@puffer_finance began as an Ethereum liquid restaking protocol.

Their initial product, pufETH, allowed users to stake just 1 ETH and restake via EigenLayer for extra yield.

That alone was a big deal, but Puffer Finance set their eyes on much more👇

2/

@puffer_finance has steadily grown from a “liquid staking product” to an “Ethereum infrastructure layer.”

Their new goal: to build the tools, validator infrastructure, and developer rails for next-gen rollups and on-chain apps, all while adhering to Ethereum's security model

3/

In light of that, they’ve introduced several major developments along the way.

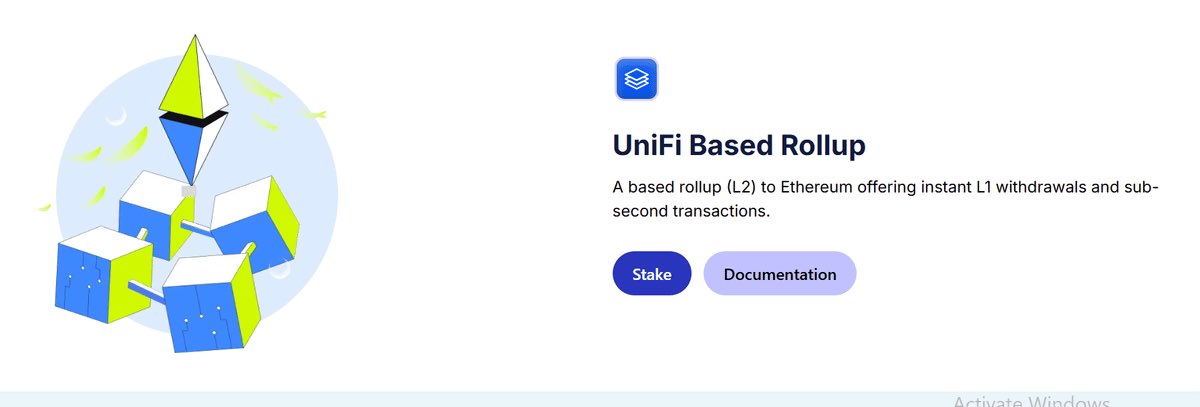

One of these is @puffer_unifi, an Ethereum based rollup that has in-built native yields and allows for instant withdrawals of assets to Ethereum.

4/

Then there's the UniFi AVS, an EigenLayer-based solution tackling challenges in Ethereum's preconfirmation ecosystem.

🟣It is designed to offer fast, secure, and neutral preconfirmations for rollups, enhancing Ethereum's scalability while upholding its core principles.

5/

Most recently, they expanded to BNB Chain, launching their token there and introducing DeFi integrations like using pufETH as collateral on @lista_dao.

But BNB is just one of many chains they’re building across.

6/

Puffer now supports cross-chain bridging, making it easy to use $pufETH across the following networks:

◾ Ethereum

◾ BNB Chain

◾ Base

◾ Arbitrum

◾ Zircuit

◾ Apechain

◾ Soneium

◾ Berachain

7/

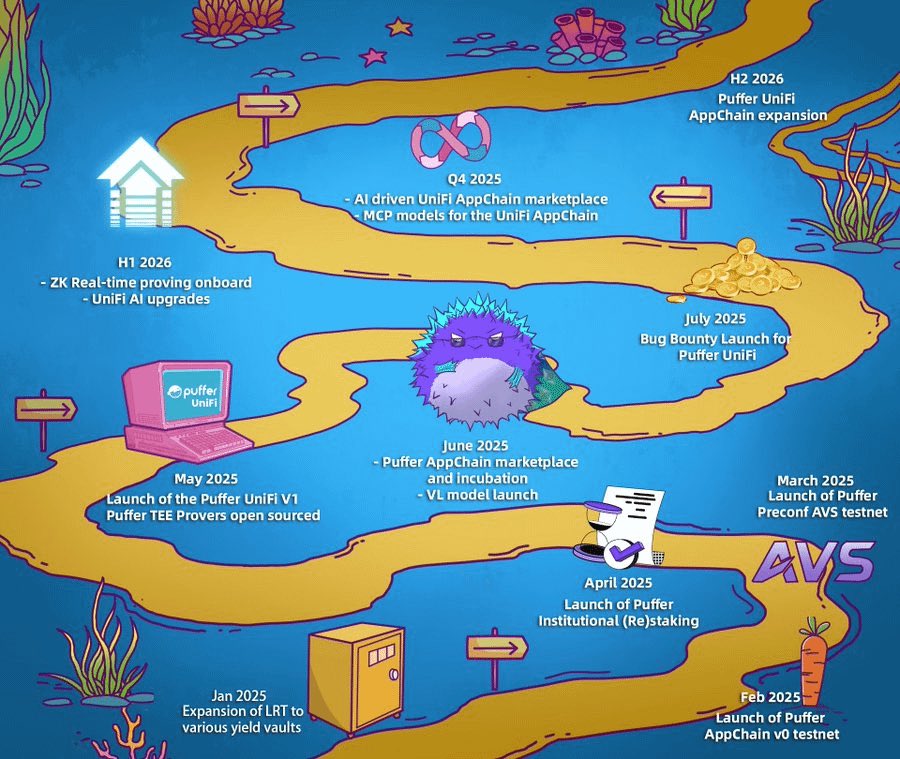

Looking ahead, there is still much to deliver:

➜ A Puffer AppChain marketplace powered by AI.

➜ The UniFi Mainnet.

➜ MCP models for the UniFi AppChain.

Given their progress so far, it's safe to say it's only a matter of time before these come to fruition.

8/

In short:

Puffer started with liquid restaking, but it’s now shaping up to be a core pillar of Ethereum’s modular future.

Real infra, real expansion, and a roadmap that’s quietly setting them up to become essential.

➜ Website:

➜ CA: 0x4d1C297d39C5c1277964D0E3f8Aa901493664530

38.47K

325

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.