Morpho price

in USD$1.8124

-$0.13020 (-6.71%)

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

Market cap

$584.94M #74

Circulating supply

322.9M / 1B

All-time high

$5.0526

24h volume

$33.38M

3.8 / 5

About Morpho

Morpho’s price performance

Past year

--

$0.00

3 months

+52.31%

$1.19

30 days

+32.60%

$1.37

7 days

-9.23%

$2.00

Morpho on socials

🟪◻️🟪◻️🟪◻️🟪----🍜

Recently, I saw someone asking:

After INFINIT launches V2, will those smart agents still be useful?

Actually, not only will they be useful, but the two systems will merge and become stronger.

Because this time @Infinit_Labs is not replacing you, but helping you turn those complex DeFi operations in your mind into one-click executions, and even strategies that can be monetized.

╭─────✦✦─⋆⋅☆⋅⋆───╮

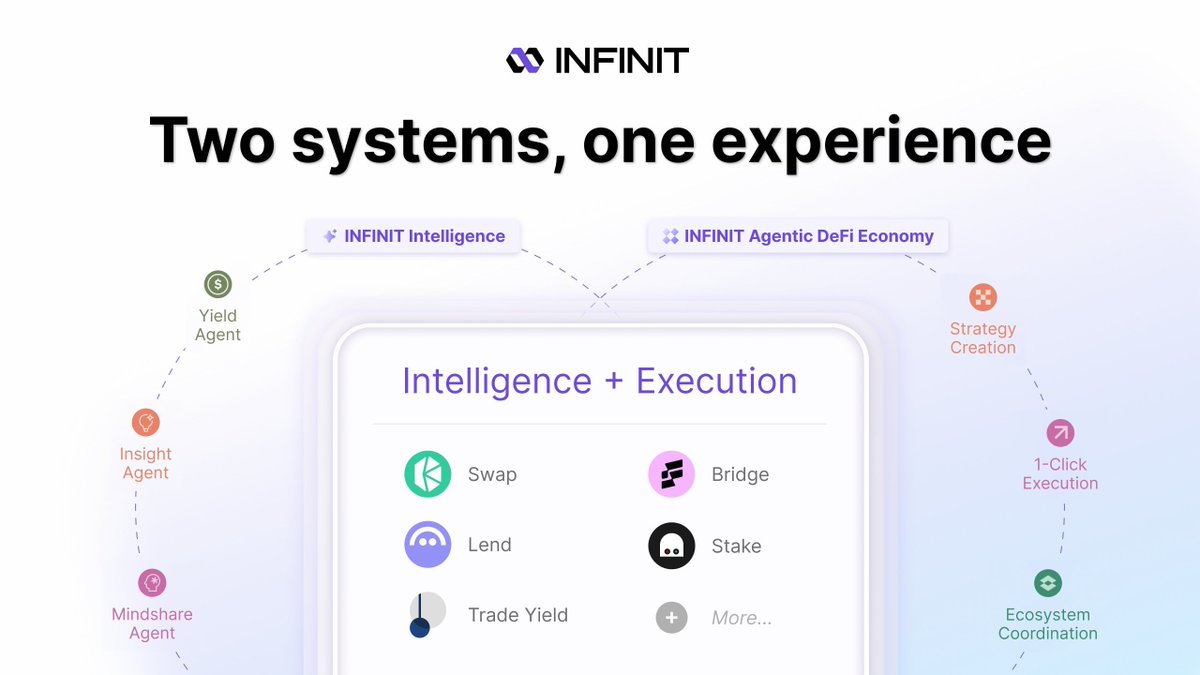

🧠 Two major systems working together

The entire structure can be broken down into two main parts:

▫️INFINIT Intelligence: like your "brain," helping you gather data, analyze numbers, and discover opportunities (which pool has high returns? Which protocol has been volatile recently?)

▫️INFINIT Agentic DeFi Economy (V2): acts like your "hands and feet," helping you turn strategies from ideas into automated executions, without needing to fiddle around pressing buttons.

Now these two parts are integrated, from information → strategy → execution, all done in one go.

╭─────✦✦─⋆⋅☆⋅⋆───╮

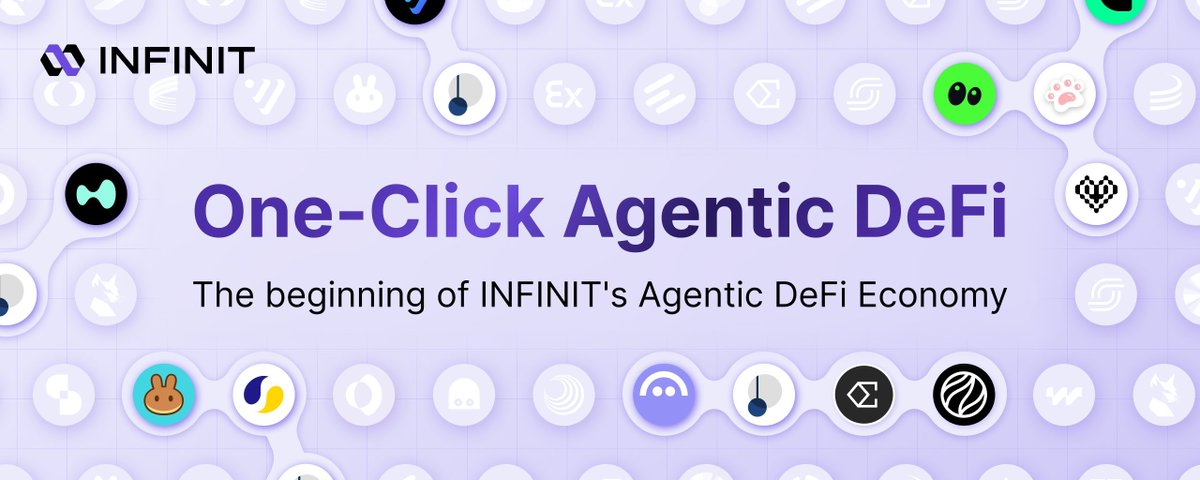

⚙️ One-click execution, complex strategies made super simple

For example, the strategy launched by #INFINIT:

PT-USR Looping Strategy

• Completed with one click

• Involves two protocols (Pendle + Morpho)

• A total of 17 steps (6 deposits/withdrawals, 5 borrow/lend, 70% leverage)

• Achieved: 2.77x leverage, 16.7% APY

• And all assets remain in your own wallet, not entering third-party contracts.

These operations that originally took half an hour to calculate back and forth can now be done with just a click.

╭─────✦✦─⋆⋅☆⋅⋆───╮

💡 Strategies turn into assets, creators can earn too

Then #INFINIT turned the "strategy creation" process into a monetizable asset.

As long as you can design a strategy, you don’t need to know how to code, you can put your ideas up for others to use with one click, and if someone uses your strategy, you can share in the profits and earn royalties.

The official even said:

Even Fifi the Cat could earn royalties 🤣🤣🤣

This kind of "knowledge monetization" method has really not been seen in DeFi, but it makes a lot of sense.

╭─────✦✦─⋆⋅☆⋅⋆───╮

🔍 The features available now are also very complete

Actually, INFINIT Intelligence has already been launched:

• Automatically finds high-yield pools for you

• One-click swap, lend, stake

• Protocol data / cross-chain routing integration

• Integrates 100+ on-chain and off-chain information sources

If you are someone who can find alpha, this system is basically an add-on for you.

╭─────✦✦─⋆⋅☆⋅⋆───╮

☁️ Personal opinion:

From initially finding data, trying strategies, and manually running processes, to now:

Information insights → Strategy creation → One-click execution → Charging for monetization

@Infinit_Labs has packed the entire DeFi into one system, whether you want simple operations or want to be a strategy creator.

After INFINIT V2 goes live, the overall experience is completely different, I really recommend everyone to give it a try.

Udon🍜うどん(🌸, 🌿)

🟪◻️🟪◻️🟪◻️🟪----🍜

The V2 update from @Infinit_Labs. Their one-click strategy is very convenient, but the logic behind the role distribution is also quite appealing~

If you usually run DeFi strategies, you know those steps can often be a headache~

The entire structure of #INFINIT breaks DeFi down into three layers👇:

╭─────✦✦─⋆⋅☆⋅⋆───╮

🧠 1|Strategy: Created by humans

In the past, we thought AI would replace humans, but now #INFINIT emphasizes:

The strategy logic is still handled by humans, AI is just for execution.

Many arbitrage opportunities and yield stacking rely on human sensitivity to the market to be constructed.

For example:

• Using PT for discount arbitrage on Pendle

• Pairing Morpho lending to increase leverage

• Then using Hyperliquid's funding rate for reverse hedging

These logics cannot be solely derived from models, which is why INFINIT leaves a lot of space for human creators~

╭─────✦✦─⋆⋅☆⋅⋆───╮

⚙️ 2|Strategy: Executed by Agents

Once the strategy is set, the execution of the entire process is handled by AI agents:

• Helping you transfer USDC across chains to Arbitrum

• Helping you deposit assets in Morpho

• Helping you purchase PT on Pendle, estimating returns

• Finally helping you set up positions for hedging on Hyperliquid, completing the overall portfolio

And it's not just one agent handling everything, but a swarm of agents

Like a strategy engineering team, each responsible for modules like swap, borrow, LP, hedge, and then packaged into a single transaction.

╭─────✦✦─⋆⋅☆⋅⋆───╮

🔒 3|Control of Assets: Always in Your Hands

I like this point because @Infinit_Labs has no concept of a Vault at all.

One-click execution of strategies, but assets do not leave your wallet, using ERC-4337 + EIP-7702 to combine multiple steps into a single transaction.

It's like you give the command, and then it runs the process and handles the parameters, but you control the funds, preventing them from falling into a middle pool or being phished by fake websites.

This is super important for regular users, especially those who are new to DeFi and afraid of making mistakes.

╭─────✦✦─⋆⋅☆⋅⋆───╮

🧩 So INFINIT V2 changes not just how to operate DeFi~

• Strategy creation: Handed to those familiar with the market

• Strategy execution: Handed to AI for automatic running

• Strategy copying: One-click following for regular users

In the past, only experts could earn DeFi yields, but now experts design strategies for you, AI executes them, and you directly take the profits.

If this goes smoothly, I will genuinely look forward to this path being successful.

Otherwise, now you have to understand a bunch of chains + a bunch of things and so on, which will only push regular users further away~

Guides

Find out how to buy Morpho

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict Morpho’s prices

How much will Morpho be worth over the next few years? Check out the community's thoughts and make your predictions.

View Morpho’s price history

Track your Morpho’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

Morpho on OKX Learn

Grayscale's Q3 2025 Altcoin Shake-Up: Avalanche and Morpho Join the Spotlight

Grayscale's 'Top 20' Altcoin List Updates: A Q3 2025 Overview Grayscale Research has unveiled its updated 'Top 20' list of promising altcoins for Q3 2025, sparking significant interest in the cryptocu

A look at Morpho history and how it was developed

What is the history of MORPHO? Morpho, a decentralized lending and borrowing protocol, has a fascinating journey that began with its official mainnet launch on December 20, 2022. The protocol was deve

What is Morpho: Get to know all about MORPHO

What is Morpho MORPHO Morpho MORPHO is a decentralized protocol built on Ethereum that enables overcollateralized lending and borrowing of crypto assets, including ERC20 and ERC4626 tokens. Designed t

Top 5 Use Cases for Morpho MORPHO: What’s Driving Its Popularity?

Exploring Morpho Adoption: A Decentralized Lending Protocol Revolutionizing Blockchain Applications Morpho, a decentralized protocol built on Ethereum, is transforming the way users lend and borrow cr

Morpho FAQ

Currently, one Morpho is worth $1.8124. For answers and insight into Morpho's price action, you're in the right place. Explore the latest Morpho charts and trade responsibly with OKX.

Cryptocurrencies, such as Morpho, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Morpho have been created as well.

Check out our Morpho price prediction page to forecast future prices and determine your price targets.

Dive deeper into Morpho

Morpho is a decentralised protocol on Ethereum enabling the overcollateralised lending and borrowing of crypto assets (ERC20 and ERC4626 tokens) on the Ethereum Virtual Machine (EVM).

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Market cap

$584.94M #74

Circulating supply

322.9M / 1B

All-time high

$5.0526

24h volume

$33.38M

3.8 / 5