This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

Babylon

Babylon price

5xpx4q...pump

$0.0000079876

+$0.00000

(--)

Price change for the last 24 hours

How are you feeling about Babylon today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Babylon market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$7.99K

Network

Solana

Circulating supply

999,999,983 Babylon

Token holders

5091

Liquidity

$9.50K

1h volume

$314.75

4h volume

$721.88

24h volume

$1.27M

Babylon Feed

The following content is sourced from .

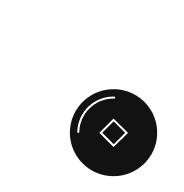

Alpha Batcher

Union Full Guide [$16M] 🪂

@union_build is an L1 blockchain built on Cosmos SDK, a direct equivalent of LayerZero

Raised: $16M from LongHash, gumi Cryptos, Borderless etc.

All-in-One guide🧵👇

✤ Connect Xion Testnet to Keplr wallet

- Download the wallet

- Register

- Go to 'Settings'

- Click on 'Add/remove non-native chains'

- Click the '+' icon and search for Xion Testnet

- Click 'Add to Keplr'

✤ XION test tokens

- Go to

- Copy your Xion address from the Keplr wallet and paste it into the faucet field

- Request XION test tokens

- After the transaction, return and do the same with the USDC token

✤ XION Bridges

- Go to

- Select Xion as the source

- Choose the XION token

- Select Sei Testnet as the recipient network

- Enter the desired token amount and send the transaction (I only sent small amounts to avoid manually using the faucet every day)

- Repeat steps 2-5 for the USDC token

- Repeat steps 2-6, changing the recipient network to Corn, Babylon, and Holesky

✤ Bridges from Holesky to other networks

- Go to:

- Receive test Holesky ETH tokens

- Convert Holesky ETH to WETH

- Detailed guide here:

- Go to

- Select Ethereum Sepolia

- Receive LINK from the Chainlink Sepolia faucet

✤ Bridges from Corn Network to other networks

- Go to the Corn Network faucet at

- Connect your EVM wallet and claim BTCN

- Visit the Union dApp

- Distribute the tokens across all available networks

✤ Make bridges from Babylon to other networks

- Get BABY from the faucet at

- Distribute across all networks through Union

✤ Dashboard

- Go to

- Complete social tasks

- Make sure to connect all your wallets in the app

✤DS Roles

- Go to their DS

- Engage actively in the chat

- The project has more than 20 roles

--------------------------

There’s no information on rewards yet, so we’re working on potential

Backers aren't bad, so they’ll be able to support the project

Currently, not many people are working on the testnet, so there’s almost no competition

Show original

19.09K

67

丰密KuiGas🔆

BOB is one of the Bitcoin Layer 2 projects that I have been closely following and am very familiar with, focusing on EVM compatibility. Another popular competitor, Botanix, just announced its mainnet launch.

I personally participated in the first phase of BOB Fusion, starting to save money from Fusion1, and later interacted with some applications around BTC, initially aiming to accumulate Spice points. Although there is still no clear airdrop plan, based on BOB's narrative design, funding background, and ecological layout rhythm, it is very likely that the TGE will adopt a community incentive and behavior retrospective method to distribute early shares.

My current ranking:

Season 2 final ranking #334, 27 million Spice

Season 3 current leaderboard ranking #376, 56 million Spice

Currently, the only yield from BOB is its ecosystem's first NFT series: PixelBobs. During the time when the team collectively changed their avatars, that NFT was speculated to reach around $600-800.

It was free to mint, with a cost of 0.

BOB, like projects such as Spider Botanix, aimed to break the status quo from the beginning, merging BTC faith with EVM innovation, breaking the limitation that BTC can only be hoarded, allowing it to run smart contracts, participate in DeFi, and earn yields like Ethereum.

BOB aims to transform Bitcoin from digital gold into the liquidity core of DeFi. On one hand, it inherits Bitcoin's native security and decentralization; on the other hand, it provides BTC with real on-chain utility and yield capabilities through smart contract mechanisms.

As a hybrid Layer 2 network, BOB combines the security of Bitcoin with the flexibility of Ethereum, unlocking new scenarios for BTC on-chain, releasing dormant value, and aiming to become the ideal city for Bitcoin DeFi.

In my view, BOB's logic can be summarized in one sentence: using Bitcoin as the foundation to build an Ethereum-style smart contract world on top.

It adopts a very special architecture: Hybrid Layer 2, balancing security and flexibility:

1. The settlement layer directly connects to the Bitcoin mainnet, inheriting its strongest security;

2. Launched based on OP Stack, it natively supports EVM contracts, meaning

It is fully compatible with Ethereum's development environment. Writing contracts, deploying applications, and connecting third-party tools can be done without changing the code; developers can "move in with their bags packed." However, it is not merely an Ethereum scaling chain. By connecting to the Bitcoin mainnet and introducing BitVM and staking mechanisms, BOB merges BTC's "hard security" with ETH's "strong flexibility," truly unlocking the core value of the two strongest chains in crypto.

Why is this architecture particularly important for BOB's BTC DeFi?

Because traditional BTC users who want to participate in DeFi usually have to bridge their coins to Ethereum, turning them into wrapped assets like WBTC or tBTC, which is both cumbersome and carries security risks.

With the support of BitVM and the BTC staking system on BOB, users can participate in DeFi with "pure" BTC at the click of a button, eliminating the cross-chain steps and enhancing security.

Also, because of its focus on building the BTC DeFi ecosystem, BOB has invested a lot of time in laying the groundwork for cooperation and ecology in the early stages. Currently, over 100 projects have been deployed on BOB, including Uniswap, Aave, Euler, LiFi, Lombard, Chainlink, Babylon, Solv, etc. The DeFi TVL is approximately $130 million.

BOB supports all mainstream BTC wrapped assets (such as WBTC, tBTC), LST (Liquid Staking Token), and Ethereum standard assets, ensuring that BTC users can directly access the existing DeFi world without needing to "relearn" and can seamlessly get started.

Core products include:

1. One-click BTC staking: Users only need to make one BTC transaction to invest assets into the DeFi vault, driven by Bitcoin Intents.

2. Hybrid BTC vault: Based on BTC security guarantees, it participates in Ethereum and multi-chain yield strategies, with positions that can be tokenized, collateralized, or leveraged.

During this time, BOB has not rushed to issue tokens but has instead steadily built its infrastructure, ecosystem, and user experience step by step.

Regarding TGE and airdrops:

To be honest, as time goes by, the dilution of Spice points has become increasingly evident, and the overall heat of BTCFi has also cooled. In this context, I am also observing:

Can BOB not only remain "technically robust" but also truly break through in products or mechanisms, bringing about an eye-catching innovation?

Perhaps it is not the value of the airdrop itself, but whether BOB can carve out a truly on-chain application path that belongs to BTC.

Show original

25.84K

28

CryptoSlate

The DeFi market has rebounded at the beginning of July, with total value locked (TVL) rising to $116.416 billion, a level last seen in April. The 24-hour increase of 4.95% reflects rising crypto asset prices and renewed deposit flows into lending protocols, restaking services, and yield-bearing primitives.

As Ethereum and Solana continue to absorb most DeFi capital, restaking-led protocols such as EigenLayer and ether.fi have positioned themselves as structural pillars of on-chain liquidity.

At the top of the DeFi leaderboard, AAVE has reasserted its position as the dominant money market with $25.871 billion in locked value across 18 chains. The platform’s 2.62% month-on-month increase reflects user preference for maturity, scale, and liquidity depth, especially during periods of rising ETH borrowing costs. AAVE now holds over 22% of the TVL across DeFi, outpacing Lido and other restaking alternatives.

Lending has emerged as one of the most stable categories within DeFi, bolstered by protocols like Morpho, which posted a 25.35% monthly gain. Morpho’s traction is closely tied to its hybrid peer-to-peer lending structure and increased collateral caps, particularly for stETH. Its rapid ascent to $4.498 billion in TVL places it just outside the top 10 and firmly above legacy competitors like JustLend and Pendle.

Meanwhile, Pendle, which enables tokenized fixed-yield strategies, recorded a monthly increase of 11.71% to $4.822 billion. The continued appetite for principal-token and yield-token separation, especially in a market with few new lending primitives, shows the persistent demand for yield certainty, even if duration risk remains.

#

Protocol

TVL

1M Change

Mcap/TVL

1

AAVE

$25.871b

+2.62%

0.16

2

Lido

$23.614b

+0.80%

0.03

3

EigenLayer

$12.145b

+7.41%

0.03

4

Binance staked ETH

$7.186b

+14.16%

–

5

ether.fi

$6.72b

+0.11%

0.06

6

Spark

$6.353b

+5.30%

0.01

7

Ethena

$5.464b

−5.74%

0.32

8

Sky

$5.368b

+1.90%

0.33

9

Uniswap

$5.021b

+1.56%

0.92

10

Babylon Protocol

$4.879b

+0.32%

0.02

11

Pendle

$4.822b

+11.71%

0.12

12

Morpho

$4.498b

+25.35%

–

13

JustLend

$3.722b

+9.88%

0.09

14

Veda

$3.58b

+35.86%

–

15

BlackRock BUIDL

$2.832b

−2.32%

1.01

The Ethereum-native restaking ecosystem remains one of the few areas in DeFi attracting fresh capital. EigenLayer, with $12.145 billion in TVL, saw a 7.41% increase over the past month despite winding down parts of its points program. That increase shows its growing role as a collateral foundation for actively validated services (AVSs) and shared security mechanisms.

Another player in the restaking niche, ether.fi, maintained its position with $6.72 billion, though its 0.11% growth over the past month signals a plateau following the rapid accumulation seen in Q2. Combined, EigenLayer and ether.fi now control over $18.8 billion, accounting for more than 16% of all DeFi capital, rivaling the entire TVL of Lido and Tron’s entire DeFi stack.

One notable outlier is Ethena, which saw a 5.74% decrease in TVL to $5.464 billion. The drawdown likely reflects redemptions of sUSDe and waning short-term enthusiasm for synthetic dollar yields after months of explosive growth. With Mcap/TVL now at 0.32, Ethena still holds a premium valuation, but the market appears to be cycling some capital into more sustainable yield venues.

The performance of BlackRock’s BUIDL token, while down 2.32% over the month, is a perfect example of the role real-world assets (RWAs) play in anchoring capital during volatile periods. With a Mcap/TVL ratio of 1.01, the fund remains fully backed by tokenized Treasury bills and shows little deviation in either direction. BUIDL’s $2.832 billion in TVL makes it the fifteenth-largest protocol in DeFi and the largest tokenized RWA instrument to date.

The marginal drawdown mirrors recent weakness in Treasury prices, rather than protocol issues. With yields climbing again on the front end of the curve, the question remains whether demand for tokenized RWAs can outpace capital rotation into higher-yield on-chain instruments.

Last week showed the convergence of spot and perpetual DEX volumes, which landed at $13.653 billion and $13.084 billion, respectively. This parity is unusual, as perpetual markets typically outpace spot by a wide margin, and may indicate a healthy shift toward hedging activity or organic demand for base-layer assets.

In previous periods of market euphoria, perpetual volumes often inflated disproportionately, driven by leverage-fueled speculation. The current ratio suggests more disciplined capital deployment, which could reflect the influence of larger players and more risk-aware strategies dominating DEX activity.

Ethereum continues to dominate DeFi TVL with $65.035 billion, representing over 55% of total locked value. Its 1-day (+6.42%) and 7-day (+6.21%) changes show strong and consistent inflows driven by asset appreciation and deposit migration back to L1 vaults.

Solana now commands $8.768 billion in DeFi TVL, a 5.67% 7-day increase. The chain continues to benefit from a resurgence in institutional and retail interest, likely supported by recent spot SOL ETF approvals in Canada and growing NFT activity. With several top-performing DEXs and yield farms, Solana has grown its share to 7.5%, the highest since Q1 2024.

Other networks, such as Base (+5.40% daily) and Sui (+9.77% daily), posted sharp one-day gains, hinting at new capital rather than just price effects. While these inflows are still modest in dollar terms, they mark a directional signal that Layer-2s and alt-L1s are beginning to claw back attention, especially as Ethereum fees remain elevated.

Stablecoins continue to serve as DeFi’s latent fuel. At $254.598 billion, the total market cap of stablecoins is more than double the value locked in DeFi protocols. This 2.19x ratio suggests substantial dry powder waiting for redeployment, especially if rates remain attractive and new structured products emerge. It also provides a buffer against forced liquidations in the event of sudden volatility, as more capital is sitting idle in pegged assets than in active yield strategies.

The first week of July has painted a picture of renewed strength for DeFi, especially in core lending and restaking segments. With a stablecoin surplus, maturing yield primitives, and clear user rotation back into blue-chip protocols, DeFi appears to be entering the second half of 2025 with stronger footing than at any point this year.

The post DeFi TVL breaks above $116B as lending roars back appeared first on CryptoSlate.

Show original21.66K

0

The Street Crypto

Bitcoin may have risen to new all-time highs by solidifying its place on the world stage as "digital gold," but a new blockchain is now officially launching to unlock new ways for holders to leverage the asset's "digital" store of value.

"Right now, we're in this interesting space where you have Bitcoin [as] a store of value that doesn't do anything," Botanix co-founder Willem Schroe recently told Coinage, pointing out that most of the lending against Bitcoin is still handled by centralized, off-chain lenders. "There's so much more in the world that needs to come onchain."

Botanix is looking to solve that by launching its mainnet to pair Bitcoin with the world of DeFi already built on Ethereum. Up until now, that bridge has mostly been gapped by centralized, offchain lenders or onchain custodians, like BitGo or others, offering wrapped bitcoin assets across different chains.

Historically, centralized lenders and centralized chokepoints for liquidity have run into issues. Centralized bitcoin lenders BlockFi and Celsius both imploded in the 2022 crypto winter that followed in the wake of Terra's $40 billion collapse. Bitcoin lending has slowly returned, but options usually carry higher interest rates than what's available in DeFi. Botanix is looking to make it easier for users to close that gap by pairing Bitcoin's value as digital gold with their Ethereum compatible chain to let users tap DeFi on Ethereum.

"You've got these two worlds, and I absolutely believe they are converging. That's what we're building," he said. "The reason is, it's going to be more permissionless, more transparent, it's going to be global, it's going to be onchain. That's what we're building for."

Other projects, like Stacks and Babylon have similarly attempted to find their footing in a similar space — offering ways for holders to finally leverage Bitcoin beyond just sitting on it. According to Schroe, the lack of programmability on Bitcoin has kept builders away, but that's quickly shifting.

"There's a lot of people building a lot of infrastructure. Now, we still have to see it actually play out, but I think over the next four years, this Bitcoin Layer-2 market, just because there is so much liquidity ... can go really, really fast," he said. "I think four years from now you'll see this whole Bitcoin application market absolutely explode."

So far, it's been a tough battle for Bitcoin scaling projects to convince holders in the Bitcoin world to unlock Bitcoin's store of value onchain. It may continue to take time, but Schroe remains set on chipping away at what continues to be an ever-growing market opportunity.

"Take the TVL of Ethereum DeFi ... it's going to be somewhere around $50 billion," Schroe says. "Ethereum is one fifth or one fourth [the market cap] of Bitcoin ... so that means the potential DeFi market on Bitcoin Layer-2s should be $250 billion."

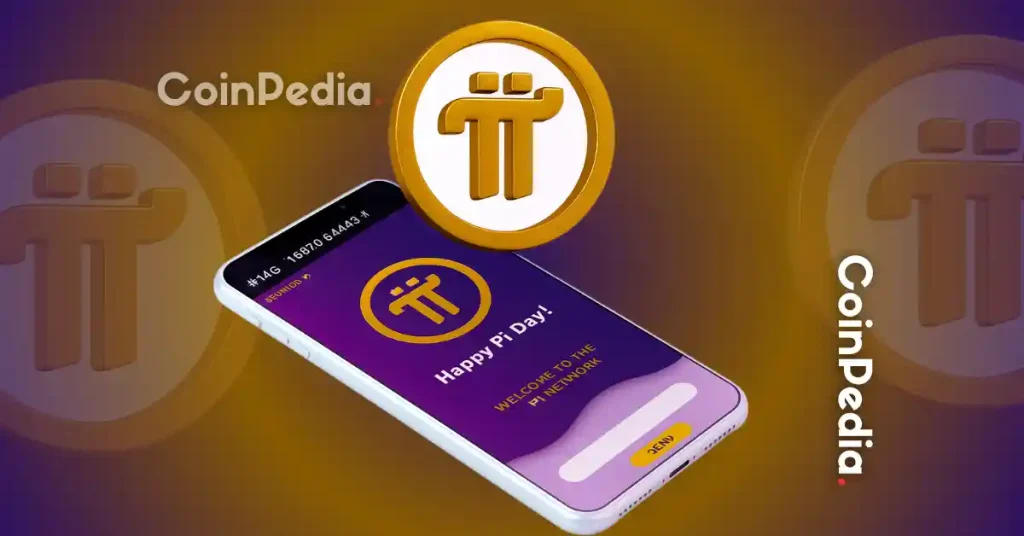

As a novel part of the mainnet launch, Botanix is also jointly launching “Bitcoin 2100”, a retro-futuristic video game to get users comfortable with what's left to explore using Bitcoin onchain.

Users can collect fractionalized pieces of Bitcoin (sats) by playing in a stylized world set in the year 2100, where Bitcoin has become the rails of a new financial system. Each house within the game represents a different live application on the Botanix network, such as Arch, Rover, and others, giving users new ways to discover what’s possible when Bitcoin becomes programmable.

Show original

1.46K

0

Cryptocito | Cosmos ⚛️

Two Major Trends in Cosmos Right Now ⤵️

1. Focus on the EVM:

Projects like Sei Network, Cosmos Hub, Babylon, TAC, Stride, and the XRPL Sidechain are doubling down on the EVM. Meanwhile, Confio has announced it will cease maintenance of CosmWasm, signaling a broader pivot toward EVM dominance.

2. Zero-Inflation & Tokenomics:

An increasing number of networks, such as Celestia, Osmosis, Saga, and others, are trending towards zero-inflation models and rethinking economics to drive long-term sustainability and value.

Show original26.58K

40

Babylon price performance in USD

The current price of babylon is $0.0000079876. Over the last 24 hours, babylon has decreased by --. It currently has a circulating supply of 999,999,983 Babylon and a maximum supply of 999,999,983 Babylon, giving it a fully diluted market cap of $7.99K. The babylon/USD price is updated in real-time.

5m

+0.00%

1h

+7.76%

4h

+9.87%

24h

--

About Babylon (Babylon)

Babylon FAQ

What’s the current price of Babylon?

The current price of 1 Babylon is $0.0000079876, experiencing a -- change in the past 24 hours.

Can I buy Babylon on OKX?

No, currently Babylon is unavailable on OKX. To stay updated on when Babylon becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of Babylon fluctuate?

The price of Babylon fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Babylon worth today?

Currently, one Babylon is worth $0.0000079876. For answers and insight into Babylon's price action, you're in the right place. Explore the latest Babylon charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Babylon, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Babylon have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.