I think issuers are DONE with AMMs.

@RenzoProtocol vertical integration and their own AMM (Dynamo) is the first of many to come.

↓

𝙀𝙕𝙀𝙏𝙃 𝘿𝙀𝙋𝙀𝙂 𝙍𝙀𝘾𝘼𝙋

If you missed the depeg, it came as users withdrew ezETH positions disappointed by the announced airdrop allocation.

While the early withdrawals were simply a reflection of changing opportunity cost, the sudden loss in value triggered further selling, which in turn triggered liquidations of looped positions on lending protocols.

AMMs simply failed to facilitate price stability for restaking tokens.

AN ASSYMETRIC FEE HOOK

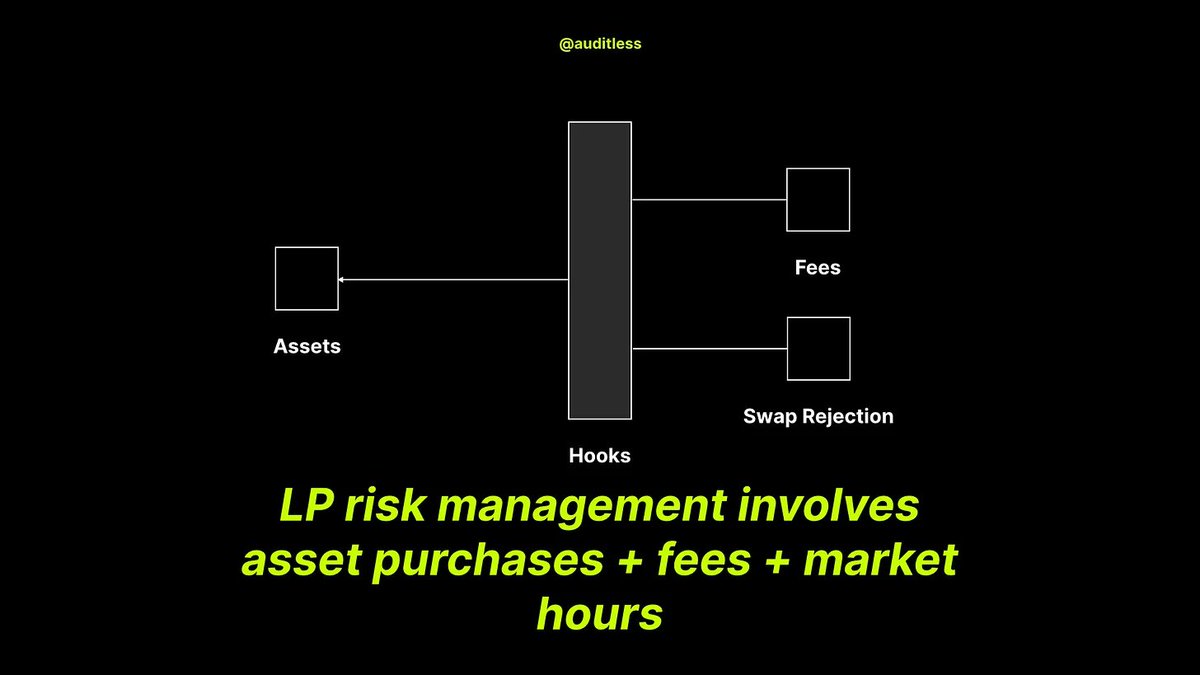

Dynamo is a dynamic fee hook.

Conceptually, dynamic fee hooks are one of the simplest and well-templated types of Uniswap v4 hooks.

While @Uniswap v4 allows modifying the trading curve completely, dynamic fee hooks use the underlying concentrated liquidity AMM and provide a function that modifies what fees are applied to trades depending on the trade itself.

We've previously classified these in the category of hooks that focus on managing LP risk because they can be used to mitigate the risks of impermanent loss and price instability.

By making fees higher for swaps that move the price further from the 1:1 peg, @RenzoProtocol hopes to add sufficient friction against panic selling.

Fees in the direction of the peg are lower, which means that in an event such as the original sell-off as a result of the airdrop announcement, arbitrageurs could step in earlier and return prices to the peg: maintaining liquidity while allowing ezETH holders to naturally rotate.

Furthermore, the spread in fees is even larger the further price has already moved from the peg.

907

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.