JTO

Jito price

$1.9680

-$0.06700

(-3.30%)

Price change for the last 24 hours

How are you feeling about JTO today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Jito market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$667.24M

Circulating supply

339,736,103 JTO

33.97% of

1,000,000,000 JTO

Market cap ranking

54

Audits

Last audit: --

24h high

$2.1260

24h low

$1.9480

All-time high

$5.3280

-63.07% (-$3.3600)

Last updated: 4 Apr 2024, (UTC+8)

All-time low

$1.3000

+51.38% (+$0.66800)

Last updated: 8 Jan 2024, (UTC+8)

Jito Feed

The following content is sourced from .

Luke Cannon

Projects I'd like to see list their token on Hyperliquid spot:

@aave

@Ripple

@arbitrum

@Uniswap

@Cardano

@chainlink

@Polkadot

@bittensor_

@BNBCHAIN

@MorphoLabs

@pepecoineth

@SkyEcosystem

@ton_blockchain

@JupiterExchange

@GetTrumpMemes

@Mantle_Official

@ShibainuCoin

@OndoFinance

@ethena_labs

@SuiNetwork

@dogwifcoin

@SonicLabs

@Optimism

@dogecoin

@bonk_inu

@trondao

@monero

@jito_sol

@Aptos

@avax

Will buy any tokens that do to support

Show original87.05K

12

Bera

Stablecoin: $Ena

AI: $wld $Kaito $NIL (?)

L1: $Sui

Defi: $Aave $Jto

Bot: $banana

Cobie

If you have to buy liquid/non-venture crypto for a 3-5 year time horizon, and you're not allowed to buy BTC, ETH, HYPE, SOL or hold stablecoins, what do you buy and why? I want to find some intelligent people with good/non-obvious ideas to follow, thanks.

28.54K

3

Karon

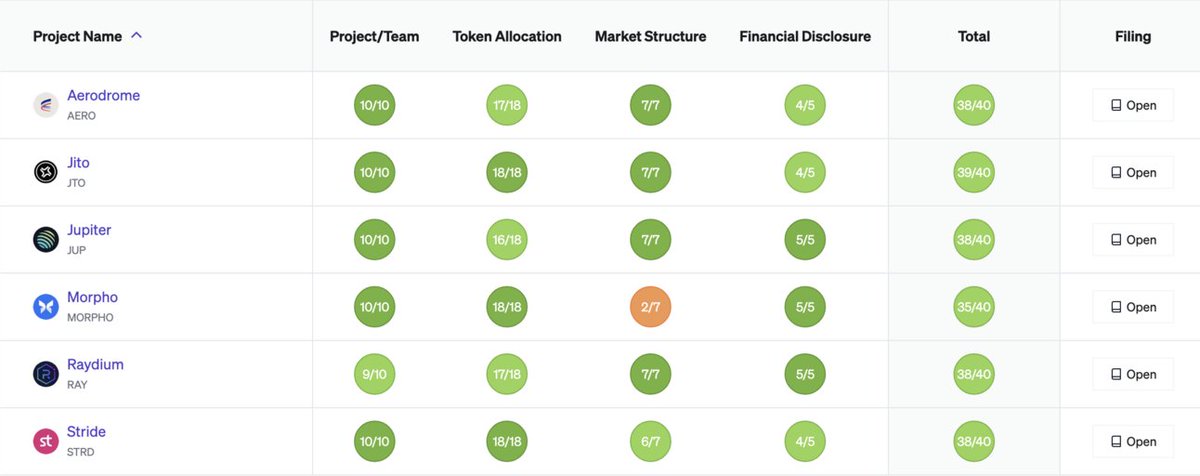

Blockworks’ Token Transparency Framework 🔎

@Blockworks_ has launched the Token Transparency Framework (TTF), an open-source disclosure system that helps crypto projects share standardized, essential information with the public.

> It addresses key issues like unclear token supply, insider incentives, and vesting schedules.

> The framework scores projects based on transparency (not quality) across 18 criteria in four categories: team, financials, token supply, and market structure.

> Projects like Jito, Jupiter, and Morpho have already adopted it.

> TTF aims to help investors, exchanges, and market makers make better decisions while encouraging responsible self-regulation across the industry.

Read More Here:

Show original

1.44K

1

knox reposted

Jito

Jito is headed to CA to support the @lamaddrops!

MLP San Clemente Tournament ⤵️

📆 Thursday, June 26th - Sunday, June 29th

🏆️ Game 1 starts 12pm on the Championship Court

🌴 Life Time in San Clemente, CA

Are you in the area? 🛬

👕 Stop by the Jito booth for some merch!!

⬇️

Show original

5.32K

117

Jito price performance in USD

The current price of Jito is $1.9680. Over the last 24 hours, Jito has decreased by -3.29%. It currently has a circulating supply of 339,736,103 JTO and a maximum supply of 1,000,000,000 JTO, giving it a fully diluted market cap of $667.24M. At present, Jito holds the 54 position in market cap rankings. The Jito/USD price is updated in real-time.

Today

-$0.06700

-3.30%

7 days

-$0.25200

-11.36%

30 days

-$0.15000

-7.09%

3 months

-$0.28500

-12.65%

Popular Jito conversions

Last updated: 23/06/2025, 01:33

| 1 JTO to USD | $1.9640 |

| 1 JTO to AUD | $3.0360 |

| 1 JTO to PHP | ₱112.29 |

| 1 JTO to EUR | €1.7042 |

| 1 JTO to IDR | Rp 32,244.29 |

| 1 JTO to GBP | £1.4596 |

| 1 JTO to CAD | $2.6971 |

| 1 JTO to AED | AED 7.2128 |

About Jito (JTO)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Learn more about Jito (JTO)

JitoSOL: Solana’s Leading Liquid Staking Token Takes Bold Steps in Restaking Innovation

JitoSOL: A Game-Changer in Solana’s Liquid Staking Ecosystem Solana’s largest liquid staking provider, Jito Labs, is making waves in the crypto world with its flagship token, JitoSOL, and its recent advancements in restaking technology. As the Solana ecosystem continues to expand, JitoSOL has emerged as a dominant force, offering users innovative ways to maximize their staking rewards while maintaining liquidity.

9 June 2025|OKX

What is Jito (JTO)? Popularizing liquid staking on Solana

Following in the footsteps of Lido and the the bonus liquidity it provides, crypto users might be pleased to read that liquid staking has made its way on Solana in the form of Jito. As a liquid staking protocol operating on a stake pool model, Jito first caught attention when it announced a massive . Those tokens went to JitoSOL holders, Solana validators who used Jito Solana’s MEV clients, and users of Jito’s MEV services. This action seemed to breathe new life into Solana's ecosystem as total value locked (TVL) levels exponentially increased as more users got introduced to Jito.

6 Jan 2025|OKX

Jito FAQ

How much is 1 Jito worth today?

Currently, one Jito is worth $1.9680. For answers and insight into Jito's price action, you're in the right place. Explore the latest Jito charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Jito, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Jito have been created as well.

Will the price of Jito go up today?

Check out our Jito price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials