#RWA The RWA sector has always been a key area of investment for us. In the past two years, the tokenization of US Treasury bonds has been booming, and now the tokenization of US stocks is becoming the new trend.

Our research team has recently discovered a new RWA opportunity: #xStocks ( @xStocksFi) is officially launching on #Bybit ( @Bybit_Official). In simple terms, it’s about bringing the US stocks we are familiar with (like Apple, Tesla, Nvidia, and other blue-chip stocks) onto the blockchain, turning them into tokens that can be traded like regular cryptocurrencies using USD. This will be a massive transformation, serving as a bridge between traditional stocks and the crypto world.

Why am I optimistic about this?

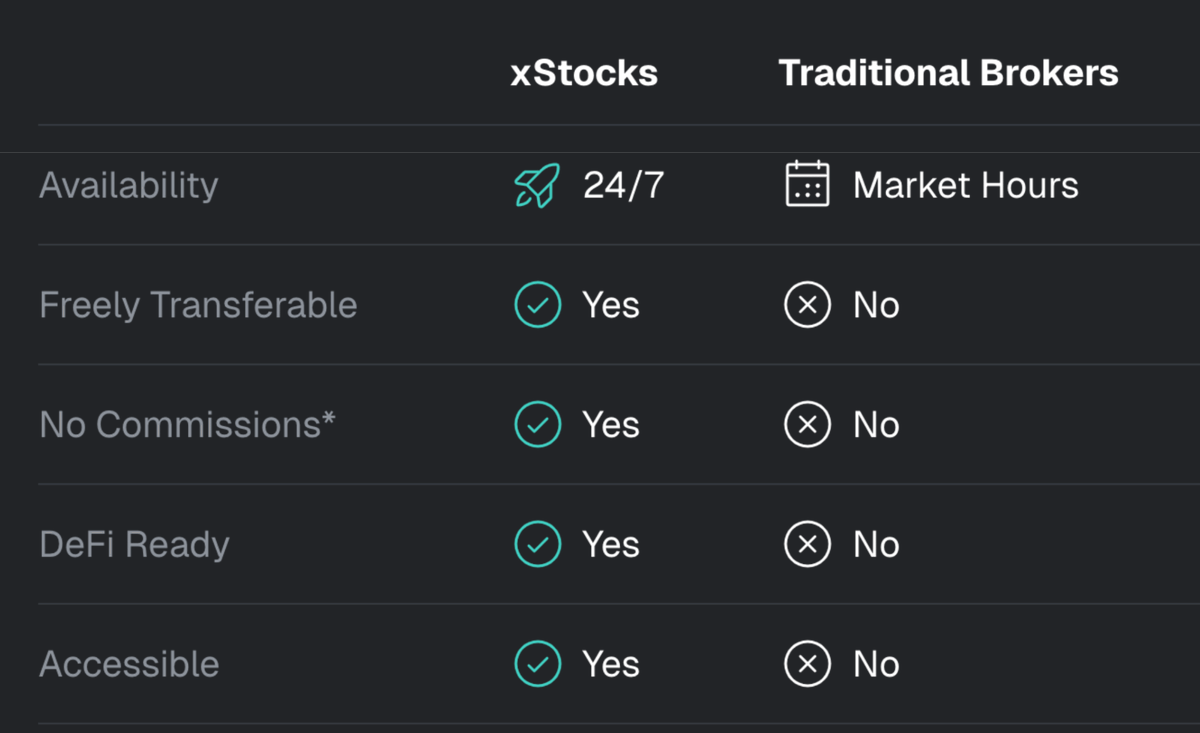

1️⃣ The advantages of traditional stocks + blockchain have come together.

Previously, to buy US stocks, we had to open a US stock account, convert currency, deal with time zone differences, pay fees, and worry about tax audits (recently, Futu has been tightening its grip, and overseas accounts are under increasing scrutiny). However, #xStocks is different; it’s tokenized stocks that can be purchased directly with USDT, allowing for 24/7 trading without missing any news or market movements.

Moreover, it is backed by real stocks, not futures or synthetic assets, but truly 1:1 tokens backed by actual stocks. The issuance is done by Backed Finance, which has complied with the European MiFID II prospectus requirements, and the assets are held by Swiss and US regulatory bodies, providing a solid foundation.

2️⃣ Play on-chain and access #DeFi.

With these #xStocks, you can not only hold them for appreciation (like long-term investing in real stocks) but also use them in #DeFi scenarios for collateral, lending, arbitrage, and yield strategies. This is incredibly friendly for us Web3 veterans, essentially allowing us to earn on both ends—having the fundamentals of real stocks while engaging in on-chain activities.

For example, I can lend out my #AAPL (APPLX) to earn interest or use it as collateral to borrow stablecoins for other investments, significantly increasing liquidity and capital efficiency.

3️⃣ #Bybit as a trading platform is very reliable.

#Bybit already has good liquidity and a user-friendly interface, and now with the introduction of #xStocks, it has become our new gateway for trading US stocks on-chain. No need to go through brokers to open accounts, no worries about currency restrictions; if you have USDT, you can get in, with the same trading interface as traditional cryptocurrencies, greatly lowering the barrier to entry.

For users in the crypto space, we can finally "trade US stocks" in a familiar environment. Plus, it’s 24/7 trading, which is a huge improvement compared to the traditional stock market that only operates for 6.5 hours a day.

4️⃣ The potential goes far beyond US stocks.

Currently, the "Seven Golden Flowers" (#AAPL, #TSLA, #NVDA, #META, #AMZN, etc.) are being launched along with some crypto-related companies (#MSTR, #HOOD, #CRCL). This is just the beginning. In the future, RWA tokenization is a major trend, with real estate, bonds, and commodities likely to become on-chain assets.

According to data, the RWA market has already exceeded $24 billion this year, with a year-end target of $50 billion. BlackRock's CEO Larry Fink has also personally endorsed it, stating that tokenization is "the future of financial infrastructure." This essentially tells us that this sector is not just a trend; it’s a wave.

5️⃣ How to participate in purchasing US stocks on #Bybit.

1. Log in or create a #Bybit account and complete the necessary KYC verification. Registration link🔗:

2. Click on #Bybit spot trading. Use the code to search for the desired #xStock tokens (the first ten stocks listed are: COINX, NVDAX, CRCLX, APPLX, HOODX, METAX, GOOGLX, AMZNX, TSLAX, MCDX).

3. The operation logic is exactly the same as traditional cryptocurrency trading.

In summary, this collaboration between #Bybit and #xStocks represents a significant leap forward in RWA development, making it easier and more convenient for ordinary cryptocurrency investors to enter the wave of US stock investment without any barriers. It allows for a full integration of crypto alpha opportunities with US stock beta opportunities, effectively hedging risks and achieving considerable returns. This will be a massive upgrade in financial tools—those who get in early will have the first-mover advantage. 🧐

📣 Tokenized stocks are landing on Bybit!

We're partnering with @xStocksFi to bring tokenized U.S. equities on-chain — introducing xStocks, fully backed, freely transferable representations of top U.S. stocks.

✅ Learn more:

#BybitListing #TheCryptoArk

68.27K

102

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.