Privacy in crypto is finally getting real support. Tornado’s ban got reversed, EU said ZK is okay

And now there's a new chain that actually rewards you for staying private..👀

This might be the start of a new meta. Here’s why.. A thread:🧵👇

2/

Data Protection is no longer illegal

In just the last few months:

▸ Tornado Cash's OFAC ban was overturned in U.S. courts

▸ EU approved ZKPs as compliant under new digital ID and finance laws

This isn't a future bet. It's an inflection point.

3/

A new meta might follow next ?

When ETH staking got institutional → LST meta exploded

When RWA got frameworks → real-world asset meta took off

Now privacy is crossing the same regulatory threshold.

4/

But privacy never had PMF - because it never paid.

Tornado, Zcash, Monero are all great tech.

But no reason to stay private.

No yield and no flywheel.

Use → exit → done.

Until one protocol decided to change it

5/

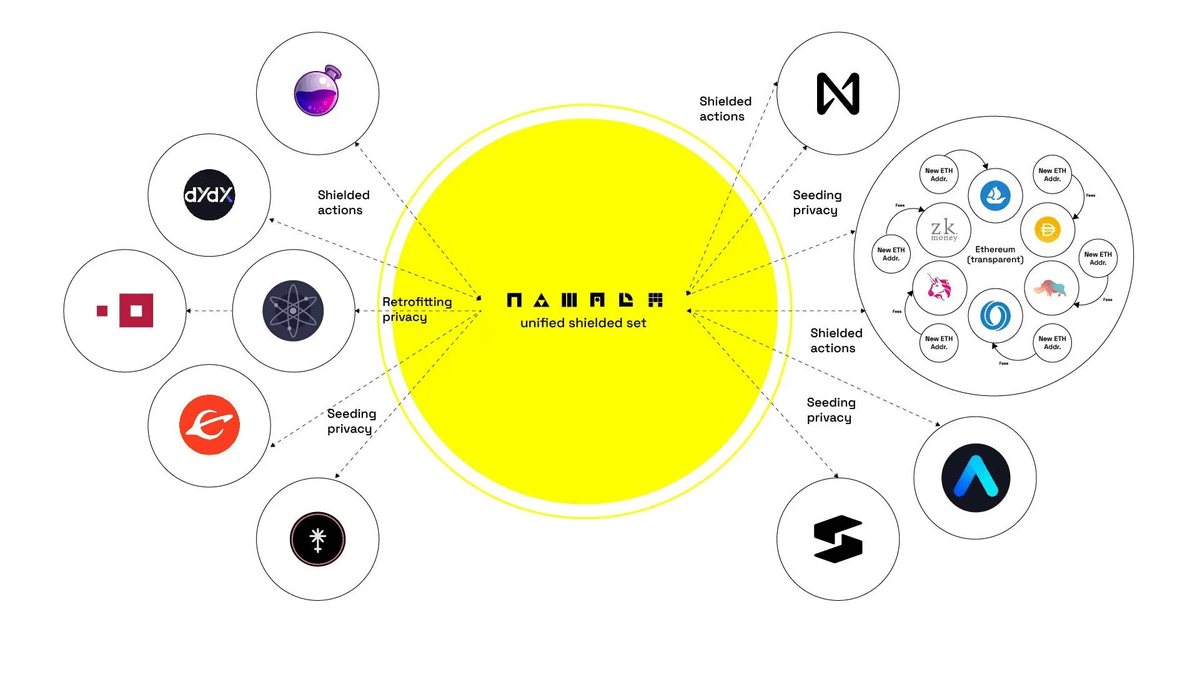

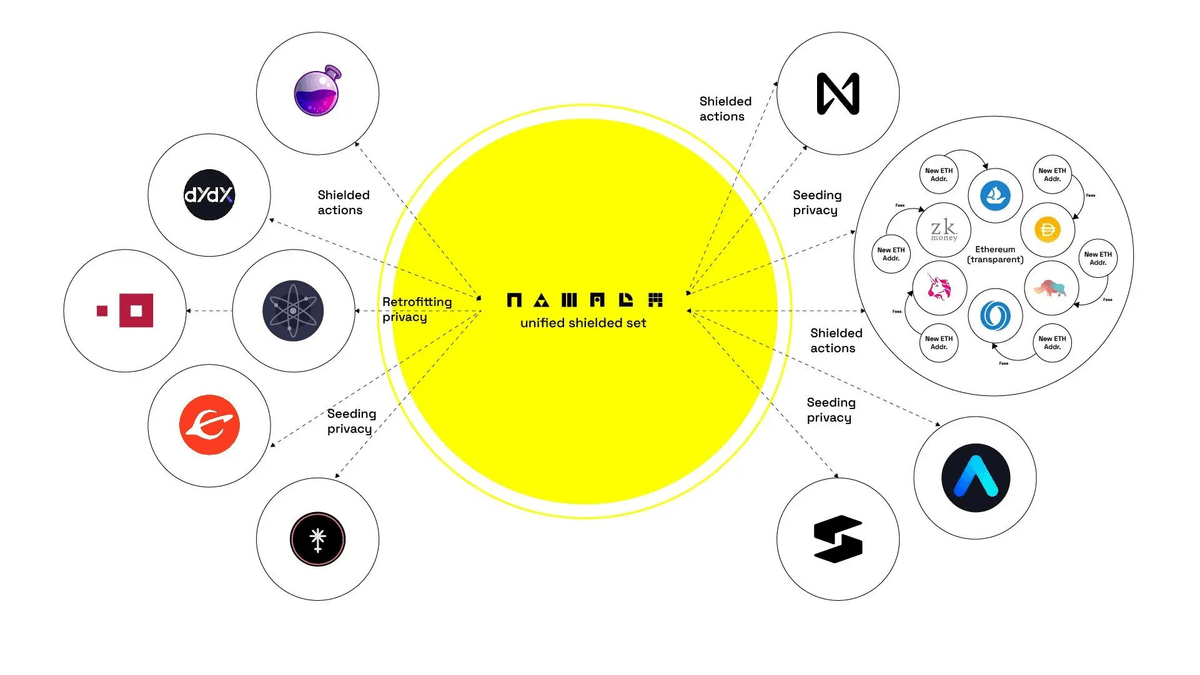

Enter @namada - the first L1 flipping this model completely.

Namada introduces actual PMF to data protection by bringing native incentives through:

▸ MASP (Multi-Asset Shielded Pool)

▸ SSR (Shielded Set Rewards)

Let's break down why this design just makes sense:

6/

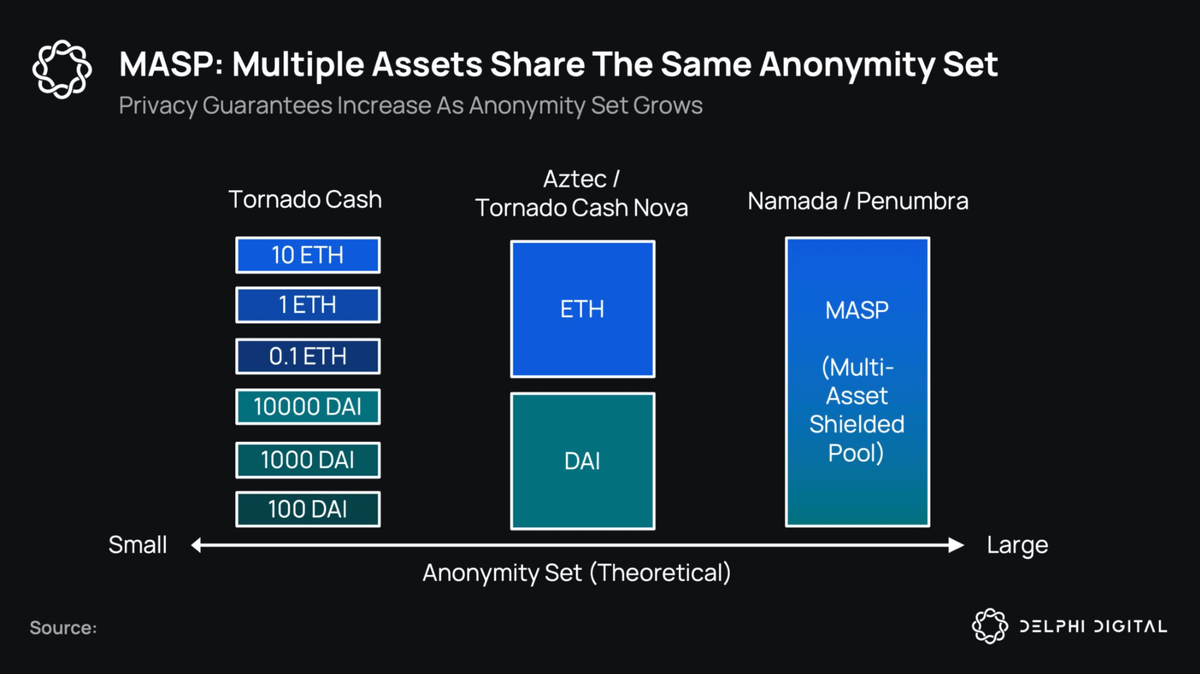

Instead of using fragmented shielded pools, Namada created MASP - one unified pool for all assets.

Whether it’s ETH, USDC, ATOM - everything goes into the same set.

This strengthens two things at once:

▸ Liquidity

▸ Anonymity

The more assets in, the harder it is to trace anything out.

7/

Now it flips the game theory with Shielded Set Rewards

SSR is Namada’s built-in incentive model that pays you $NAM for shielding assets and holding it

Every time you shield, you’re strengthening the entire anonymity set.

It literally pays you to make the system more private.

8/

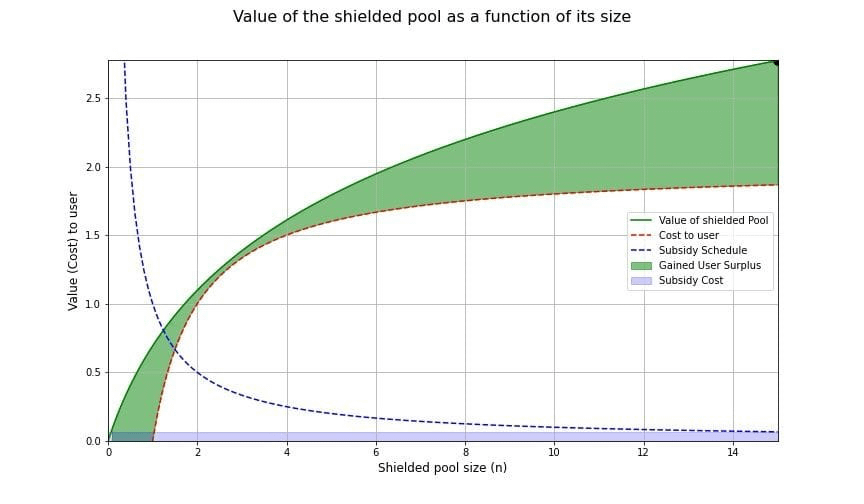

One of the most scalable flywheels:

▸ SSR rewards early users → more assets get shielded

▸ Pool grows → anonymity deepens

▸ Value > cost → organic growth kicks in

Over time the less subsidy needed and system becomes self-sustaining

Privacy becomes profitable and permanent.

9/

Here's how anyone can shield and earn:

▸ Go to

▸ Connect your Namada wallet

▸ Select $NAM or any asset and shield

That simple. You can transfer anonymously or just hold it or stake it to keep earning yield.

10/

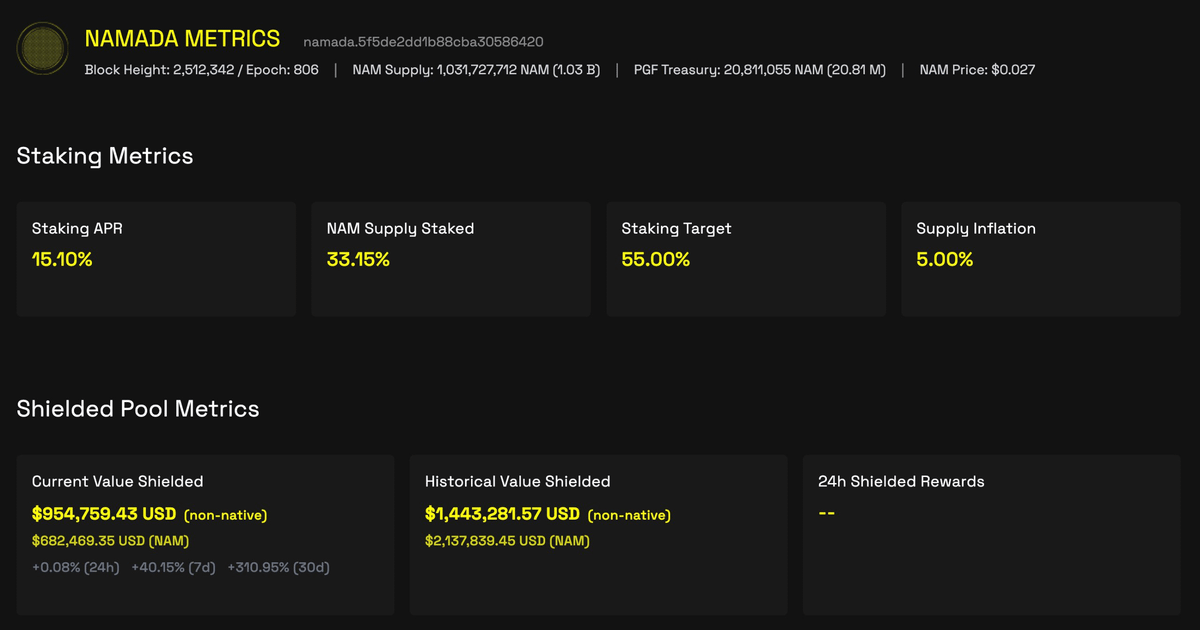

Looking at the metrics :

▸ Total Shielded Value: $1.65M

▸ 30d TVL Growth: +320%

▸ IBC Assets Supported: 10

▸ Unique Addresses: 80,864

With current Staking APY around 15.10%

11/

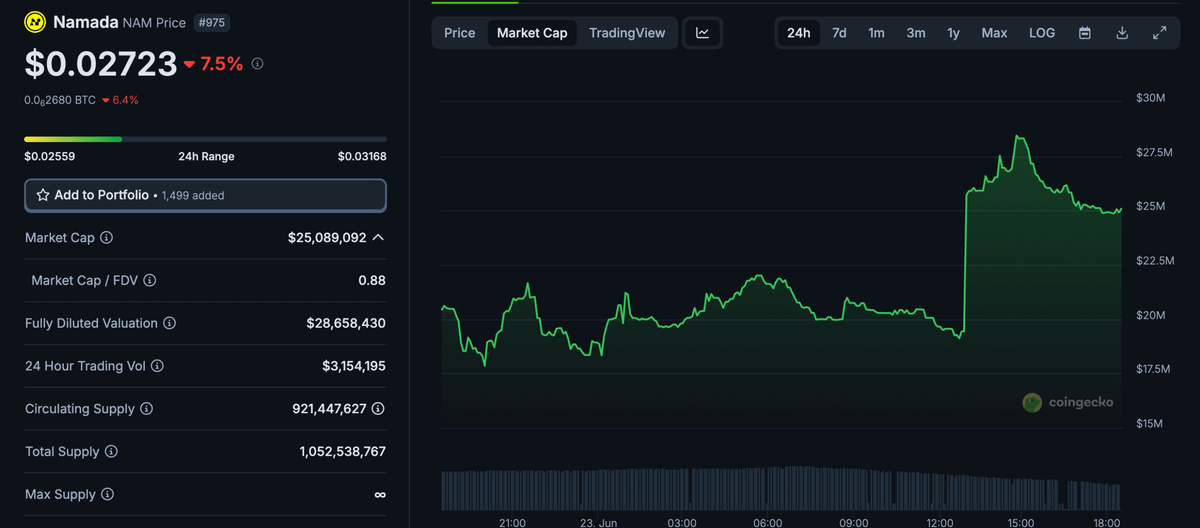

Token: $NAM

They went for a fair launch with full supply out from Day 1 so no future dilution.

▸ Market Cap/FDV: $28M

▸ Supply Staked: 33.15%

Pretty undervalued for an L1 with all supply circulating and users already staking imo

12/

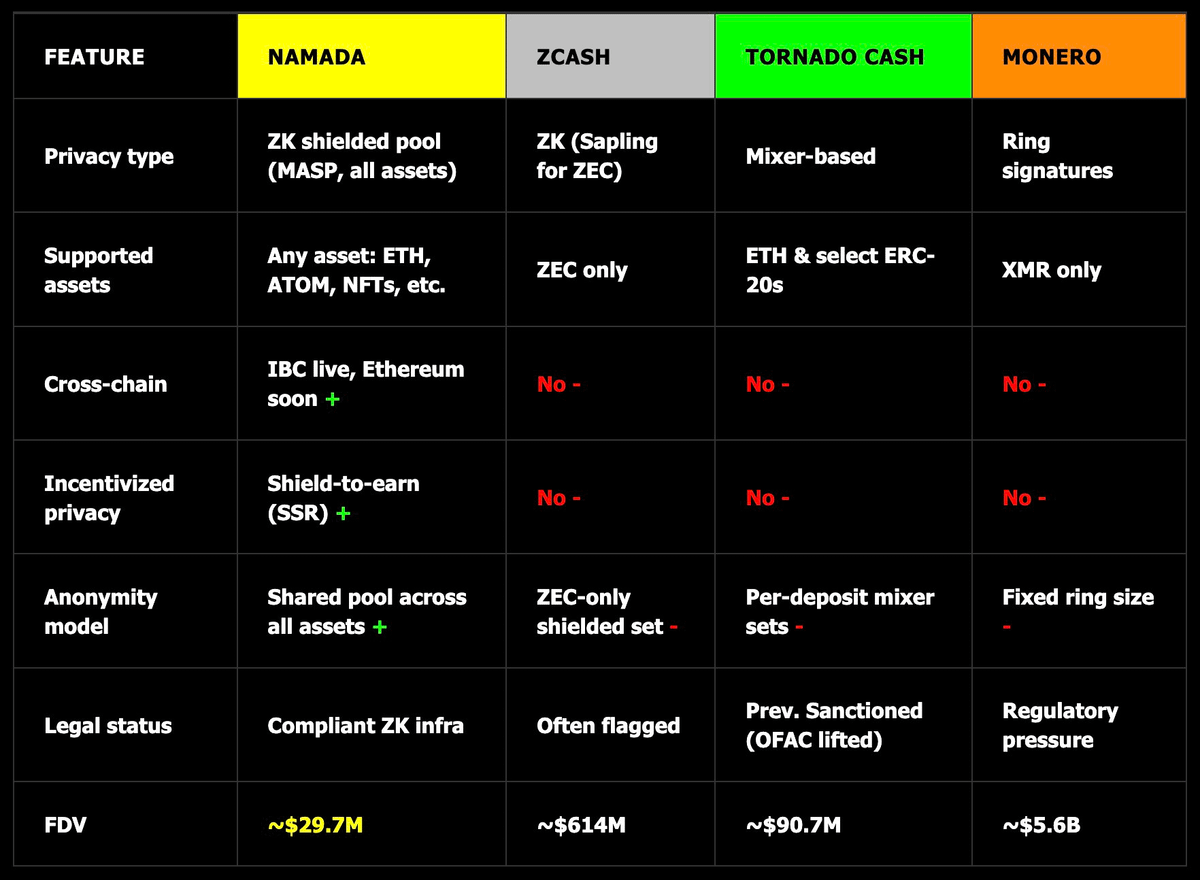

Comparing to existing privacy infrastructure:

You’ve got Tornado Cash, Zcash, and Monero as legacy players. But Namada stands in a league of its own with :

▸ Only one supporting multi-chain assets

▸ Only one with an incentivization model

▸ Only one with better supply dynamics

13/

The future thesis:

All existing privacy solutions are chain-specific.

Namada is the first that works across ecosystems AND has economic incentives.

If privacy goes mainstream, this becomes the plug-and-play layer that ships by default in every ecosystem.

That’s a wrap!

Got any questions about this thread? Drop them in the comments, and I’ll be happy to help.

Stay updated by joining my Telegram:

And if you found this useful, I’d really appreciate a follow: @Axel_bitblaze69

Thanks for reading! 😉

15.79K

51

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.