This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

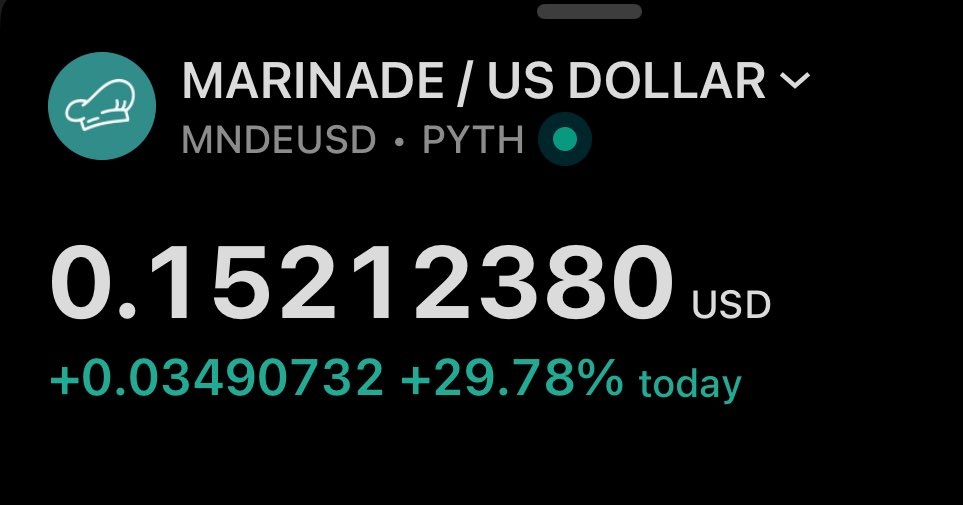

CLOUD

Cloud price

CLoUDK...FzAu

$0.14815

+$0.0066233

(+4.68%)

Price change for the last 24 hours

How are you feeling about CLOUD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

CLOUD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$148.15M

Network

Solana

Circulating supply

999,995,575 CLOUD

Token holders

90915

Liquidity

$4.72M

1h volume

$13,997.14

4h volume

$107,775.16

24h volume

$1.62M

Cloud Feed

The following content is sourced from .

币世王

Fragmetric @fragmetric|A protocol driving the path of re-staking on Solana

Another truly native, practical, and transparent asset protocol is rising on Solana! It builds its Restaking pyramid step by step, relying on underlying technology, real yields, and community consensus!

You may have heard of fragSOL, fragBTC, fragJTO, but it is far more than just an ordinary version of re-staking. Fragmetric is pushing Solana's high performance and asset efficiency to a new limit! The question is, how is it doing this?

▰▰▰▰▰

What is Fragmetric?

Fragmetric is the first native liquidity re-staking protocol on Solana. Simply put, you deposit LSTs like $SOL, $BTC, $JTO, and they instantly transform into new assets like fragSOL, fragBTC, fragJTO. These assets not only continue to generate staking yields but also allow you to participate in multiple protocols with one click, earn F-Points, and receive airdrops.

The core technology is its proposed FRAG-22 asset standard, which is even more aggressive than ERC-4626:

▪ Modular strategy extensibility

Can integrate liquidity pools, lending, and structured strategies at any time.

▪ Unified standard for multi-asset deposits

A single interface to handle multiple LSTs, finally matching Solana's high-speed performance with diversified asset management.

▪ On-chain instant reward distribution mechanism

Every staking or operation can trigger reward settlement, transparent and verifiable.

While other protocols are still working on Farming-as-a-Service, Fragmetric is already building Solana's asset allocation system!

▰▰▰▰▰

How to leverage fragSOL / fragJTO / fragBTC for maximum yield?

You are not just staking assets; you are activating a multi-layered yield structure:

▪ Staking yields

From the staking income of the original assets themselves.

▪ MEV capture

fragSOL has integrated with Jito.

▪ Restaking rewards

NCN/AVS partnership agreements (Switchboard, Ping) provide additional yields.

▪ F-Point rewards

Daily rankings and interactions can accumulate points, leading directly to airdrops.

▪ DeFi protocol integration

fragAssets can be used directly on Orca, Kamino, Loopscale, RateX, etc., for LP, lending, and structured operations.

Moreover, they are preparing to open a cross-chain bridge for wfragSOL, which will allow Solana's re-staking assets to circulate off-chain, earning double yields!

▰▰▰▰▰

Recent Airdrop

The airdrop page for the $FRAG token is now live:

This round of airdrop is different from many projects; there are no vesting periods, no lock-ups? It's a one-time OG-style release!

The airdrop covers the following groups:

▪ Users who have deposited into partner protocols.

▪ Participants of fragSOL, fragJTO, fragBTC.

▪ Early community active users (Discord, DRiP, TOPU NFT).

▪ Backpack wallet users receive additional point bonuses!

A TOPU NFT can yield 750 $FRAG tokens, estimated at a previous average minting cost of 1.85 SOL, corresponding to a $FRAG cost of only ~$0.35, which is fantastic!

▰▰▰▰▰

Byreal Reset Launch: Understanding Fragmetric's Valuation Logic

Fragmetric is the first project launched by @byreal_io, and Byreal's Reset Launch model is quite different:

▪ Smart price ladder mechanism, similar to a spot order book, allowing users to participate in minting at different price levels!

▪ Higher bidders receive larger allocations: encouraging sincere users to participate deeply, rejecting front-running arbitrage.

Simply put, this is an on-chain IEO, but the project selection mechanism is similar to CEX selection. Fragmetric itself is a VC coin, having completed $12 million in financing and received official support from Solana. The FDV won't be cheap, but it also means clearer value anchoring!

Referencing the same ecosystem's $CLOUD, which once surged to a $600M FDV, while Fragmetric's current TVL has exceeded $280 million, as the asset management foundation of Solana, this round is just the starting point!

▰▰▰▰▰

Why do I have long-term confidence in Fragmetric?

I see Fragmetric as Solana's EigenLayer, for the following reasons:

▪ It truly achieves a mixed combination of Restaking.

Multiple LSTs, multi-protocol access, MEV rewards, AVS network.

▪ The community has a protective network.

The SANG (Solana Network Guard) community has formed a real network effect.

▪ The asset standard has inheritability.

FRAG-22 can be ported to more DeFi applications, with future composability far exceeding that of a single LRT protocol.

▰▰▰▰▰

Summary

Other protocols issue tokens to attract liquidity.

Fragmetric issues tokens to return asset management rights to users!

Show original

2.88K

69

Squid

"We're cooking with @solana & @jito_sol to deliver something exceptional on the L1."

Interesting anon

Davo 👾 (Ecosystem Arc)

Drift's immediate plan is to be the best decentralized derivatives platform. Built on @solana at the L1 level to harness the global atomic state machine. No rollups or isolated environments.

The benefit is asset availability. Drift is the only cross-margin perps DEX and this is only possible because of the L1. Products built on the L1 are directly downstream of asset issuance. You can expect an L1 like Solana to dominate in this area in the coming years.

To date, Drift has $1 billion in TVL across multiple types of collateral over SOL, BTC, ETH and a myriad of Solana tokens that can be natively supported (JITO, JUP, KMNO, DRIFT, CLOUD, etc).

With the rollup debate and CLOB discussions taking place, we've conveniently forgotten composability. My belief is that in the long term, composability is king.

CLOB Debate

CLOBs are a means to an end; whilst there is a lot of merit to the discussion taking place, I would argue that HL's success is due to their liquidity model, rather than the choice of a CLOB. There's been a long history of dead CLOBs and I will happily bet against any newcomer that don't have clear or existing GTM.

Most build some great piping that never get used. So unless your environment is exceptional, it is very difficult to convince users to bridge assets into an isolated environment.

TLDR: Takers like CLOBs since it gives them the last look at the price. Makers hate on-chain CLOBs as they are ripe for the picking.

Drift's Design

Drift is fully on-chain today. No off-chain matching engine or any part of the stack off-chain. Hence, a slightly different design under the hood with a distributed limit orderbook (DLOB) alongside just-in-time liquidity (JIT).

When you build on share blockspace on the L1, extractive activities can take place. Drift cannot re-order, prioritize or slow down specific transactions that take place on Solana. Trust me, we'd love to give makers priority cancels where we can - but we can't.

This is why JIT was introduced. Unlike CLOBs, JIT allows the maker to have the last look at the price (just-in-time) before electing to fill them. It is a novel mechanism designed to protect makers.

The disadvantage with this model is the inability to show resting liquidity - since there is no "resting" inventory. We have done our best to work with makers to provide indicative liquidity quotes but I understand that it isn't the same as seeing thick quotes on the orderbook.

We are working on some big updates that will be released in a few weeks to continue improving resting liquidity.

The Current Narrative

We're cooking with @solana & @jito_sol to deliver something exceptional on the L1. Stay tuned for some big updates.

The experience on Drift should have improved significantly today so if you haven't tried Drift for a while, give it a shot and let me know how it feels.

If you experience remotely unacceptable slippage, DM me and I'll personally compensate you for it.

h/t @SebMontgomery for asking the question in the first place!

4.41K

4

Davo 👾 (Ecosystem Arc)

Drift's immediate plan is to be the best decentralized derivatives platform. Built on @solana at the L1 level to harness the global atomic state machine. No rollups or isolated environments.

The benefit is asset availability. Drift is the only cross-margin perps DEX and this is only possible because of the L1. Products built on the L1 are directly downstream of asset issuance. You can expect an L1 like Solana to dominate in this area in the coming years.

To date, Drift has $1 billion in TVL across multiple types of collateral over SOL, BTC, ETH and a myriad of Solana tokens that can be natively supported (JITO, JUP, KMNO, DRIFT, CLOUD, etc).

With the rollup debate and CLOB discussions taking place, we've conveniently forgotten composability. My belief is that in the long term, composability is king.

CLOB Debate

CLOBs are a means to an end; whilst there is a lot of merit to the discussion taking place, I would argue that HL's success is due to their liquidity model, rather than the choice of a CLOB. There's been a long history of dead CLOBs and I will happily bet against any newcomer that don't have clear or existing GTM.

Most build some great piping that never get used. So unless your environment is exceptional, it is very difficult to convince users to bridge assets into an isolated environment.

TLDR: Takers like CLOBs since it gives them the last look at the price. Makers hate on-chain CLOBs as they are ripe for the picking.

Drift's Design

Drift is fully on-chain today. No off-chain matching engine or any part of the stack off-chain. Hence, a slightly different design under the hood with a distributed limit orderbook (DLOB) alongside just-in-time liquidity (JIT).

When you build on share blockspace on the L1, extractive activities can take place. Drift cannot re-order, prioritize or slow down specific transactions that take place on Solana. Trust me, we'd love to give makers priority cancels where we can - but we can't.

This is why JIT was introduced. Unlike CLOBs, JIT allows the maker to have the last look at the price (just-in-time) before electing to fill them. It is a novel mechanism designed to protect makers.

The disadvantage with this model is the inability to show resting liquidity - since there is no "resting" inventory. We have done our best to work with makers to provide indicative liquidity quotes but I understand that it isn't the same as seeing thick quotes on the orderbook.

We are working on some big updates that will be released in a few weeks to continue improving resting liquidity.

The Current Narrative

We're cooking with @solana & @jito_sol to deliver something exceptional on the L1. Stay tuned for some big updates.

The experience on Drift should have improved significantly today so if you haven't tried Drift for a while, give it a shot and let me know how it feels.

If you experience remotely unacceptable slippage, DM me and I'll personally compensate you for it.

h/t @SebMontgomery for asking the question in the first place!

Show original

60.51K

182

CLOUD price performance in USD

The current price of cloud is $0.14815. Over the last 24 hours, cloud has increased by +4.68%. It currently has a circulating supply of 999,995,575 CLOUD and a maximum supply of 999,995,575 CLOUD, giving it a fully diluted market cap of $148.15M. The cloud/USD price is updated in real-time.

5m

+0.08%

1h

+0.40%

4h

+1.61%

24h

+4.68%

About Cloud (CLOUD)

Latest news about Cloud (CLOUD)

HIVE Digital to Launch Canadian AI Data Hub With 7.2 MW Toronto Site Purchase

The site will host BUZZ HPC’s first liquid-cooled Tier 3 facility supporting AI training and cloud workloads.

Jun 24, 2025|CoinDesk

Riot Platforms Taps Data Center Veteran to Expand Beyond Bitcoin Mining

Jonathan Gibbs will lead Riot’s push into enterprise-grade data centers for AI and cloud computing.

Jun 2, 2025|CoinDesk

SHIB Under Pressure, Below Ichimoku Cloud After High-Volume Overnight Selling

The cryptocurrency faced resistance at 0.00001307 and found support at 0.00001275.

Jun 2, 2025|CoinDesk

Learn more about Cloud (CLOUD)

Moonveil and Impossible Cloud Network Forge Decentralized Gaming Revolution with zkEVM Polygon Technology

Introduction: A New Era for Web3 Gaming The gaming industry is undergoing a transformative shift, driven by the rise of Web3 technologies and decentralized ecosystems. At the forefront of this revolution is Moonveil , a full-stack Web3 gaming protocol powered by zkEVM Polygon technology . Backed by leading venture capital firms such as Animoca Ventures , Spartan Group , and Gumi Cryptos Capital , Moonveil is redefining the gaming landscape by introducing decentralized infrastructure, asset interoperability, and on-chain identity verification.

Jun 27, 2025|OKX

How Cloudflare's Security Measures Impact Crypto Transactions Effectively

Cloudflare's Role in Safeguarding Crypto Transactions In the fast-paced world of cryptocurrency, security remains a top priority for investors and platforms alike. Cloudflare, a leading web security provider, has emerged as a critical player in protecting online transactions, including those involving crypto assets. Recent developments highlight how its security solutions are shaping the landscape for crypto-curious investors.

May 23, 2025|OKX

Akash explained: disruptive and decentralized cloud computing

Akash has capitalized on the disruptive force of blockchain technology in computing by advancing the decentralized of cloud computing infrastructure. Through its open-source and transparent cloud computing platform, many believe the Akash network could challenge today’s internet giants of Amazon Web Service (AWS), Google Cloud Platform (GCP), and Microsoft Azure.

May 20, 2024|OKX

OKX and Google Cloud Host Successful Hackathon for Decentralized Applications on OKT Chain

__VICTORIA, SEYCHELLES, April 5, 2023__ – OKX, the second largest crypto exchange by trading volume and a leading Web3 technology company, has teamed up with Google Cloud to host the OKX Hackathon to

Apr 25, 2024|OKX

CLOUD FAQ

What’s the current price of Cloud?

The current price of 1 CLOUD is $0.14815, experiencing a +4.68% change in the past 24 hours.

Can I buy CLOUD on OKX?

No, currently CLOUD is unavailable on OKX. To stay updated on when CLOUD becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of CLOUD fluctuate?

The price of CLOUD fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Cloud worth today?

Currently, one Cloud is worth $0.14815. For answers and insight into Cloud's price action, you're in the right place. Explore the latest Cloud charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Cloud, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Cloud have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.