Why can't you hold your short/long orders?

1. Think about how much you can accept losses before making money, and don't open a position if you can't accept losing money.

2. Unless a genius does not do ultra-short-term, the contract is not a game of small and big, and it is guaranteed that the price will not be liquidated if it is doubled.

3. Block out interference, no one predicts the market 100% Many times others suggest that only let you lose money and be responsible for your own trading.

A short-selling strategy organized with a tuition fee of 1 million, recommended to forward and save.

1. Stop loss all positions if it drops by half, double the principal. Don’t focus on the amount, focus on the overall position and ratio. If the position is large, stop loss half of the total position if it drops by 30%. (melania)

2. Short-sell avoiding strong coins; when the market drops significantly, they rise against the trend.

3. Only place limit orders, not market orders. It’s okay if you can’t buy; there will be another chance, but buying at too high a price greatly affects your mindset.

4. Don’t touch teams that are good at trading; it’s best to find projects from technical teams/art backgrounds to short-sell. (layer/anime)

6. In the last cycle, financing occurred; this round, tokens without financing generally have significant economic pressure, consider short-selling. (elx)

7. Unless it’s a fully unlocked token, as long as there’s real selling pressure from unlocked tokens and no real capital inflow, they can be added to the watchlist. People are always self-interested; no one can resist the temptation of massive wealth. (wld)

8. Before operating, you must write down the logic; often, you see it correctly but don’t hold on. If your mindset is poor and you can’t accept losses, don’t open a position.

9. Do fewer contracts unless short-selling; only do long positions, not short ones, because what makes me money are long positions.

10. After closing a position, write a summary: "Where did this order go wrong?", "How to improve next time?"

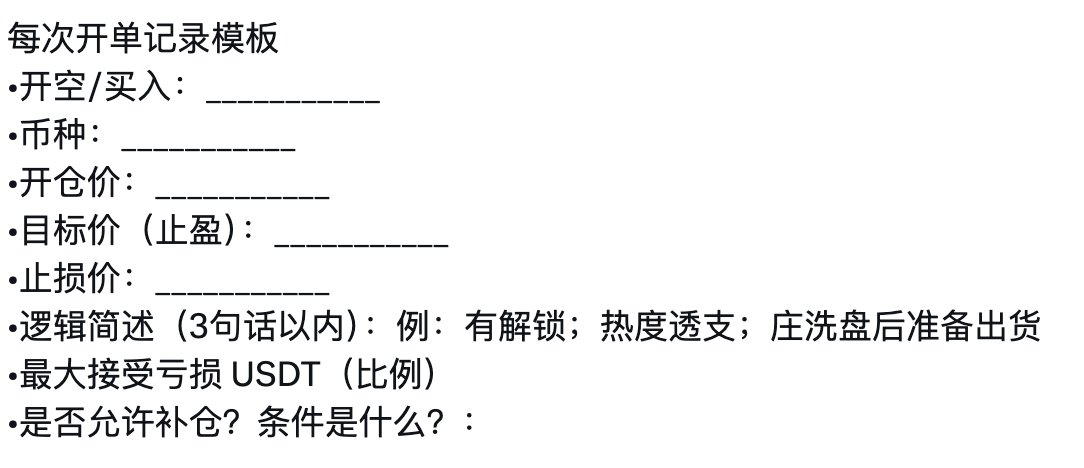

Template for recording each order:

• Short-sell/Buy: ___________

• Coin type: ___________

• Opening price: ___________

• Target price (take profit): ___________

• Stop loss price: ___________

• Brief logic (within 3 sentences): e.g., unlocked; overheated; preparing to sell after a washout by the operator.

• Maximum acceptable loss in USDT (percentage)

• Is averaging down allowed? What are the conditions?

69

15.63K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.