This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

LUNA

Luna by Virtuals price

0x55cd...7ee4

$0.022095

-$0.00257

(-10.41%)

Price change for the last 24 hours

How are you feeling about LUNA today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

LUNA market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$22.06M

Network

Base

Circulating supply

998,493,054 LUNA

Token holders

385026

Liquidity

$5.61M

1h volume

$15,181.58

4h volume

$275,313.96

24h volume

$1.19M

Luna by Virtuals Feed

The following content is sourced from .

币圈梭哈哥AllInBro ⚡️

Six black swan events in the currency circle

1. February 2014 Mentougou Incident: Bitcoin Plummeted by 80%

In February 2014, the Mentougou incident was regarded as one of the most serious events in the history of the cryptocurrency circle.

At that time, MTGOX, the world's largest bitcoin exchange, was hacked and lost nearly 850,000 bitcoins, accounting for seven percent of the world's total bitcoins.

This event not only caused the price of bitcoin to plummet by 80%, but also triggered a crisis of confidence in the cryptocurrency market.

2. 2017 9.4 event: market value evaporated 80%

In 2017, the cryptocurrency market experienced tremendous volatility, with 80% of its market value evaporated in just a few days.

Investors have lost a lot in this crisis, but it is this experience that gives a deeper understanding of the complexities of the cryptocurrency market.

3. March 12, 2020 Incident: Ether Plummets to $80 On this heartbreaking day, the price of Ether plummeted below $80.

The event has shone a light on the impermanence and uncertainty of the cryptocurrency market, but despite this, the belief in the great potential and value of cryptocurrencies remains strong.

4. The 5.19 event in 2021: 600,000 contract dogs liquidated This is a shocking event, 600,000 contract dogs were liquidated overnight, and countless investors suffered huge losses.

This incident reminds us once again that the cryptocurrency market is full of risks and uncertainties.

5. 2022 Luna Black Swan Event: Crisis in the DFI Sector The Luna Black Swan event marked a major turning point in the cryptocurrency market, triggering a major crisis in the decentralized finance (DFI) space that had a profound impact on the market.

6. The 2022 FTX Thunderstorm: A Crisis of Market Confidence

The FTX explosion triggered a crisis of confidence in the entire cryptocurrency market, which hit the market hard.

Although the market has been relatively friendly to us this year, these tragic events are still a wake-up call for us to stay vigilant.

We look forward to the beginning of a new chapter in the ever-changing industry.

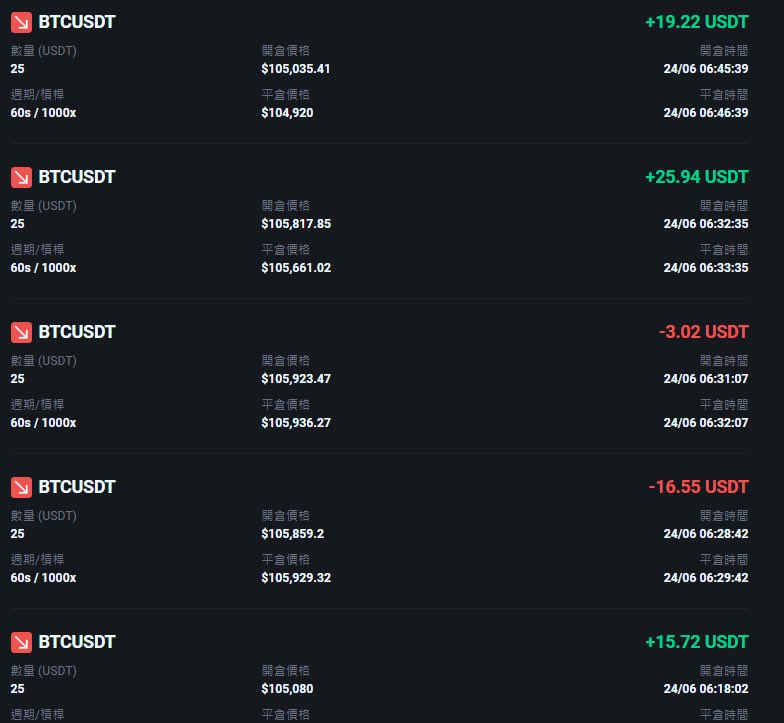

Short-term trading + 10,000 times leverage + 0 handling fee

Choose the VEX Index Trading Platform:

Show original

43.27K

1

LUNA price performance in USD

The current price of luna-by-virtuals is $0.022095. Over the last 24 hours, luna-by-virtuals has decreased by -10.41%. It currently has a circulating supply of 998,493,054 LUNA and a maximum supply of 998,493,080 LUNA, giving it a fully diluted market cap of $22.06M. The luna-by-virtuals/USD price is updated in real-time.

5m

-0.13%

1h

-1.90%

4h

-3.56%

24h

-10.41%

About Luna by Virtuals (LUNA)

LUNA FAQ

What’s the current price of Luna by Virtuals?

The current price of 1 LUNA is $0.022095, experiencing a -10.41% change in the past 24 hours.

Can I buy LUNA on OKX?

No, currently LUNA is unavailable on OKX. To stay updated on when LUNA becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of LUNA fluctuate?

The price of LUNA fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Luna by Virtuals worth today?

Currently, one Luna by Virtuals is worth $0.022095. For answers and insight into Luna by Virtuals's price action, you're in the right place. Explore the latest Luna by Virtuals charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Luna by Virtuals, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Luna by Virtuals have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.