Perpetual DEXs generated over $70M in protocol revenue over the past 30 days.

Yet most assessments stop at trading volume and fees, neglecting token emissions, float %, and FDV.

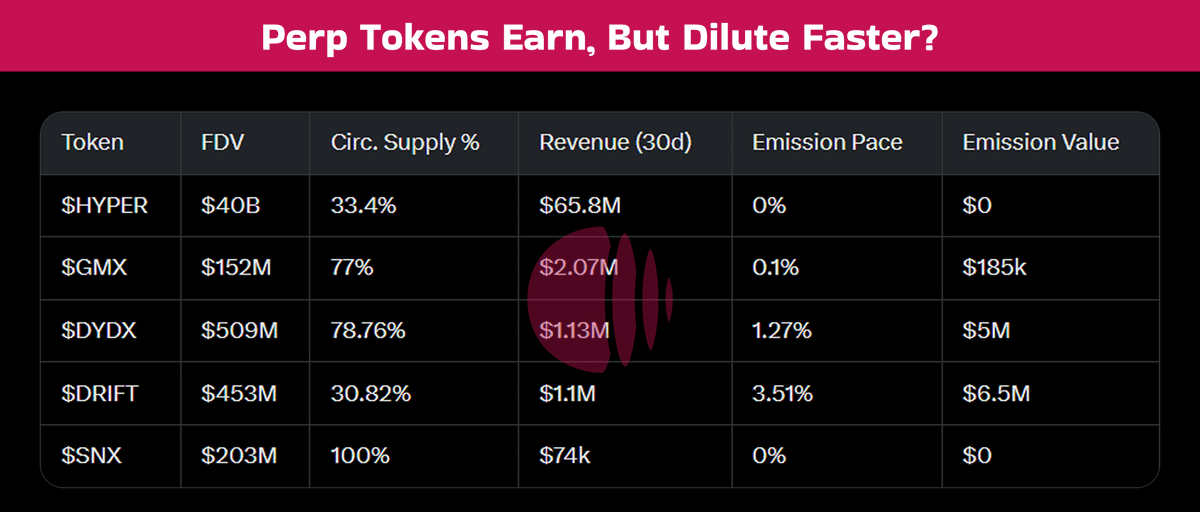

We examined five key protocols to evaluate efficiency (Revenue-to-Emission ratio) and dilution risk.

1/ Breakdown of Perp Protocols | Revenue (30d) vs Emissions :

$HYPE: $65.8M revenue | 0% emissions

$GMX: $2.07M revenue | 0.1% emissions ($185K)

$DYDX: $1.13M revenue | 1.27% emissions ($5M)

$DRIFT: $1.1M revenue | 3.51% emissions ($6.5M)

$SNX: $74K revenue | 0% emissions

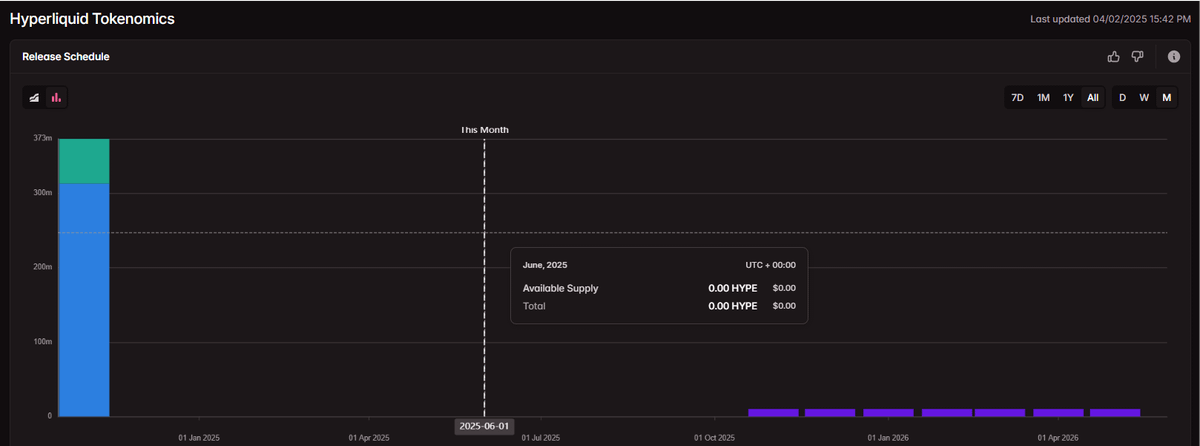

2/ $HYPE

•Revenue: $65.8M

•Emissions: 0%

•FDV: $40B | Float: 33%

Despite the absence of emissions, $HYPE’s valuation is driven by secondary market assumptions. A $40B FDV with a third in float raises concerns over eventual unlock impact and valuation sustainability.

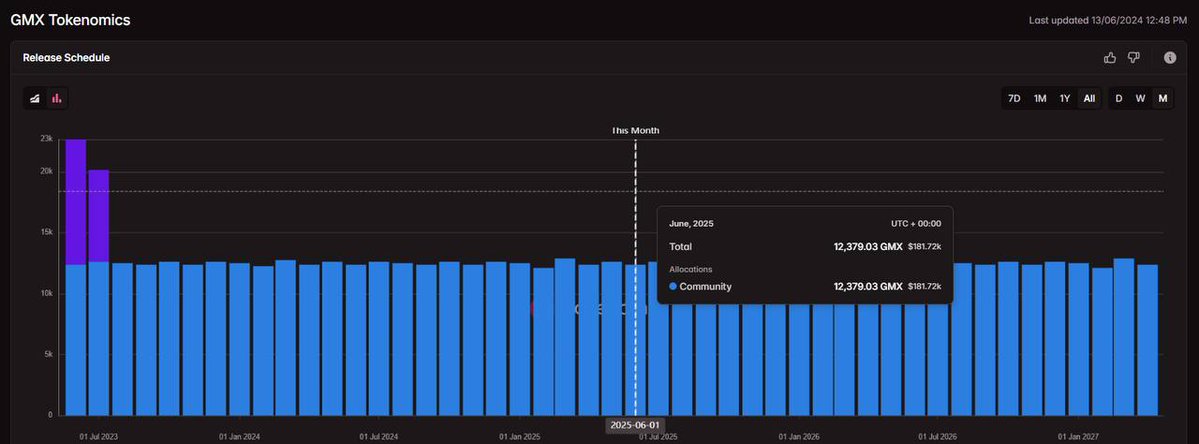

3/ $GMX

•Revenue: $2.07M

•Emissions: $185K (0.1%)

•FDV: $152M | Float: 77%

•Rev/Emission Ratio: 11.2x

A standout on efficiency. $GMX combines high float with disciplined emissions. Revenues significantly outpace token inflation, supporting a stronger value accrual narrative.

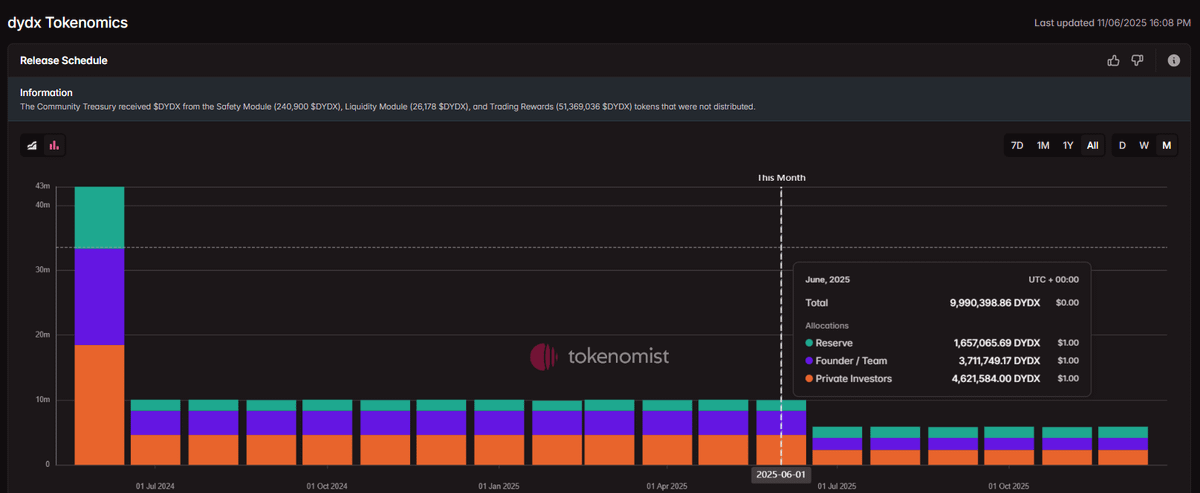

4/ $DYDX

•Revenue: $1.13M

•Emissions: $5M (1.27%)

•FDV: $509M | Float: Moderate

•Rev/Emission Ratio: 0.23x

$DYDX emits 4x more in tokens than it earns in revenue. This negative carry dilutes holders and undermines the protocol’s economic sustainability, despite strong brand presence.

5/ $DRIFT

•Revenue: $1.1M

•Emissions: $6.5M (3.51%)

•FDV: $453M | Float: 30%

•Rev/Emission Ratio: 0.17x

The weakest performer. With just 30% float and emissions far exceeding revenue, $DRIFT’s token model is heavily inflationary — a typical profile for early-stage protocols, but one that limits capital efficiency in the short term.

6/ $SNX

•Revenue: $74K

•Emissions: 0%

•FDV: $203M | Fully Diluted

Though emission-free and fully diluted, $SNX is currently generating negligible revenue. Without a material top-line, value capture remains theoretical.

7/ Key Takeaways

•Emission Discipline Matters: $GMX is the most emission-efficient, maintaining revenue at 11x its token inflation.

•High Revenue ≠ Sustainable Value: $HYPE leads in revenue, but with zero token distribution, questions remain around future dilution.

•DYDX & DRIFT Highlight Risk: Both emit several multiples more than they earn, compounding float pressure and weakening fundamentals.

Like what you read? Share the post and follow @Tokenomist_ai for more insights like this.

📊 Start analyzing emission schedules today:

9

6.74K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.