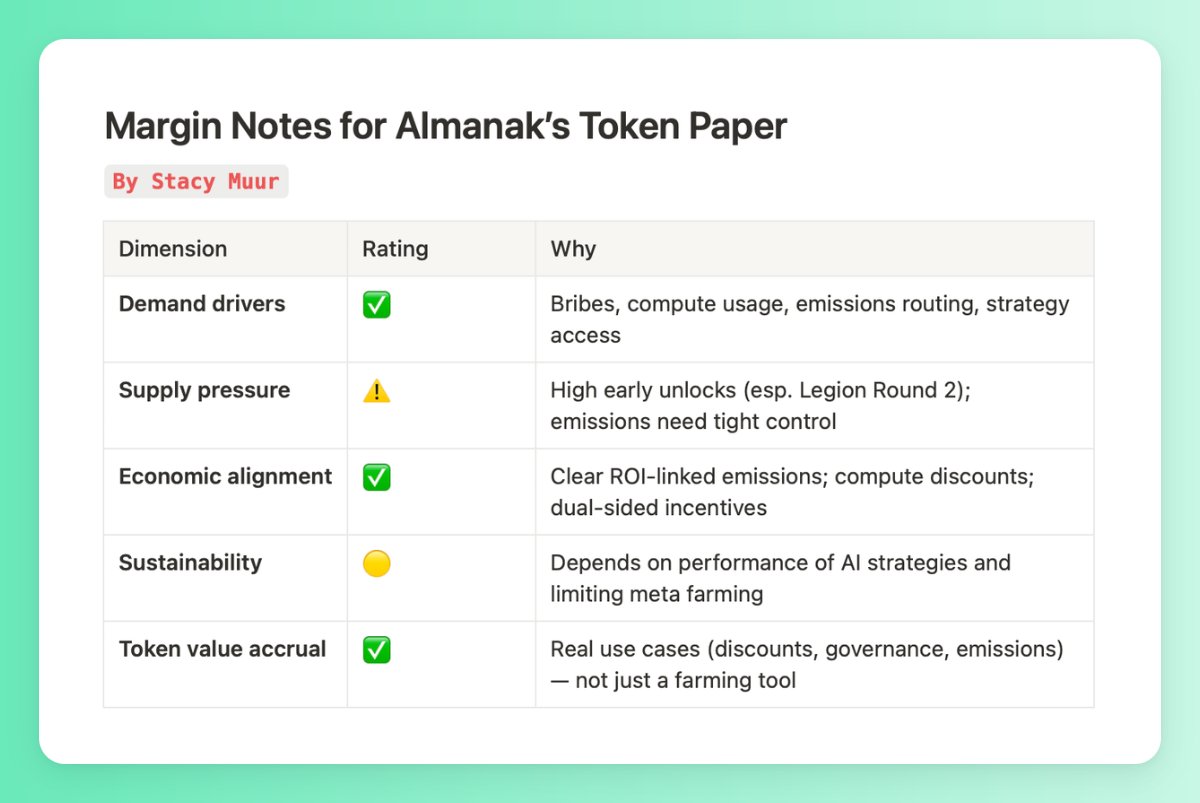

Just finished reading @Almanak__'s token paper.

My margin notes ↓

QUICK BLURB:

Almanak builds a decentralized marketplace for AI-driven asset management, letting users deploy algorithmic trading strategies via a swarm of specialized AI agents.

> 🟢 Commentary: The platform’s core bet is that future financial flows will increasingly be managed by autonomous agents — and it creates infrastructure, incentives, and composability for this AI-first future. This is a strong narrative fit for both the AI and DeFi verticals.

Almanak = Direct competitor to Theoriq.

KEY ACTORS:

1. Strategy & Vault Curators

• Build strategies with AI agents and deploy them into Vaults.

• Monetize via fees (TVL-based) and emissions (performance-based).

• Can choose private or public setups for IP protection or community collaboration.

> 🟢 Commentary: Aligns well with top-side platform contributors. Curators get upside from both usage (TVL) and emissions (ROI), incentivizing quality.

> 🔴 Risk: If emissions are overly generous, we may see overfitting of strategies just to farm emissions (as seen in some InfoFi protocols). Some kind of slashing or penalty for poor performance could be useful in the future.

2. Liquidity Providers

• Provide capital to Vaults to gain exposure to curated AI strategies.

• Receive a fungible tokenized position, usable in DeFi.

• Earn emissions proportional to performance of Vaults they support.

> 🟢 Commentary: Capital is routed dynamically to the most performant Vaults — a clear alignment of incentives. LPs aren't passive — they’re voting with their capital.

> 🟡 Neutral: Emission farming could outweigh real demand early on; sustainability will depend on organic returns from AI strategies.

TOKEN UTILITY

Almanak Token serves 3 key purposes:

1. Compute Discounts — For strategy builders.

2. Governance (veToken) — Stake to vote and boost emissions to desired Vaults.

3. Bribe Layer — Protocols can direct emissions to Vaults that support their tokens/contracts.

> 🟢 Commentary: Clear supply sink (staking) + high utility for builders and protocols.

> 🟡 Neutral: As with Curve, power will concentrate among early veToken lockers. Future DAO governance must balance whales vs ecosystem health.

INCENTIVES

Bittensor-Style Emission Allocation

• Vaults with more TVL and better ROI earn more emissions.

• LPs earn proportionally based on the Vaults they supported.

> 🟢 Commentary: Very strong market-driven incentive alignment — emissions chase performance.

> 🔴 Risk: Could lead to excessive strategy cycling (“meta farming”) unless emissions decay over time or poor performers are penalized.

Almanak Wars (Curve-style)

• Protocols can bribe emission flow toward Vaults using their smart contracts.

• Vaults that drive traffic to certain protocols can get 3x boosted emissions via veAlmanak votes.

> 🟢 Commentary: Creates demand for the token beyond speculation. If agentic traffic becomes a key source of protocol growth, this becomes a meta coordination layer.

> 🔴 Risk: If not well-governed, could lead to protocols gaming the system for short-term volume rather than real demand.

TOKENOMICS

• Team/VCs/Advisors: Long cliffs (12 months) + long vesting (48–54 months)

• Community (Legion Rounds): 45–100% unlocked at TGE

• Emissions: Yearly halving + DAO-adjusted

> 🟡 Mixed Commentary:

• Long-term vesting for insiders is good.

• However, high unlocks in early community rounds may lead to immediate sell pressure unless countered by strong utility demand.

• Emissions need to be managed tightly to avoid “runaway inflation” like in many staking-token DeFi systems.

Agree or not?

Show original

23.49K

160

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.