At this rate, Arbitrum can be crowned the king of L2 - rewriting the playbook for on-chain utility.

‣ $20B+ in Total Value Locked

‣ Over 34.5M transactions processed (yes, more than Ethereum)

‣ Pectra upgrade live: one-click swaps, gas sponsorship, multi-token support

‣ 900+ dApps and counting

While most L2s are optimizing for hype cycles, @arbitrum is scaling real usage, from DeFi to gaming to something even more abstract: attention.

Because in 2025, attention is no more just metrics. It’s an asset.

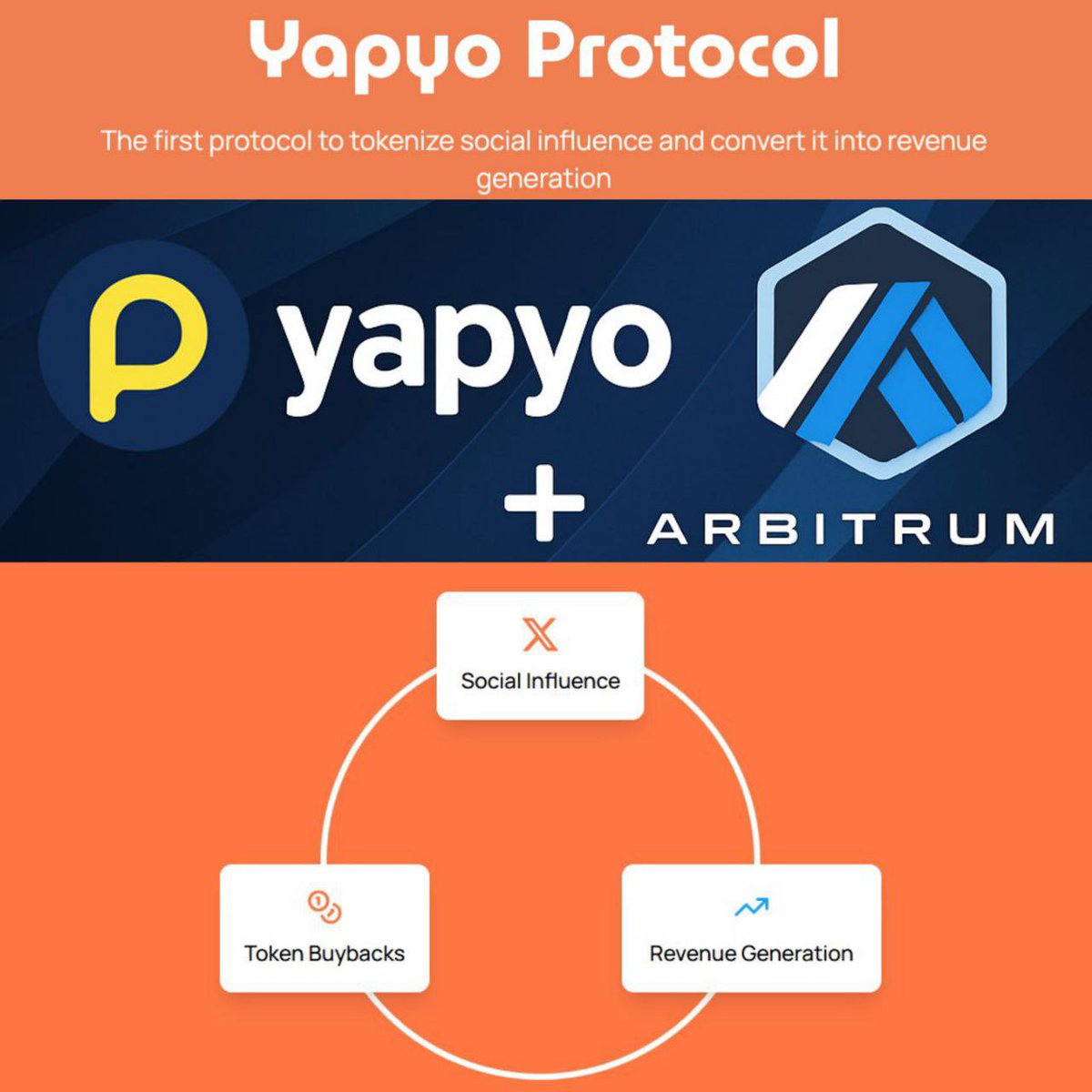

And that’s exactly where @yapyo_arb comes in.

Yapyo is the protocol turning mindshare into market share.

It’s not a social app. It’s not another memecoin. It's a decentralized attention economy built on Arbitrum’s infrastructure.

‣ 2.5M+ engagements tracked

‣ AI-verified social data via @KaitoAI

‣ On-chain leaderboard ranking top “yappers” live

‣ Protocol revenue flows back to users - not advertisers

Where most platforms extract value from users, Yapyo flips it. You post, you engage, you earn.

Yapyo’s core mechanics: constant micro-interactions, real-time indexing, AI analytics - demand speed and scalability.

Arbitrum delivers that.

• Stylus enables flexible development in Rust, C, and C++.

• Optimistic rollups keep fees low and throughput high.

• Gas flexibility reduces friction for non-ETH-native users.

This is not just a convenient L2. It’s necessary infrastructure for Yapyo to function at scale.

‣ What Comes Next

Arbitrum is expanding its validator set and rolling out Orbit for custom L3s.

Yapyo is ramping up toward a token launch, likely via presale or airdrop on Camelot or GU Trade.

Meanwhile, the $YAPYO token already saw a 6,800%+ surge on Uniswap V2.

Still just 36 holders. Early is an understatement.

‣ TL;DR

Arbitrum is the backbone of Ethereum’s L2 future.

And projects like @yapyo_arb are proof that it’s more than hype. It’s a home for real innovation.

• Arbitrum powers scale, speed, and UX

• Yapyo turns social influence into on-chain value

• Leaderboard live, token heating up

• InfoFi might just start here

Watch the chain. Follow the trend.

Tagging Gigachads that might be interested in this 👇

- @SamuelXeus

- @TheDeFISaint

- @hmalviya9

- @poopmandefi

- @ayyeandy

- @zerokn0wledge_

- @LadyofCrypto1

- @milesdeutscher

- @1CryptoMama

- @Deebs_DeFi

- @RubiksWeb3hub

- @stacy_muur

- @TheDeFinvestor

- @splinter0n

- @izu_crypt

- @belizardd

- @eli5_defi

- @the_smart_ape

- @ViktorDefi

- @cryppinfluence

- @CryptoGirlNova

- @Haylesdefi

- @DeRonin_

- @0xAndrewMoh

- @defiinfant

- @DeFiMinty

- @Louround_

- @0xSalazar

- @crypthoem

- @CryptoShiro_

Show original

4.58K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.