ICX

ICON price

$0.11824

-$0.00138

(-1.16%)

Price change for the last 24 hours

How are you feeling about ICX today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

ICON market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$126.02M

Circulating supply

1,067,866,299 ICX

98.69% of

1,081,965,268 ICX

Market cap ranking

137

Audits

Last audit: 1 June 2020, (UTC+8)

24h high

$0.12369

24h low

$0.11445

All-time high

$13.0000

-99.10% (-$12.8818)

Last updated: 12 Jan 2018, (UTC+8)

All-time low

$0.069810

+69.37% (+$0.048430)

Last updated: 7 Apr 2025, (UTC+8)

ICON Feed

The following content is sourced from .

Min 🥤

Update on KRW Stablecoin: FACTS & THOUGHTS — Part 2

If you missed Part 1, scroll down to the previous post at the bottom

1. Korean Exchanges Are Finally Making Bold Moves

One of my long-standing criticisms has been that Korean exchanges are too conservative and hesitant to invest meaningfully in the local crypto ecosystem. That may be starting to change.

Bithumb Exchange recently announced a KRW stablecoin competition with a prize pool of KRW 300 billion (~$22 million USD). This kind of capital and opportunity has the power to attract fresh talent and renewed attention — exactly what Korea’s stagnant crypto scene needs. I deeply respect this initiative.

IMHO even more surprising is Upbit, Korea’s largest exchange by far, recently launching USDT on Aptos and USDC on Solana — a bold move for an exchange known for its cautious approach. This not only signals a shift in regulatory sentiment, but also suggests that Upbit is actively preparing for the coming KRW stablecoin era.

2. Korea Will Follow Circle’s ($CRCL) Lead

At the moment, Korean exchanges, builders, and investors are spreading their bets due to uncertainty around how KRW stablecoin regulations will take shape. That’s expected in an early-stage race.

However, if history is any guide, Korea rarely leads on regulation. Instead, it looks to established global frameworks for precedent — and Circle is currently the most credible model. Circle is NYSE-listed, SEC-reviewed, and MiCA-compliant. That makes USDC more favorable in the eyes of Korean regulators compared to USDT, which is not MiCA-compliant (at least not yet). It’s likely Korea will view Circle’s choice of Layer 1s and partners as a vetted, safe template to emulate.

3. Domestic Players Will Lead KRW Stablecoin Issuance

Since the 1997 Asian Financial Crisis, Korea has maintained strict capital controls. This means the government will only permit domestic entities to issue and operate KRW stablecoins. Foreign-headquartered companies will likely be excluded, while Korean banks, locally licensed VASPs (Virtual Asset Service Providers), and local well-capitalized technology vendors will be front and center.

CONCLUSION:

The momentum is real, but the path is still unfolding. Korea’s KRW stablecoin race is heating up — and the players, frameworks, and partners involved today will shape its outcome tomorrow.

If you found this useful, pls ❤️ + 🔄 + FOLLOW for more updates.

Min 🥤

Here are the FACTS and my THOUGHTS on the KRW Stablecoin:

1. Political Promises vs. Reality

Korea has seen “pro-crypto” presidents before — yet nothing meaningful came of it. Will this new administration be different? Personally, I’m skeptical. Korean politicians don’t exactly have a strong track record when it comes to delivering on innovation.

2. Regulatory Momentum Is Real

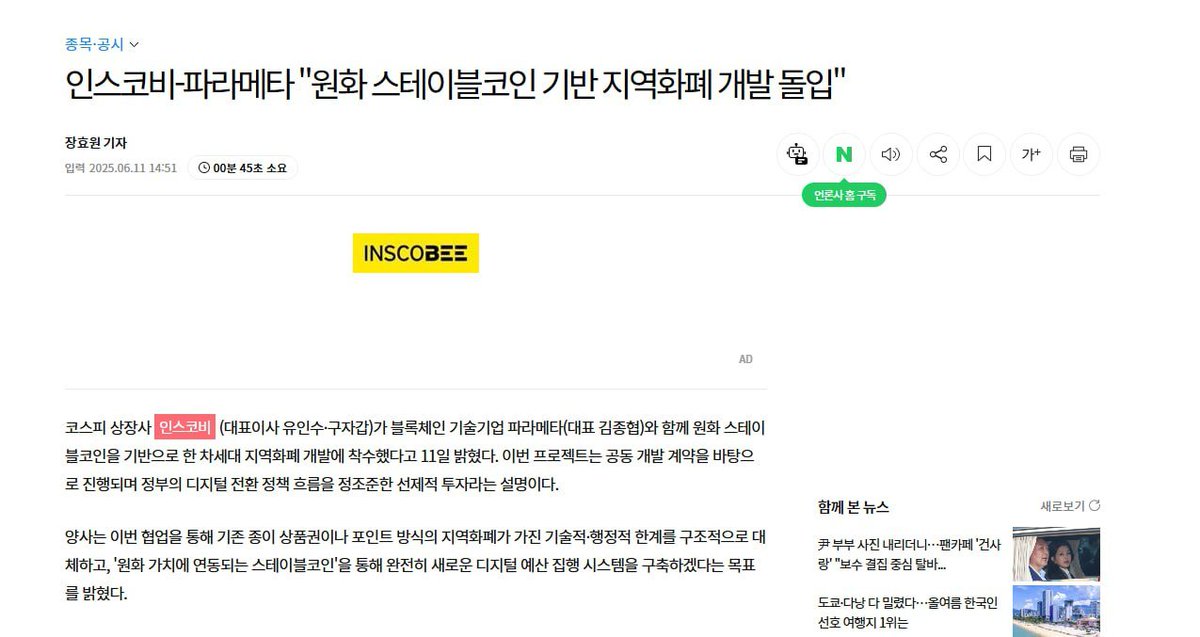

It’s true that the current administration is moving quickly on KRW stablecoin regulation. The momentum is strong, fueled further by Circle’s ($CRCL) IPO, which has reignited interest in the stablecoin sector. Banks, tech giants, and startups are all jockeying for position — evident in moves like Parameta’s partnership with Inscobee. Right now, KRW stablecoin is the hottest topic in Korea.

3. Too Many Cooks in the Kitchen?

We’re likely to see multiple KRW stablecoin issuers competing. The largest banks have already formed a consortium to explore opportunities. But with so many players and agendas, real progress could be slow. The hype is here — the execution remains to be seen.

4. Limited Market, Limited Winners

Let’s be honest — KRW is not a global currency, and it’s not even among the top 10 most-traded. The market likely isn’t big enough to support multiple winners. It’s possible only one will break through — or none at all.

5. Multi-Chain or Bust

This part is non-negotiable: the winning KRW stablecoin must be multi-chain. It won’t survive if it’s tied to a single Layer 1. But that also means a lower market cap stablecoin will have to be spread thin across several ecosystems.

So, what does this mean for SODAX?

This is where $SODA and SODAX shine.

We’re already multi-chain — or more accurately, chain-agnostic. SODAX sits above the base layers as the execution and routing layer — integrating with all major chains, not competing with them. So regardless of which chain a KRW stablecoin runs on, SODAX benefits.

That’s the power of being the middle layer — we don’t bet on winners; we connect them.

10.79K

21

Min 🥤

Here are the FACTS and my THOUGHTS on the KRW Stablecoin:

1. Political Promises vs. Reality

Korea has seen “pro-crypto” presidents before — yet nothing meaningful came of it. Will this new administration be different? Personally, I’m skeptical. Korean politicians don’t exactly have a strong track record when it comes to delivering on innovation.

2. Regulatory Momentum Is Real

It’s true that the current administration is moving quickly on KRW stablecoin regulation. The momentum is strong, fueled further by Circle’s ($CRCL) IPO, which has reignited interest in the stablecoin sector. Banks, tech giants, and startups are all jockeying for position — evident in moves like Parameta’s partnership with Inscobee. Right now, KRW stablecoin is the hottest topic in Korea.

3. Too Many Cooks in the Kitchen?

We’re likely to see multiple KRW stablecoin issuers competing. The largest banks have already formed a consortium to explore opportunities. But with so many players and agendas, real progress could be slow. The hype is here — the execution remains to be seen.

4. Limited Market, Limited Winners

Let’s be honest — KRW is not a global currency, and it’s not even among the top 10 most-traded. The market likely isn’t big enough to support multiple winners. It’s possible only one will break through — or none at all.

5. Multi-Chain or Bust

This part is non-negotiable: the winning KRW stablecoin must be multi-chain. It won’t survive if it’s tied to a single Layer 1. But that also means a lower market cap stablecoin will have to be spread thin across several ecosystems.

So, what does this mean for SODAX?

This is where $SODA and SODAX shine.

We’re already multi-chain — or more accurately, chain-agnostic. SODAX sits above the base layers as the execution and routing layer — integrating with all major chains, not competing with them. So regardless of which chain a KRW stablecoin runs on, SODAX benefits.

That’s the power of being the middle layer — we don’t bet on winners; we connect them.

Marc ⚡️ 10X

🇰🇷 Korea’s Stablecoin Greenlight could be a Game-Changer for $SODA 👀

South Korea just made a historic move: it’s now allowing private companies to issue Korean won–pegged stablecoins under a regulated framework.

While this sounds like another piece of global stablecoin news, it’s actually a major tailwind for a lean, emerging DeFi protocol: SODAX (formerly ICON).

Let’s break down why this matters and why $SODA could be a key beneficiary. 🚀

The Stablecoin Context

In Q1 2025, Korea saw nearly ₩57 trillion (~$41B) flow out of domestic exchanges, mostly via USDT and USDC.

That’s a clear problem for regulators and builders alike: value is flowing out, and Korean users have no native, trusted digital won to transact within the crypto economy.

Now, that’s changing.

Parameta, a Korean Web3 infrastructure firm deeply linked to ICON/SODAX, is collaborating with Inscobee (a KOSDAQ-listed firm) to issue a won-pegged stablecoin under Korea’s new Digital Asset Basic Act.

Why It Matters for SODAX

SODAX isn’t a Layer-1 anymore. It’s evolved into a DeFi product stack - a modular, cross-chain platform offering swaps, lending, and liquidity routing. It runs on top of Sonic.

And stablecoins are its fuel.

As the Korean stablecoin becomes active, DeFi demand will shift toward yield, trading, and borrowing/lending options using the won.

That’s exactly where SODAX shines:

Its DEXs (like Balanced) can offer liquid trading pairs

Its lending protocols can accept the stablecoin as collateral

Its intent-based swap router will route capital efficiently across chains

All of this drives real on-chain usage and fees.

The $SODA Token Flywheel

Here’s the kicker:

SODAX isn’t just a DeFi platform. It’s also a fee-sharing protocol with a deflationary token ($SODA), capped at 1.5 billion supply.

With SODAX built on Sonic, up to 90% of all transaction fees are returned to protocol users and token holders.

So as stablecoin adoption grows:

More trades, more swaps, more lending

More volume across SODAX 🔥

More fee revenue for $SODA holders

It’s a direct value capture model. And the more institutional and retail usage this stablecoin sees, the stronger the economic engine of $SODA becomes.

Regulatory Tailwind + Market-Ready Infrastructure

Unlike most DeFi ecosystems still navigating uncertain regulatory terrain, SODAX is aligned with Korea’s next-gen crypto framework. Parameta is well positioned to gain approval.

So we have:

🔸️ A trusted issuer of the stablecoin

🔸️ A compliant DeFi infrastructure to use it

🔸️ A fee-sharing token that benefits directly from growth

This combination is rare and powerful.

What Comes Next 🤓

As the Korean stablecoin infrastructure rolls out, SODAX has the potential to become the liquidity layer of Korea’s digital won economy.

It wouldn't just be another DeFi protocol; it could become the core financial routing layer for the country’s on-chain capital flows.

If this unfolds as I speculate, $SODA becomes one of the few crypto tokens with:

✅ Real-world regulatory alignment

✅ Clear product-market fit

✅ Direct revenue participation

✅ Capped supply and deflationary design

$ICX #SODAX $SODA #ICON #Stablecoins

20.81K

84

CryptoMyhobby

📕 "InskoBee & Parameta Begin Development of KRW-Backed Stablecoin for Local Currency"

✅ The project is based on a joint development agreement and is being positioned as a proactive investment aligned with the government’s digital transformation policies.

Through this collaboration, the two companies aim to replace the technical and administrative limitations of traditional paper vouchers and point-based local currencies with a new digital budget execution system based on a KRW-pegged stablecoin.

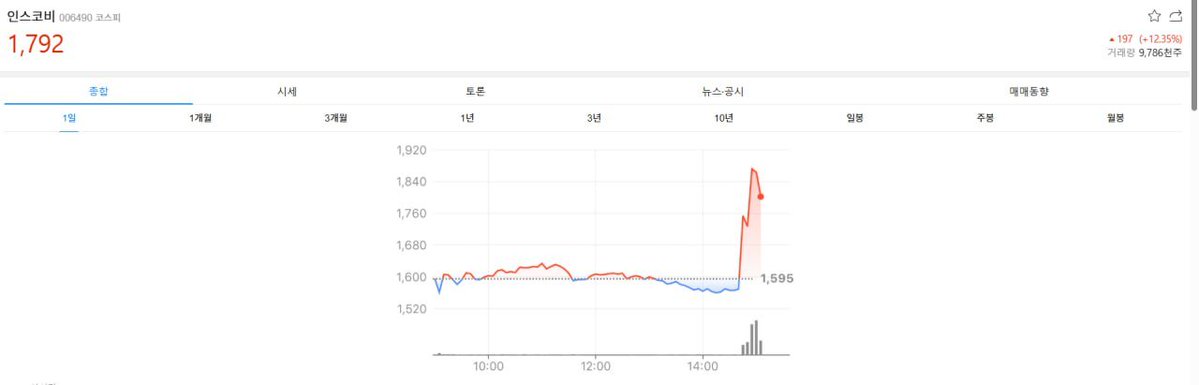

💬 InskoBee's stock price is currently rising due to the news of its involvement in stablecoin-based local currency development. Parameta is the new name of the company formerly known as ICONLOOP.

However, it’s worth noting that the announcement of the “InskoBee–Parameta KRW-based stablecoin” was already made two weeks ago ( So it's a bit unclear how directly related this development is to Parameta's post name-change.

Still, this news could be used as a trading catalyst, so sharing it here for informational purposes.

#국내 #ICX

Show original

20.26K

1

ICON price performance in USD

The current price of ICON is $0.11824. Over the last 24 hours, ICON has decreased by -1.15%. It currently has a circulating supply of 1,067,866,299 ICX and a maximum supply of 1,081,965,268 ICX, giving it a fully diluted market cap of $126.02M. At present, ICON holds the 137 position in market cap rankings. The ICON/USD price is updated in real-time.

Today

-$0.00138

-1.16%

7 days

-$0.00634

-5.09%

30 days

+$0.0047600

+4.19%

3 months

+$0.011540

+10.81%

Popular ICON conversions

Last updated: 23/06/2025, 12:15

| 1 ICX to USD | $0.11815 |

| 1 ICX to AUD | $0.18452 |

| 1 ICX to PHP | ₱6.8070 |

| 1 ICX to EUR | €0.10279 |

| 1 ICX to IDR | Rp 1,948.38 |

| 1 ICX to GBP | £0.088058 |

| 1 ICX to CAD | $0.16264 |

| 1 ICX to AED | AED 0.43391 |

About ICON (ICX)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

ICON FAQ

How much is 1 ICON worth today?

Currently, one ICON is worth $0.11824. For answers and insight into ICON's price action, you're in the right place. Explore the latest ICON charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as ICON, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as ICON have been created as well.

Will the price of ICON go up today?

Check out our ICON price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials