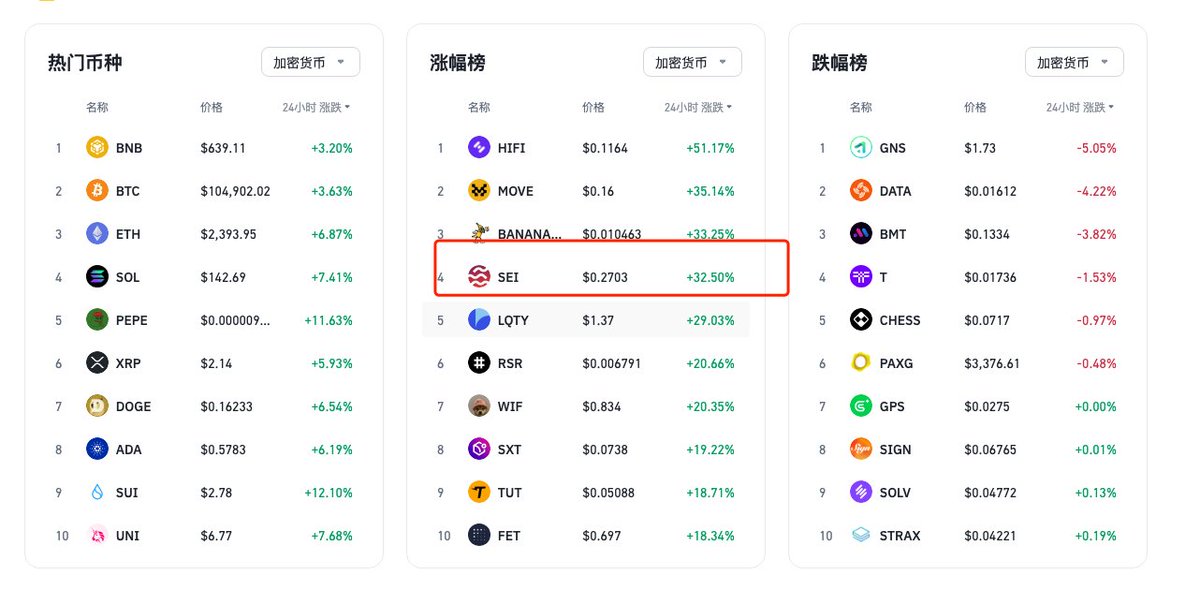

$sei pulled the plate today, and it deserves to be the third-ranked public chain selected by Wyoming

$APT $SOL $SEI $ETH $ZRO #WYST

Today I saw a news report that Wyoming, USA, is choosing a public blockchain for its upcoming stablecoin WYST through a public scoring system. Ultimately, 11 chains made it to the candidate list, with Aptos and Solana tying for first place with 32 points, followed closely by Sei with 30 points, while Ethereum and several L2s scored only 26 points or lower.

The selection process filtered 11 chains from a pool of 28, based on compliance, TPS, costs, stability, speed, activity, and 9 other indicators, along with additional advantages/risks. Aptos led due to its balance of compliance and performance, while Solana excelled in speed, and Ethereum lagged behind due to performance issues.

In addition to the public chain selection, this state-level stablecoin project in Wyoming is also noteworthy. As the first state in the U.S. planning to issue a stablecoin, WYST was originally scheduled to launch before July 4, but during the regular meeting at the end of May, this timeline was pushed back to the third quarter of 2025, with a new proposed date of August 20. This project is empowered by LayerZero for multi-chain interoperability, with Franklin Templeton managing the reserves, marking a new advancement in state-level stablecoins on-chain.

Besides Wyoming, Nebraska has passed its "Financial Innovation Act," authorizing an entity named Telcoin to issue a state-supported stablecoin, temporarily called eUSD.

Recently, there has been a lot of discussion about the RMB stablecoin, with some large companies eager to try it out. After the question of whether to have one, the next issue may be which chain to run it on. Should they use their own consortium chains like Ant Chain or JD Chain, or launch a dedicated chain; should they connect to commonly used international public chains, or use some domestic public chains like Hashkey Chain, Conflux, etc.? This question poses a new challenge for governments and enterprises in China, the U.S., and other countries around the world. Wyoming's scoring and public disclosure system may not be perfect, but it sets an example for future entrants. We should expect to see more interesting governance developments in the future.

15.01K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.