🌍💸 RWA Weekly: Ripple’s XRP Ledger heats up with tokenized debt, T-bills & AI infra

From Guggenheim to Ondo, major players are betting on RWAs across new networks. Plus: Plume’s Genesis launch & tokenized ETFs.

Here’s your weekly roundup of the RWA economy 👇

@plumenetwork @OndoFinance @RWA_xyz @BackedFi @nimanodeai @RippleXDev @Guggenheim 🔎 DIA xReal powers the data backbone of this expanding RWA stack.

Live on 55+ chains, DIA delivers:

• FX & bond oracles

• Tokenized stock pricing

• Verifiable randomness

• ZK-proofed feeds (v2)

Explore the RWA oracle suite →

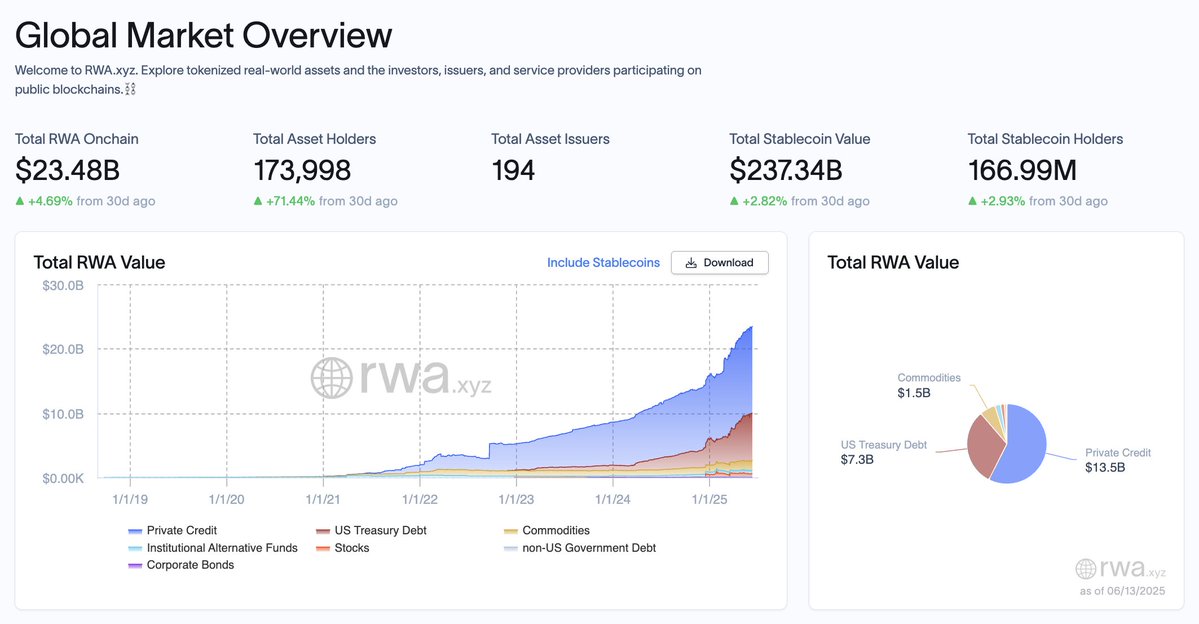

📊 RWAs in Numbers (June 13th)

• Total RWA On-chain: $23.48B

• Asset-backed stablecoin total market cap: $237.34B

• Total asset issuers: 194

• Leading RWA chains: Ethereum, ZKSync Era, Stellar, Solana, Polygon.

Learn more at

⚙️ Alchemy Pay integrates tokenized ETFs and stocks via Backed

@AlchemyPay partners with @BackedFi to offer tokenized ETFs and equities to global users through its payments platform.

🪙 Nimanode launches $NMA token to power AI ecosystem on XRP Ledger

@nimanodeai begins its token presale to fuel a decentralized AI agent infrastructure built on the XRP Ledger.

⛓️ Ondo Finance brings tokenized Treasuries to XRP Ledger

@OndoFinance expands to the XRP Ledger to offer tokenized US Treasuries and improve institutional access to yield-bearing RWAs.

🤝 Guggenheim teams up with Ripple to issue tokenized debt on XRP Ledger

@Guggenheim partners with @Ripple to bring digital debt products to the XRP Ledger, targeting regulated capital markets.

🆕 Franklin Templeton debuts intraday yield for tokenized funds on Benji

@FTI_Global enhances its Benji platform with intraday yield tracking for tokenized assets and liquidity optimization.

🌏 Ripple allocates five million dollars to blockchain education in Asia Pacific

@Ripple commits new funding to advance Web3 education and developer training across institutions in the APAC region.

💰 IOST raises twenty-one million dollars to scale tokenized infrastructure in regulated markets

@IOST_Official secures strategic funding to expand RWA infrastructure and compliant tokenization tools for global finance.

🚀 Plume launches Genesis mainnet with Blackstone and Invesco to bridge RWAs and DeFi

@plumenetwork goes live with major institutional backers as it connects traditional real-world assets with DeFi protocols.

💥 Origin Protocol introduces Super OETH on Plume for enhanced ETH yield

@OriginProtocol launches Super OETH on @plumenetwork, offering amplified yield and RWA integration for DeFi participants.

RWAs are no longer experimental; they’re being deployed across the largest chains by the biggest names in finance.

From XRPL to Plume, this wave is just getting started.

Catch you next week for more on-chain real-world finance.

36.03K

260

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.