of Community and Editor-in-Chief at Stocktwits, commented that “the market’s been flashing signs of overheating, with meme stocks and altcoins taking the spotlight.”

However, “despite all the noise,” Bruni says, major indexes barely moved, while international stocks remained range-bound. If risk assets, including Bitcoin, drop even after “positive” tariff news, “that could be a warning sign that this run is losing steam.”

XRP is Regaining Momentum

Moreover, James Toledano, Chief Operating Officer at Unity Wallet, commented on XRP’s recent price performance.

“The waters are a little choppy where XRP is concerned because the price is low compared to Bitcoin, so the price swings, although seemingly small, are big in percentage terms.”

The price is down 9% in a week, and it’s up 44% in a month and 420% in a year. Despite the weekly drop, “the general feeling is optimistic,” Toledano says.

The coin is regaining momentum as exchange-traded fund (ETF) optimism and legal clarity “converge, pushing it briefly above $3.6 before correcting.” Futures products like ProShares’ UXRP are “fueling speculation about a potential spot ETF becoming a reality.” Also, XRP saw stronger institutional confidence since Ripple’s “partial legal win” in March

With the US Securities and Exchange Commission (SEC) “maintaining a softened posture, many see a structural step forward for XRP’s legitimacy in U.S. markets,” Toledano writes. “Despite recent volatility and $105 million in liquidations, improving liquidity, growing institutional flows, and ETF-driven optimism are aligning, making a continued rally plausible if inflows and optimism continue to converge.”

Levels & Events to Watch Next

At the time of writing, BTC trades at $118,976. Despite the minor drop today, the price recuperated quickly from the intraday low of $117,948. It peaked at $119,468 and has continued trading between $117,000 $119,000.

These are strong indications of what to observe: whether the price will be pushed below the $117,000 level, in which case it may return to $115,000, possibly lower. On the other hand, climbing above $119,000 could lead to $122,000, and subsequently a new ATH.

Moreover, Ethereum is currently trading at $3,886. This is a decrease from the daily high of $3,919.

Nonetheless, the price is evidently moving to the much-anticipated $4,000 mark. Many analysts argue that it’s bound to hit it very soon. How long it will hold it is another story.

Furthermore, the crypto market sentiment has dropped towards the neutral zone, nearly entering it. The crypto fear and greed index now stands at 63 today, compared to 67 yesterday, signaling growing caution among investors.

That said, there is still optimism in the market, and this level can generally be seen as healthy.

Meanwhile, on Monday, the US BTC spot exchange-traded funds (ETFs) saw inflows of $157.03 million. The cumulative net inflow stands at $54.98 billion as of 28 July.

BlackRock leads this list with $147.36 million in inflows. Fidelity and Grayscale also saw positive flows, while Bitwise and Ark&21 Shares recorded outflows.

At the same time, the US ETH ETFs recorded the 17th consecutive day of positive flows with $65.14 million on Monday. The surge in price continues to fuel institutional interest. The cumulative net inflow is now $9.4 billion.

Of the Monday’s amount, BlackRock took in $131.95 million. On the other hand, Grayscale and Fidelity noted outflows.

As mentioned above, investors are keeping an eye on earnings and economic news coming from the US, specifically trade and tariff deals, tech companies’ earnings, Q2 GDP data, the July jobs report, and the Federal Reserve interest rate.

Meanwhile, ARK Invest named SOL Strategies as its new Solana staking provider. “Being selected as ARK’s Solana staking provider represents significant validation of our institutional infrastructure and market position,” said Leah Wald, CEO of SOL Strategies.

Our BitGo integration was key to making this relationship possible.

— SOL Strategies (@solstrategies_) July 28, 2025

When the world's leading institutional custody platform trusts your validators, and ARK chooses your infrastructure…

That's how you know you're building the right foundation for the future of finance.

Also, Mill City Ventures III, a Nasdaq-listed non-bank lender, raised $450 million in a private placement to establish a crypto treasury centered on Sui. Galaxy Asset Management will manage the new treasury.

Galaxy is investing and managing the treasury for Mill City Ventures III, Ltd., following a $450M private placement to initiate a $SUI treasury strategy.

— Galaxy (@galaxyhq) July 28, 2025

Backed by a broad group of institutional investors, including the @SuiFoundation, @Karatage_, and others.

Galaxy Asset…

Also, Tron, a Nasdaq-listed company formerly known for selling theme park souvenirs, filed to register up to $1 billion in securities, aiming to build a crypto treasury centered on TRX.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market decreased over the last 24 hours, and the stock market closed with a mixed performance on Monday. For example, the S&P 500 was up by 0.018%, the Nasdaq-100 increased by 0.36%, and the Dow Jones Industrial Average fell by 0.14%. The stock market is awaiting a flurry of news related to trade deals, tech company earnings reports, and several key economic data and decisions.

- Is this dip sustainable?

This is likely a typical market pullback, and the prices will still go up. That said, incoming news from the US, including trade deals, tariffs, inflation, and the interest rate, will affect the market. It remains to be seen in what way.