This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

USDY

Ondo US Dollar Yield price

0x960b...USDY

$1.0924

+$0.0018539

(+0.17%)

Price change for the last 24 hours

How are you feeling about USDY today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

USDY market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$17.56M

Network

SUI

Circulating supply

16,079,478 USDY

Token holders

5622

Liquidity

$1.38M

1h volume

$66,797.29

4h volume

$251,733.48

24h volume

$1.24M

Ondo US Dollar Yield Feed

The following content is sourced from .

kram

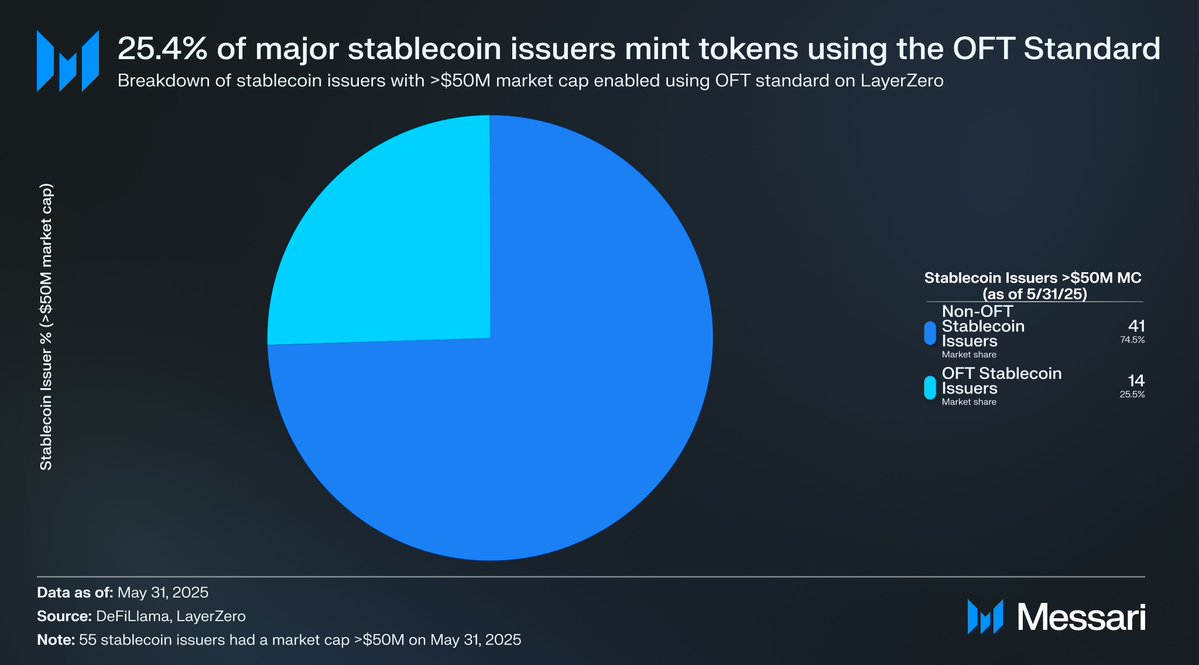

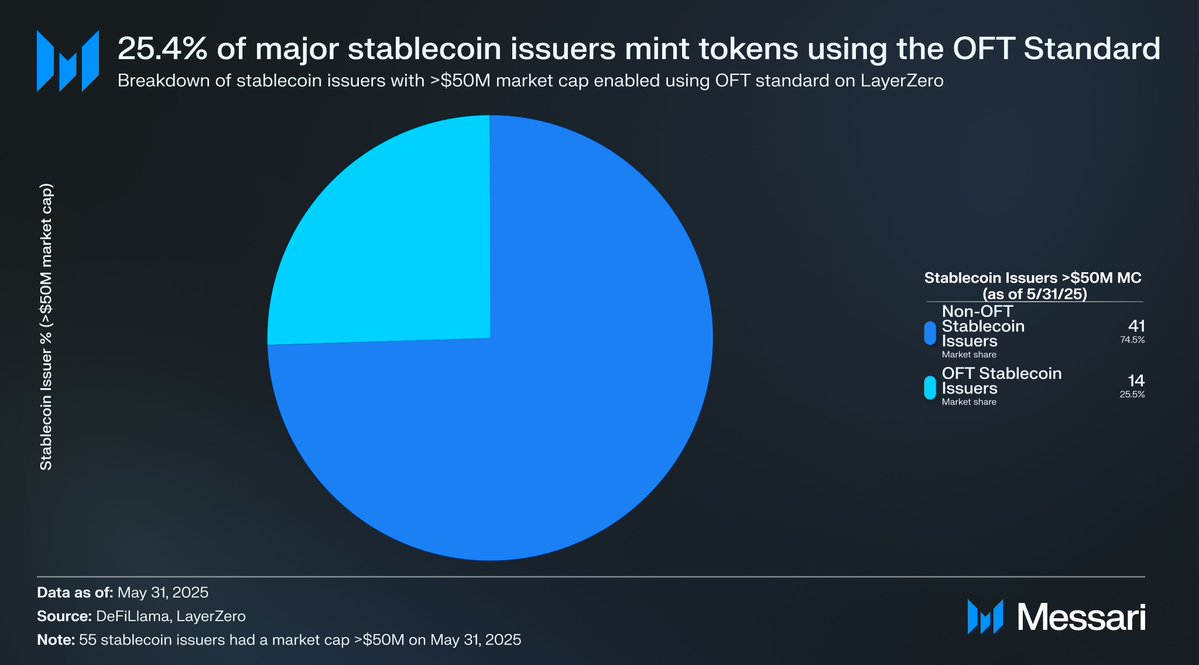

Interop is perfectly positioned as a second order effect to stablecoins.

- 25% of all stables (14/55) over $50M use LayerZero to issue their tokens.

- 61% ($150B) of stablecoins move between chains using LayerZero messaging.

0xweiler

1/ 25.4% of major stablecoin issuers (>$50M market cap) issue tokens using @LayerZero_Core's OFT Standard.

This includes USDT0 (@Tether_to), USDe (@ethena_labs), PYUSD (@PayPal), USDY (@OndoFinance), frxUSD (@fraxfinance), and more.

With stablecoins going multichain, OFT is becoming the path to scale with no wrapped assets.

Here’s what’s driving the shift in the @Messari_crypto LayerZero Pulse report🧵👇

🔗

6.84K

8

Messari

Wrapped tokens are out. Native scale is in.

25% of top stablecoins—Tether, PayPal, Ethena, Ondo—now use @LayerZero_Core's OFT standard to go multichain without the mess.

The stablecoin backbone is forming quietly.

Full breakdown and free report 👇

0xweiler

1/ 25.4% of major stablecoin issuers (>$50M market cap) issue tokens using @LayerZero_Core's OFT Standard.

This includes USDT0 (@Tether_to), USDe (@ethena_labs), PYUSD (@PayPal), USDY (@OndoFinance), frxUSD (@fraxfinance), and more.

With stablecoins going multichain, OFT is becoming the path to scale with no wrapped assets.

Here’s what’s driving the shift in the @Messari_crypto LayerZero Pulse report🧵👇

🔗

37.2K

109

常为希 |加密保安🔸🚢🇺🇸

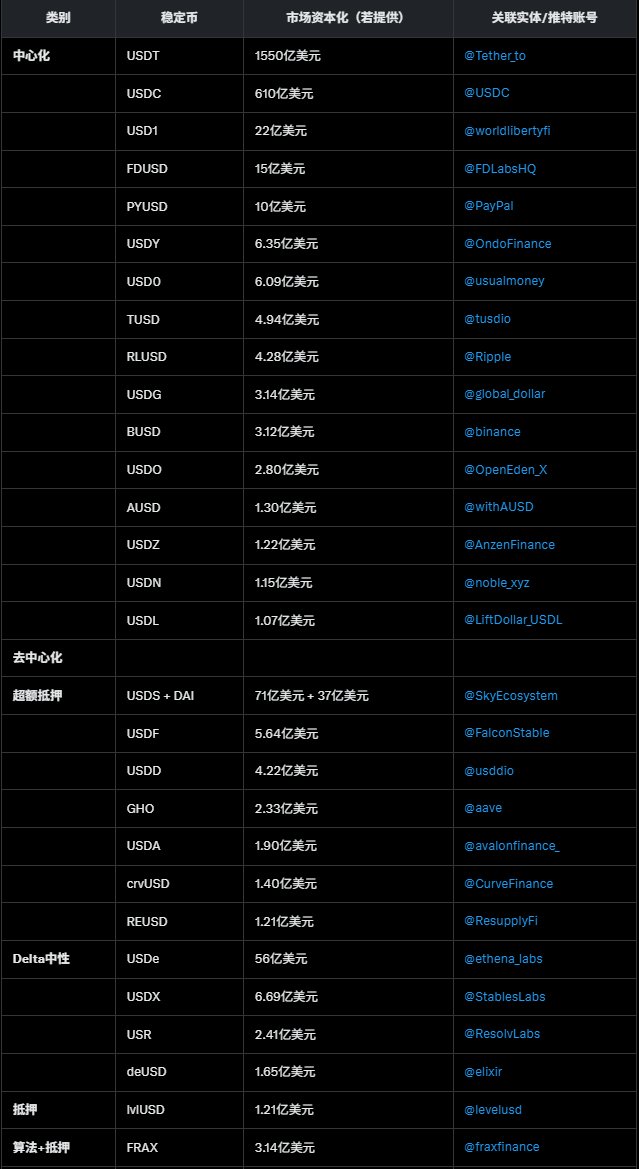

The market capitalization (MC) of stablecoins exceeding $100 million is categorized into centralized and decentralized types, with the decentralized category further divided into over-collateralized, delta-neutral, collateralized, and algorithmic + collateralized categories.

The total market capitalization of centralized stablecoins is significantly higher than that of decentralized ones.

USDT ($155 billion) and USDC ($61 billion) dominate, collectively controlling a large portion of the centralized stablecoin market (about 85%).

Other centralized stablecoins (such as USD1, FDUSD, PYUSD, etc.) have market capitalizations ranging from $100 million to $2.2 billion, indicating that small to medium-sized projects are also attempting to enter the market. PayPal's PYUSD ($1 billion) shows that traditional financial giants are starting to venture into the stablecoin space.

Over-collateralized: Represented by USDS + DAI ($7.1 billion + $3.7 billion), this category relies on over-collateralized crypto assets (such as ETH) to maintain stability, with a relatively balanced market capitalization distribution.

Delta-neutral: USDe ($5.6 billion) leads, with this mechanism achieving price stability through hedging strategies (such as perpetual futures), offering high capital efficiency.

The total market capitalization of centralized stablecoins far exceeds that of decentralized ones, reflecting the current market's preference for stable solutions backed by institutions.

The diversified mechanisms of decentralized stablecoins, such as delta-neutral and algorithmic stability, demonstrate the potential for technological innovation.

42.57K

5

BLACK ANGEL ⚫

Injective Is Quietly Rebuilding How Finance Works On-Chain

Most tokenization platforms today just issue digital claims. You get a token that says you own something off-chain. That’s it. No real utility. No native functionality.

@Injective isn’t following that route.

It’s building a full-stack infrastructure where real-world assets (RWAs) can actually be used, directly, on-chain, in trading, lending, hedging, and yield generation.

This shift starts with Injective’s iAssets framework.

➤ iAssets <> Financial Instruments That Do More

iAssets aren’t just representations of real-world value. They’re programmable, composable, and ready to plug into any DeFi use case:

» Dynamic exposure and liquidity tools

» Native integration with perpetuals, lending markets, and automated hedging strategies

» No need for upfront capital or off-chain clearance

All of this runs at Layer-1 speed and cost, and it's already live.

➤ Purpose-Built RWA Module + Oracle Layer

Injective launched the first RWA module with native asset permissioning, transfers, and regulatory controls.

It also includes custom oracles for complex data feeds like FX and bond markets, enabling these assets to function properly in DeFi.

Everything is handled on-chain, with full composability across dApps.

➤ Real Yield, Real Activity

This infrastructure is already seeing traction:

» @AgoraHub_io’s AUSD (backed by U.S. Treasuries) with $84M TVL across chains

» @OndoFinance’s USDY treasury tokens integrated into Injective lending

» @BlackRock’s BUIDL index available through on-chain perpetual markets

Upshift alone pulled $140M in net inflows via Injective’s Peggy bridge in May 2025. These aren’t test deployments, they’re generating volume.

➤ Ultra-Low Fees and Institutional Onboarding

With fees around $0.0003 per transaction and deflationary tokenomics through Burn Auctions, Injective offers unmatched cost efficiency.

It also supports institutional-grade APIs, integrations with @BitGo, Twinstake, and full validator support, setting the stage for more enterprise adoption.

➤ Multi-Chain Support <> EVM, Cosmos, and Beyond

Injective’s inEVM environment connects Ethereum-based apps directly to its high-speed DeFi stack.

Support for multiple VMs means developers from different ecosystems (WASM, Solana, etc.) can bring apps over while sharing liquidity and functionality.

This isn't just cross-chain; it’s cross-environment.

➤ Bottom Line <> A New Standard for RWA DeFi

Injective has built a foundation where real-world assets aren’t isolated tokens, they’re building blocks for real financial products.

With deep integrations, live market activity, and infrastructure designed for scale, Injective is setting the benchmark for what tokenized finance can become.

Not theory. Not hype. It’s working now.

Show original

5.4K

91

USDY price performance in USD

The current price of ondo-us-dollar-yield is $1.0924. Over the last 24 hours, ondo-us-dollar-yield has increased by +0.17%. It currently has a circulating supply of 16,079,478 USDY and a maximum supply of 16,079,478 USDY, giving it a fully diluted market cap of $17.56M. The ondo-us-dollar-yield/USD price is updated in real-time.

5m

+0.00%

1h

+0.05%

4h

+0.05%

24h

+0.17%

About Ondo US Dollar Yield (USDY)

USDY FAQ

What’s the current price of Ondo US Dollar Yield?

The current price of 1 USDY is $1.0924, experiencing a +0.17% change in the past 24 hours.

Can I buy USDY on OKX?

No, currently USDY is unavailable on OKX. To stay updated on when USDY becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDY fluctuate?

The price of USDY fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Ondo US Dollar Yield worth today?

Currently, one Ondo US Dollar Yield is worth $1.0924. For answers and insight into Ondo US Dollar Yield's price action, you're in the right place. Explore the latest Ondo US Dollar Yield charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Ondo US Dollar Yield, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Ondo US Dollar Yield have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.