Berachain's Boyco unlock countdown on May 6: 20 hours left $BERA 🐻

$BERA 🐻: Doom or rebirth?

As everyone knows, $BERA has suffered a significant drop this month (-40%), mainly due to anticipated selling pressure from the upcoming Boyco unlock.

💡 Boyco assets will be unlocked tomorrow at 8:30 PM.

💡 2% of $BERA tokens (10M) will be unlocked in one go on this day.

💡 Berachain's capital outflow has slowed down since last week.

**Type 1: I want to cash out, what should I do?**

1️⃣ Some protocols require redemption through their official websites, such as @ConcreteXYZ and @Stake_Stone. Note that withdrawals from these platforms will enter a 24-72 hour queue.

- @origami_fi: Two steps are required: Retrieve your deposit LP tokens from the Boyco page, then withdraw USDC from the Origami page.

2️⃣ If you are a direct participant in Boyco, you can redeem directly on Royco. The website is here:

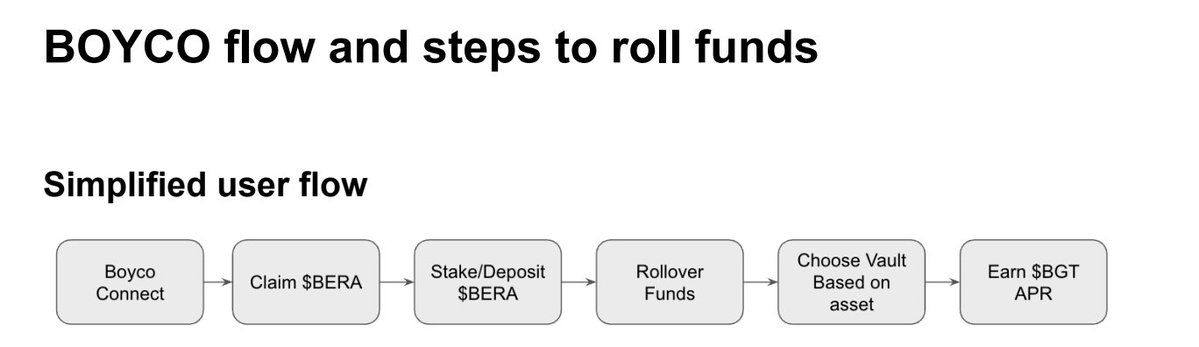

The official team has also prepared documentation to help more users transfer funds with one click and continue earning yields.

⚠️ If your funds are stored in the pre-pre deposit vault, your rewards will not appear in the checker.

⚠️ When exiting assets, you will inevitably face slippage risks during swaps, such as HONEY <> USDC, or sudden spikes in Layer0 cross-chain fees. Be cautious during cross-chain transactions.

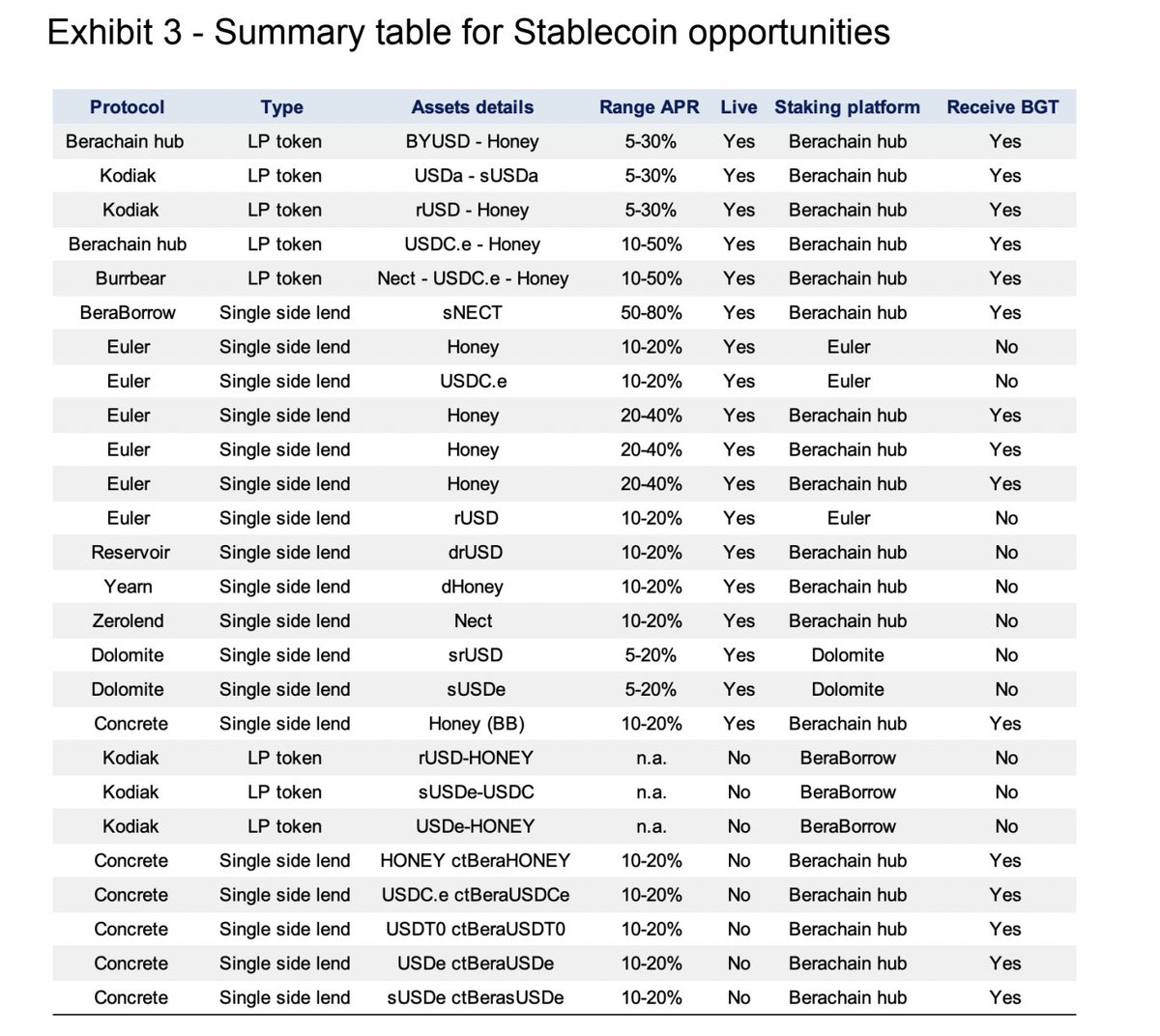

**Type 2: I want to continue farming as a bear 🐻 👨🌾. What other opportunities are there for the funds I withdraw?**

Currently, several teams have already prepared measures to accommodate the funds released from the Boyco unlock, allowing users to continue farming.

This makes sense, as it provides an opportunity for each protocol to capture more TVL. Here are a few examples:

- @beraborrow: Launching the Beraborrow Managed Leverage Vault tomorrow. Funds from users who participated in Boyco will be automatically transferred, requiring no additional action.

- @Lombard_Finance: Supports one-click upgrades for participating users to Lombard's most popular new DeFi strategy vaults.

I also noticed that @BerachainCN has already provided a very comprehensive guide for this group of users earlier.

Whether it's $BTC, $ETH, stablecoins, or $BERA, there are opportunities for all! Additionally, there are detailed steps for asset withdrawal that you can refer to.

**Type 3: I'm unsure whether to continue with Berachain. What information should I focus on?**

I agree with @jimcurrywang's tweet today, stating that $BGT is undoubtedly the most important asset in the ecosystem. A lack of buying pressure indicates a lack of confidence from major holders.

When $BERA's price dropped to a point where confidence was lost, the first thing I bought was $BGT-related assets (e.g., iBGT, LBGT). From my observation, iBGT/BERA hasn't dropped significantly 👀.

For further information, credit to @0x_ultra.

**Key points to consider regarding confidence in Berachain's future:**

1️⃣ Capital outflows: As mentioned earlier, the DeFi weekly report tracks the top 3 inflows and outflows weekly, providing insights into capital movements on each chain. Berachain's capital outflows began to slow down last week. Therefore, I believe the Boyco unlock is unlikely to be as disastrous as some expect. However, on-chain data should continue to be monitored.

2️⃣ Has the official team prepared for the potential impact of Boyco on the ecosystem? From the documents they released, I think they show some sincerity. However, for users whose yields may fall short of expectations, are there other incentives to look forward to? This is also worth keeping an eye on.

After all, Bera's DeFi ecosystem has been running for a while, and other types of protocols are just starting to launch. It would be a pity if it were to fail prematurely. Frankly, I don't think $BERA's FDV will drop to the same level as $MOVE. Hopefully, a short-term rebound can boost morale.

Show original

83.18K

80

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.