What is Liquidity Providing?

A breakthrough invention in DeFi 🧠

Liquidity providers deposit tokens into a smart contract so YOU can make swaps.

In exchange, they earn rewards.

This simple idea transformed the way markets work, bringing economic freedom to internet users around the world.

Here’s why it matters 👇

2/ Why liquidity providing matters

Liquidity providing makes it possible for anyone to:

• Swap tokens outside of centralized exchanges

• Access new kinds of markets

• Generate yield on your crypto

• Trade lesser-known assets

• Support protocols you believe in

Every time you make a swap on Katana, you’re relying on a liquidity provider!

Here’s how to BECOME one – and earn rewards 👇

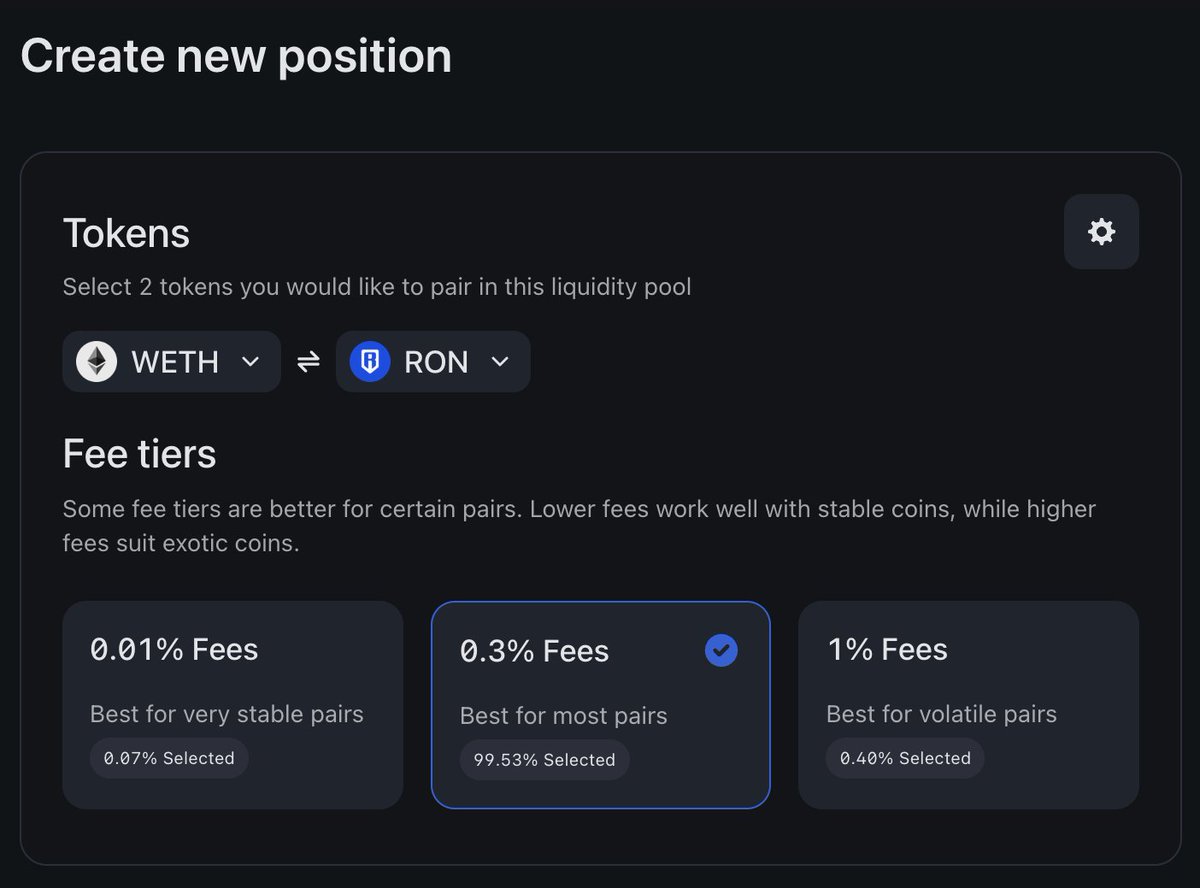

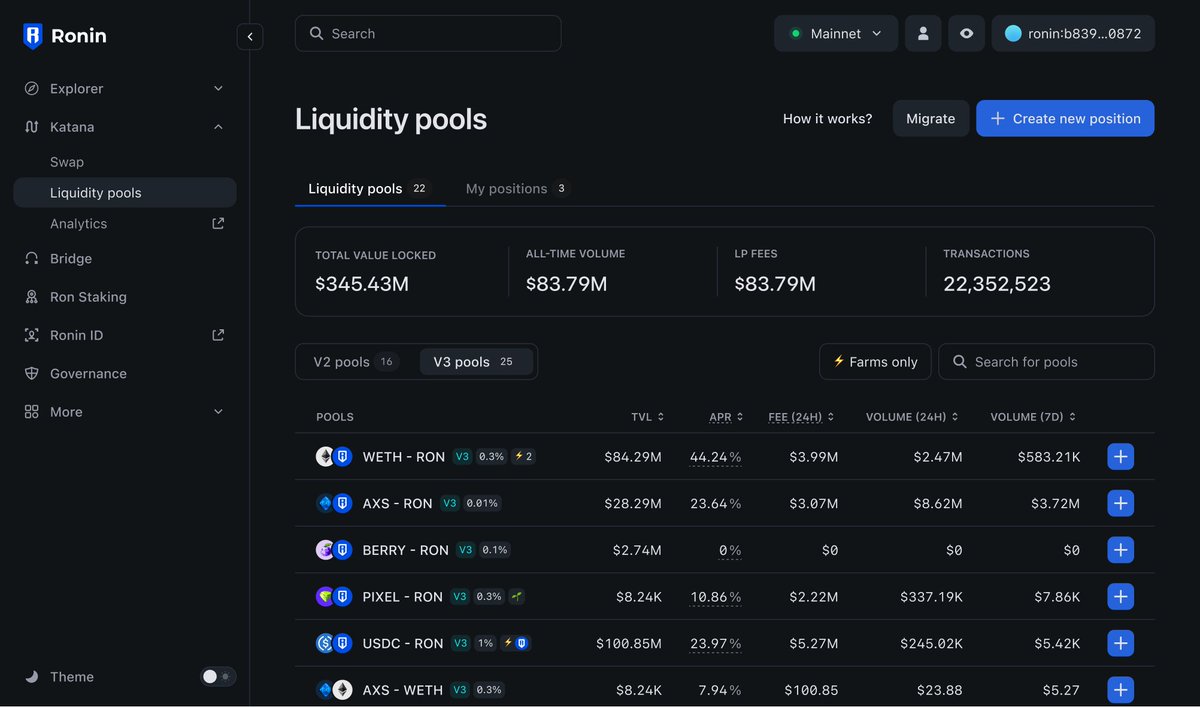

3/ How to provide liquidity

Step 1: Go to a DEX like Katana

Step 2: Deposit a pair of tokens in a liquidity pool

Step 3: Receive Liquidity Provider (LP) tokens representing your contributions

Step 4: Earn rewards every time someone uses your liquidity pool to swap those tokens

4/ Things to think about when providing liquidity

DeFi rewards always come with risk, including:

• Impermanent Loss: auto-rebalancing pools can reduce your rewards

• Smart Contract Vulnerability: bugs and bad actors can affect liquidity pool safety

• Market volatility: yields and prices are always subject to change

Want to learn more?

Check out the Ronin Wiki 👇

🔗 :

3

875

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.