This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

SOL

wynning price

A2q2z4...Nh2u

$0.000094308

+$0.000059701

(+172.51%)

Price change for the last 24 hours

How are you feeling about SOL today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

SOL market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$94,307.21

Network

Solana

Circulating supply

999,990,601 SOL

Token holders

19

Liquidity

$0.00

1h volume

$5.86M

4h volume

$6.70M

24h volume

$6.70M

wynning Feed

The following content is sourced from .

Four Pillars KR

Populous is joining Perena's Stablebank Network!

@Perena__ is a leading stablecoin infrastructure on Solana, addressing the issue of stablecoin fragmentation through deep liquidity.

Stablebank is a consortium aimed at accelerating on-chain finance, and as a trusted research firm, Populous will contribute through insightful content.

Perena

On-chain finance doesn’t happen in isolation.

💠 Introducing: The Stablebank Network - a coordinated alliance of builders shaping the future of programmable money.

Over the past few months, we’ve consolidated a network of forces, going beyond any single product.

Here’s how our partners are reimagining the core functions of banking, on-chain 👇

44

0

Jay : : FP

Discussions around stablecoin adoption are deepening not only within the industry but also across nations. While building out stablecoin infrastructure is undoubtedly important, what matters even more is securing real-world use cases.

Perena(@Perena__ )'s Stablebank Network offers a fully integrated stack—from infrastructure and real-world applications to research—under a single, unified network.

We can’t help but look forward to a stablecoin pipeline built on top of Solana’s best-in-class payment infrastructure!

Thank you for welcoming Four Pillars (@FourPillarsFP) to be part of this exciting journey ahead! :)

Perena

On-chain finance doesn’t happen in isolation.

💠 Introducing: The Stablebank Network - a coordinated alliance of builders shaping the future of programmable money.

Over the past few months, we’ve consolidated a network of forces, going beyond any single product.

Here’s how our partners are reimagining the core functions of banking, on-chain 👇

103

1

Michael Pinto

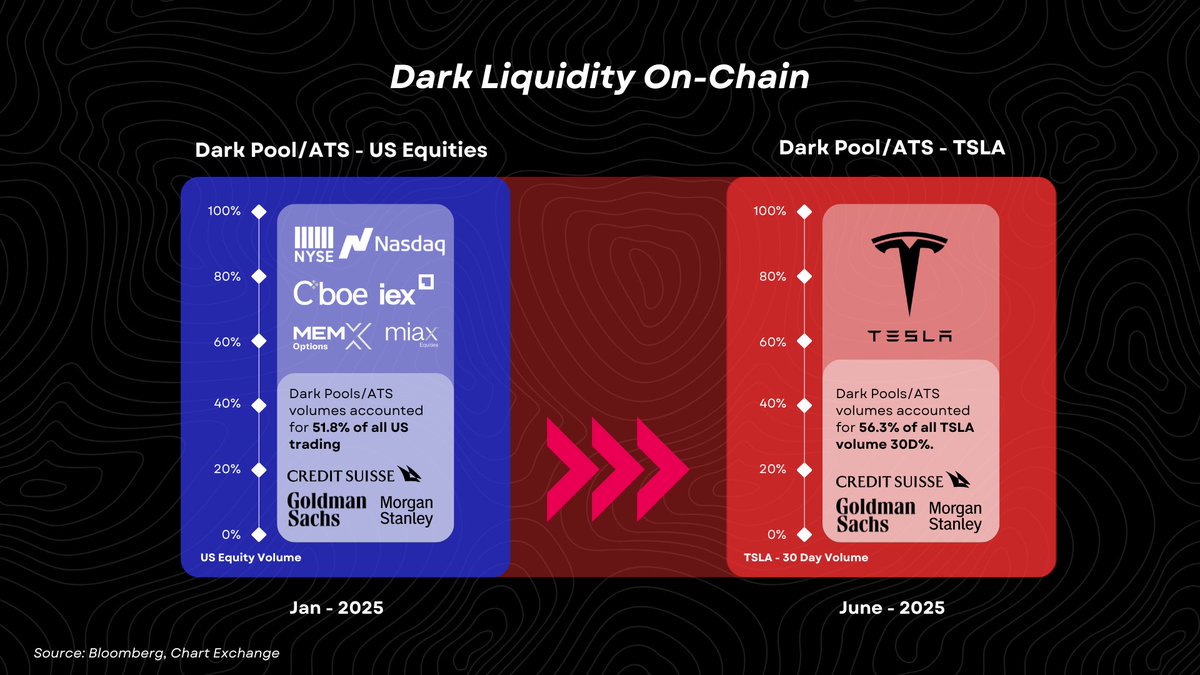

If Dark AMMs reach PMF on-chain they will dominate spot volume on @solana

Michael Pinto

On-Chain Dark Pools: A Global Race🕳️💧

Dark Pools/ATS are increasingly becoming a massive percentage of stock trading in TradFi. But they don’t exist in crypto yet, or if they do, they are built for niche use cases or on the wrong tech stacks.

The goal is the ability to trade privately on-chain with zero slippage, no MEV, and CEX-level execution.

We don’t need to rewrite the playbook, this has existed since the 1980s in TradFi.

A dark pool is a private trading venue where institutions execute large trades without either party(s) showing their hands. Orders are hidden until matched, so there’s no front-running, back-running, slippage, or price impact. It’s how serious money from BlackRock, Citadel, Millennium, Jane Street, Vanguard, Fidelity, etc. avoids moving the market.

As Bloomberg says: “Wall Street Enters Darker Age With Most Stock Trading Hidden.” This isn’t a niche. Trillions in U.S. equities trades through dark pools every year, with Goldman’s Sigma X, MS’s MS Pool, and Credit Suisse’s Crossfinder dominating flows.

As of January 2025, nearly 51.8% of U.S. stock trading is now done off-exchange via dark pools or ATS (alternative trading systems). With certain stocks, off-exchange activity can spike significantly higher.

For example, over the last 30 days, approximately 56.3% of TSLA trading volume was routed off-exchange, primarily through dark pools.

Institutional players are increasingly viewing the public markets and on-chain markets as hostile environments and prefer the neutrality and simplicity of dark pools.

So why haven’t dark pools made it to crypto and DeFi? Because most blockchains simply aren’t built to support them. While some (like @solana and @Aptos) now offer confidential transfers that hide transaction amounts, the sender and receiver addresses remain public meaning the trade itself still reveals critical data can be re-ordered in some scenarios.

True dark pools require full privacy (counterparties, price, and intent) along with fast, scalable settlement and most chains fall short on both fronts.

On top of that, most chains are highly incentivized to allow MEV (maximal extractable value). This means that large orders are routinely front-run, reordered, or sandwiched before they can settle, which is a serious hindrance and risk for institutional participants.

Recently, Hyperliquid has showcased that traders are willing to move to no-KYC platforms with deep liquidity, but there are issues with the level of visibility that takes place on @HyperliquidX.

On the one hand, extra transparency can improve execution and increase non-toxic flow. On the other hand, it can lead to situations like we saw with @JamesWynnReal, where market makers were willing to size up as they knew who it was but if they were trading against Jane Street, it would be a different ball game.

However, I see a potential path where existing players like Aptos, Solana, Sui or a new player building on top of a high-throughput chain who has one half of the puzzle (fast finality, parallel execution, low latency, etc.) could prioritize a bespoke matching engine or encrypted order routing. That would make dark pools viable on-chain.

Essentially, certain chains will continue down the path of optimizing for increased volumes via trading activity while simultaneously enabling institutional players to onboard and utilize dark pools as a refuge from on-chain market games and toxic order flow.

The second half of the journey toward massively increasing on-chain volumes is dark liquidity driven by institutional players.

If you're building this hmu.

249

0

Four Pillars

: : Thrilled to join the Stablebank Network led by Perena!

As Solana’s flagship stablecoin infrastructure, @Perena__ addresses fragmentation with deep, unified liquidity.

Stablebank is a coordinated alliance to accelerate onchain finance. As a trusted research firm, @FourPillarsFP will contribute research-driven insights to strengthen the Stablebank Network.

Perena

On-chain finance doesn’t happen in isolation.

💠 Introducing: The Stablebank Network - a coordinated alliance of builders shaping the future of programmable money.

Over the past few months, we’ve consolidated a network of forces, going beyond any single product.

Here’s how our partners are reimagining the core functions of banking, on-chain 👇

216

0

SOL price performance in USD

The current price of wynning is $0.000094308. Over the last 24 hours, wynning has increased by +172.51%. It currently has a circulating supply of 999,990,601 SOL and a maximum supply of 999,990,601 SOL, giving it a fully diluted market cap of $94,307.21. The wynning/USD price is updated in real-time.

5m

+0.00%

1h

+2.27%

4h

+172.51%

24h

+172.51%

About wynning (SOL)

SOL FAQ

What’s the current price of wynning?

The current price of 1 SOL is $0.000094308, experiencing a +172.51% change in the past 24 hours.

Can I buy SOL on OKX?

No, currently SOL is unavailable on OKX. To stay updated on when SOL becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of SOL fluctuate?

The price of SOL fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 wynning worth today?

Currently, one wynning is worth $0.000094308. For answers and insight into wynning's price action, you're in the right place. Explore the latest wynning charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as wynning, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as wynning have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.