#0xCult深度测评

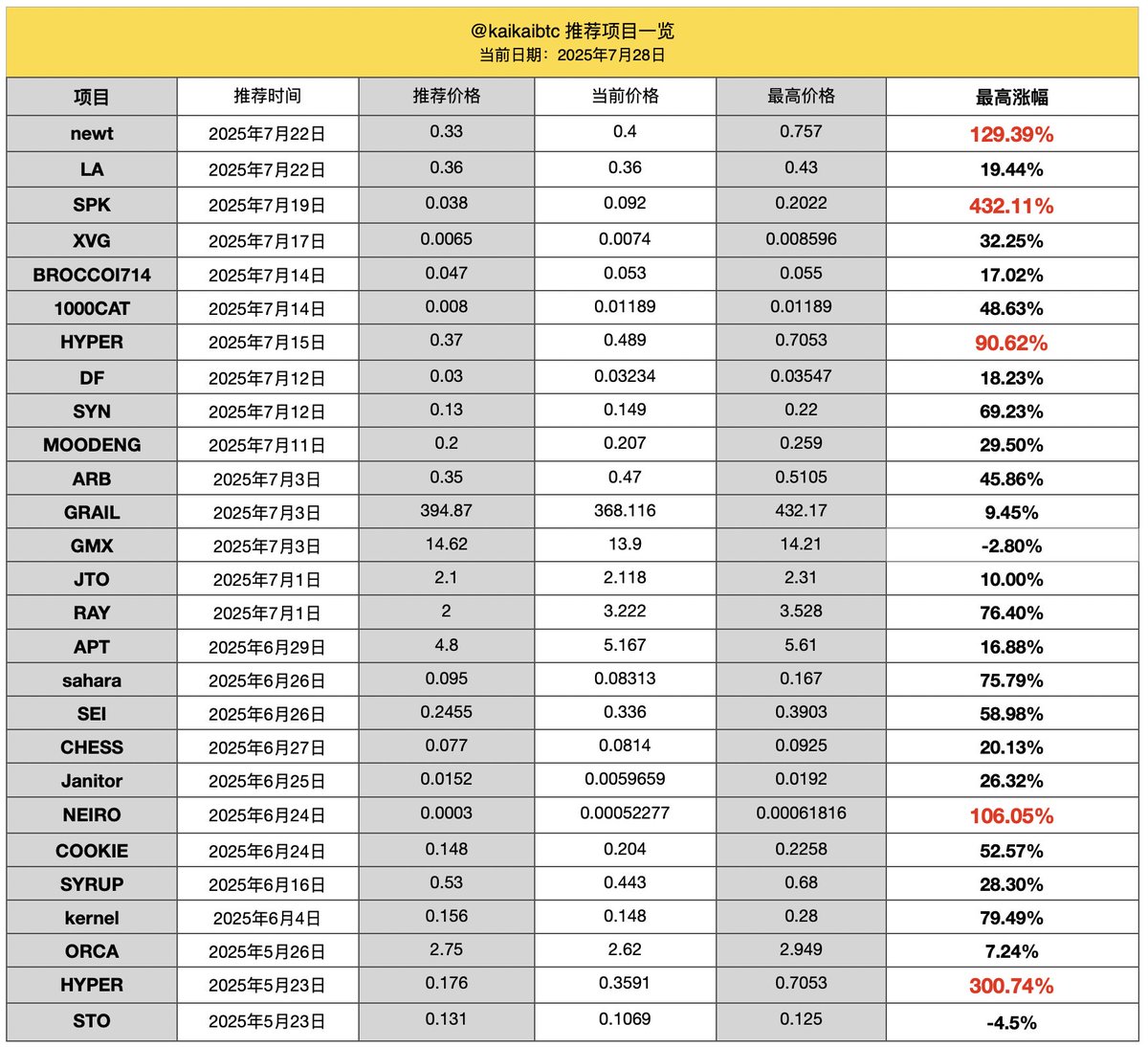

This issue invites a secondary marketing teacher I like very much - Kai Ge @kaikaibtc. As we all know, there are all kinds of teachers on the chain, but it is indeed rare for a nanny-level shouter like Kai Ge to clearly inform specific operations such as buying, stop-loss, and take-profit.

Reasons for recommendation and guest introduction

In the current period of relatively poor liquidity, and there is obvious stratification between the primary market and the secondary market, it is a more appropriate choice to buy some secondary spot with higher certainty, on the one hand, you can maintain sensitivity without leaving the market, on the other hand, there is a greater possibility of keeping the principal or even rolling up the principal, Brother Kai told me that the opportunities on the primary chain will definitely always exist, but we need to do different things in different periods to have the opportunity to get the results we have the opportunity to get.

Kai Ge's recent increase in famous brands Twitter shouts, I always think that the shouting on Twitter famous brands is the real data.

$newt

$spk

$hyper

$NEIRO

In the secondary field, according to Kaige's trading logic, there will be good returns. For low increases or a small amount of poor data, Kege is also reserved and handed over to the market for verification.

Leave the position to time, you don't need to say much, the income will speak for you!

Frustrated and cold, bottoming out, the "open" Kai Ge started with A8!

Kai Ge used to come from the traditional financial industry, because the industry was not developing smoothly and encountered some unpleasant experiences, he decided to seek a new direction and finally entered the currency circle. When I entered the currency circle, I was also introduced by a friend, saying that there was a good opportunity, coupled with some sense of smell in the traditional financial industry, Kai Ge felt that there was amazing potential in it, but unfortunately after entering the circle, the first project was regarded as a stumble, selling a house at home for hundreds of thousands of yuan to choose to continue to set off, the second project was a mining machine project to subscribe every day, and then took off directly on the spot, directly doubled the principal by 30 times, accumulated to the first pot of gold in the currency circle, and directly started A8!

Looking back on this experience, Kai Ge believes that he really learned the trading model of the currency circle in early 2021, and summarized the previous lessons through review. In the bull market at that time, Kai Ge did not pay too much attention to the K-line chart when trading, but relied more on capital flow and news, and even made decisions based on the sense of the market. And in the bull market at that time, no matter what you buy, it may seem like you are on the top of the mountain when you buy, but after a month or two, the buying point is only on the mountainside.

So much so that the so-called bear market will have corresponding narratives in the industry, whether it is chain games, NFTs and inscriptions, they are all new narratives that can be played, not like the current situation where BTC has been rising but the liquidity on the chain is very poor.

Perhaps many people know Kai Ge because they have been calling for fixed investment in $SOL and $METis from a very early age, and then $METis has risen from $10 to almost 170 knife, and $SOL has gone from $20 to a high of nearly 290 knife.

Old experiences can be a resistance in the face of new narratives

Kai Ge summed up his experience of losing money in the secondary market last year and admitted that he did not seize the opportunity of the on-chain AI market. Although he started with spot, he was not proficient in contract trading, so he only chose to go long when trying contract trading, which made him miss many opportunities.

Today, Kai Ge hopes to reinvent his Twitter IP, interact with more young people, and learn from the latest trends on the chain. Many things on the chain are very abstract concepts, young people will accept them relatively quickly, which is why in the last round of the market, P players got more results, at the beginning of the market, in fact, many people in defi, those who stroked their hair were sneering at the local dog, when the market reached its peak, it could really attract others, in fact, the market was slowly fading, and even became the liquidity of P young generals to withdraw.

The narrative on the chain will last forever, and the baton may slowly be handed over to young people

Whether it is a blockchain game, NFT or inscription, it is a manifestation of on-chain narrative. As time goes on, the pace on the chain is getting faster and faster, and the younger generation is taking over most of the market rhythm, but the money is still in the hands of established investors. Kai Ge believes that whether it is the on-chain market or the secondary market, they should go hand in hand and complement each other. The on-chain logic is stronger, which can significantly increase the probability of making money.

There is also never to reject the bookmaker, if there is no banker K-line will go very ugly, basically no currency will run out, North America and Europe have been playing finance for hundreds of years, there will definitely be market makers, know that market makers are to provide you with psychological support at the price. Only by dancing with the banker and accepting this unspoken rule can we better control the market.

Show original

91.69K

53

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.