This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

spark

spark price

3W8HdH...pump

$0.0000040779

+$0.00000

(-0.88%)

Price change for the last 24 hours

How are you feeling about spark today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

spark market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$4,070.56

Network

Solana

Circulating supply

998,208,861 spark

Token holders

298

Liquidity

$6,507.11

1h volume

$0.00

4h volume

$0.00

24h volume

$21.44

spark Feed

The following content is sourced from .

老白|Laobai

The palm prints have really faced a backlash today due to the反撸, and the criticism is overwhelming 😂

Yesterday it was all praise, and today it has turned into a street rat 🐭

This is the backlash of "mouth撸" 🥳 This is how reputation gets ruined.

So the pressure is on for tomorrow's SPARK @sparkdotfi

After all, it's the flagship of Cookie🍪, the beloved child of SKY @SkyEcosystem, with a TVL of $6 billion, ranking 4th among all blockchain projects, and the $SPK coin price is still considered undervalued.

Currently, the SNAPS points are inflating rapidly, almost doubling in just a week, exceeding 15,000 points. Based on the total airdrop amount of 0.5%, with 2/3 allocated to these 15,000 points, the value of 1 point is approximately 100u.

(1/3 of which goes to Cookie stakers)

I hope #SPARK is not a project that suffers from the backlash of "mouth撸". The answer will be revealed tomorrow night at 10 PM. Good luck to the Cookie🍪 friends 🔥

Lastly, let me say the slogan of #SPARK, "Not a bank!"

Overdrive is for the ones who staked, stayed & believed.

It's the 2nd phase of the airdrop, where you can stake your SPK via @symbioticfi and get a share of the unclaimed Ignition SPK.

Show original

7.23K

1

0xkevin (🖤 , 💙)

"From Financial Black Swans to On-Chain Reconstruction: Why We Need Spark"

Recently, Circle went public, and this stablecoin issuer suddenly became a darling of Wall Street, unaware that two years ago it faced a decoupling crisis due to the collapse of Silicon Valley Bank.

We have long known the problems of the traditional banking system, but a true alternative only took shape with the emergence of #Spark, which finally possesses a "system-level" prototype.

› ••••••••• ‹

The subprime mortgage crisis of 2008 is well-known to most people.

At that time, real estate companies were pulling in people who couldn't repay their loans to buy houses, packaging these high-risk loans, rebranding them, and selling them as so-called "investment-grade products."

Lehman Brothers was the first to fall, but that was just the first domino. Many people around the world lost decades of savings and homes bought over a lifetime in that collapse, which turned into a digital zero.

We are used to thinking of banks as neutral entities that serve users. But after that year, more and more people realized: banks are more like machines for capital; at critical moments, they will not protect you.

Fast forward to 2023, the collapse of Silicon Valley Bank. Silicon Valley Bank was like most banks: buying long-term bonds, but then faced with the Federal Reserve's sudden interest rate hikes. This back-and-forth led to bond devaluation, users wanting to withdraw money, and the bank found it had insufficient cash flow, resulting in a sudden collapse.

The core issue was a bank run: the "depositors' money" had essentially become the bank's own liabilities. Once users collectively wanted to "get their money back," the system could not sustain itself.

🚨 Your money in the banking system is actually no longer your money.

Every time a bank has issues, everyone can only pray for government bailouts, central banks printing money, and risks being "collectively borne." But this system is actually very fragile.

We have long known the problems of the traditional banking system, but a true alternative only took shape with the emergence of Spark, which finally possesses a "system-level" prototype.

@sparkdotfi is currently the first DeFi construct that systematically addresses these three points:

> Credit creation

> Liquidity adjustment

> Interest rate setting

In the traditional banking system, there is a high dependency between commercial banks and central banks: one provides deposit and loan services, while the other controls currency issuance and interest rates.

The design of @sparkdotfi was not initially to be an "Aave alternative," but rather: to combine the central bank role of MakerDAO (issuing DAI → now USDS) with Aave's lending system (fund matching, liquidation mechanisms), plus the asset deployment capabilities of hedge fund strategies.

🛡️ Integrated into a unified system.

In other words, it is not just an on-chain bank, but a hybrid of on-chain central bank + commercial bank + investment bank, truly moving the financial system into a user-visible, verifiable, and governable on-chain world.

How does Spark solve the "banking problem"?

In traditional banks, your money is just a "digital record" of the bank; it uses it for other purposes, and if it collapses, you bear the loss. In Spark, all collateral is on-chain and held by smart contracts. The liquidation mechanism is written in code, with no human intervention and cannot be misappropriated.

Spark introduces a "transparent interest rate" mechanism, where the borrowing rates for USDS and USDC are determined by governance votes from Sky, making them predictable, adjustable, and publicly transparent. This is similar to how central banks announce benchmark interest rates, but the control is in your hands.

Spark's liquidity comes from stablecoin reserves directly injected by the D3M module. This mechanism, in traditional banks, equates to "having a central treasury backing it up," while on-chain, it is a treasury you can see with your own eyes, and you decide how it is used.

Spark's SLL directly deploys liquidity to the most optimal protocols on-chain, such as Curve, Aave, and Morpho, and dynamically balances returns and risks through off-chain smart monitoring tools.

This is equivalent to a real-time market-responsive, auto-rebalancing on-chain hedge fund system, with all profits used for dividends to holders (sUSDS earnings).

📍 If you deposit money in Spark today, the biggest difference from a bank is:

🔹 Your money is truly under your control.

🔹 Interest is not "decided by the bank," but determined by governance, which you participate in.

🔹 The source of profits is not "you paying for others," but profits actively earned by the protocol.

🔹 Risk control mechanisms are not "hoping the bank is professional," but clearly written in the contract.

In the event of a collapse, it is not about "waiting for the government to save you," but rather on-chain assets automatically liquidating and self-repairing.

@sparkdotfi is the "order restorer" born from past financial failures.

Every financial black swan event pushes for a round of institutional reform. The significance of Spark lies in:

It is not about "using blockchain to create a bank," but rather completely dismantling the entire banking system and reassembling it into a financial order that users govern, hold, and define risks and returns themselves.

In this new order, there is no such thing as "too big to fail," and no "your deposited money is actually someone else's liability." Every operation has traceability, every governance can be voted on, and every interest rate is publicly transparent.

From the lineage of Maker, the resources of @SkyEcosystem, the evolution of DAI, the establishment of $USDS, to the deployment capabilities of SLL and the equity model of SPK, what it is building is the first systematic, governance-enabled, profit-generating, and moat-protected "on-chain central bank + investment bank + commercial bank" in the entire decentralized world.

This is a response to all past financial collapses and a prototype of a future order.

@cookiedotfun #cookie.

Show original

27.79K

121

龙神🌊🕊️ reposted

龙神🌊🕊️

Remember, the sense of proportion in adults is a kind of silence that stops at the right moment! Given the current market conditions, don't talk about useless futures; right now, infofi is the trend of this round. Embrace infofi, and only then can you seize the opportunity in this bull market! @KaitoAI #yaps #infofi

龙神🌊🕊️

2025-6-21, it's the weekend holiday again. The middle school entrance examination students take the middle school entrance examination, and we can have a good rest again. In a word, let go of the market and enjoy the weekend. If there is a northeast and northwest wind, I laugh at the sky!

1️⃣ Everything is a conspiracy, everything is a design, and it is said that they are afraid of war to cause trouble. Everyone's eyes are wide-eyed, either looking at this news or that data. This is not the rise of American stocks, and many of them are the same as imitations, so don't be high in the encryption circle, work honestly, and don't lose all the little money in your pocket, haha! In a word, encryption is not the mainstream in the world financial circle. Large capital is still the first choice of U.S. stocks, but this is also an opportunity to wait for the return of funds. In fact, a little capital of U.S. stocks can make encryption flood. This is also a unique dividend of the web3 market. Although it is not much, it is still the most tempting place! Quietly waiting for the increment, the best and safest way in the stock market is yap, while yap, while waiting for the market, accumulating chips is the king's way!

2️⃣ As mentioned in the previous article, the background of the rise of #infofi is that the market is caused by the lack of liquidity and the game of stock. The market's funds are not enough to support so many projects, so the competition for attention becomes the first choice, and #Kaito stands out. He cleverly uses Ai to identify Technology and attention quantification lead market participants to rush in crazily, so that some good pattern projects have been paid attention to by the market. Market attention often means the attention of funds, and the project parties can also cleverly use options to greatly save funds while achieving perfect network-wide publicity! This determines the main theme of this round of market infofi. Even if there is a flood of liquidity, the water will flow to places with high attention. The saying "good wine fears no deep alley" does not exist in web3. Do you think that in today's increasingly perfect market, there will still be a situation like the previous bull market where water floods and everything rises? It's hard, including web2. If a product has no attention, it is destined to have no productivity!

So you must follow the trend. Don't say useless futures. Currently, infofi is the trend of this round. Embrace infofi, and you can win half the battle in this bull market! @KaitoAI #yaps #infofi

3️⃣ Yesterday there was an interesting thing, the Ai data project Octopus, @OpenledgerHQ, logged into Cookie @cookiedotfun, which is currently the only project that has logged into both Kaito and Cookie. In fact, I think that for a while in the future, this will also be a choice for some projects that cannot reach the front row heat on Kaito. This is also what I said, Cookie serves as a complementary platform for infofi, creating differentiated competition and allowing infofi to flourish! #SNAPS @RiverdotInc

4️⃣ Routine reminder 📣:

1. @Humanityprot has now opened for iOS download. Crypto enthusiasts generally use Apple products, so you can go and do palm print recognition verification in time. Yesterday, the official Twitter mysteriously mentioned 24, 📷! What does it mean? Something big is coming, those who understand know!

2. Spark @sparkdotfi is currently counting down to less than three days. Friends who are sprinting can seize the last opportunity to continue increasing points. Although I don't know what the last point equals to? spark! But at least it's a good airdrop, keep up the good work!

3. I suggest that friends participating in @SuccinctLabs testnet phase two can upgrade half of their points and bid with the other half. Recently, this strategy has been pretty good for me, level 15 is almost full, and I win every day, after all, the number of participants has decreased, haha! Everyone can consider it!

Alright, I need to hurry to the tea room for tea, and later I have to accompany the kids to play badminton, keep exercising! Remember, the sense of proportion for adults is a kind of silence that stops at the right moment!

5.11K

42

龙神🌊🕊️ reposted

龙神🌊🕊️

2025-6-21, it's the weekend holiday again. The middle school entrance examination students take the middle school entrance examination, and we can have a good rest again. In a word, let go of the market and enjoy the weekend. If there is a northeast and northwest wind, I laugh at the sky!

1️⃣ Everything is a conspiracy, everything is a design, and it is said that they are afraid of war to cause trouble. Everyone's eyes are wide-eyed, either looking at this news or that data. This is not the rise of American stocks, and many of them are the same as imitations, so don't be high in the encryption circle, work honestly, and don't lose all the little money in your pocket, haha! In a word, encryption is not the mainstream in the world financial circle. Large capital is still the first choice of U.S. stocks, but this is also an opportunity to wait for the return of funds. In fact, a little capital of U.S. stocks can make encryption flood. This is also a unique dividend of the web3 market. Although it is not much, it is still the most tempting place! Quietly waiting for the increment, the best and safest way in the stock market is yap, while yap, while waiting for the market, accumulating chips is the king's way!

2️⃣ As mentioned in the previous article, the background of the rise of #infofi is that the market is caused by the lack of liquidity and the game of stock. The market's funds are not enough to support so many projects, so the competition for attention becomes the first choice, and #Kaito stands out. He cleverly uses Ai to identify Technology and attention quantification lead market participants to rush in crazily, so that some good pattern projects have been paid attention to by the market. Market attention often means the attention of funds, and the project parties can also cleverly use options to greatly save funds while achieving perfect network-wide publicity! This determines the main theme of this round of market infofi. Even if there is a flood of liquidity, the water will flow to places with high attention. The saying "good wine fears no deep alley" does not exist in web3. Do you think that in today's increasingly perfect market, there will still be a situation like the previous bull market where water floods and everything rises? It's hard, including web2. If a product has no attention, it is destined to have no productivity!

So you must follow the trend. Don't say useless futures. Currently, infofi is the trend of this round. Embrace infofi, and you can win half the battle in this bull market! @KaitoAI #yaps #infofi

3️⃣ Yesterday there was an interesting thing, the Ai data project Octopus, @OpenledgerHQ, logged into Cookie @cookiedotfun, which is currently the only project that has logged into both Kaito and Cookie. In fact, I think that for a while in the future, this will also be a choice for some projects that cannot reach the front row heat on Kaito. This is also what I said, Cookie serves as a complementary platform for infofi, creating differentiated competition and allowing infofi to flourish! #SNAPS @RiverdotInc

4️⃣ Routine reminder 📣:

1. @Humanityprot has now opened for iOS download. Crypto enthusiasts generally use Apple products, so you can go and do palm print recognition verification in time. Yesterday, the official Twitter mysteriously mentioned 24, 📷! What does it mean? Something big is coming, those who understand know!

2. Spark @sparkdotfi is currently counting down to less than three days. Friends who are sprinting can seize the last opportunity to continue increasing points. Although I don't know what the last point equals to? spark! But at least it's a good airdrop, keep up the good work!

3. I suggest that friends participating in @SuccinctLabs testnet phase two can upgrade half of their points and bid with the other half. Recently, this strategy has been pretty good for me, level 15 is almost full, and I win every day, after all, the number of participants has decreased, haha! Everyone can consider it!

Alright, I need to hurry to the tea room for tea, and later I have to accompany the kids to play badminton, keep exercising! Remember, the sense of proportion for adults is a kind of silence that stops at the right moment!

16.28K

55

The Data Nerd

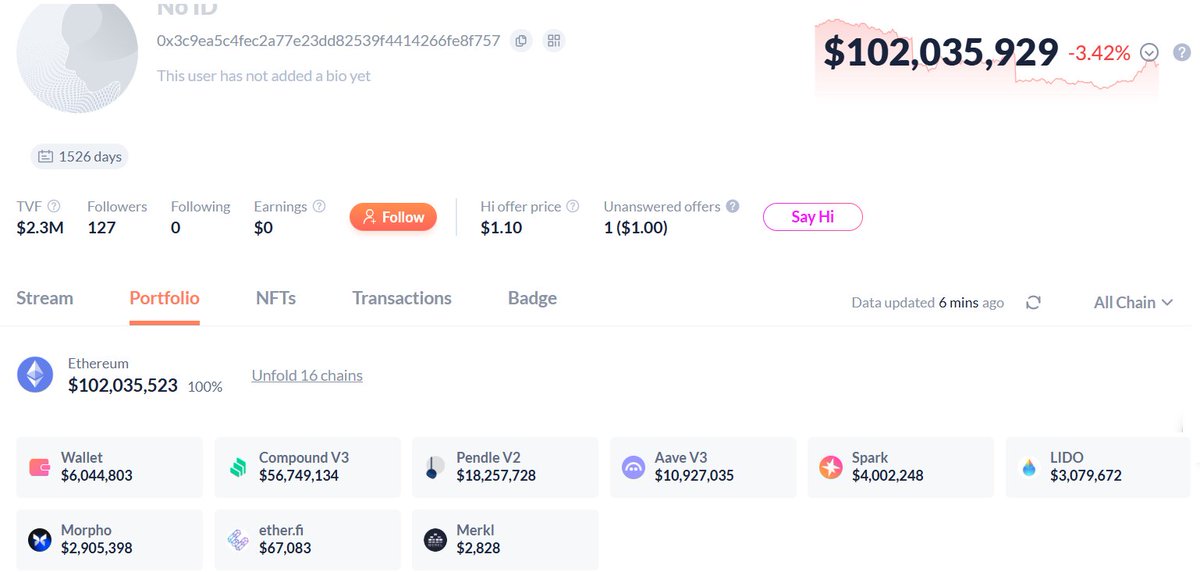

Within 24 hours, this $100M Whale 0x3c9 deposited 2k $ETH (~$5.04M) into #Binance.

This whale is a king of DEFI with a lot of assets in different protocols:

- $56.75M in #Compound

- $18.26M in #Pendle

- $10.93M in #AAVE

- $10M totally in #Spark, #Morpho and #LDO

Address:

Show original

26.32K

1

spark price performance in USD

The current price of spark is $0.0000040779. Over the last 24 hours, spark has decreased by -0.88%. It currently has a circulating supply of 998,208,861 spark and a maximum supply of 998,208,861 spark, giving it a fully diluted market cap of $4,070.56. The spark/USD price is updated in real-time.

5m

+0.00%

1h

+0.00%

4h

+0.00%

24h

-0.88%

About spark (spark)

Learn more about spark (spark)

Nasdaq Firms Embrace Hyperliquid: Institutional Adoption of HYPE Token Sparks DeFi Revolution

Institutional Adoption of Hyperliquid and HYPE Token The cryptocurrency industry is undergoing a transformative shift as Nasdaq-listed firms increasingly integrate Hyperliquid’s HYPE token into their treasury strategies. This trend signifies a major milestone in institutional engagement with decentralized finance (DeFi) and blockchain technology. With companies like Eyenovia and Lion Group Holding leading the charge, the HYPE token is rapidly emerging as a preferred asset for corporate treasuries. This article delves into the strategic moves by these firms, the implications for the DeFi ecosystem, and the broader impact on institutional crypto adoption.

20 June 2025|OKX

Spark (SPK): A Comprehensive Guide to Coin Price, News, Market Cap & Key Metrics

Introduction to Spark (SPK) Spark (SPK) is the native token of the Spark Protocol, a decentralized finance (DeFi) platform designed to optimize stablecoin yield farming and liquidity management. Launched on June 17, 2025, the token has quickly gained attention due to its innovative approach to DeFi lending and borrowing, as well as its listings on major exchanges like Binance and Coinbase.

19 June 2025|OKX

Circle IPO Sparks Crypto IPO Wave: What Investors Need to Know

Circle IPO Crypto: A Defining Moment for the Industry The recent IPO of Circle, the issuer of the USDC stablecoin, has marked a pivotal moment in the cryptocurrency industry. With CRCL stock soaring nearly 290% above its initial offering price, Circle’s debut on the New York Stock Exchange (NYSE) has ignited a wave of interest in crypto IPOs. This article explores the implications of Circle’s IPO, the emerging trend of crypto companies going public, and what investors should watch for in this evolving landscape.

17 June 2025|OKX

XRP News Today: Ripple-SEC Case Update Sparks Optimism Amid Market Recovery

Ripple-SEC Case Update: A Pivotal Moment for XRP Investors The ongoing legal battle between Ripple and the SEC has entered a critical phase, with significant implications for XRP's future. As of June 16, the SEC is required to file a settlement status report with the US Court of Appeals. This filing could determine whether Ripple must submit its appeal-related reply brief, advancing the SEC’s appeal against the Programmatic Sales of XRP ruling.

17 June 2025|OKX

spark FAQ

What’s the current price of spark?

The current price of 1 spark is $0.0000040779, experiencing a -0.88% change in the past 24 hours.

Can I buy spark on OKX?

No, currently spark is unavailable on OKX. To stay updated on when spark becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of spark fluctuate?

The price of spark fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 spark worth today?

Currently, one spark is worth $0.0000040779. For answers and insight into spark's price action, you're in the right place. Explore the latest spark charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as spark, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as spark have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.