This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

MEME

Meme the Donkey price

GwSDvy...pump

$0.000064972

-$0.00018

(-73.44%)

Price change for the last 24 hours

How are you feeling about MEME today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

MEME market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$649,718.46

Network

Solana

Circulating supply

9,999,999,778 MEME

Token holders

207

Liquidity

$46,811.64

1h volume

$2.58M

4h volume

$2.58M

24h volume

$2.58M

Meme the Donkey Feed

The following content is sourced from .

Leafswan

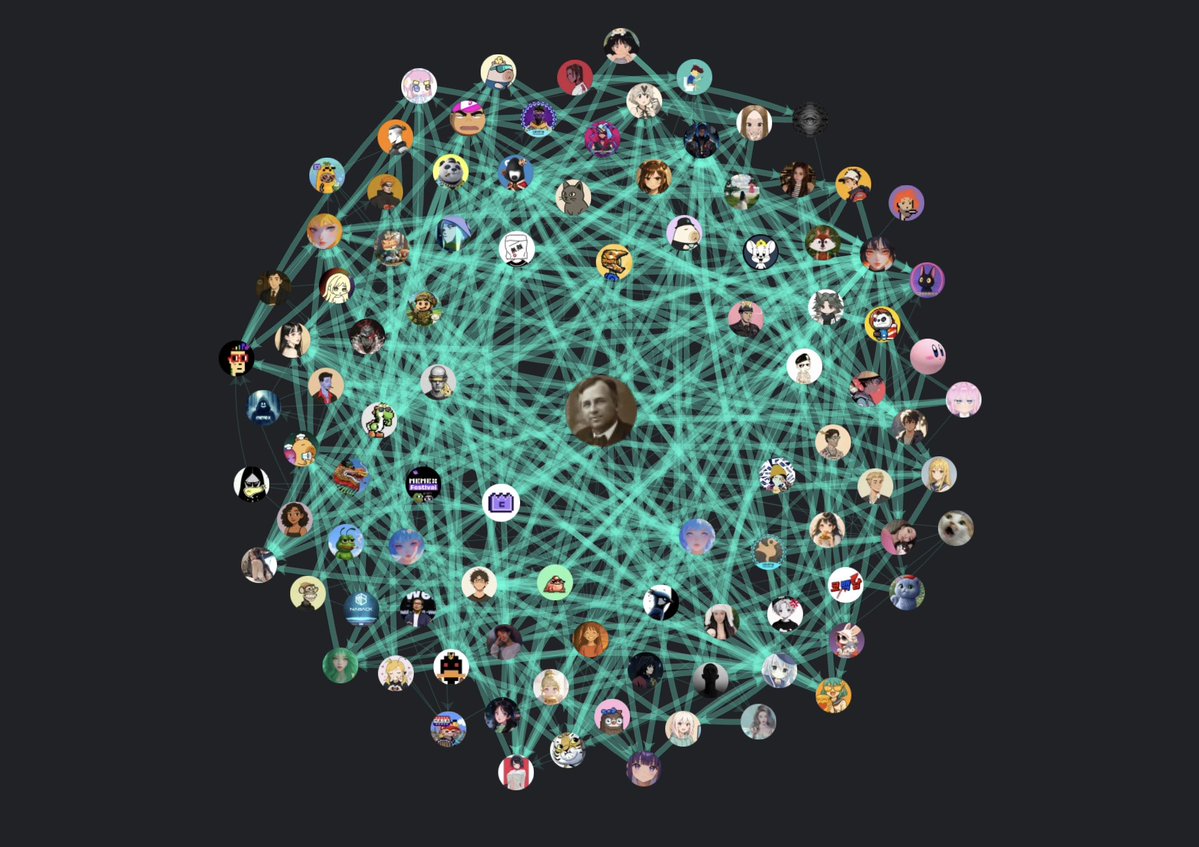

What is @MemeX_MRC20 building?

Verification has always been about palms, retina scans, face ID, thumb print and all that.

The human identification system has undergone different changes, and still we haven't come up with less invasive ways for people to prove their identity.

Most of the ID systems require you to give part of your core self, and this data can be sold on the open market for millions. KYC has always been invasive, and that's why people shy away from systems that require a weird identification of themselves.

Who knows, maybe KYC in the future can even become satanic, but why can't we make KYC non-invasive? You can give part of yourself without that part being part of you.

So what is this? @MemeX_MRC20 has come up with a crazy cool concept, the POS. This isn't proof of stake, it's proof of SHIT, where meme revolution where users get to create their meme, mint and launch.

Participate in meme culture without having prior knowledge of crypto, private keys, seed phrases, or any other technical term.

Memex is rewarding the top 500 YAPPERS with a massive $700K worth of MEME CORE TOKENS. All you need to do is leverage the noise, create hype and attention, make your voice loud, and bring the attention of CT to what @MEMEX is hoping to build, turn this attention into rewards, and be part of this revolution.

As an INNER CT, let me help leverage your voice and let the algorithm do the rest.

MemeX

Finally. We’re here with @KaitoAI .

With a prize pool of $700K❤️🔥$M

In celebration of our collaboration with @KaitoAI , we are introducing the new PoS, Proof of 💩 — a simple human verification system where users prove they are human with everyday 💩

It’s absurd, it’s unforgettable, and it’s something no AI can fake. In a sea of automation, PoS keeps MemeX proudly real — raw, human, and impossible to replicate.

1.46K

25

悟空去听风风风|1000X GEM🔆

✍️ Followed the short bird brother with a beak @MemeCore_ORG

I heard that @MemeCore_ORG is a short-term project, and it may be at TGE next month, just on the @KaitoAI, and there are many bigwigs on the list, @0xzhaozhao, @uniswap12, etc., taking the lead.

🤖Brief introduction.

@MemeCore_ORG is a meme chain (Layer-1) that connects creators and communities through memes and DApps. It is designed specifically for the Meme Coin and aims to create a playground for the Meme community in the blockchain ecosystem.

#基础设施 #L1 #MEME

🤖 Why

Because it's very simple, Brother Short Bird @wanghebbf said that the project party is very rich, and Brother Short Bird saw my post and asked me to interact with it~

Show original

1.37K

3

ChainCatcher 链捕手

TL,DR

Macro data showed that U.S. inflation is showing signs of easing but still above the Fed's target, the labor market is generally solid, consumer spending is slowing due to high interest rates, and the Fed is keeping interest rates unchanged and cautious about cutting rates. At the same time, the geopolitical conflict in the Middle East has exacerbated market volatility, and although there is a temporary boost from the resumption of economic and trade dialogue between China and the United States, the global economic outlook is under pressure, and the future market trend will be affected by the expectation of interest rate cuts and changes in the international situation.

The overall trading volume of the crypto market is active but the momentum is weakening, and funds tend to be cautious due to geopolitical risks; The market capitalization fell by 4.03% month-on-month, and the focus of funds returned to BTC significantly, and ETH and stablecoins performed steadily. Most of the newly launched tokens are concentrated in the DeFi and Layer 1 tracks, VC-backed projects are still dominant, and hot spots are still dominated by emotions.

Despite the pressure on market sentiment due to geopolitical risks and the hawkish stance of the Federal Reserve, both Bitcoin and Ethereum prices retreated, the Bitcoin spot ETF still had a net inflow of $1.13 billion, while Ethereum saw a net outflow of about $80 million due to a larger price decline, reflecting a rise in short-term risk aversion. At the same time, driven by stablecoin legislation and the favorable listing of Circle, the stablecoin market continued to expand, and the overall circulation increased by about $4.17 billion in June.

On June 22, after Trump announced a ceasefire between Israel and Iran, Bitcoin rebounded strongly above $108,000, and the continuous net inflows of ETFs reflected institutional bullish sentiment, and the technical picture showed that the bulls regained control of the rhythm and could challenge the all-time high of $111,980 in the short term. Ethereum and Solana also rebounded synchronously, and if the key moving average resistance is broken through, it is expected to open up further upside, on the contrary, if it is blocked to the downside, it may return to the shock adjustment pattern.

Circle's successful listing and benefited from the passage of the GENIUS Act led to the strength of the stablecoin sector, but its valuation is highly dependent on spread income, and its subsequent sustainability remains to be seen. Virtual exploded in the Base ecosystem with its innovative new mechanism, and early users made significant profits, but after the "green lock mechanism" restricted liquidity, the popularity ebbed, and the token price retraced by more than 30% from its high.

Pumpfun's $4 billion token auction has been postponed again, and the market is still divided on whether it can bring a structural breakthrough due to the crisis of trust in the platform and ecological doubts. Coinbase promotes the integration of the Base chain and the main application, and JPMorgan Chase pilots the "deposit token" JPMD, marking the acceleration of the layout of the on-chain USD and compliant stablecoin tracks by traditional institutions and centralized platforms.

1. Macro perspective

1. Inflation trend

CPI data for June 2025 showed that inflation growth slowed to 3.3%, unchanged from the previous month, and the core CPI increased by 3.4% year-on-year and 0.2% month-on-month. While inflationary pressures have eased, the Fed still believes that the current level of inflation is on the high side, far from the 2% target. As economic data accumulates further, the Fed remains cautious, emphasizing the need for more positive data to support the decision to cut interest rates.

2. Labor market

The U.S. labor market remained relatively solid, with the unemployment rate edging up to 4.5%, slightly higher than the previous forecast of 4.4%. Although the unemployment rate has risen, it remains relatively low, reflecting the stability of the labor market. Retail sales fell 0.9% month-on-month, the biggest drop in four months, especially as consumer spending was significantly subdued amid high interest rates and underlying inflationary pressures, especially for durable and high-priced goods.

3. Monetary policy dynamics

The Fed left the federal funds rate unchanged at 4.25%-4.5% at its June meeting, the fourth consecutive time it has left rates unchanged. While the Fed expects two possible rate cuts by the end of 2025, it remains highly vigilant about inflation risks. The dot plot shows that there are still expectations of a rate cut in the second quarter of 2025, but the divergence on the future path of monetary policy is growing, reflecting the divergent views within the Fed on the timing of the rate cut.

4. Trade policy and global economic outlook

Global markets fell significantly in June due to the escalation of geopolitical risks in the Middle East and the hawkish stance of the Federal Reserve. Israel's airstrikes on Iran sparked panic in the market, and the U.S. stock market came under pressure in the short term. At the same time, the news of the resumption of economic and trade talks between the United States and China in London once boosted market risk sentiment, but the escalation of geopolitical conflicts quickly shattered the calm of the market. With the global economic outlook under pressure, investors' risk appetite has generally declined.

5. Summary

Macro data for June showed that the U.S. economy is still facing strong inflationary pressures, although some inflation indicators have slowed, but the overall economic growth forecast has been revised downward, and the Federal Reserve is cautious about cutting interest rates. The geopolitical conflict in the Middle East has had a great impact on market sentiment, which has intensified in the short term, but has picked up as the international situation eases and the Fed's interest rate cut expectations rise. It is expected that in the coming months, the Fed may start a cycle of interest rate cuts supported by data, but it also needs to be wary of the continued impact of geopolitical uncertainty on the market.

2. Overview of the crypto market

Currency data analysis

Trading volume & daily growth rate

According to CoinGecko data, as of June 25, the average daily trading volume in the crypto market was about $107.7 billion, down 6.6% from the previous cycle. During the period, the trading volume showed a trend of "rising and falling" many times, with a single-day rise and fall of more than 10%, of which the peak trading volume was recorded on June 13, reaching 167.9 billion US dollars, and there were also many sharp pullbacks. On the whole, although the market still maintains a certain degree of activity, the momentum of funds has weakened compared with the previous period, affected by uncertain factors such as geopolitical conflicts in the Middle East, market funds tend to be cautious in late June, and risk appetite has fallen.

Market capitalization > daily growth

According to CoinGecko data, as of June 25, the total cryptocurrency market capitalization slipped to $3.40 trillion, down 4.03% from the previous month. Among them, the market share of BTC rose to 64.8%, and the market share of ETH rose to 9.0%, and the market center of gravity has obviously returned to BTC. In terms of overall structure, BTC is still dominant, ETH and stablecoins are relatively stable, and short-term hot sectors mostly rely on emotional speculation and lack sustainable support, making it difficult to form long-term incremental momentum.

New popular tokens in June

Among the newly launched popular tokens in June, relying on the Binance Alpha listing route, VC background projects are still dominant, and the popular tracks focus on DeFi and Layer 1, among which DeFi projects - SPK, RESOLV, HOME, etc. have received wide attention from the market.

3. On-chain data analysis

3.1 Analysis of inflows and outflows of BTC and ETH ETFs

BTC ETF inflows in June amounted to $1.13 billion

In June, the escalation of geopolitical risks in the Middle East + the impact of the Federal Reserve's "hawkish" stance led to a decline in market risk appetite, and the sentiment of the Bitcoin market was under pressure, and the price showed a volatile downward trend. The price of Bitcoin fell from $105,649 to $100,987, a decrease of about 4.41%. Although the subsequent temporary ceasefire between Iran and Israel led to a price correction, the market remains under the influence of war risks. Bitcoin spot ETF funds still maintained a net inflow trend, reflecting the confidence of traditional investors in long-term value, with a cumulative net inflow of about $1.13 billion in June.

In June, ETH ETFs saw an outflow of $80 million

As for Ethereum, the price fell even more significantly after the impact of the war. The price of ETH fell by 12.1% to $2,228 from $2,536 at the beginning of the month. Correspondingly, there was a net outflow of Ethereum spot ETF funds, indicating that short-term fund risk aversion is heating up, with a cumulative net outflow of about $80 million in June.

3.2 Analysis of stablecoin inflows and outflows

Stablecoin inflows in June were about $100 million – mainly from USDT and USDC

In June, the stablecoin market continued its strong growth momentum with the positive news of the stablecoin bill and the listing of the Circle U.S. stock. Among them, USDT, USDE, and USDC became the main drivers of growth this month, and the total circulation of stablecoins increased by about $4.17 billion.

4. Price analysis of mainstream currencies

4.1 BTC Price Change Analysis

Bitcoin's rally that began on June 22 was prompted by US President Donald Trump's announcement of a "total ceasefire" between Israel and Iran, and the price quickly broke above $108,000, indicating continued strong bull buying. Despite the recent rise in geopolitical risks, the US spot bitcoin ETF has recorded net inflows for 11 consecutive days, indicating that institutional investor sentiment remains positive.

Bitcoin is currently on track to challenge an all-time high of $111,980. However, in the absence of new catalysts, prices are likely to remain range-bound.

Bitcoin rebounded strongly from $100,000 on June 22 and broke through all major moving averages, showing strong buying at the low level. The 20-day exponential moving average (EMA) has now started to move upwards and the RSI indicator has also entered positive territory, suggesting that the bulls are regaining control of the market rhythm.

In the short term, the bears may build a line of defense between the descending trend line and $111,980. If the price finds resistance in this area but is able to find support near the 20-day EMA, it will indicate that the bulls are buying on dips and then hope to launch another breakout attempt. Conversely, if the price breaks below the MA support, the BTC/USDT pair may continue to trade in the range of $98,200 to $111,980.

4.2 ETH price change analysis

Ethereum rebounded from $2,111 on June 22 and hit the 20-day EMA ($2,473) on June 24. At present, the 20-day EMA tends to be flat, and the RSI is also close to the central axis, indicating that the market bullish and bearish forces are temporarily in equilibrium.

If ETH breaks above the moving averages, it may open upside, targeting the resistance levels of $2,738 and $2,879. Conversely, if the price is blocked near the 20-day EMA and falls below $2,323, it means that the bears continue to put pressure on the rally, and the ETH/USDT pair could once again test the key support at $2,111.

4.3 SOL Price Change Analysis

Solana rebounded from $126 on June 22 and broke through the key decline of $140 on June 24. The current rally is met with resistance near the 20-day EMA ($147), but the positive sign is that the bulls have managed to hold the $140 mark.

If the pullback is limited, the market is expected to try to break above the 20-day EMA, and once it gains ground, the SOL/USDT pair could further test the $160 level where the 50-day simple moving average (SMA) is located.

If the bears manage to push the price back below $140, it could trigger a further pullback, with support at $123 or even $110.

5. Hot events of the month

1. The listing of Circle has triggered a boom in the concept of stablecoins

Circle Internet Group, the parent company of stablecoin issuer Circle, successfully listed on the New York Stock Exchange on June 5, and its stock price rose from its opening price of $31 to a high of $298, soaring 861%, with a market capitalization of about $76 billion. Subsequently, because Cathie Wood's ARK fund quickly reduced its holdings of about 1.5 million shares and cashed out more than $330 million after the IPO, its price fell to $198 as of June 26, with a market value of about $50.6 billion.

At its peak, Circle's market capitalization has surpassed USDC's actual circulating market capitalization, and its revenue mainly comes from USDC reserve interest, generating a total of $1.6 billion in revenue by the end of 2024, of which Coinbase has taken more than half, becoming Circle's largest source of distribution costs. While the partnership is critical to expanding USDC's reach, the current yield structure also exposes the risk of Circle's over-reliance on spread income, which could squeeze profitability if interest rates fall in the future. However, the IPO coincided with the passage of the GENIUS Act by the U.S. Senate, which strengthened policy support for compliant stablecoins and became a catalyst for market hype on the "digital dollar" theme. Overall, Circle's listing has become an important node in the compliance of the stablecoin industry, and the market has given it a premium as a "digital dollar leader", but whether its long-term valuation can stand firm still depends on its ability to break through the dependence on reserve income and build a sustainable diversified income model.

2. The GENIUS Act is passed, pending the President's signature

IN JUNE 2025, THE U.S. SENATE OVERWHELMINGLY PASSED THE GENIUS STABLECOIN BILL (68:30), MARKING A HISTORIC STEP FORWARD IN CRYPTOCURRENCY REGULATION IN THE UNITED STATES. The bill imposes strict compliance requirements on stablecoin issuers, including $1:1 or short-term Treasury reserves, monthly audits, a ban on interest-bearing stablecoins, and only allowing issuance by bank subsidiaries and federal or specific state-authorized entities. The bill explicitly includes stablecoins in the regulatory scope of the Bank Secrecy Law, establishing the legal status of "digital currency" for them, which is regarded as an important milestone in promoting the mainstream of digital assets. Local platforms such as Circle and Coinbase have become direct beneficiaries, with Circle's market value soaring by 35% after the bill passed, while Tether is facing multiple compliance challenges such as audit qualifications and reserve structure.

Although the bill has yet to be voted on by the House of Representatives to be signed by the president, Trump has publicly endorsed it on social media, calling it "the foundation of the digital dollar." Overall, the passage of the GENIUS Act is not only a strategic move by the United States to compete for the dominance of digital currencies, but also may become a bellwether for the global stablecoin regulatory paradigm, the stablecoin market is expected to usher in explosive growth, and the U.S. financial system is also accelerating towards a new era of more digitalization and globalization.

3.Virtual: pumpfun+Bn Alpha new mechanism detonates the market heat

This month's Virtual is undoubtedly one of the most talked-about projects in the market in recent times. With its innovative new launch mechanism, it has quickly attracted a large amount of funds and user participation, and has become the core representative of the current base ecological new development narrative. THE PRICE OF VIRTUAL HAS RISEN BY 400% FROM $0.5 IN MID-APRIL TO A HIGH OF $2.5 IN EARLY JUNE. The core advantages of Virtual's new development are:

Extremely low financing price: Each new project is raised at a market value of 42,425 virtual ($224,000), so users can participate in financing at a very low price, and the potential profit margin of the project after the launch of the project is huge.

Linear token unlocking: Unlike MEME on PumpFun, Virtual's new projects are not unlocked after the opening, but are unlocked in batches with a transparent token economic model like VC coins. In addition, in order to prevent the project party from smashing the market, the raised funds are not directly handed over to the project party, but are all injected into the initial liquidity pool.

Low risk of new projects: If users participate in new projects that are not successfully funded, they will be returned to users in full, and Virtual only sends a few new projects a day, so the quality is generally higher than that of MEME, and the risk of user participation is very low.

Reduce the Rug probability of the project team: Virtual sets a 1% handling fee, of which 70% is returned to the project team, this incentive model makes the project team have the incentive to increase transaction activity instead of short-term cash, forming a benign ecological closed loop.

However, with the rise in popularity of the platform, early users frequently obtain short-term high returns through the strategy of opening and selling, resulting in huge selling pressure on new projects and undermining the stability of the overall ecosystem. To this end, Virtual launched the "Green Lock Mechanism" in mid-June, setting a mandatory lock-up period for new users, during which the obtained tokens cannot be sold, and points accumulation will be suspended if they violate the rules. Although this mechanism helps to curb early sell-offs and extend the project life cycle, it also significantly changes the original speculative logic. The profit cycle of users is forced to lengthen, the capital efficiency declines, and the market enthusiasm has a phased ebb and flow. Virtual's price entered a downward channel in mid-June, falling back from its high to $1.69, a drop of more than 37%.

6. Outlook for next month

1. Pumpfun: The $4 billion token auction has been postponed again

The Pumpfun token auction, originally scheduled for the end of June, has been postponed again and is now expected to be postponed until mid-July. This is already a number of postponements since the token offering was first proposed at the end of last year. It is reported that Pumpfun plans to raise $1 billion at a valuation (FDV) of $4 billion, and plans to airdrop 10% of the tokens for community incentives.

Since its launch, Pumpfun has achieved about $700 million in revenue relying on the low fee and binding curve mechanism, becoming one of the most profitable projects on the Solana chain, but its ecosystem is facing multiple trust challenges such as the proliferation of bot transactions, the stagnation of product innovation, and the unclear use of funds. In mid-June, the platform and the founder's social account were banned on the X platform, which triggered the spread of false news such as "regulatory intervention" and "founder's arrest", which further amplified market doubts. Whether this round of high-valuation financing can bring a structural breakthrough to the Solana ecosystem, or become another capital harvest, is still controversial in the market.

2. Coinbase Promotes Base On-Chain Integration, JPMorgan Chase Pilot "Deposit Token"

Coinbase has recently pushed for deep integration of the Base chain into its main application, and has now launched the Coinbase Verified Pools feature, which allows KYC users to interact with the DApps on Base directly using their Coinbase account balance, without the need for cumbersome wallet switching and on-chain transfer processes, and has announced Uniswap and Aerodrome as its DEX platforms for on-chain transactions. While this feature is still in its early stages, this direction is highly consistent with the current trend of multiple centralized exchanges promoting on-chain and off-chain integration. For example, Binance enables exchange users to directly purchase on-chain tokens through the Alpha system; Bybit launched Byreal to provide its exchange users with DeFi capabilities to trade popular on-chain tokens as well as Solana assets. At present, the one-stop trading experience of centralized exchanges and on-chain transactions has become an important direction for the evolution of the platform.

At the same time, JPMorgan Chase & Co. piloted the launch of JPMD, a "deposit token" on the Base chain, as a compliant digital dollar tool for institutions, which is backed by bank deposits and is permission-only. From the perspective of the industry, the combination of Coinbase and Base strengthens its compliance chain positioning and entry-level advantages, and if the application-level integration is realized in the future, it may significantly expand the active user base on the chain. The pilot of JPMorgan Chase reflects the positive impact of the passage of the GENIUS Stablecoin Act, and traditional institutions have begun to deploy the on-chain dollar track on a large scale, which may inject new variables into the competitive landscape of compliant stablecoins in the context of the current trend of gradual policy easing. Both of them can be regarded as important signals under the trend of "centralized institutions and on-chain ecology", and it is worth paying attention to their subsequent large-scale implementation rhythm and policy interaction effect.

Show original9.01K

0

MEME price performance in USD

The current price of meme-the-donkey is $0.000064972. Over the last 24 hours, meme-the-donkey has decreased by -73.44%. It currently has a circulating supply of 9,999,999,778 MEME and a maximum supply of 9,999,999,778 MEME, giving it a fully diluted market cap of $649,718.46. The meme-the-donkey/USD price is updated in real-time.

5m

-75.77%

1h

-73.44%

4h

-73.44%

24h

-73.44%

About Meme the Donkey (MEME)

MEME FAQ

What’s the current price of Meme the Donkey?

The current price of 1 MEME is $0.000064972, experiencing a -73.44% change in the past 24 hours.

Can I buy MEME on OKX?

No, currently MEME is unavailable on OKX. To stay updated on when MEME becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of MEME fluctuate?

The price of MEME fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Meme the Donkey worth today?

Currently, one Meme the Donkey is worth $0.000064972. For answers and insight into Meme the Donkey's price action, you're in the right place. Explore the latest Meme the Donkey charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Meme the Donkey, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Meme the Donkey have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.