Base's "Onchain Summer" is finally here

On June 18, the U.S. Senate officially passed the GENIUS Act, marking the first time that the U.S. government has recognized the compliance legitimacy of crypto assets in the form of legislation, breaking the policy vacuum caused by the ambiguity of the regulatory powers of the SEC and the CFTC.

Against this backdrop of favorable regulation, JPMorgan Chase and Coinbase released major developments on the same day, focusing on on-chain banking and tokenized securities, respectively, showing that traditional finance and crypto ecosystems are deeply integrated.

JPMorgan Chase's deposits can now be placed on the base,

and JPMorgan Chase & Co., which is the earliest and most active in the layout of blockchain among traditional financial institutions, announced the launch of a pilot project called JPMD (JPMorgan Deposit Token). JPMD is an on-chain token that represents a customer's USD bank deposit, based on a partial reserve mechanism, and will be deployed on the Coinbase-backed public chain, Base.

–

Naveen Mallela, co-head of Kinexys, JPMorgan's blockchain arm at JPMorgan Chase, said the bank will complete its first JPMD transfer in the coming days, transferring funds from its digital wallet to the Coinbase platform, paving the way for subsequent institutional customers to use the token for on-chain transactions.

The pilot, which is expected to last several months, signals that JPMorgan Chase is further exploring efficient and secure institutional-grade trading tools through on-chain deposit tokens. The day before, the bank had applied for the "JPMD" trademark, which covers digital asset payment, transfer and transaction services, indicating its intention to use the tool for a long time.

J.P. Morgan's choice to pilot the issuance of JPMD on Base not only shows its recognition of Base's security and transaction efficiency, but also means that institutional customers may directly clear on-chain funds through the Base and Coinbase ecosystems in the future, which will inject core liquidity sources into the "CeDeFi Bridge" built by Coinbase.

Why "Deposit Tokens"?

While the launch of JPMD has sparked speculation about its possible foray into the stablecoin market, however, Naveen Mallela, an executive at JPMorgan Chase's blockchain arm Kinexys, said in an interview with Bloomberg that deposit tokens are a better alternative for institutional users than stablecoins because they are more scalable because they are based on a partial reserve mechanism.

He pointed out that deposit tokens represent actual USD deposits in customer bank accounts and operate in a way that relies on the traditional banking system, while stablecoins are just digital twins of fiat currencies backed by cash and equivalents, and their legal status and operating logic are more free from the traditional financial system.

In parallel with the launch of the JPMD pilot, three key JPMorgan executives have held closed-door talks with the SEC's Crypto Task Force to discuss how capital market instruments can be migrated to public blockchains, the impact that changes may have on market structures, and how institutions should evaluate the risk control and return models that on-chain finance brings.

According to the minutes of the meeting released by the SEC, the exchanges between the two sides covered multiple cutting-edge directions such as digital repurchases, digital debt instruments, and on-chain financing. JPMorgan Chase & Co. also made it clear that it is actively evaluating whether it can form a structural competitive advantage in terms of asset tokenization and on-chain settlement efficiency.

In addition to "rushing dogs", the ability to buy stocks on Base

echoes JPMorgan's exploration of an on-chain banking system, and Coinbase is also evolving from an exchange platform to an on-chain asset infrastructure provider. The company's chief legal officer, Paul Grewal, revealed that Coinbase is applying for a no-objection letter from the US SEC to launch a tokenized stock trading service to US customers, subject to an exemption or license. Obtaining a No Objection Letter means that SEC staff will not take enforcement action against Coinbase's launch of the tokenized stock service.

If Coinbase is successfully approved for the tokenized stock business, it will realize the integrated closed-loop asset flow of "stablecoin purchase→ on-chain settlement→ stock trading → rebate consumption" within the same platform for the first time. This not only challenges the trading entry status of brokerages such as Robinhood and Schwab, but may also force these platforms to consider introducing stablecoin payment and on-chain settlement logic, forcing the entire securities industry to enter the era of on-chain assets.

Tokenized shares promise faster settlements, longer trading windows, and lower operating costs. But at the moment, U.S. investors don't have access to such products. Coinbase's new plan means that it will not only be the "NASDAQ" of crypto assets, but also become the on-chain entry point for traditional securities trading.

– >

– >

In fact, Coinbase's exploration of tokenized stocks isn't the first time. As early as 2021, during the S1 filing stage before the company's listing, there was a plan to tokenize its own stock COIN, but it was ultimately stranded due to lack of SEC approval.

The attempt is the latest move by Coinbase to expand beyond crypto assets, with the aim of opening up new revenue streams and driving further adoption at the institutional level. Just last week, Coinbase launched an American Express-backed credit card and partnered with Shopify and Stripe to promote the USDC stablecoin payment app.

Regulatory uncertainty has been a major obstacle to the widespread adoption of blockchain securities trading. But with the SEC's plans to adopt DeFi as well as stablecoins, it's clear that regulation is no longer a concern for Coinbase at the moment.

At the same time, competition is intensifying. The news of Coinbase's launch of tokenized shares comes on the heels of Kraken's xStocks project, which was announced weeks ago. The latter has started offering on-chain trading services for more than 50 stocks and ETFs in Europe, Latin America, Africa, and Asian markets. Coinbase needs a faster and clearer regulatory path to deal with the new race to become a crypto broker.

Allfor revenue

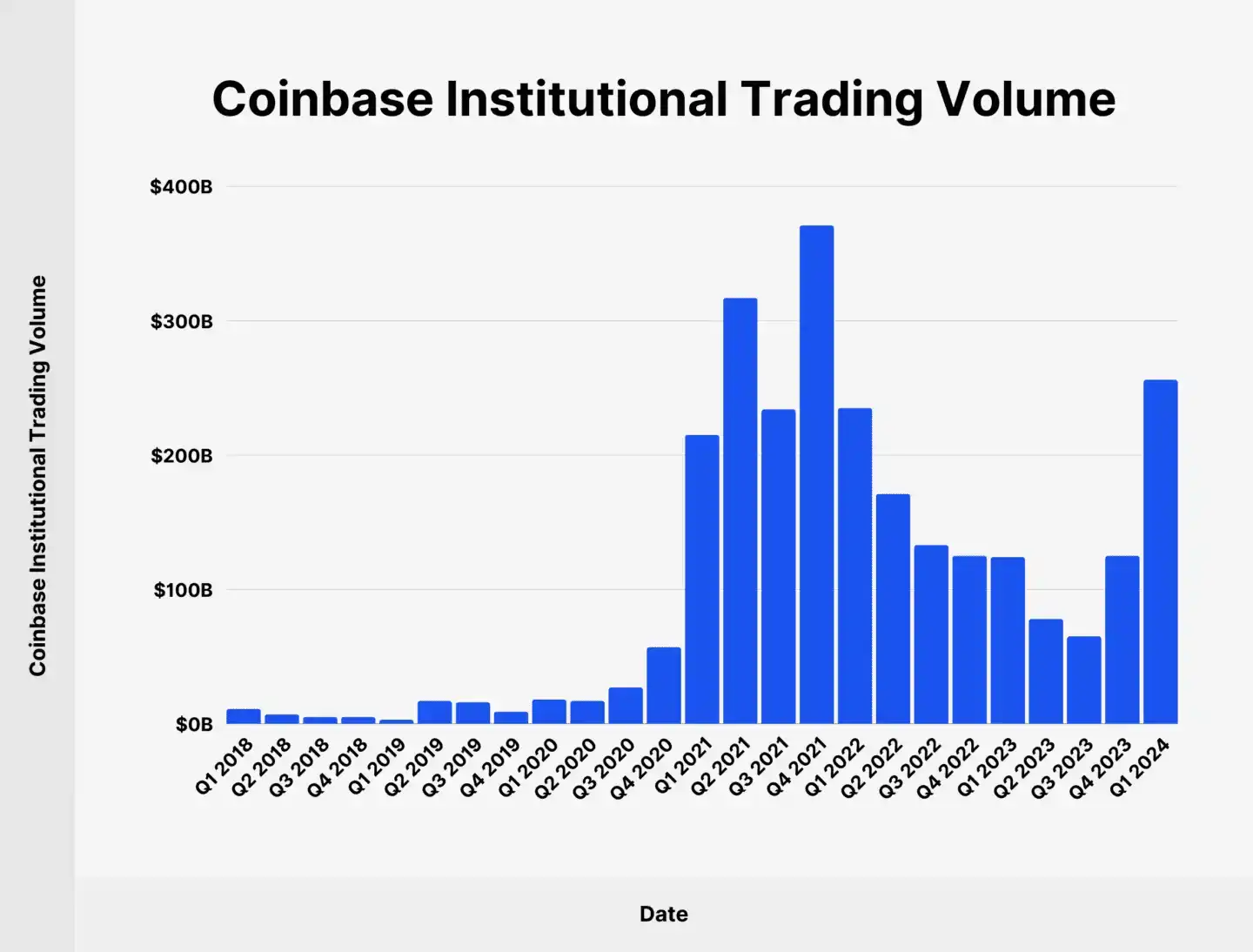

According to statistics, retail trading accounts for only about 18% of Coinbase, and from 2024, the proportion of trading volume of Coinbase's institutional customers will continue to increase (Q1 2024 trading volume is $256 billion, accounting for 82.05% of total trading volume), and with Coinbase's integration of DEXs on Base, it should be able to introduce a large amount of liquidity to tens of thousands of Base on-chain tokens More importantly, a large number of products in the Base ecosystem will have the possibility of Coinbase as a compliance channel with the real world.

Related reading: Coinbase wants to be "Binance in the United States""

This month, Coinbase cooperated with Shopify to support USDC payments on Base on the e-commerce checkout page, cutting into cross-border stablecoin payments; On the other hand, the DEX on Base will be integrated into the main Coinbase application to open up the flow channel between on-chain assets and CeFi users. The most disruptive move was the announcement of the launch of a 24/7 perpetual contract trading feature in the United States that complies with the CFTC regulatory framework.

Behind these actions, they all point to a core - rebuilding Coinbase's revenue model. As spot trading revenue shrinks year over year, Coinbase's earnings data shows that its trading revenue is overly reliant on the crypto market cycle. Against this backdrop, derivatives have become a more anti-cyclical source of income. By integrating Deribit's liquidity and user base, Coinbase is building a closed loop on derivatives trading for global institutions, and the CFTC endorsement has created a compliance moat in the U.S. market.

At the same time, Coinbase has partnered with Shopify and Stripe to promote the native use of USDC in e-commerce payment scenarios. Shoppers can pay directly with USDC at checkout on their Shopify store, while merchants can choose to settle in stablecoins or their own currency. Combined with the smart contract hosting and API module on Base, this process does not require consumers or merchants to have cryptographic knowledge, forming a highly scalable "compliant crypto payment engine". Stablecoin transactions not only bring on-chain gas fees and clearing fees, but also open up stable revenue channels for Coinbase in long-tail markets such as small businesses and cross-border e-commerce.

Coinbase One Card's cooperation with American Express uses rebates as a link to bind users through asset lock-up to further activate the trading behavior within the platform. Although these products still need to face a trade-off between cost and yield, it reflects Coinbase's strategic vision of gradually integrating "financial services + consumption scenarios".

This rhythm of multi-point attacks is not accidental. In the window period when regulatory benefits are beginning to emerge and the on-chain settlement infrastructure is gradually complete, Coinbase has chosen to use its platform as a hub to build a multi-dimensional revenue network with compliance as the core and diversified asset flows as the characteristic, from DEX and stablecoin payments to derivatives trading. Behind this logic is the key inflection point in Coinbase's transformation from a crypto exchange to an on-chain financial operating system.

Whether it is JPMorgan Chase's JPMD based on bank deposits, or the layout of Coinbase's tokenized securities platform, they all point to the same trend - on-chain finance is entering a period of institutional restructuring driven by regulation, infrastructure and mainstream financial institutions.

The passage of the GENIUS Act, the heated discussion of stablecoins, and the continued experimentation of major institutions on on-chain market infrastructure mean that crypto finance is no longer a marginal experiment, but a realistic choice to gradually embed itself in the structure of global financial markets, and the boundaries between on-chain and off-chain are being broken layer by layer by these first movers.