Jito Staked SOL price

in USD$228.28

+$1.9800 (+0.87%)

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

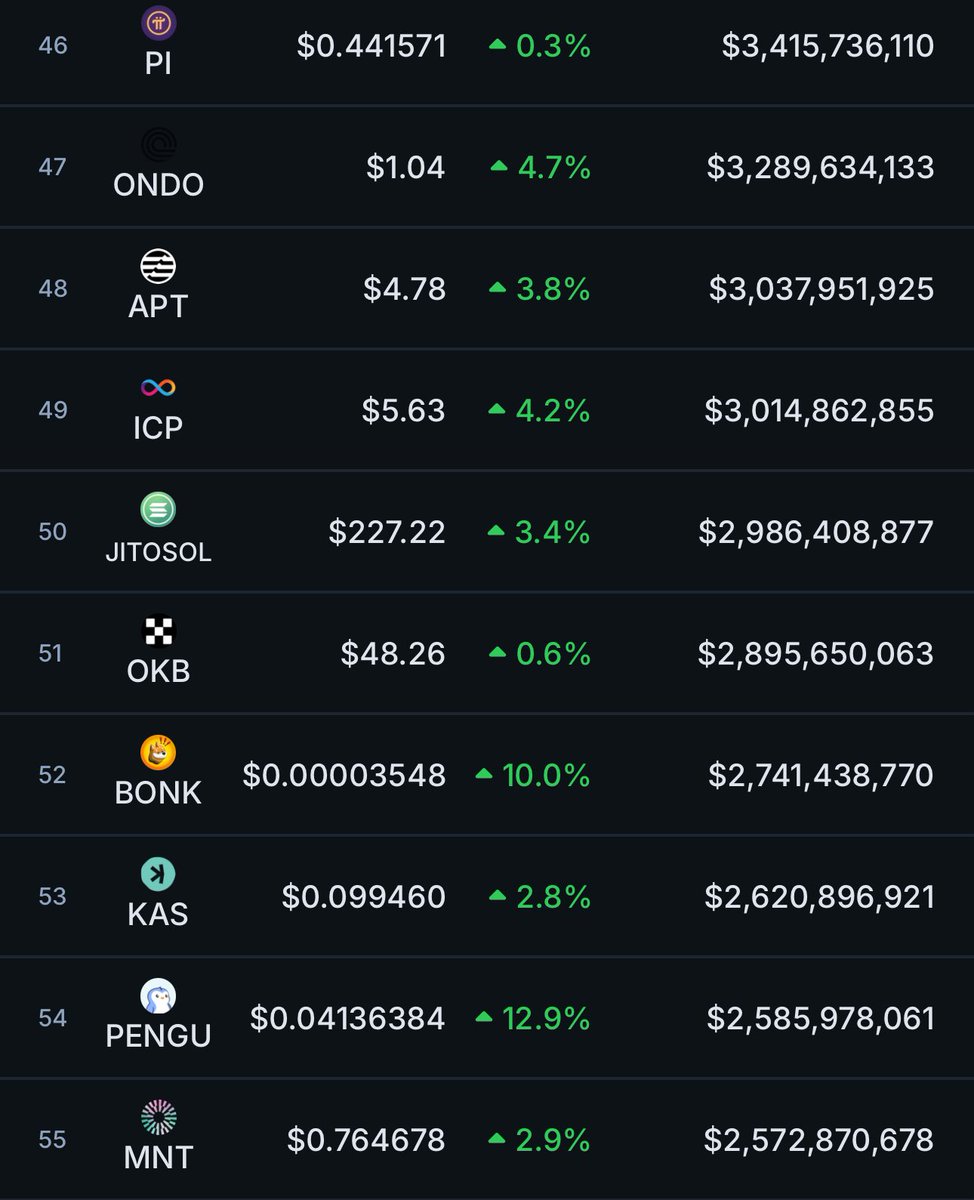

Market cap

$2.98B #33

Circulating supply

13.07M / 13.07M

All-time high

$250.77

24h volume

$35.00M

3.9 / 5

About Jito Staked SOL

Jito Staked SOL’s price performance

Past year

--

$0.00

3 months

--

$0.00

30 days

+27.00%

$179.74

7 days

-4.67%

$239.46

Jito Staked SOL on socials

Crypto Prices: Bitcoin, Ethereum, and Solana Long Trades In Spotlight

Bitcoin, Ethereum, and Solana long trades stayed in focus this week as the market recovered.

Top trader TheWhiteWhaleHL held firm, while big institutions made fresh moves in Ethereum and Solana.

This simply shows continued interest despite recent price swings.

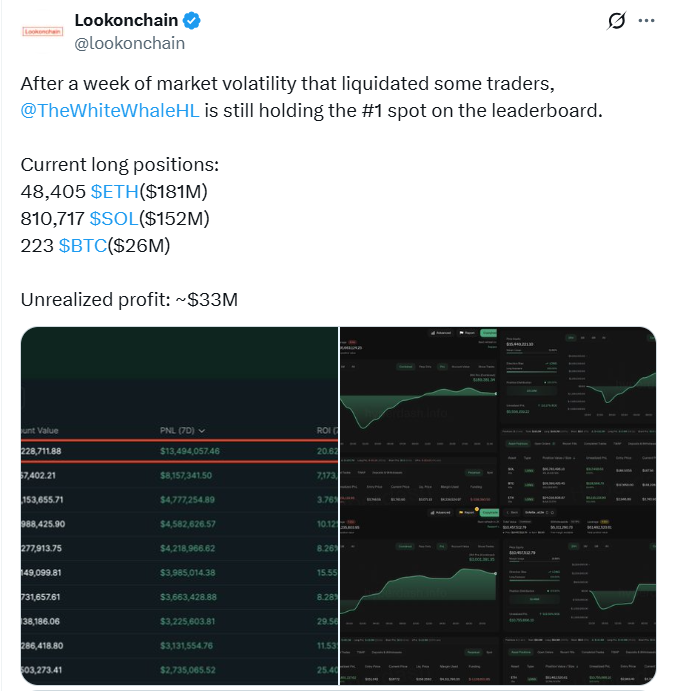

It is worth noting that after a shaky week for crypto prices that saw many traders lose money, one name stayed on top.

On-chain data shared by Lookonchain showed that TheWhiteWhaleHL kept the number one spot on the trading leaderboard.

While the market drop pushed others out, this trader held strong long positions in three major cryptocurrencies.

The data revealed that the trader held 48,405 ETH worth about $181 million. Likewise, 810,717 SOL, which is worth $152 million, and 223 BTC, valued at $26 million.

Market Trade Outlook | Source: Lookonchain

Altogether, the trader’s unrealized gains totaled approximately $33 million. These long trades stood out at a time when many traders were forced to exit their positions.

It is worth noting that even amid market swings, some traders remained confident.

The move by TheWhiteWhaleHL demonstrated that certain players were willing to hold through the uncertainty, likely expecting crypto prices to rebound.

Bitcoin and Stablecoins Could Help, Not Hurt, the Dollar

In a separate update, Anatoly Yakovenko, one of the founders of Solana, shared his thoughts on the current conversation surrounding Bitcoin and stablecoins.

Per his recent statement, he said that these digital assets could support the U.S. dollar, rather than weaken it.

He explained that Bitcoin is too volatile for everyday use. People would not want to use it to buy oil or get a mortgage.

However, stablecoins, which the U.S. Treasury often backs, make such use possible.

He added that the demand for stablecoins also leads to higher demand for U.S. government debt, which in turn supports the dollar.

His view contradicts the notion that cryptocurrency harms traditional finance. Instead, Yakovenko argued that digital assets, such as Bitcoin and stablecoins, could coexist alongside the dollar in today’s global economy.

Anatoly Yakovenko on Market Coexistence | Source: Solana

Still, adding to this point of view, Hunter Horsley said that after the iPhone launch, every business had a mobile app strategy within a few years.

He noted that, following the GENIUS Act, nearly every e-commerce, banking, and payments company will have stablecoins in their operations within 24 months.

Another sign of growing interest came from the ETF market. According to crypto analyst sassal0x, Ethereum ETFs saw net inflows of $1.8 billion over the past week.

Bitcoin ETFs generated a significantly smaller $71 million during the same period. This shift suggested that investors may be leaning more toward Ethereum at the moment.

Meanwhile, Sharplink Gaming, the company known for holding the largest amount of ETH in its treasury, made another significant move.

On-chain records showed that it received $145 million in USDC from Circle. It then sent the funds to Galaxy Digital, likely for more Ethereum purchases.

Solana also saw attention from investment firms. REX-Osprey added JitoSOL, Solana’s top liquid staking token, to its ETF product.

This marked the first time a liquid staking asset was included in a U.S.-listed crypto ETF. It signaled a new level of acceptance for staking-related tokens in formal investment products.

Senator Cynthia Lummis continued to push for increased crypto adoption in the U.S. She stated that Bitcoin could serve as a valuable hedge against inflation.

In her view, it provides people with another option when the value of the dollar is unstable.

She also described Bitcoin as a modern store of value and urged for its role in the financial system to be taken seriously.

The post Crypto Prices: Bitcoin, Ethereum, and Solana Long Trades In Spotlight appeared first on The Coin Republic.

Guides

Find out how to buy Jito Staked SOL

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict Jito Staked SOL’s prices

How much will Jito Staked SOL be worth over the next few years? Check out the community's thoughts and make your predictions.

View Jito Staked SOL’s price history

Track your Jito Staked SOL’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

Own Jito Staked SOL in 3 steps

Create a free OKX account

Fund your account

Choose your crypto

Jito Staked SOL FAQ

Currently, one Jito Staked SOL is worth $228.28. For answers and insight into Jito Staked SOL's price action, you're in the right place. Explore the latest Jito Staked SOL charts and trade responsibly with OKX.

Cryptocurrencies, such as Jito Staked SOL, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Jito Staked SOL have been created as well.

Check out our Jito Staked SOL price prediction page to forecast future prices and determine your price targets.

Dive deeper into Jito Staked SOL

JitoSOL is a liquid staking token issued by the Jito Foundation on Solana, enabling users to stake SOL, earn staking and MEV rewards, and maintain liquidity for use in DeFi applications.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Market cap

$2.98B #33

Circulating supply

13.07M / 13.07M

All-time high

$250.77

24h volume

$35.00M

3.9 / 5