Who is the biggest beneficiary of the rise of global stablecoin payments?

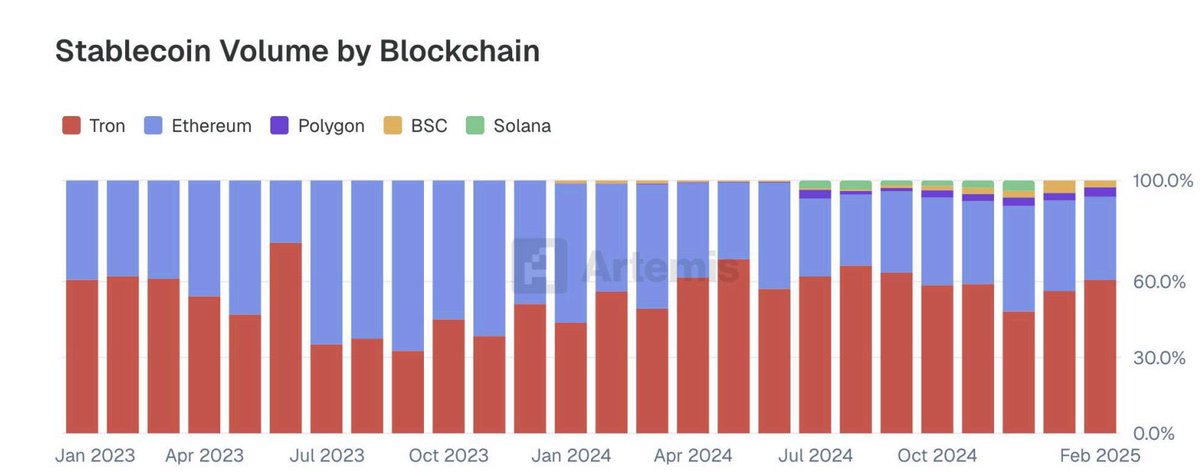

In the era of stablecoins gradually moving towards compliance and corporate payments are fully embracing crypto finance, the first to eat dividends is not Circle, not Solana, but low-key TRON!

▰▰▰▰▰

According to data published by Artemis,

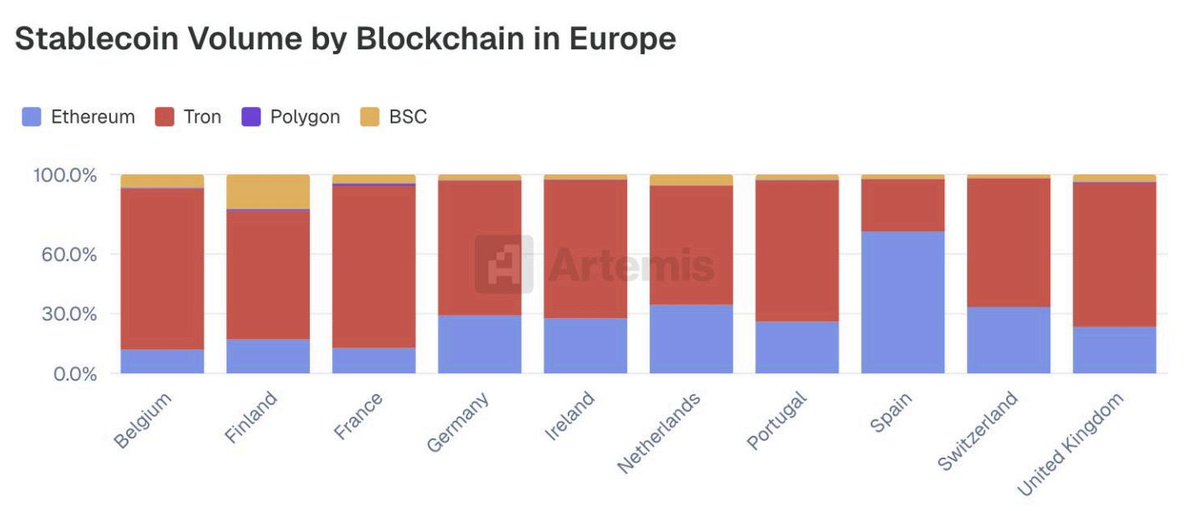

▪ TRON leads the world's strongest payment chains, not just in developing countries

In the past few years, we have always thought that USDT on TRON is a third world story, but from this picture, you will find that many developed countries in Europe; From Germany and France to Finland and Belgium, TRON is the largest public chain in terms of stablecoin payment volume, and its market share far exceeds that of Ethereum, BSC and Polygon!

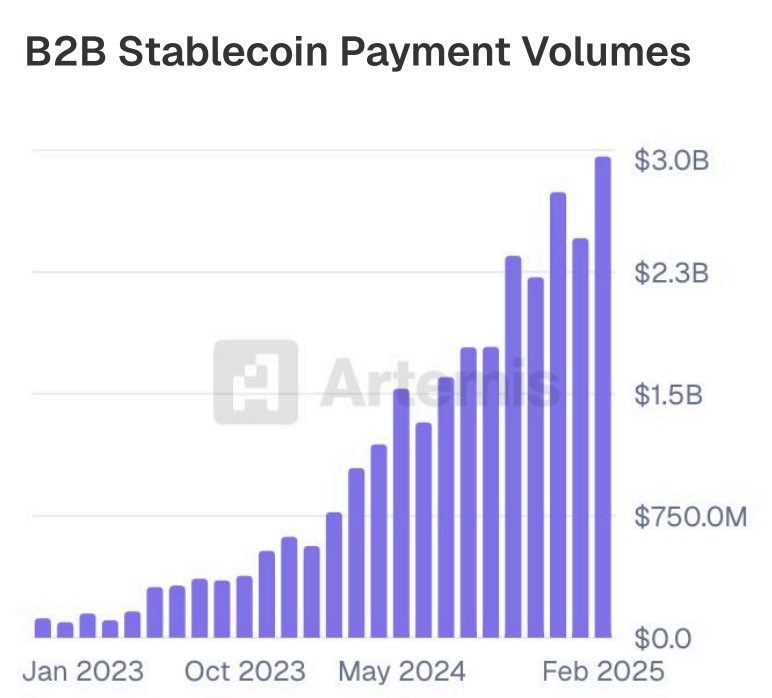

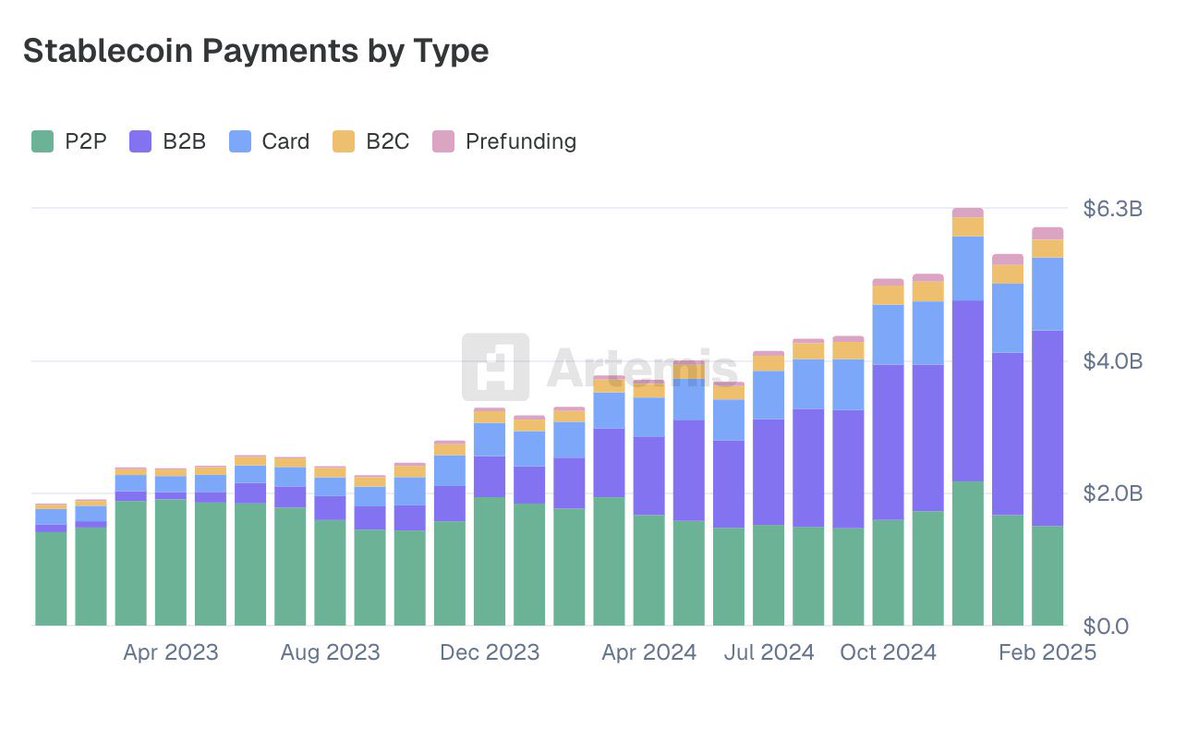

▪ B2B payments are growing rapidly, and TRON is the biggest beneficiary

Since 2023, global stablecoin-based B2B payment transaction volume has grown by 215%, with monthly transaction volume surging from less than $2 billion to more than $6.3 billion. Of the data we were able to attribute, $9.42 billion was settled through the TRON network!

▰▰▰▰▰

What's more:

▪ Visa: The global B2B payments market is $145 trillion

This means that the market in which TRON operates today is only the tip of the iceberg. B2B stablecoin payments are less than 0.01%, and TRON has firmly established itself as the first public chain in the payment infrastructure of this emerging track!

▪ The market gives a signal, and the user gives an answer

➤ 2023~2025, 215% monthly growth in stablecoin payments

➤ TRON's market share continues to expand, far surpassing ETH and upstart Solana

➤ Even under regulatory and macro pressures, on-chain transaction stability remains >96%

➤ From Lebanon to Argentina, from Germany to Portugal, TRON is the dollar payment track used by countless ordinary people and businesses

▰▰▰▰▰

The first year of compliance began; Stablecoin legislation is coming

THE GENIUS BILL OFFICIALLY PASSED THE U.S. SENATE, AND STABLECOINS OFFICIALLY USHERED IN FEDERAL-LEVEL LEGISLATION. This is an anchor of trust and a door to legitimacy for public chains like TRON, which have long undertaken sovereign-level stablecoins such as USDT, USDD, and USD1!

In his statement, Trump said:

“This is American Brilliance at its best, and we are going to show the world how to WIN with Digital Assets like never before!”

In such a context, a strong dual-track cooperation system has been formed between TRON and Tether, with a chain-level stablecoin payment chain on one side and an asset-level USD stabilizer on the other!

▰▰▰▰▰

summary

TRON is already a hidden giant in the global stablecoin track! It doesn't rely on marketing, it doesn't rely on narrative, but every transaction on the chain is accumulating real market fruits. In the next 1~3 years, as the USD stablecoin becomes the new default channel for global B2B transactions, the chain that supports it all is called TRON!

@justinsuntron @sunyuchentron @trondao @sunpumpmeme #TRON #TRONEcoStar

Show original

11.21K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.