This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

TSLAx

xStocks Tesla price

65UdAE...Pump

$0.00015777

+$0.00011274

(+250.31%)

Price change for the last 24 hours

How are you feeling about TSLAx today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

TSLAx market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$157.77K

Network

Solana

Circulating supply

999,999,946 TSLAx

Token holders

18

Liquidity

$0.00

1h volume

$7.80M

4h volume

$7.80M

24h volume

$7.80M

xStocks Tesla Feed

The following content is sourced from .

TechFlow

Words: Aiying Research

The tokenization of Real-World Assets (RWA) is no longer a futuristic narrative of self-congratulatory blockchain circles, but a financial reality that is happening. In particular, the tokenization of stocks has begun with the entry of fintech giants such as Kraken and Robinhood, a structural change driven by blockchain technology. For the first time, global investors have the opportunity to trade "digital stocks" of companies such as Apple and Tesla 24/7 in a near-frictionless manner. However, under the hustle and bustle of the market, deeper questions need to be answered. The book continues from the previous session "From Retail Paradise to Financial Disruptor: An In-depth Breakdown of Robinhood's Business Landscape and Future Chess Game", Aiying's report aims to penetrate the surface of market hotspots and deeply analyze the internal logic of current mainstream stock tokenization products. We will no longer stop at the "what" level, but focus on the "how" and "what's at risk", providing our clients, investors, developers and regulators with a reference map that is both in-depth and practical.

Aiying will conduct an in-depth comparative analysis of two typical cases - xStocks (issued by Backed Finance and traded by exchanges such as Kraken) that represents the "open DeFi" path and Robinhood which represents the "compliance walled garden" path, supplemented by the practices of key industry players such as Hashnote and Securitize, to jointly explore a core question:

How do these platforms balance stringent financial regulation, complex technology implementations, and huge market opportunities? What paths did they choose, and how did their underlying logic and compliance design fundamentally differ? This is the core of what this report will reveal.

1. Core analysis (1): The "mantra" and "talisman" of compliance - the underlying logic of the two mainstream models

The number one challenge with stock tokenization is not technology, but compliance. Any attempt to "onboard" traditional securities to the blockchain will have to confront the intricacies of global financial regulations. In the long-term battle with regulation, the market has quietly diverged into two very different compliance paths: 1:1 asset-backed security tokens and derivatives contract tokens. The underlying legal structure and operational logic of these two models are very different, which determines their product forms, user rights and risk characteristics. Let's break them down one by one.

Mode 1: xStocks – Embracing the open path to DeFi

Core Definition: A user's token holdings (e.g., TSLAX representing Tesla stock) legally represent ownership or interest in real stock (TSLA). This is an on-chain mapping of "real" stocks, which pursues the authenticity and transparency of assets.

Legal Framework and Market Performance

Aiying believes that xStocks' compliance design is exquisite, and its core lies in embracing the openness of the blockchain while minimizing legal risks through multi-layered legal entities and a clear regulatory framework.

Currently, xStocks supports 61 stocks and ETFs, 10 of which have been traded on-chain, showing initial market vibrancy. After being backed by Bybit and Kraken, its trading volume exploded, reaching $6.641 million in daily trading volume as of July 1, with more than 6,500 users and more than 17,800 transactions.

Issuer and Regulatory Framework:

xStocks is issued by Backed Finance, a Swiss company, and its operations follow the Swiss DLT (Distributed Ledger Technology) Act. Switzerland was chosen as the legal home base because the country offers a relatively clear and friendly regulatory environment for digital assets and blockchain innovation.

Special Purpose Vehicles (SPVs):

This is the cornerstone of the entire architecture. Backed Finance has set up a Special Purpose Vehicle (SPV) in Liechtenstein, where the legal and tax environment is stable. This SPV is like an "asset safe" whose sole function is to hold real shares. This design achieves critical risk isolation: even if the platform on which the user trades (such as Kraken or Bybit) or the issuer has operational issues, the underlying assets held in the SPV remain safe and independent.

Asset-backed and liquidity strategies

To ensure the value and credibility of on-chain tokens, xStocks has established a transparent asset-backed and dual-track liquidity system.

1:1 Anchor (1 coin = 1 share):

Every xStock token circulating on-chain strictly corresponds to a real share held in a third-party custodian. This 1:1 anchoring relationship is at the heart of its value proposition. Currently, NVIDIA, Circle, and Tesla each have more than 10,000 stock tokens.

Issuance process:

Professional accredited investors can apply for a Backed Account to purchase shares through Backed. Backed plays the role of a primary investor, buying shares from a brokerage, which are then held in escrow by a third-party institution. Finally, xStocks mints a corresponding number of tokens based on the number of shares purchased and returns them to Tier 1 investors. These Tier 1 investors can issue and redeem equity tokens at any time.

Proof of Reserve:

Transparency is the cornerstone of trust. xStocks is integrated with Chainlink PoR, the industry's leading oracle network. This means that anyone can query and verify Backed Finance's reserve vault on-chain in real-time and autonomously, ensuring that the real number of shares they hold is sufficient to support all issued tokens.

Dual-track liquidity strategy:

1. Centralized Exchange (CEX) Market Makers:

On major exchanges such as Kraken and Bybit, professional market makers are responsible for providing liquidity, ensuring that users can buy and sell xStocks as easily as they would regular cryptocurrencies.

2. Decentralized Finance (DeFi) Protocols:

The tokens of xStocks are open, and users can deposit them into DeFi protocols (e.g., lending platforms, DEX liquidity pools) on the Solana chain to provide liquidity and earn yield on their own. Currently, xStocks has partnered with DEX aggregator Jupiter and lending protocol Kamino to take full advantage of DeFi's composability and create additional value for assets. For example, the most traded SP500 (SPY) token has reached $1 million in USDC-margined liquidity on the chain.

The xStocks ecosystem consists of publisher Backed, trading platforms Bybit and Kraken, and underlying blockchain Solana

Model 2: Robinhood – A "Walled Garden" with Compliance First

Core Definition: Unlike xStocks, a stock token purchased by a user on the Robinhood platform is not legally a stock ownership, but a financial derivatives contract between the user and Robinhood Europe that tracks the price of a specific stock. Its legal essence is over-the-counter (OTC) derivatives, and the on-chain token is only a digital certificate of the rights of this contract.

1. Legal framework and technical implementation

The Aiying team found Robinhood's model to be a very pragmatic form of "regulatory arbitrage", which cleverly packaged the product as an existing financial instrument with a clear regulatory framework and quickly deployed it at a very low cost.

Issuer and Regulatory Framework:

The tokens are issued by Robinhood Europe UAB, an investment company registered in Lithuania and regulated by its central bank. Its products are regulated under the European Union's MiFID II (Markets in Financial Instruments Directive) framework. According to MiFID II, these tokens are classified as derivatives, bypassing more complex securities issuance regulations.

Low-cost and rapid deployment:

Robinhood deployed 213 stock tokens on the Arbitrum chain at a total cost of just $5.35 (on-chain gas fees), demonstrating extreme efficiency in leveraging Layer 2 technology. Of these, 79 tokens have metadata set and are ready for subsequent transactions.

Pioneering Attempts:

Robinhood boldly made its first foray into tokenization of shares of private companies, launching tokens from OpenAI and SpaceX in an attempt to get a head start in the high-value space of private equity. Currently, Robinhood has minted 2,309 OpenAI(o) tokens. (The OpenAI token will provide investors with the opportunity to invest indirectly in OpenAI through Robinhood's ownership in the SPV, and then pegging the price of the OpenAI token to the value of OpenAI shares held by that SPV)

2. "Walled garden" style technical and compliance design

Robinhood's technology implementation is tightly tied to its compliance strategy, and together they build a closed but compliant ecosystem.

On-chain KYC & Whitelist:

Through a reverse analysis of Robinhood's stock token smart contract, the community developers found that strict permission controls were embedded in their contracts. Each token transfer triggers a check to verify that the recipient's address is in the "Approved Wallet" registry maintained by Robinhood. This means that only EU users who have passed Robinhood KYC/AML will be able to hold and trade these tokens, creating a "Walled Garden".

Limited DeFi Composability:

As a direct consequence of this "walled garden" model, its stock tokens are virtually impossible to interact with expansive, permissionless DeFi protocols. The on-chain value of the asset is firmly locked within Robinhood's ecosystem.

Future Planning (Robinhood Chain):

To better serve its RWA strategy, Robinhood plans to develop its own Layer 2 network, Robinhood Chain, on top of the Arbitrum technology stack, demonstrating its ambition to take control of the underlying technology.

Although Robinhood's model has found a path to compliance under the EU framework, it has also caused a lot of controversy and potential risks.

"Fake Equity" Turmoil:

The most emblematic events are its launch of OpenAI and SpaceX tokens. Soon after, OpenAI officially made a public statement, denying working with Robinhood and making it clear that the tokens do not represent the company's equity. This incident exposes the huge risks of the derivatives model in terms of information disclosure and user perception.

Centralization Risk:

The security of the user's assets and the execution of the transaction are completely dependent on the operational health and creditworthiness of Robinhood Europe. If there is a problem with the platform, the user will be exposed to counterparty risk.

3. Comparison and summary of the two major models

Through the above analysis, we can clearly see the fundamental differences between the two models. The xStocks model is closer to the open spirit of Crypto Native and DeFi, while the Robinhood model is a "shortcut" to finding within the existing regulatory framework.

Key takeaways:

The path of xStocks is "asset on-chain", which tries to truly and transparently map the value of traditional assets to the blockchain world and embrace open finance. Robinhood's path is "business on-chain", which uses blockchain as a technical tool to package and deliver its traditional derivatives business, which Aiying understands is essentially more like a blockchain-based upgrade of "CeFi" (centralized finance).

2. Core analysis (2): The "Song of Ice and Fire" of the technical architecture - open DeFi and walled gardens

Under the compliance framework, the technology architecture is the backbone that enables the product vision. Aiying believes that the differences between xStocks and Robinhood in terms of technology selection and component design also reflect their two different philosophies of "openness" and "closure".

1. The choice of the underlying public chain: a triangular game of performance, ecology and security

Choosing which public chain to use as the "soil" for asset issuance is a strategic decision related to performance, cost, security, and ecology.

xStocks Chooses Solana:

The core motivation is the pursuit of extreme performance. Solana is known for its high throughput (theoretical TPS up to tens of thousands), low transaction costs (typically less than $0.01), and sub-second transaction confirmation speeds. This is critical for stock tokens that need to support high-frequency trading and real-time interaction with complex DeFi protocols. However, several network outages in history have also exposed stability challenges, which is a risk that must be taken when choosing Solana.

Robinhood Chooses Arbitrum:

Arbitrum is Ethereum's Layer 2 scaling solution, and the logic behind its choice is to "stand on the shoulders of giants". By adopting Arbitrum, Robinhood not only achieves higher performance and lower fees than the Ethereum mainnet, but more importantly, inherits Ethereum's unparalleled security and large developer community and mature infrastructure. In addition, Robinhood has also announced plans to migrate to its own Layer 2 network based on Arbitrum technology in the future, optimized specifically for RWA, showing its ambition for a long-term layout.

Comparative analysis: This is not simply a question of "who is better", but a reflection of the strategic path. Solana is a monolithic chain that pursues "integrated high performance", while Arbitrum represents a path of "modularity" and inheritance of Ethereum security. The former is more aggressive, the latter is more robust.

2. Analysis of core technical components

In addition to the underlying public chain, several key technical components together constitute the core function of the stock tokenization product.

Smart Contract Design:

xStocks (SPL Token):

As a standard token (SPL) on Solana, its smart contracts are designed to be freely transferable, similar to ERC-20 on Ethereum. This open design is the technical foundation for its ability to seamlessly integrate with DeFi protocols, such as as using the Kamino lending platform as collateral.

Robinhood (Permissioned Token):

As mentioned earlier, the contract has a transfer restriction logic embedded in it. Each transaction is verified by invoking an internal whitelist registry, which is the technical core of its "walled garden" model and the root cause of its isolation from open DeFi protocols.

The key role of oracles (using Chainlink as an example):

Price Information:

The value of a stock token needs to keep pace with the real-world share price. Oracles, such as Chainlink Price Feeds, act as data bridges, feeding stock prices from multiple trusted data sources to smart contracts securely and decentrally, which is the lifeblood for functions such as maintaining price pegging, executing trades, and conducting liquidations.

Proof of Reserves (PoR):

For a 1:1 anchored product like xStocks, it's crucial. With Chainlink PoR, smart contracts can automatically and regularly prove the adequacy of their off-chain reserve assets to the outside world, solving the trust problem at the code level and making it far more timely and convincing than traditional audit reports.

Cross-chain interoperability (using Chainlink CCIP as an example):

Value:

With the formation of a multi-chain pattern, the cross-chain capability of assets has become crucial. The Cross-Chain Interoperability Protocol (CCIP) allows assets such as xStocks to be securely transferred between different blockchains, such as from Solana to Ethereum. This can break down the silos between chains, greatly expand the liquidity pool and application scenarios of assets, and is a key technology to realize the vision of "one token, 10,000 chains". Backed Finance has mentioned the use of Chainlink CCIP for cross-chain bridging in its products.

3. Detailed explanation of asset on-chain and SPV operation

For asset-backed tokens, SPVs are a key hub that connects real-world assets to the blockchain world. Its operational processes are rigorous and interlocking, ensuring the safety and compliance of assets.

1. Asset Isolation:

Issuers, such as Backed Finance, first buy real shares in a compliant financial market, such as the NYSE. These shares are not placed on the issuer's own balance sheet, but are held in a separate, regulated special purpose vehicle (SPV) and held in custody by a third-party licensed custodian such as a bank.

2. Token Minting:

Once the SPV and custodian confirm the receipt of the real asset, they send a verified instruction to the on-chain smart contract authorizing the minting of an equivalent amount of tokens on the target blockchain (e.g., Solana) (e.g., 100 TSLAX tokens for depositing 100 shares of TSLA).

3. Token Distribution:

Minted tokens are sold through compliant exchanges (such as Kraken) or directly to accredited investors who have passed KYC/AML audits.

4. Lifecycle Management:

During the duration of the token, the issuer handles corporate actions through smart contracts and oracles. For example, when Tesla Inc. pays out a dividend, the SPV receives the dividend and triggers a smart contract to distribute the equivalent amount of stablecoins or tokens to on-chain holders. In the case of a stock split, the smart contract automatically adjusts the number of tokens for all holders.

5. Redemption & Burning:

When accredited investors wish to redeem, they send on-chain tokens to a designated burn address. Once the smart contract is verified, the SPV is notified. The SPV then sells the corresponding amount of real shares in the traditional market and returns the cash received to investors. At the same time, the on-chain tokens are permanently burned to ensure that the on-chain circulation and off-chain reserves are always in a 1:1 balance.

3. Core analysis (3): Business model and risk assessment - the "reef" behind the opportunity

Behind the complex compliance and technology architecture is a clear business logic. The stock tokenization platform not only creates unprecedented value for users, but also opens up new profit channels for itself. However, opportunities and risks always come with them.

1. Business model and source of profit

Although they all offer stock token trading, different platforms have their own profit models.

Robinhood's Sources of Revenue:

Explicit Income:

According to its official statement, Robinhood mainly charges a 0.1% foreign exchange (FX) conversion fee for transactions made by non-Eurozone users. This fee is incurred when a user buys a token denominated in USD using EUR.

Potential Income:

Although it currently focuses on "zero commission" to attract users, its business model is scalable. In the future, it may introduce monetization methods similar to its traditional U.S. stock business, such as Order Flow Payment (PFOF), although it is strictly restricted in the EU, membership value-added services for high-frequency traders, or income from the underlying assets held.

Expanding into the Private Equity Market:

By issuing tokens from private companies such as OpenAI and SpaceX, Robinhood has expanded its high-value asset class, which is not only a powerful user acquisition strategy, but may also be profitable in the future through related value-added services (such as messaging, transaction matchmaking) fees.

xStocks (Kraken & Backed Finance)'s revenue streams:

Transaction Fees:

Kraken, as one of the core trading platforms, charges a percentage of transaction fees for buyers and sellers of xStocks, which is the exchange's most traditional profit model.

Minting/Redemption Fee:

As the issuer, Backed Finance mainly serves institutional clients. It may charge a service fee for large minting and redemption operations performed by institutional users to cover their costs of purchasing, hosting, and managing the underlying assets.

B2B Services:

The core business model of Backed Finance is to provide a one-stop Tokenization-as-a-Service solution for other financial institutions. xStocks is both a product and a showcase of its technological prowess.

2. Comprehensive risk assessment matrix

While investors enjoy the convenience brought by stock tokenization, they must be soberly aware of the various risks hidden behind it.

3. Market structure and future outlook: Who will dominate the next generation of financial markets?

In the asset tokenization track, major platforms are competing for the market with different strategic positioning. Understanding their differences can help us gain insight into the future of the industry.

1. Comparison of the main player matrix

The RWA tokenization track is a multitude of competitors based on different strategic considerations. We divided the main players into three camps for an in-depth comparison.

2. Market trends and evolution paths

Looking ahead, there are several clear trends emerging from stock tokenization and the RWA track as a whole:

From Isolation to Convergence:

Early tokenization projects were mostly isolated attempts within a single platform. Today, the trend is shifting to deep integration with mainstream financial institutions such as BlackRock, Franklin Templeton, and the vast DeFi ecosystem. Tokenized assets are becoming a bridge between TradFi and DeFi.

Regulation-Driven Innovation:

Regulatory clarity is the strongest catalyst for market development. The European Union's MiCA Act, Switzerland's DLT Act, and MAS's Guardian Scheme are all providing greater clarity to the market, which in turn is incentivizing more compliance innovation. Compliance capabilities are becoming the core competitiveness of the platform.

Institutional Admission & Product Diversification:

As BlackRock brings the trillion-dollar money market to the blockchain through its BUIDL fund, institutional participation will inject unprecedented liquidity and trust into the market. The product range will also expand from a single equity and bond to more complex structured products, private equity and alternative assets.

Private Equity Tokenization Becomes the New Blue Ocean:

Platforms represented by Robinhood are beginning to explore the tokenization of shares of private companies, which opens a window into the private equity market, which is usually limited to institutional and high-net-worth individuals. Although there are huge challenges in valuation, disclosure and law, this is undoubtedly a new direction with great potential.

Future outlook and thinking

The wave of stock tokenization is unstoppable, but the road ahead is not easy. A few core questions will determine its final form:

Open vs. Closed Controversy:

Will the market be dominated by an open, composable model like xStocks, or will a compliant, but closed, "walled garden" model like Robinhood win? More likely, the two will coexist for a long time, serving user groups with different risk appetites and needs. Crypto Native users will embrace the open world of DeFi, while traditional investors may prefer to experiment in a familiar, regulated "garden".

The race between technology and law:

Cross-chain technologies (e.g., CCIP), Layer 2 solutions, and privacy-preserving computing (e.g., ZK-proofs) will continue to evolve to address current technical bottlenecks in scalability, interoperability, and privacy. At the same time, the ability of the global legal framework to keep pace with technological innovation and provide certainty for these innovations will determine the speed and ceiling of the industry as a whole.

Stock tokenization is much more than simply "on-chain" financial assets, it is fundamentally reshaping the paradigm of asset issuance, trading, liquidation, and ownership. It promises a more efficient, transparent, and inclusive global financial market. Although this path is full of technological, market and regulatory "reefs", the future direction it points to is undoubtedly irreversible. For all market participants, whether investors, builders or regulators, it is imperative to actively and prudently embrace the coming financial revolution on the basis of a deep understanding of its underlying logic and potential risks.

Show original1.38K

0

Ario 🌲

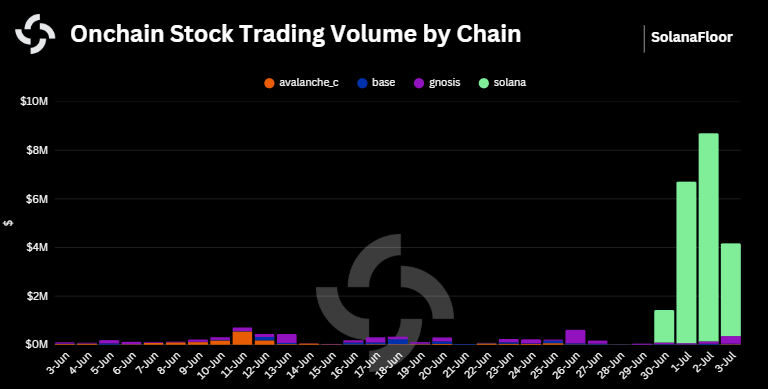

🚨 The dawn of tokenized equities on blockchain is here, and @solana is leading the charge.

✍️ In a bold move, @BackedFi launched @xStocksFi on June 30, 2025, introducing over 60 tokenized stocks to both centralized and decentralized platforms—an ambitious step in reshaping digital finance.

💹 The market's response?

Electrifying. In just four days, DEXs on Solana saw trading volumes surpass an impressive $20 million, capturing an astounding 95% of the total trading volume across multiple blockchain platforms. Clearly, traders have spoken, and Solana is their preferred stage for tokenized equity trading.

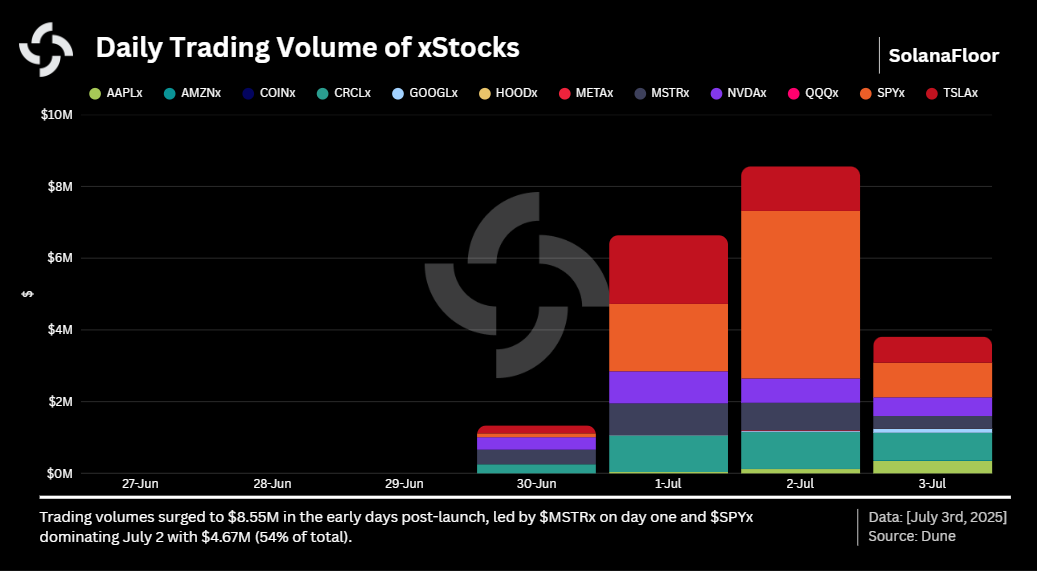

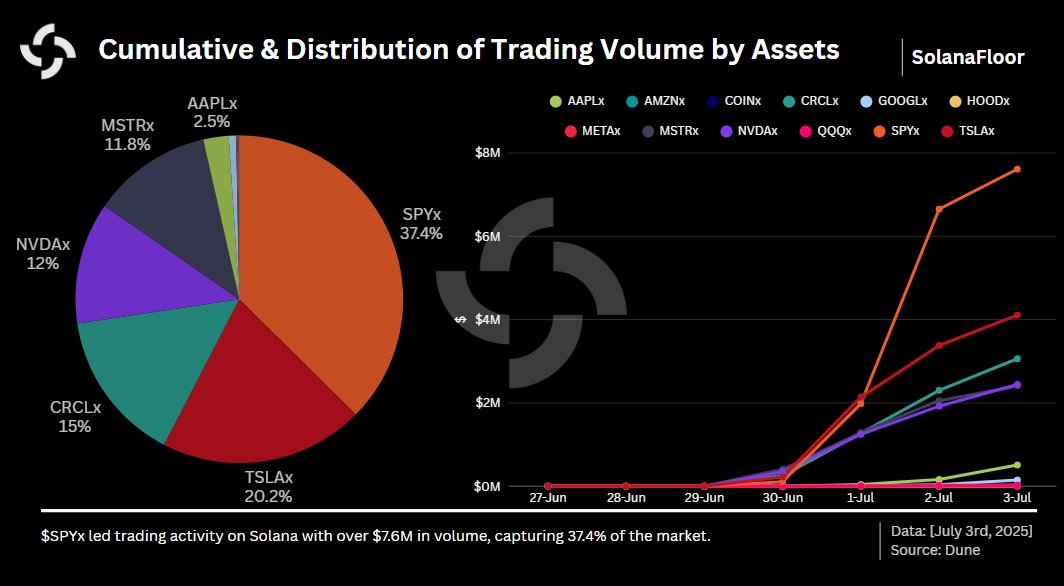

🗓️ On the very first day, enthusiasm surged with $1.3 million in trades. @Strategy's tokenized equity ($MSTRx) initially led, capturing around 30% of volume. Yet, investor preference shifted swiftly. Major players like S&P 500 ($SPYx) and @Tesla ($TSLAx) quickly rose to dominance. Notably, $SPYx surged ahead on July 2, achieving a remarkable daily trading volume of $4.67 million—54% of the day's total trades.

🥇 Yet, even amidst this flux, clear winners emerged. $SPYx solidified its position as the most traded asset, commanding over $7.6 million in cumulative volume—a dominant 37.4% market share. $TSLAx followed with $4.1 million, while @circle's $CRCLx secured third place with $3 million traded.

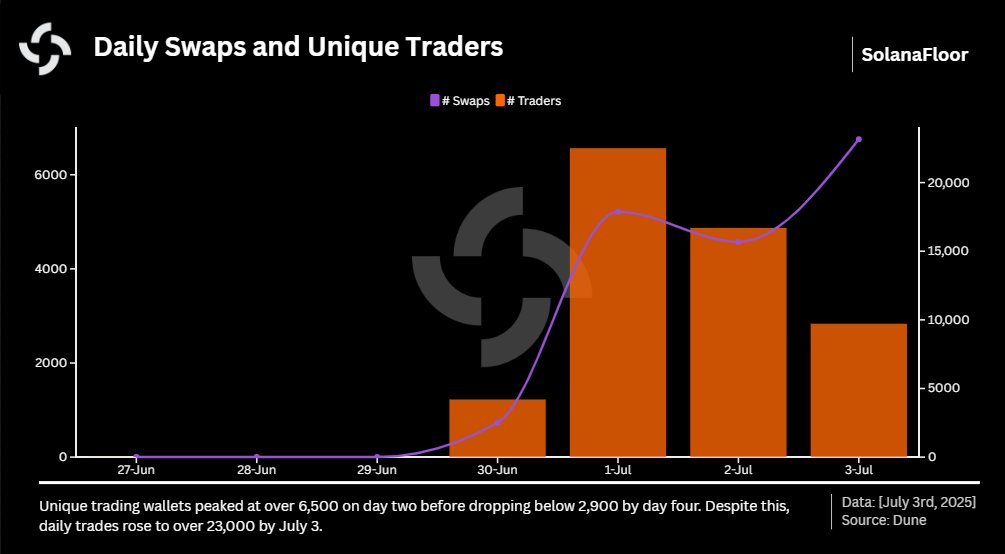

👥 Investor behavior offered intriguing insights. Unique active wallets peaked impressively above 6,500 on the second day but fell to fewer than 2,900 by day four. Interestingly, despite fewer unique participants, transaction counts soared to over 23,000 trades on July 3.

Yet, the journey ahead for tokenized equities on Solana isn't without challenges.

Liquidity remains relatively thin in certain pools—an expected hurdle at this nascent stage. However, the initial success and enthusiastic investor participation point toward a promising future, potentially redefining equity trading as we know it.

Will tokenized equities sustain this momentum on Solana? Only time—and market liquidity—will tell.

Stay tuned.

Read the full piece: 👇🔗

6.57K

8

Odaily

Recently, when I opened Twitter, the screen was full of U.S. stock tokenization. It's no exaggeration to say that if you've not been discussing this for the past few days, it probably means that you have lost touch with the market.

"U.S. stocks on the chain" is the biggest hot spot in the market this week. Robinhood launched a stock tokenization service in Europe, while xStocks also launched on Kraken and Bybit. Solana DEX and the Arbitrum ecosystem began to list AAPLx, TSLAx and other trading pairs, and a new set of narratives such as stock tokenization was quickly rolled out.

But if you only see the heat and don't understand the structure, then you may become a leek in this narrative.

In my opinion, stock tokenization is not essentially a "token", but a stress test of on-chain finance:

Can the Web3 world really host the issuance, trading, pricing, and redemption of mainstream financial assets?

It's not a heat, it's a structural stress test of on-chain finance

From my perspective, our industry narrative is constantly evolving in cycles. As early as 2019, both Binance and FTX tried to tokenize U.S. stocks, but both were eventually shut down by regulators. Mirror Protocol, which used synthetic assets to simulate U.S. stock prices, also died with the Terra crash and SEC regulation. This is not a new thing, but the industry was not very mature at that time.

And today's stock tokenization is not a reckless experiment, but a compliance path led by licensed institutions such as Robinhood and Backed Finance. This is a critical watershed.

Taking Robinhood as an example, the stock tokenization service it launched in Europe this time has taken an unprecedented closed-loop path of "broker-owned + on-chain issuance".

Instead of simply listing a price on the chain, Robinhood is licensed in the EU on its own, buying real US stocks, and issuing 1:1 mapped tokens on-chain. From custody, issuance, to clearing and settlement, and user interaction, the whole process is connected, and the trading experience is basically close to the combination of securities account + wallet.

In the early stage, they deployed these tokens on Arbitrum to ensure that the speed and cost of on-chain transactions were controllable, and later they planned to move to the self-built Robinhood Chain, which means that the entire infra should also be controlled by themselves.

Although the voting rights cannot be opened yet, because it is necessary to avoid governance supervision, the overall structure can already be seen in the prototype: it is like establishing an almost independent "on-chain securities trading system" at the structural level.

For the crypto industry, this is the first time to see a traditional online brokerage, not only has autonomy on the issuance side, but also has carried out a deconstruction of the on-chain structure of assets.

From reckless trials to compliance closures

This round of stock tokenization is not accidental, as I have repeated before. Essentially, several core variables resonate at the same point in time. The so-called right time, place and people, probably that's it.

First of all, there is the loosening of the regulatory level and the clarity of the direction. For example, MiCA in Europe has officially landed, and the SEC in the United States has stopped blindly firing the hammer and has begun to release some signals that "can be talked about and can be done".

Robinhood was able to launch its stock token service in the EU so quickly because of its securities license in Lithuania; The fact that xStocks is connected to both Kraken and Bybit is also inseparable from the compliance structures it has built in Switzerland and Jersey.

At the same time, since the funds on the chain are indeed looking for new assets to export, the structure of the funds in the market has changed. The gap between traditional financial markets and crypto non-MEME markets is only going to get smaller.

Looking at the present, there are a bunch of projects on the chain that have no fundamentals but have ultra-high FDV, and there is no place for liquidity to go there, and stable funds have also begun to find "anchor and logical" asset allocation outlets. At this time, regular armies such as Robinhood and xStocks come in with compliant structures and trading experiences, and stock tokens become attractive. It's familiar, it's stable, it has a narrative space, and it's also tied to stablecoins and DeFi.

The combination of TradFi and Crypto has gone deeper and deeper. From BlackRock to JPMorgan Chase, from UBS to MAS, traditional financial giants are no longer standing on the sidelines, but are really building chains, running pilots, and doing infrastructure. As the most mainstream and recognizable asset, stocks will obviously become the preferred choice for tokenization.

Is the on-chain of traditional assets an opportunity for crypto or a threat to projects?

Jiayi's subjective view:

Looking ahead, stock tokenization will most likely not be an explosive growth curve, but it has the potential to become a very resilient infrastructure evolution path in the Web3 world.

The significance of this narrative lies in the fact that it has brought about two important structural changes: first, the asset boundaries have begun to truly migrate on-chain, and second, the traditional financial system is willing to use the on-chain method to organize part of the transaction and custody process. These two things, once established, are irreversible.

So, is it good or bad for stocks to rush for Crypto project liquidity?

In my opinion, this is a typical double-edged sword. It brings higher quality assets, but it also subtly rewrites the flow structure of funds on the chain.

From the Front:

1. The entry of "blue-chip assets" in traditional finance has given new places for on-chain funds, and has also added some options for the allocation of "stable assets". In a market where the narrative rotates too fast and funds move for a long time, this kind of assets with a clear structure and realistic anchor points are actually helping liquidity regain the basic coordinates of "where to allocate and where to match".

2. At the same time, this will also bring about the "catfish effect". As soon as the strong narrative asset of U.S. stock tokenization came up, the benchmark of the entire chain was raised, which will inevitably push the overall quality of Web3 projects to go up. Let's just let the garbage project be eliminated from the market, in my heart.

3. Crypto players can directly buy stocks in the form of Cypto Native, which reduces the liquidity sucking of the large pool of Crypto by US stocks

But look at it the other way around:

1. It also puts pressure on crypto-native projects. Not only will the narrative be robbed, but the capital structure and user preferences on the chain will also be slowly reshaped. Especially when tokenized stocks become liquid and start running perp, lending, and portfolio allocation, it will directly compete with native assets for stablecoin traffic, mainstream users, and on-chain attention.

2. For the project party: it will be difficult to obtain financing. When there is AAPLx, TSLAx, and in the future, tokenized private equity from OpenAI or SpaceX appear in the on-chain asset pool. Investors and users' intuitive judgments about "what is worth investing in" and "what has a pricing anchor" will migrate.

Stock tokenization makes us rethink: Is Web3 a system that can carry mainstream assets and real trading behavior? Can we use an open financial structure to rebuild a securities system with lower friction and greater transparency than the traditional market?

Show original3.73K

0

gum

Solana changed the game this week with the launch of xStocks, don't let this be forgotten

It is now closer than ever to Toly's vision of being the decentralized Nasdaq

You can trade on @ranger_finance and farm its airdrop

Hyperliquid integration is coming too so keep an eye out for Ranger

11.84K

88

SolanaFloor

📊 Solana Data Insights – Tokenized Stocks See $20M+ Volume in 4 Days via @xStocksFi

✍️ @ario_57_

Key takeaways from this report:

• xStocks launched 60+ tokenized equities on Solana and CEXs on June 30; DEXs on Solana saw $20M+ volume in 4 days

• Solana captured 95%+ of total tokenized stock trading volume across chains

• $SPYx led with $7.6M in trades (37.4%), followed by $TSLAx ($4.1M) and $CRCLx ($3M)

• AUM topped $48.6M across all xStocks; $SPYx leads with $6.9M, $METAx at $4.3M, $TSLAx at $3.4M

• Trading peaked on July 2 ($8.55M), but dropped 55% on July 3; 23K+ total trades show growing per-user activity

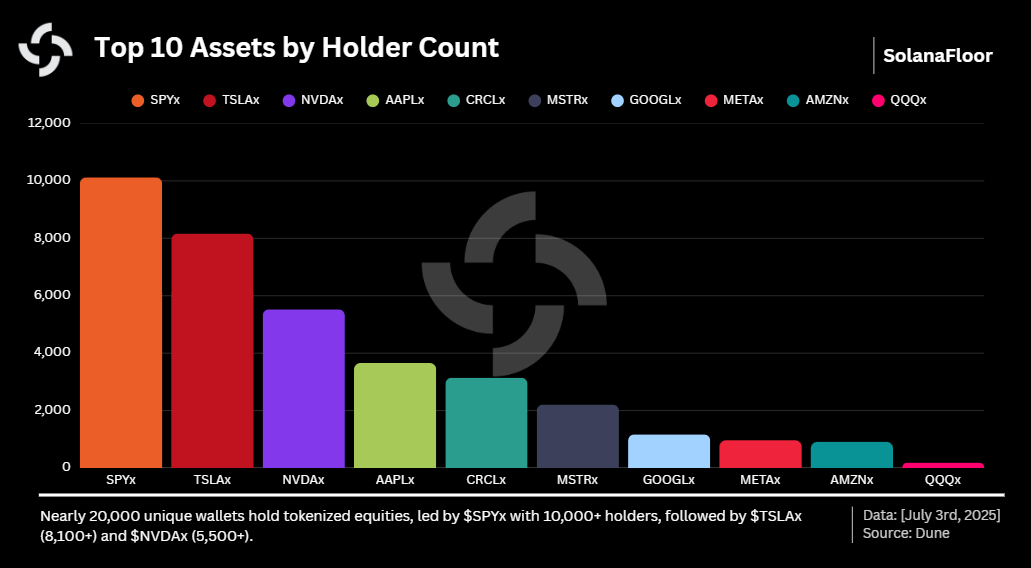

• Nearly 20K wallets now hold xStocks; $SPYx has 10K+ holders, $TSLAx 8.1K+, $NVDAx 5.5K+

Subscribe for the full breakdown 👇

16.74K

64

TSLAx price performance in USD

The current price of xstocks-tesla is $0.00015777. Over the last 24 hours, xstocks-tesla has increased by +250.31%. It currently has a circulating supply of 999,999,946 TSLAx and a maximum supply of 999,999,946 TSLAx, giving it a fully diluted market cap of $157.77K. The xstocks-tesla/USD price is updated in real-time.

5m

+0.00%

1h

+250.31%

4h

+250.31%

24h

+250.31%

About xStocks Tesla (TSLAx)

TSLAx FAQ

What’s the current price of xStocks Tesla?

The current price of 1 TSLAx is $0.00015777, experiencing a +250.31% change in the past 24 hours.

Can I buy TSLAx on OKX?

No, currently TSLAx is unavailable on OKX. To stay updated on when TSLAx becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of TSLAx fluctuate?

The price of TSLAx fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 xStocks Tesla worth today?

Currently, one xStocks Tesla is worth $0.00015777. For answers and insight into xStocks Tesla's price action, you're in the right place. Explore the latest xStocks Tesla charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as xStocks Tesla, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as xStocks Tesla have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.