Compound price

in USDCheck your spelling or try another.

About Compound

Compound’s price performance

Compound on socials

Guides

Compound on OKX Learn

Compound FAQ

Dive deeper into Compound

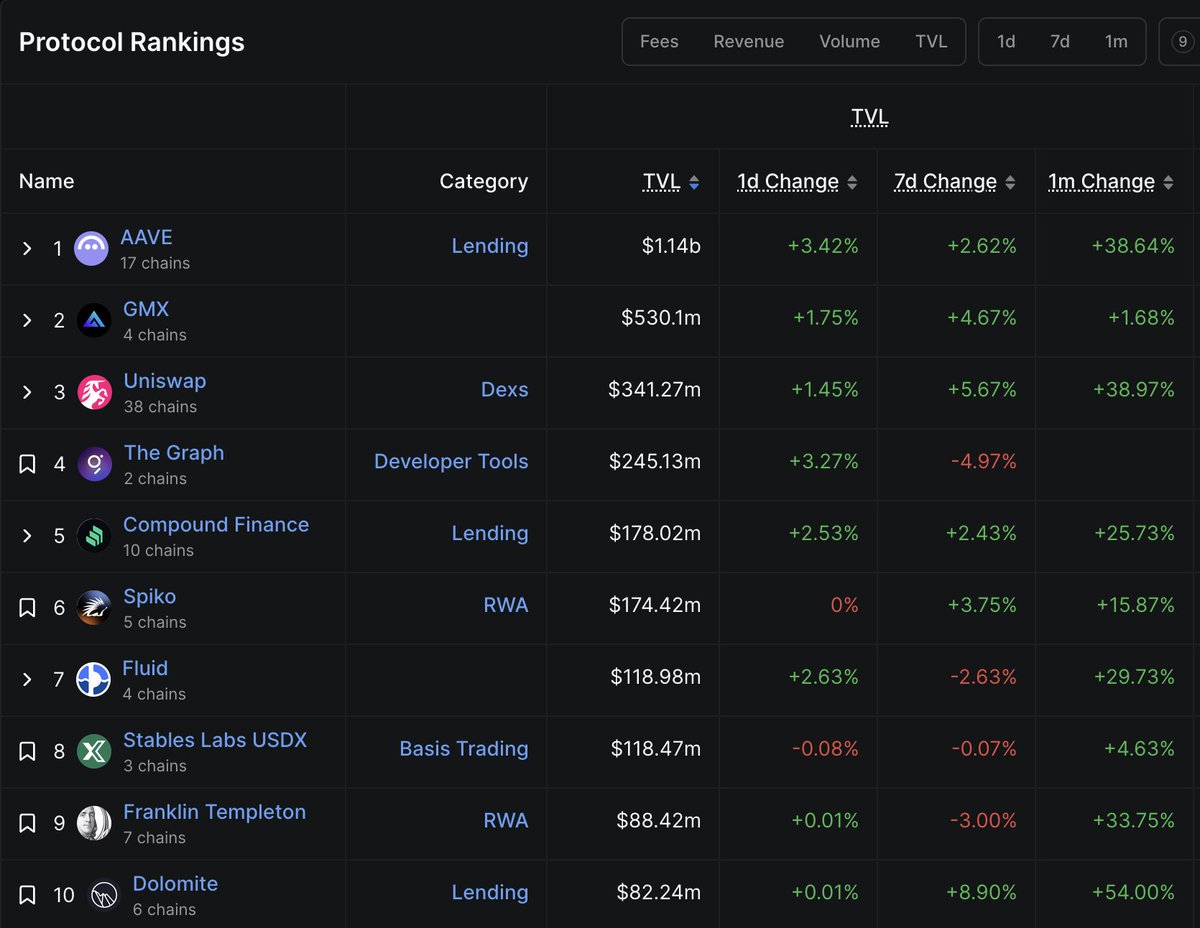

Compound (COMP) is a cryptocurrency that plays a significant role in shaping the future of borrowing and lending protocols within the decentralized finance (DeFi) industry.

What is Compound

Compound is a prominent DeFi protocol that utilizes its native token, COMP, as an integral part of its platform. COMP enables users to access and utilize the services offered by Compound seamlessly. One of the critical features of COMP is its governance functionality, which empowers token holders to participate in the decision-making process actively. By holding COMP tokens, users have the authority to propose and vote on modifications and improvements to the protocol, allowing them to shape its future development.

The Compound team

The Compound team comprises blockchain programmers and entrepreneurs driven by a shared vision of establishing an efficient and accessible financial system. Robert Leshner leads the team, bringing expertise in economics and finance to the table. The team has achieved remarkable milestones, securing more than $8 million in funding from prominent stakeholders. Currently, the Compound protocol manages assets valued at over $1 billion, showcasing the team's success in building a robust and trusted platform.

How does Compound work?

Compound operates as a DeFi protocol that facilitates the lending and borrowing of cryptocurrencies. Built on the Ethereum blockchain, users can engage in these activities transparently and securely.

The platform's native token, COMP, serves dual purposes: governance and incentives. COMP holders have the power to propose and vote on changes to the protocol, shaping its future. Additionally, COMP is a reward mechanism, encouraging users to supply assets or borrow against collateral. This incentivizes participation and contributes to the platform's overall functionality.

Compound’s native token: COMP

Compound's native token, COMP, plays a crucial role in the ecosystem by serving multiple functions. With a maximum supply of 10 million, COMP operates on the Ethereum blockchain as an ERC-20 token. It is used for governance and liquidity mining rewards within the Compound platform.

COMP token holders can propose and vote on modifications to the protocol, actively participating in the decentralized governance of the platform. This empowers the community to shape the future direction of Compound.

Additionally, COMP tokens are utilized as incentives for users who engage in the liquidity mining program of the DeFi protocol. By providing liquidity to the platform, users can earn COMP tokens as rewards, further enhancing participation and liquidity within the ecosystem.

How to stake COMP

To stake COMP tokens and maximize rewards, COMP holders should purchase COMP from reputable cryptocurrency exchanges like OKX. If an account still needs to be established, registration should be completed, along with the setup of an ERC-20 wallet.

Once these steps are taken, the COMP tokens can be sent to the chosen staking platform, such as OKX Earn, which offers a flexible staking setup. The next step involves confirming the desired amount of COMP to stake and selecting the Subscribe button to initiate the staking process.

COMP use cases

The COMP token has multiple use cases within the Compound ecosystem and the broader DeFi sector. COMP holders can participate in the Compound protocol's governance by suggesting proposals and voting on important decisions. Additionally, they can earn rewards by participating in DeFi programs or staking their COMP tokens.

Distribution of COMP

The distribution of COMP tokens is as follows:

- 50 percent of the tokens are allocated to Compound's liquidity mining program.

- 25 percent is reserved for the Compound team and advisors.

- The remaining 25 percent is set aside for future needs within the Compound ecosystem.

What does the future hold for Compound

The future of Compound holds plans for platform expansion, encompassing stablecoins, fiat currencies, and additional cryptocurrencies. Geographically, Compound aims to extend its presence to promising regions like Asia and Latin America. Furthermore, the team intends to introduce new DeFi products and services, including derivatives and financial markets, and forge partnerships with other DeFi protocols.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.