This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

crvUSD

Curve.Fi USD Stablecoin price

0x498b...c1e5

$0.99818

-$0.00050

(-0.05%)

Price change for the last 24 hours

How are you feeling about crvUSD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

crvUSD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$4.58M

Network

Arbitrum

Circulating supply

4,587,073 crvUSD

Token holders

0

Liquidity

$2.62M

1h volume

$22,795.21

4h volume

$82,850.60

24h volume

$1.05M

Curve.Fi USD Stablecoin Feed

The following content is sourced from .

常为希 |加密保安🔸🚢🇺🇸

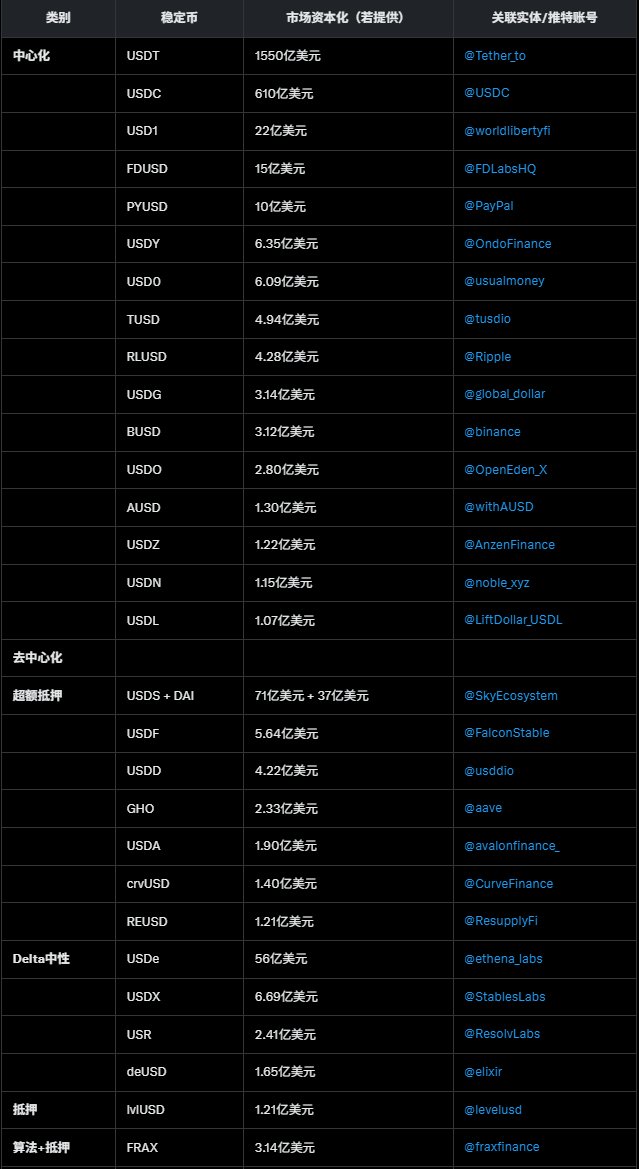

The market capitalization (MC) of stablecoins exceeding $100 million is categorized into centralized and decentralized types, with the decentralized category further divided into over-collateralized, delta-neutral, collateralized, and algorithmic + collateralized categories.

The total market capitalization of centralized stablecoins is significantly higher than that of decentralized ones.

USDT ($155 billion) and USDC ($61 billion) dominate, collectively controlling a large portion of the centralized stablecoin market (about 85%).

Other centralized stablecoins (such as USD1, FDUSD, PYUSD, etc.) have market capitalizations ranging from $100 million to $2.2 billion, indicating that small to medium-sized projects are also attempting to enter the market. PayPal's PYUSD ($1 billion) shows that traditional financial giants are starting to venture into the stablecoin space.

Over-collateralized: Represented by USDS + DAI ($7.1 billion + $3.7 billion), this category relies on over-collateralized crypto assets (such as ETH) to maintain stability, with a relatively balanced market capitalization distribution.

Delta-neutral: USDe ($5.6 billion) leads, with this mechanism achieving price stability through hedging strategies (such as perpetual futures), offering high capital efficiency.

The total market capitalization of centralized stablecoins far exceeds that of decentralized ones, reflecting the current market's preference for stable solutions backed by institutions.

The diversified mechanisms of decentralized stablecoins, such as delta-neutral and algorithmic stability, demonstrate the potential for technological innovation.

31.29K

5

Poopman (💩🧱✨)

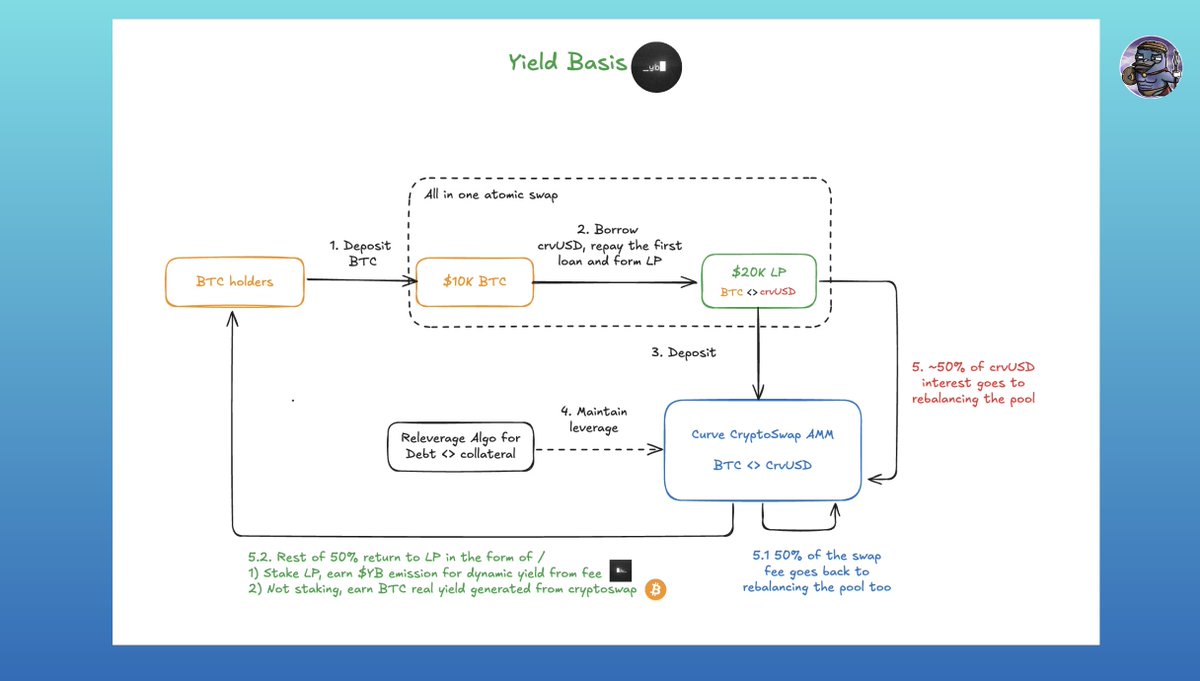

Here’s the concept of @yieldbasis :

An AMM that 2x leverages your liquidity to mitigate the impermanent loss with boosted yield.

🔸Cryptoswap with Stableswap Invariant:

In theory, maintaining a 2x leverage can mitigate IL, but in Uni V2 it only 2x your losses. Simulation shows an improved result in Curve's Cryptoswap once it combines with Stableswap Invariant.

🔸2x Leverages but how?

1) You deposit BTC (let's say $100K) in YB

2) YB borrows $100K $crvUSD against your BTC

3) Form a $200K LP to borrow another $100K crvUSD

4) Then repay the first loan (100K $crvUSD)

5) Finally, it forms a 2x leveraged LP

6) All happened in one atomic swap, and the purpose of this design is avoiding 1 to 1 borrowing (100% LTV) but rather keeping a 50% LTV.

🔸Releverage Algo:

To maintain a 2x leverage, YB uses another specialized AMM to automatically adjust the position by managing debt against your LP. E.g, When BTC moves 10% up, your debt goes up by 10% accordingly, this keeps the debt / collateral ratio at 50:50.

🔸Subsiding and Rebalancing:

In YB, concentrated liquidity is constantly rebalancing. In which, 50% of the fees from the AMM and ~50% of the crvUSD interest will go back to subsidize the budget of moving the CL for the best depth and fee generation.

🔸Take $YB or Take $BTC:

If you do not stake your LP, you get $BTC real yield.

If you stake your LP, you can receive $YB emission, which is entitled to a % of yield taken from the fee too.

The Dynamic ?

As more LPs are staked, the more fee is collected from the yield for $YB. In contrast, if no LP is staked, only a floor yield will be taken from the fee.

--------------------------------------------------------

Quick thought 🧠:

Interesting but complicated.

YB's core concept is basically leveraging cryptoswap design with stableswap invariant while using boosted yields from leveraged BTC positions to pay for rebalance costs.

On the other hand, the $YB token forms a nice game theory between protocol believers and yield farmers.

If this works, YB could attract a lot of bridged BTC by offering yields that outperform current market borrowing rates. This should also boost crvUSD adoption, a W-W solution for @CurveFinance I think.

However, given the complex design, reliance on flash loans, and a lot of mathematical assumptions, we should pay attention to potential smart contract vulnerabilities and flash loan attacks during implementation.

*Thanks @newmichwill, @llamaintern and the team for patiently answering all my questions.

As always, NFA and DYOR🎙️.

I do not own a bag.

Show original

16.7K

155

RedStone ♦️

Hey, what stablecoins does RedStone support?

Only:

$USDT

$BUIDL

$USDC

$sUSDe

$SUDSz

$sfrxUSD

$gmdUSDC

$sUSDX

$USDe

$wUSDM

$sUSDs

$USD3

$sdeUSD

$tacUSD

$GUSD

$frxUSD

$USD1

$USD+

$scUSD

$deUSD

$USDtb

$USDP

$USDD

$eUSD

$crvUSD

$USDX

$fxUSD

$aUSD

$MUSD

$ALUSD

$USDB

$LUSD

$TUSD

$DOLA

$OUSD

$USDM

$CUSD

$DAI

$sDAI

$USR

Show original17.74K

88

Odaily

Original title: Stablecoin Update May 2025

Original source: Artemis

Original compilation: Bitpush

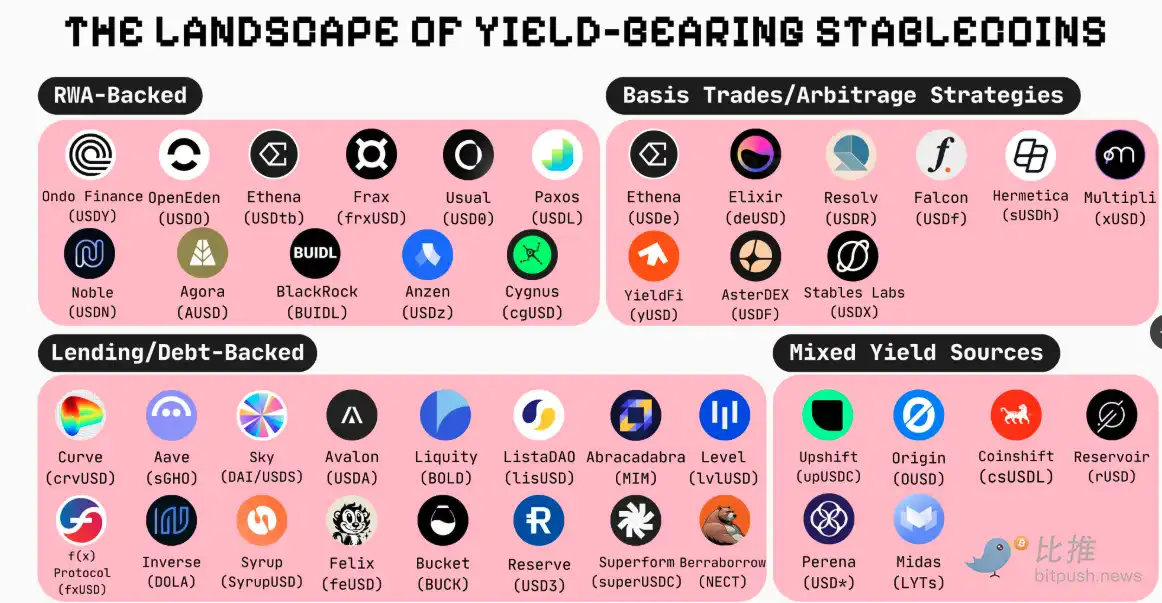

In the crypto market, stablecoins are no longer just "stable" – they are quietly helping you make money. From U.S. Treasury yields to perpetual contract arbitrage, yield-bearing stablecoins are becoming the new income engine for crypto investors. At present, there are dozens of related projects with a market value of more than $20 million, with a total value of more than $10 billion. In this article, we will break down the revenue sources of mainstream interest-earning stablecoins, and take stock of the most representative projects in the market to see who is really "making money" for you.

What is an interest-bearing stablecoin?

Unlike regular stablecoins, such as USDT or USDC, which only serve as a store of value, interest-bearing stablecoins allow users to earn passive income during their holdings. Their core value lies in bringing additional income to coin holders through the underlying strategy while keeping the stablecoin price anchored.

How are the benefits generated?

There are various sources of income for interest-bearing stablecoins, which can be summarized into the following categories:

Real World Asset (RWA) Investments: Protocols invest money in real-world low-risk assets such as U.S. Treasury bonds (T-bills), money market funds, or corporate bonds, and return the proceeds from those investments to the holders.

DeFi Strategy: The protocol deposits stablecoins into decentralized finance (DeFi) liquidity pools, conducts liquidity farming, or employs "delta-neutral" strategies to extract yield from market inefficiencies.

Borrowing: The deposit is lent to the borrower, and the interest paid by the borrower becomes the income of the holder.

Debt Support: The protocol allows users to lock up crypto assets as collateral to lend stablecoins. The income is primarily derived from stability fees or interest generated on non-stablecoin collateral.

Hybrid Sources: Yield comes from a variety of combinations such as tokenized RWA, DeFi protocols, centralized finance (CeFi) platforms, etc., to achieve diversified returns.

A quick overview of the interest-bearing stablecoin market landscape (projects with a total supply of about $20 million and above)

Below is a list of some of the current mainstream interest-bearing stablecoin projects, categorized according to their main yield generation strategies. Please note that the data is for the total supply, and the list mainly covers interest-bearing stablecoins with a total supply of $20 million or more.

1. RWA-backed (mainly through U.S. Treasuries, corporate bonds, commercial paper, etc.)

These stablecoins generate returns by investing money in real-world low-risk, yielding assets.

Ethena Labs (USDtb – $1.3 billion): Backed by BlackRock's BUIDL fund.

Usual (USD 0 – $619 million): Liquidity deposit token of the Usual protocol, backed 1:1 by ultra-short-term RWA (specifically aggregated US Treasury tokens).

BUIDL ($570 million): BlackRock's tokenized fund that holds U.S. Treasuries and cash equivalents.

Ondo Finance (USDY – $560 million): Fully backed by U.S. Treasuries.

OpenEden (USDO – $280 million): Proceeds come from U.S. Treasuries and repo-backed reserves.

Anzen (USDz – $122.8 million): Fully backed by a diversified portfolio of tokenized RWAs, consisting primarily of private credit assets.

Noble (USDN – $106.9 million): Composable interest-bearing stablecoin, backed by 103% of US Treasuries, utilizing M0 infrastructure.

Lift Dollar (USDL – $94 million): Issued by Paxos, fully backed by U.S. Treasuries and cash equivalents, and automatically compounded daily.

Agora (AUSD – $89 million): Backed by Agora reserves, including USD and cash equivalents such as overnight reverse repos and short-term US Treasuries.

Cygnus (cgUSD – $70.9 million): Backed by short-term Treasury bonds, it runs on the Base chain as a rebase-style ERC-20 token, with its balance automatically adjusted daily to reflect yields.

Frax (frxUSD – $62.9 million): Upgraded from Frax Finance's stablecoin FRAX, it is a multi-chain stablecoin backed by BlackRock's BUIDL and Superstate.

2. Basis trade/arbitrage strategy

This type of stablecoin obtains income through market-neutral strategies, such as perpetual contract funding rate arbitrage, cross-trading platform arbitrage, etc.

Ethena Labs (USDe – $6 billion): Backed by a diversified pool of assets, it maintains its peg through spot collateral delta hedging.

Stables Labs (USDX – $671 million): Generate yield through a delta-neutral arbitrage strategy between multiple cryptocurrencies.

Falcon Stable (USDf – $573 million): Backed by a portfolio of cryptocurrencies, yielding yield through Falcon's market-neutral strategies (funding rate arbitrage, cross-platform trading, native staking, and liquidity provision).

Resolv Labs (USR – $216 million): Fully backed by an ETH staking pool, ETH price risk is hedged through perpetual futures, and assets are managed by off-chain escrow.

Elixir (deUSD – $172 million): Using stETH and sDAI as collateral, creates a delta-neutral position by shorting ETH and captures a positive funding rate.

Aster (USDF – $110 million): Backed by crypto assets and corresponding short futures on AsterDEX.

Nultipli.fi (xUSD/xUSDT – $65 million): Earn through market-neutral arbitrage, including Contango arbitrage and funding rate arbitrage, on centralized exchanges (CEXs).

YieldFi (yUSD – $23 million): Backed by USDC and other stablecoins, yields come from Delta-neutral strategies, lending platforms, and yield trading protocols.

Hermetica (USDh – $5.5 million): Backed by Delta hedged Bitcoin, using short-selling perpetual futures on major centralized exchanges to earn funding.

3. Borrowing/debt-backed

This type of stablecoin generates returns by lending deposits, charging interest, or through collateralized debt positions (CDPs) for stability fees and liquidation proceeds.

Sky (DAI – $5.3 billion): Based on CDP (Collateralized Debt Position). Minted by staking ETH (LSTs), BTC LSTs, and sUSDS on @sparkdotfi. USDS is an upgraded version of DAI and is used to earn yield through Sky Savings Rate and SKY Rewards.

Curve Finance (crvUSD – $840 million): An overcollateralized stablecoin, backed by ETH and managed by LLAMMA, whose peg is maintained through Curve's liquidity pools and DeFi integrations.

Syrup (syrupUSDC – $631 million): Backed by a fixed-rate mortgage provided to crypto institutions, the proceeds are managed by @maplefinance's credit underwriting and lending infrastructure.

MIM_Spell (MIM – $241 million): An overcollateralized stablecoin minted by locking interest-bearing cryptocurrency into Cauldrons, with yields derived from interest and liquidation fees.

Aave (GHO – $251 million): minted through collateral provided in the Aave v3 lending marketplace.

Inverse (DOLA – $200 million): A debt-backed stablecoin minted through collateralized lending on FiRM, with yield generated by staking into sDOLA, which earns self-lending income.

Level (lvlUSD – $184 million): Backed by USDC or USDT deposited into DeFi lending protocols (such as Aave) to generate yield.

Beraborrow (NECT – $169 million): Berachain's native CDP stablecoin, backed by iBGT. Yields are generated through liquidity stabilization pools, liquidation yields, and leverage boosts for PoL incentives.

Avalon Labs (USDa – $193 million): A full-chain stablecoin minted using assets such as BTC through the CeDeFi CDP model, offering fixed-rate lending and generating yield by staking in the Avalon vault.

Liquity Protocol (BOLD – $95 million): Backed by over-collateralized ETH (LSTs) and generating sustainable yield through interest payments from borrowers and ETH liquidation proceeds earned through its Stability Pools.

Lista Dao (lisUSD – $62.9 million): An overcollateralized stablecoin on BNB Chain, minted by using BNB, ETH (LSTs), stablecoins as collateral.

f(x) Protocol (fxUSD – $65 million): Minted through leveraged xPOSITIONs backed by stETH or WBTC, yields from stETH staking, opening fees, and stability pool incentives.

Bucket Protocol (BUCK – $72 million): An over-collateralized CDP-backed stablecoin based on @SuiNetwork, minted by staking SUI.

Felix (feUSD – $71 million): Liquity fork CDP on @HyperliquidX. feUSD is an overcollateralized CDP stablecoin that is minted using HYPE or UBTC as collateral.

Superform Labs (superUSDC – $51 million): USDC-backed vault that is automatically rebalanced to top-tier lending protocols (Aave, Fluid, Morpho, Euler) on Ethereum and Base, powered by Yearn v3.

Reserve (US D3 – $49 million): Backed 1:1 by a basket of blue-chip interest-bearing tokens (pyUSD, sDAI, and cUSDC).

4. Hybrid income sources (combining DeFi, traditional finance, centralized finance income) are stablecoins that combine multiple strategies to diversify risk and optimize returns

Reservoir (rUSD – $230.5 million): An overcollateralized stablecoin backed by RWAs and a combination of USD-based capital allocators and lending vaults.

Coinshift (csUSDL – $126.6 million): Backed by T-Bills and DeFi lending via Morpho, it offers regulated, low-risk returns through a vault curated by @SteakhouseFi.

Midas (mEGDE, mTBILL, mMEV, mBASIS, mRe 7 YIELD – $110 million): A compliant institutional-grade stablecoin strategy. LYTs represent claims on actively managed interest-bearing RWA and DeFi strategies.

Upshift (upUSDC – $32.8 million): Earns interest and is partially supported by a lending strategy, but yields are also derived from LP (liquidity provision), staking.

Perena (USD*- $19.9 million): Solana's native interest-bearing stablecoin, which is at the heart of the Perena AMM and earns yield through swap fees and an IBT-powered liquidity pool.

summary

The above highlights interest-earning stablecoins with a total supply of around $20 million or more, but keep in mind that all interest-earning stablecoins come with risks. Yields are not risk-free, and they may be subject to smart contract risk, protocol risk, market risk, or collateral risk, among other things.

Show original

14.63K

0

Blockbeats

Original title: Stablecoin Update May 2025

Original source: Artemis

Original compilation: Bitpush

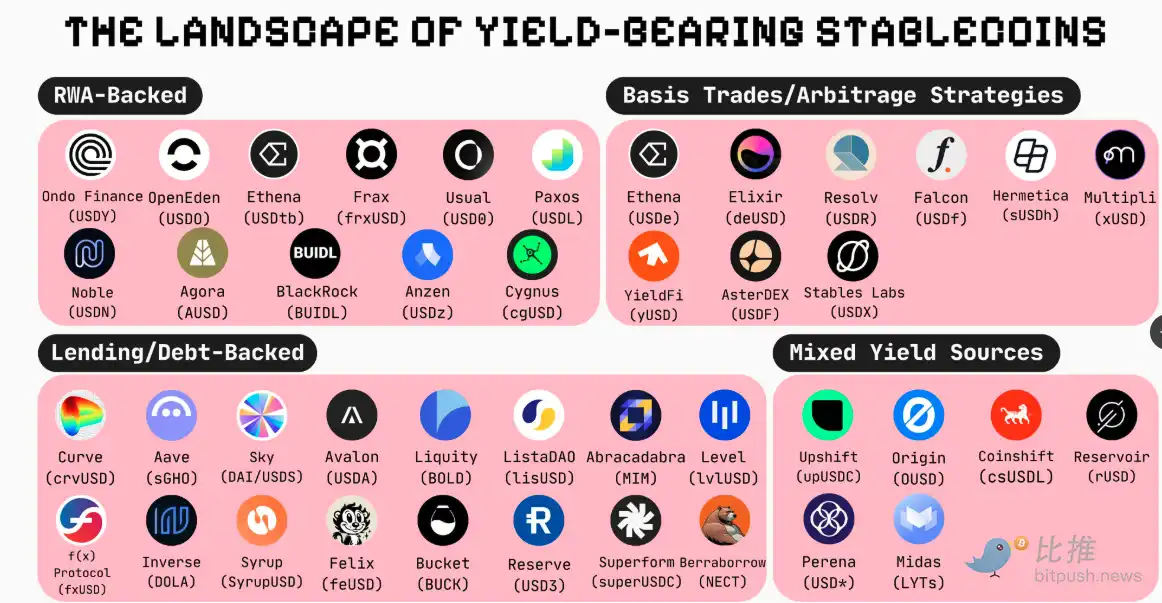

In the crypto market, stablecoins are no longer just "stable" – they are quietly helping you make money. From U.S. Treasury yields to perpetual contract arbitrage, yield-bearing stablecoins are becoming the new income engine for crypto investors. At present, there are dozens of related projects with a market value of more than $20 million, with a total value of more than $10 billion. In this article, we will break down the revenue sources of mainstream interest-earning stablecoins, and take stock of the most representative projects in the market to see who is really "making money" for you.

What is an interest-bearing stablecoin?

Unlike regular stablecoins, such as USDT or USDC, which only serve as a store of value, interest-bearing stablecoins allow users to earn passive income during their holdings. Their core value lies in bringing additional income to coin holders through the underlying strategy while keeping the stablecoin price anchored.

How are the benefits generated?

There are various sources of income for interest-bearing stablecoins, which can be summarized into the following categories:

· Real World Asset (RWA) Investments: Protocols invest money in real-world low-risk assets such as U.S. Treasury bonds (T-bills), money market funds, or corporate bonds, and return the proceeds from those investments to the holders.

· DeFi Strategy: The protocol deposits stablecoins into decentralized finance (DeFi) liquidity pools, conducts liquidity farming, or employs "delta-neutral" strategies to extract yield from market inefficiencies.

· Borrowing: The deposit is lent to the borrower, and the interest paid by the borrower becomes the income of the holder.

· Debt Support: The protocol allows users to lock up crypto assets as collateral to lend stablecoins. The income is primarily derived from stability fees or interest generated on non-stablecoin collateral.

· Hybrid Sources: Yield comes from a variety of combinations such as tokenized RWA, DeFi protocols, centralized finance (CeFi) platforms, etc., to achieve diversified returns.

A quick overview of the interest-bearing stablecoin market landscape (projects with a total supply of about $20 million and above)

Below is a list of some of the current mainstream interest-bearing stablecoin projects, categorized according to their main yield generation strategies. Please note that the data is for the total supply, and the list mainly covers interest-bearing stablecoins with a total supply of $20 million or more.

1. RWA-backed (mainly through U.S. Treasuries, corporate bonds, commercial paper, etc.)

These stablecoins generate returns by investing money in real-world low-risk, yielding assets.

· Ethena Labs (USDtb – $1.3 billion): Backed by BlackRock's BUIDL fund.

· Usual (USD0 – $619 million): Liquidity deposit token of the Usual protocol, backed 1:1 by ultra-short-term RWA (specifically aggregated US Treasury tokens).

· BUIDL ($570 million): BlackRock's tokenized fund that holds U.S. Treasuries and cash equivalents.

· Ondo Finance (USDY – $560 million): Fully backed by U.S. Treasuries.

· OpenEden (USDO – $280 million): Proceeds come from U.S. Treasuries and repo-backed reserves.

· Anzen (USDz – $122.8 million): Fully backed by a diversified portfolio of tokenized RWAs, consisting primarily of private credit assets.

· Noble (USDN – $106.9 million): Composable interest-bearing stablecoin, backed by 103% of US Treasuries, leveraging M0 infrastructure.

· Lift Dollar (USDL – $94 million): Issued by Paxos, fully backed by U.S. Treasuries and cash equivalents, and automatically compounded daily.

· Agora (AUSD – $89 million): Backed by Agora reserves, including USD and cash equivalents such as overnight reverse repos and short-term US Treasuries.

· Cygnus (cgUSD – $70.9 million): Backed by short-term Treasury bonds, it runs on the Base chain as a rebase-style ERC-20 token, with its balance automatically adjusted daily to reflect yields.

· Frax (frxUSD – $62.9 million): Upgraded from Frax Finance's stablecoin FRAX, it is a multi-chain stablecoin backed by BlackRock's BUIDL and Superstate.

2. Basis trade/arbitrage strategy

This type of stablecoin obtains income through market-neutral strategies, such as perpetual contract funding rate arbitrage, cross-trading platform arbitrage, etc.

· Ethena Labs (USDe – $6 billion): Backed by a diversified pool of assets, it maintains its peg through spot collateral delta hedging.

· Stables Labs (USDX – $671 million): Generate yield through a delta-neutral arbitrage strategy between multiple cryptocurrencies.

· Falcon Stable (USDf – $573 million): Backed by a portfolio of cryptocurrencies, yielding yield through Falcon's market-neutral strategies (funding rate arbitrage, cross-platform trading, native staking, and liquidity provision).

· Resolv Labs (USR – $216 million): Fully backed by an ETH staking pool, ETH price risk is hedged through perpetual futures, and assets are managed by off-chain escrow.

· Elixir (deUSD – $172 million): Using stETH and sDAI as collateral, creates a delta-neutral position by shorting ETH and captures a positive funding rate.

· Aster (USDF – $110 million): Backed by crypto assets and corresponding short futures on AsterDEX.

· Nultipli.fi (xUSD/xUSDT – $65 million): Earn through market-neutral arbitrage, including Contango arbitrage and funding rate arbitrage, on centralized exchanges (CEXs).

· YieldFi (yUSD – $23 million): Backed by USDC and other stablecoins, yields come from Delta-neutral strategies, lending platforms, and yield trading protocols.

· Hermetica (USDh – $5.5 million): Backed by Delta hedged Bitcoin, using short-selling perpetual futures on major centralized exchanges to earn funding.

3. Borrowing/debt-backed

This type of stablecoin generates returns by lending deposits, charging interest, or through collateralized debt positions (CDPs) for stability fees and liquidation proceeds.

· Sky (DAI – $5.3 billion): Based on CDP (Collateralized Debt Position). Minted by staking ETH (LSTs), BTC LSTs, and sUSDS on @sparkdotfi. USDS is an upgraded version of DAI and is used to earn yield through Sky Savings Rate and SKY Rewards.

· Curve Finance (crvUSD – $840 million): An overcollateralized stablecoin, backed by ETH and managed by LLAMMA, whose peg is maintained through Curve's liquidity pools and DeFi integrations.

· Syrup (syrupUSDC – $631 million): Backed by a fixed-rate mortgage provided to crypto institutions, the proceeds are managed by @maplefinance's credit underwriting and lending infrastructure.

· MIM_Spell (MIM – $241 million): An overcollateralized stablecoin minted by locking interest-bearing cryptocurrency into Cauldrons, with yields derived from interest and liquidation fees.

· Aave (GHO – $251 million): minted through collateral provided in the Aave v3 lending marketplace.

· Inverse (DOLA – $200 million): A debt-backed stablecoin minted through collateralized lending on FiRM, with yield generated by staking into sDOLA, which earns self-lending income.

· Level (lvlUSD – $184 million): Backed by USDC or USDT deposited into DeFi lending protocols (such as Aave) to generate yield.

· Beraborrow (NECT – $169 million): Berachain's native CDP stablecoin, backed by iBGT. Yields are generated through liquidity stabilization pools, liquidation yields, and leverage boosts for PoL incentives.

· Avalon Labs (USDa – $193 million): A full-chain stablecoin minted using assets such as BTC through the CeDeFi CDP model, offering fixed-rate lending and generating yield by staking in the Avalon vault.

· Liquity Protocol (BOLD – $95 million): Backed by over-collateralized ETH (LSTs) and generating sustainable yield through interest payments from borrowers and ETH liquidation proceeds earned through its Stability Pools.

· Lista Dao (lisUSD – $62.9 million): An overcollateralized stablecoin on BNB Chain, minted by using BNB, ETH (LSTs), stablecoins as collateral.

· f(x) Protocol (fxUSD – $65 million): Minted through leveraged xPOSITIONs backed by stETH or WBTC, yields from stETH staking, opening fees, and stability pool incentives.

· Bucket Protocol (BUCK – $72 million): An over-collateralized CDP-backed stablecoin based on @SuiNetwork, minted by staking SUI.

· Felix (feUSD – $71 million): Liquity fork CDP on @HyperliquidX. feUSD is an overcollateralized CDP stablecoin that is minted using HYPE or UBTC as collateral.

· Superform Labs (superUSDC – $51 million): USDC-backed vault that is automatically rebalanced to top-tier lending protocols (Aave, Fluid, Morpho, Euler) on Ethereum and Base, powered by Yearn v3.

· Reserve (USD3 – $49 million): Backed 1:1 by a basket of blue-chip interest-bearing tokens (pyUSD, sDAI, and cUSDC).

4. Hybrid income sources (combining DeFi, traditional finance, centralized finance income) are stablecoins that combine multiple strategies to diversify risk and optimize returns.

· Reservoir (rUSD – $230.5 million): An overcollateralized stablecoin backed by RWAs and a combination of USD-based capital allocators and lending vaults.

· Coinshift (csUSDL – $126.6 million): Backed by T-Bills and DeFi lending via Morpho, it offers regulated, low-risk returns through a vault curated by @SteakhouseFi.

· Midas (mEGDE, mTBILL, mMEV, mBASIS, mRe7YIELD – $110 million): Compliant institutional-grade stablecoin strategy. LYTs represent claims on actively managed interest-bearing RWA and DeFi strategies.

· Upshift (upUSDC – $32.8 million): Earns interest and is partially supported by a lending strategy, but yields are also derived from LP (liquidity provision), staking.

· Perena (USD*- $19.9 million): Solana's native interest-bearing stablecoin, which is at the heart of the Perena AMM and earns yield through swap fees and an IBT-powered liquidity pool.

summary

The above highlights interest-earning stablecoins with a total supply of around $20 million or more, but keep in mind that all interest-earning stablecoins come with risks. Yields are not risk-free, and they may be subject to smart contract risk, protocol risk, market risk, or collateral risk, among other things.

Link to original article

Show original

11.44K

0

crvUSD price performance in USD

The current price of curve-fi-usd-stablecoin is $0.99818. Over the last 24 hours, curve-fi-usd-stablecoin has decreased by -0.05%. It currently has a circulating supply of 4,587,073 crvUSD and a maximum supply of 4,587,073 crvUSD, giving it a fully diluted market cap of $4.58M. The curve-fi-usd-stablecoin/USD price is updated in real-time.

5m

+0.01%

1h

+0.00%

4h

+0.01%

24h

-0.05%

About Curve.Fi USD Stablecoin (crvUSD)

crvUSD FAQ

What’s the current price of Curve.Fi USD Stablecoin?

The current price of 1 crvUSD is $0.99818, experiencing a -0.05% change in the past 24 hours.

Can I buy crvUSD on OKX?

No, currently crvUSD is unavailable on OKX. To stay updated on when crvUSD becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of crvUSD fluctuate?

The price of crvUSD fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Curve.Fi USD Stablecoin worth today?

Currently, one Curve.Fi USD Stablecoin is worth $0.99818. For answers and insight into Curve.Fi USD Stablecoin's price action, you're in the right place. Explore the latest Curve.Fi USD Stablecoin charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Curve.Fi USD Stablecoin, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Curve.Fi USD Stablecoin have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.