Maple Finance has made a major comeback post-2022. AUM is up nearly 10x since January to $2.35B, with $885M in active loans. It’s now one of the largest crypto lenders.

@maplefinance 2/ The turnaround? A shift to short-term, overcollateralized loans via Maple Direct.

Revenue has followed:

– $622K in April

– $1.06M+ in May

– ~$900K already in June

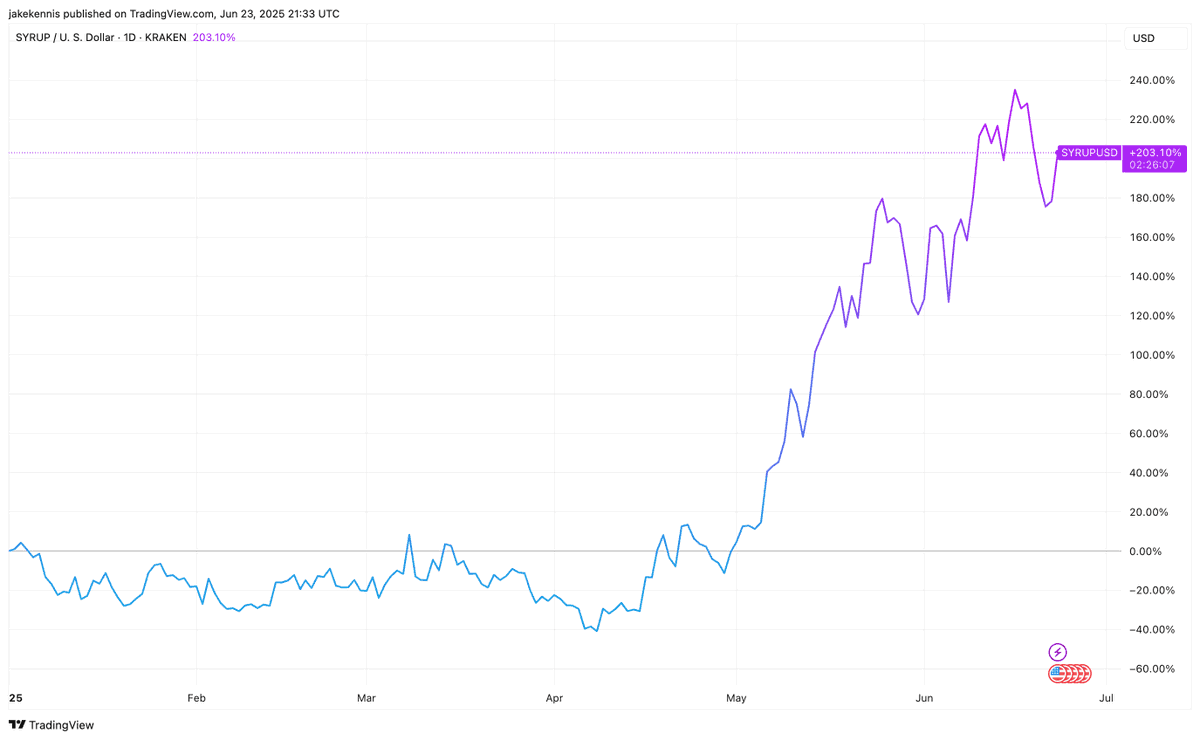

3/ SYRUP, Maple’s token, has increased 3x YTD.

– $540M+ market cap

– 20% of protocol revenue goes to stakers

– 7,747 wallets hold $1+

– whale holdings up 116,000% in 90 days

4/ syrupUSDC pool hit $1.5B+ AUM. Loan originations near $8B. Borrowers include Circle and BlockTower.

Notable partners: Spark ($325M), Bitwise, Cantor Fitzgerald, Lido, Kamino.

5/ Onchain flows show mixed sentiment:

– Smart money down 83%

– Exchange balances up 96%

– Notable CEX deposits by BlockTower, Dragonfly, Maven11

6/ Maple is scaling fast, with strong revenue, growing institutional adoption, and expanding DeFi integrations.

One of the clearest post-crisis credit plays in DeFi today.

Read more about this on:

6.25K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.