This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

OBOL

OBOL Binance price

0x3d51...e709

$0.000000028461

+$0.00000

(-20.39%)

Price change for the last 24 hours

How are you feeling about OBOL today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

OBOL market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$28,460.74

Network

BNB Chain

Circulating supply

1,000,000,000,000 OBOL

Token holders

319

Liquidity

$32,338.08

1h volume

$6.45M

4h volume

$6.45M

24h volume

$6.45M

OBOL Binance Feed

The following content is sourced from .

Rejamong.eth

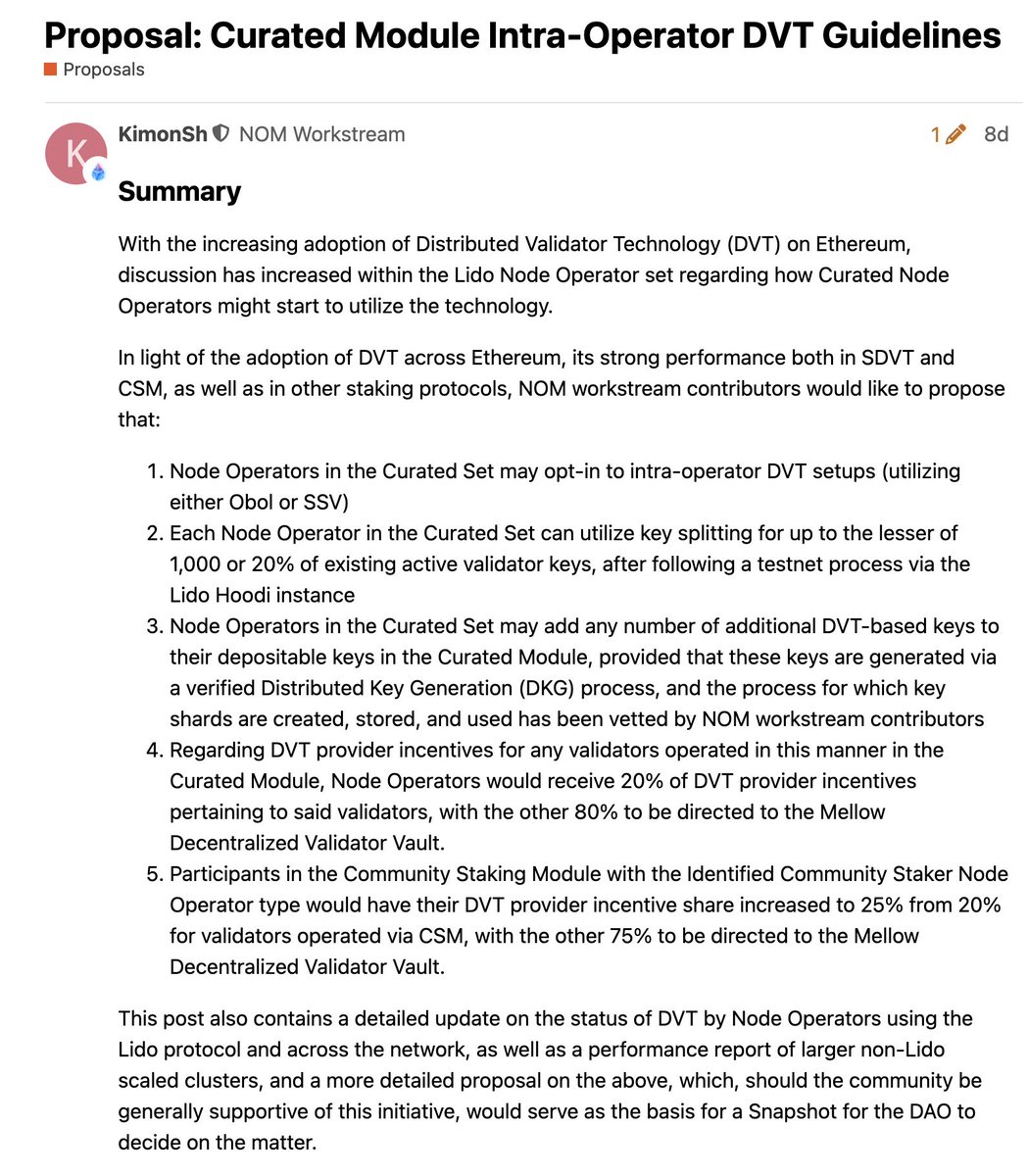

DVT (feat. SSV / Obol) is becoming the "standard" for Ethereum infrastructure.

Last week, the Lido Foundation proposed a suggestion.

The proposal is to change 20% of the Ethereum validators operated by Lido's Curated Operators (or 1,000 validators per operator) to be based on DVT (Distributed Validator Technology).

Even if each Curated Operator converts 1,000 validators to DVT, it corresponds to a total of 38,000 validators.

In fact, this is a trend not only for Lido but also for staking liquidity protocols like Mantle and Etherfi, which are consistently attempting to transition to DVT.

Our A41 is also operating 14,000 out of about 25,000 validators based on DVT (SSV + Obol).

DVT is a technology that splits a single Ethereum validator key into 4 or 7 parts, allowing participation in consensus even if only 3 or 5 of them are alive.

- This greatly increases the stability of each validator.

- Additionally, by encrypting the validator's key and operating it in a distributed manner, it is advantageous in terms of security.

- The split keys can be operated by multiple operators instead of a single operator, eliminating the risk of relying on a single operator's trust.

- Furthermore, in addition to Ethereum staking rewards, $SSV and $OBOL token rewards increase the APY.

Nevertheless, the reason DVT has not been actively adopted until now is that, unlike operating a single validator, using DVT requires operating 4 to N times more nodes for a single validator, leading to a significant cost burden.

However, after the Pectra hard fork, it became possible to operate more ETH for a single validator, allowing for a reduction in the number of validators, thereby decreasing the cost burden while increasing the importance of stability.

In this situation, DVT can be the best alternative. By using the resources secured from the reduced number of validators for DVT, additional cost burdens can be reduced while significantly increasing stability.

Currently, the DVT technology is monopolized by the two protocols, SSV and Obol.

Validators must pay fees to these protocols to use DVT, and these fees become the main use case for $SSV and $OBOL.

(Of course, currently both SSV and Obol are in a situation where they are distributing a kind of 'massive' token rewards to attract validators.)

In any case, DVT protocols like SSV and Obol are being actively adopted by large Ethereum staking pools,

becoming the new standard for operating Ethereum validators.

Show original

12.22K

52

Gohan 🧬

Just a story..

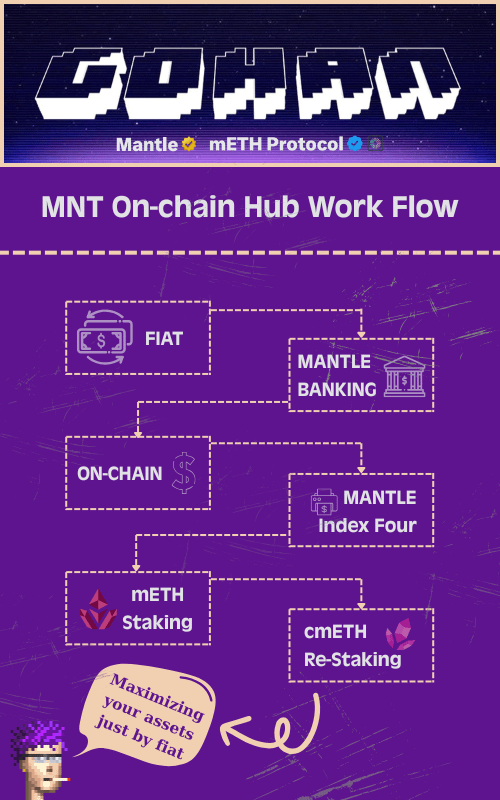

Mantle Network: A Secure Bridge from Web2 to Web3

I’ve shared extensively about MNT’s strategic vision to become a liquidity bridge, enabling Web2 users to safely and efficiently access DeFi solutions.

However, it may still be confusing for new users, so this article is here to break it down 👌

1. Mantle Banking: Fiat to Onchain

Mantle Banking serves as the entry point, seamlessly converting fiat into onchain $ through direct integration with traditional bank accounts.

➜ This eliminates technical barriers for Web2 users, ensured by the secure Optimistic Rollup technology inherited from Ethereum.

2. MI4: Optimizing DeFi Strategies

MI4, Mantle’s AI investment fund, analyzes markets in real-time to select the best DeFi strategies: staking, lending, or yield farming.

➜ With an initial portfolio of BTC, ETH, SOL and stablecoins, MI4 rebalances quarterly to maximize returns based on market cap and risk.

3. $mETH: Executing Staking

mETH facilitates Ethereum staking, creating mETH tokens as value-accumulating certificates.

Redeemable 1:1 with ETH plus staking rewards, mETH offers stable yields, especially as collateral in DeFi platforms.

4. $cmETH: Executing Restaking

cmETH enhances the flow by restaking mETH on protocols like EigenLayer and Symbiotic, boosting yields through a diverse restaking portfolio, turning initial capital into a continuous income stream.

◢ Result: Users Always Win with Smart Money Flow

@Mantle_Official’s smart money flow, blending top-tier security, AI optimization and staking/restaking strategies, ensures maximum profit with minimal risk.

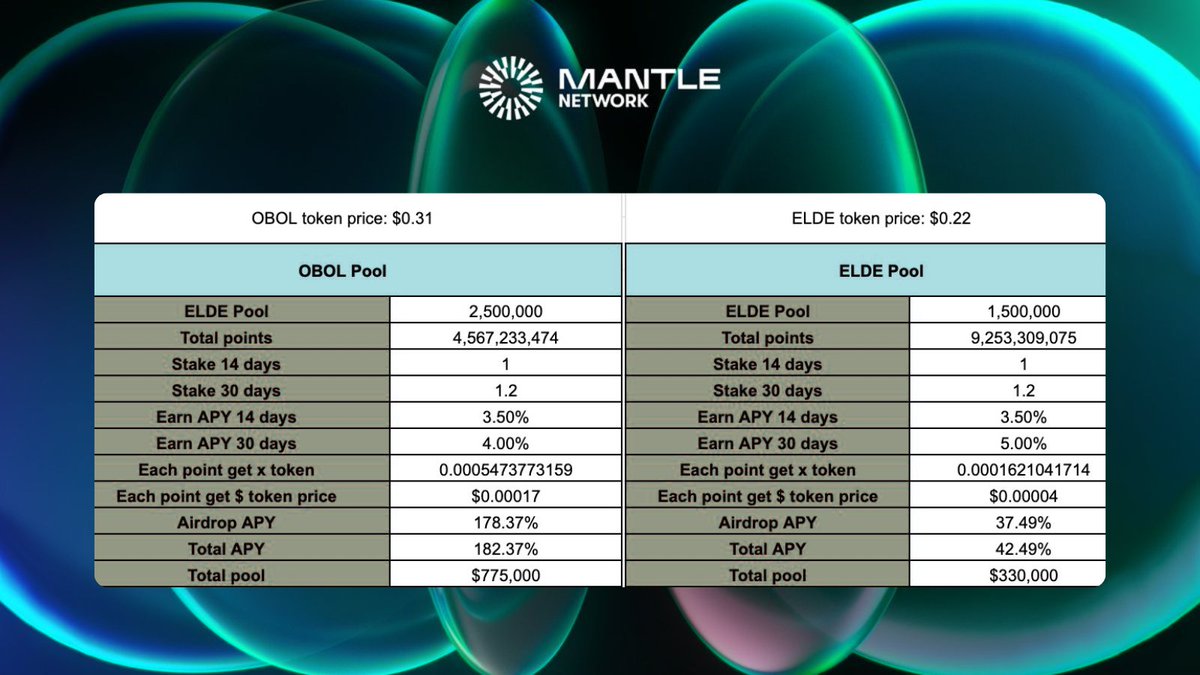

With a TVL exceeding $3 billion and a 182% APY from Megadrops (OBOL), Mantle leads the way.

At its core, MI4’s advanced AI might drive optimal DeFi strategies, while Mantle goes beyond connecting Web2 and Web3, empowering users with a smart, winning financial ecosystem.

Hope you enjoy today's show, Homies!

Show original

11.75K

97

拉菲_Laffae

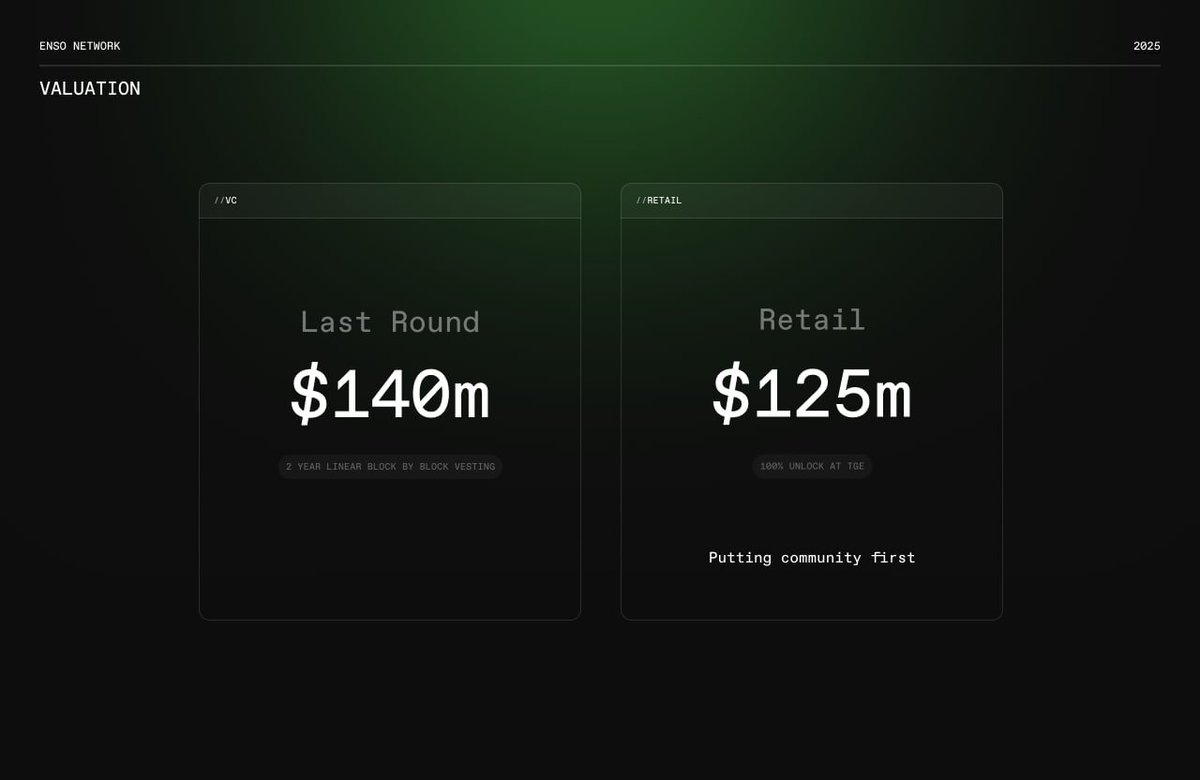

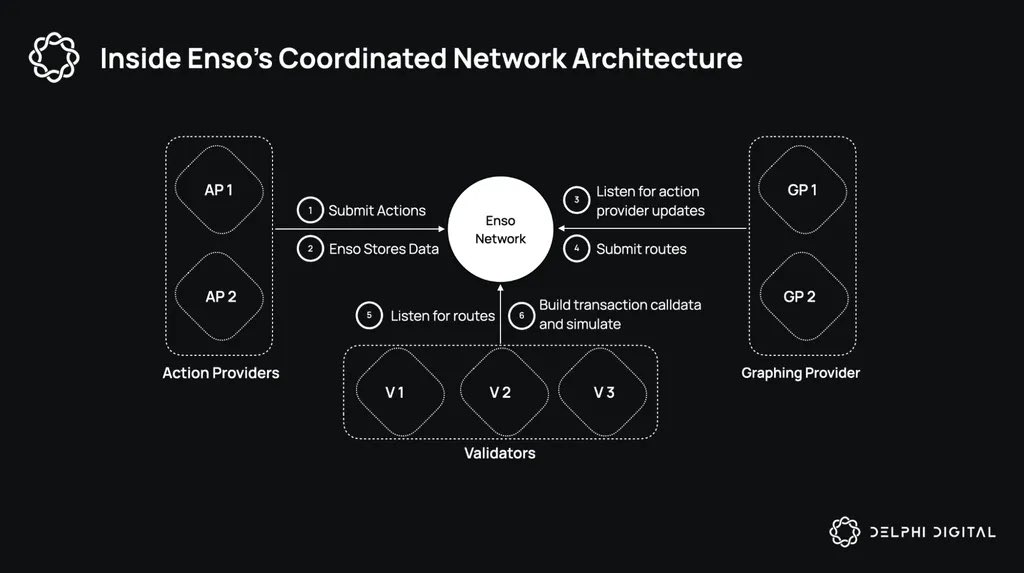

【🧩CoinList Launches New Project, Enso Community Round Debuts】

@CoinList is one of the mainstream early fundraising platforms, where projects like $WCT, $OBOL, and $FLOW have previously launched. For users looking to get in early on projects and secure first-round tokens, CoinList has always been a popular entry point. This time, @EnsoBuild brings two major highlights in the community round: "entry price lower than VC" and "100% unlock at TGE," offering a rare opportunity to enter at a price cheaper than institutional investors. Next, from the user's perspective, let's break down the highlights, risks, and participation steps of this project 👇

🔧 Project Introduction

Enso is an on-chain integration tool that allows developers to read and write to over 200 protocols using a single API. Currently, over 100 projects have officially adopted it, facilitating more than $15B in on-chain transactions. Incentive programs like Berachain, ZKsync, and Sonic have chosen to use Enso, making it a Web3 infrastructure that is already live and generating traffic.

💡 Why is this CoinList community round special?

1️⃣ Valuation cheaper than VC

This round's FDV is $125M, while the previous round's institutional private placement valuation was $140M.

2️⃣ 100% unlock, complete freedom

Tokens can be transferred and traded on the day of TGE, with no common linear unlock or long-term lock-up restrictions.

3️⃣ Tokens have real utility

ENSO serves as the internal fee for network queries and executions, governance, and staking mechanisms.

🧭 Enso Community Round Participation Information

🗓 Start Time: 6/13-20 01:00 (UTC+8)

🔓 Unlock Mechanism: 100% unlock on TGE day

📦 Issuance Volume: 4,000,000 ENSO (accounting for 4% of total supply)

💡 Participation Steps:

1️⃣ Go to the purchase page:

2️⃣ Log in to CoinList to place an order and participate

3️⃣ ENSO will be automatically sent to your account on TGE launch

💜 A Little Insight from Laffy

Enso is not a concept stock that paints a big picture before the token is released; it is an infrastructure project that is already operational. The low valuation and full unlock conditions are relatively user-friendly, suitable for those who want to participate early but do not want to be locked up. However, risk assessment is still essential. Although the valuation is cheap, the price performance after the token launch will be influenced by market sentiment, and the 100% unlock means all participants can sell on TGE day. If liquidity is insufficient or confidence is weak, it may also create short-term pressure.

Enso | ⌘ 🛠️

Enso unifies every blockchain into one network, with Blockchain Shortcuts.

Now it’s your turn to be part of it.

We’re launching our Enso Token Sale on @CoinList. Your chance to join the Enso Network from day one.

45.12K

6

𝑫𝒐𝒗𝒆 • 德芙 🕊️

ENSO will officially launch the CoinList community round subscription on June 12 at 17:00 UTC. Here are the key details to share with everyone in advance 👇

This community round has a total of 4 million ENSO, accounting for 4% of the total supply, with a valuation of only 125 million USD, and 100% will be unlocked at TGE.

The CoinList page is now live:

This is not an airdrop narrative, nor is it a project still building a PPT; ENSO has already been solidly integrated:

1️⃣ Over 100 on-chain protocols are in real use, with a cumulative trading volume exceeding 15 billion USD+

2️⃣ Has actually supported core projects like Berachain, Uniswap, ZKsync, Plume, etc.

3️⃣ Covers 200+ protocol APIs, serving as the liquidity and coordination "engine layer" of Web3

4️⃣ Backed by top-tier VCs including Polychain, Multicoin, Naval Ravikant, etc.

Not only is there technology and data, but also top-notch endorsements.

Comparing with previous CoinList IDOs:

$WCT listed on Upbit, Binance, with a peak return of 600%+

$OBOL listed on Binance Future, Binance Alpha, Bybit, with a maximum of 240%+

$RDAC listed on Binance Alpha

ENSO's product is mature, the roadmap is clear, the valuation is low + the unlock is reasonable + the project progress is extremely fast, making it the only round open for participation before TGE, maximizing the opportunity cost!

Show original

15.93K

10

Gohan 🧬

You know what?

A lot of people talk about how fragmented liquidity is in this market and the same goes for insights.

Sure, KAITO and InfoFi are opening a new era of attention, but that also means feeds on X are flooded, making it harder for users to keep up.

As a Mantle Hustle YAPPER, I feel responsible for bringing accurate and up-to-date insights about how Mantle might convert trad cash flow through its products and events.

◢ @mETHProtocol is obviously the backbone!

By reshaping the structure of DeFi liquidity, mETH helps optimize capital flow in the least risky way.

If you joined the recent mETH YAP CLUB ROAST, you’ve probably heard we've emphasized mETH’s role in pushing institutional DeFi adoption.

As DeFi integrates more into institutional strategies, protocols like mETH help make Ethereum-based yield strategies more accessible and reliable, building trust and drawing Web2 capital in.

◢ It’s not just words, Bybit Megadrops proved Mantle’s potential with real numbers.

➜ APYs were insane: OBOL at 182.31% and ELDE at 42.22%, showcasing Mantle’s strength in optimizing yield for investors.

➜ OBOL Pool: 2.5M total points, 4.86B MNT staked, 12,306 participants, 875,000 tokens rewarded.

➜ ELDE Pool: 1.2M points, 8.29B MNT staked, 14,290 participants, 350,000 tokens rewarded.

The traction is massive!

And this wasn’t the first big collab between MNT and Bybit. Mantle has backed 2 Bybit Megadrops, 9 Project Drops (Rewards Station), 10 Bybit Launchpads, 31 Bybit Launchpools - building a whole ecosystem to power liquidity.

It's only getting bigger!

If mETH = the backbone, Megadrops = the performance

◢ MI4 & Mantle Banking = the future

Before diving into MI4, know that $400M from the @Mantle_Official Treasury is being committed to MI4.

By teaming up with @Securitize to RWAs, MNT is targeting TradFi liquidity. While everyone’s eyes are on InfoFi, RWA is silently booming.

According to @BinanceResearch, the RWA market has surged +260% since early 2025.

MI4 automates access to a diversified basket of crypto assets like BTC, ETH, SOL, and various USD-backed or synthetic stablecoins (e.g., USDC, USDe, sUSDe).

It integrates DeFi-native strategies using mETH, bbSOL and USDe, bringing extra yield to users.

◢ And the flow is super simple, especially for Web2 users:

1. Deposit crypto or fiat (Visa, PayPal, etc.) via Mantle Banking

2. Store both TradFi and DeFi assets

3. Enhance yield through MI4 (mETH included)

4. Sit back and profit, while others stress about inflation.

Mantle Banking will be the final piece, the ultimate liquidity pool connecting Web3 and traditional capital.

➜ While waiting for that, you might want to stake Mantle on Coinbase with APYs up to 64.83%.

Mantle now holds $1.4B in Staking MC out of a massive total $2.1B.

Hope you enjoy the flow, long-form style, homies!

Show original

30.24K

128

OBOL price performance in USD

The current price of obol-binance is $0.000000028461. Over the last 24 hours, obol-binance has decreased by -20.39%. It currently has a circulating supply of 1,000,000,000,000 OBOL and a maximum supply of 1,000,000,000,000 OBOL, giving it a fully diluted market cap of $28,460.74. The obol-binance/USD price is updated in real-time.

5m

-21.28%

1h

-20.39%

4h

-20.39%

24h

-20.39%

About OBOL Binance (OBOL)

OBOL FAQ

What’s the current price of OBOL Binance?

The current price of 1 OBOL is $0.000000028461, experiencing a -20.39% change in the past 24 hours.

Can I buy OBOL on OKX?

No, currently OBOL is unavailable on OKX. To stay updated on when OBOL becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of OBOL fluctuate?

The price of OBOL fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 OBOL Binance worth today?

Currently, one OBOL Binance is worth $0.000000028461. For answers and insight into OBOL Binance's price action, you're in the right place. Explore the latest OBOL Binance charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as OBOL Binance, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as OBOL Binance have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.