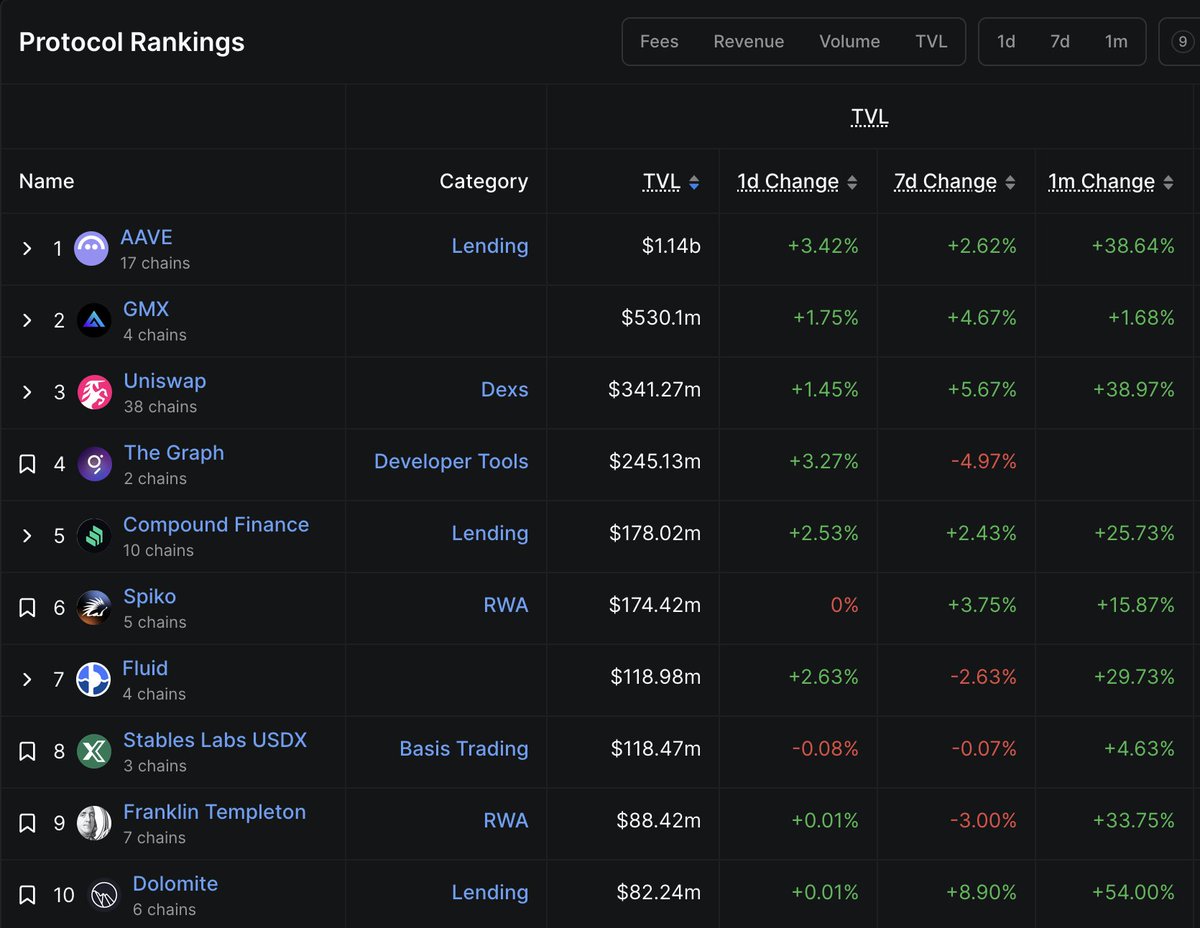

Franklin Templeton @FTI_US is now the ninth largest project in terms of total lock-up on Arbitrum

When I saw the news, my biggest feeling is: in the past, when we talked about DeFi, it was a testing ground for idealists, but now, it is being faced, accepted, and even adopted by the real capital market.

I would like to talk about a few words from the perspective of "trust migration":

Traditional financial institutions have always been regarded as risk-averse, stable and conservative. In the past, companies like Franklin Templeton, which managed trillions of assets, had a more cautious on-chain attitude towards on-chain assets.

Now, it has not only issued an on-chain-based compliance fund, but has even actively deployed it on DeFi homes like Arbitrum, making it the ninth largest project in its TVL. This behavior itself sends a signal that trust has migrated from off-chain to on-chain, from centralized systems to smart contracts and public chain ecosystems.

And what does this mean for the entire Web3 industry, especially the Layer 2 expansion solution represented by Arbitrum?

It means that this chain has jumped from "technically feasible" to "capitally reliable".

Further, this trust migration will also change the entire narrative structure: in the past, when talking about blockchain, we always emphasized "de-intermediation", "anti-banking" and "distrust is value", but now, we are talking about "on-chain funds", "tokenized treasury bonds" and "compliance entry", not to overthrow the financial system, but to become its new skeleton.

This is not only a milestone for @arbitrum, but also a turning point for DeFi to enter the mainstream asset allocation category. In the future, more funds, more chains, and more assets will follow this path: on-chain trust has changed from a vision to a reality.

Arbitrum is everywhere 🫡 @arbitrum_cn

Franklin Templeton is now the ninth largest project on Arbitrum by total lock-up.

Institutional entry, Arbitrum is 🫡 everywhere

27.46K

65

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.