This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

lvlUSD

Level USD price

0x7c11...af37

$0.99988

-$0.00010

(-0.01%)

Price change for the last 24 hours

How are you feeling about lvlUSD today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

lvlUSD market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$125.19M

Network

Ethereum

Circulating supply

125,208,851 lvlUSD

Token holders

1434

Liquidity

$15.23M

1h volume

$34.25

4h volume

$199,409.79

24h volume

$1.81M

Level USD Feed

The following content is sourced from .

Level 🆙

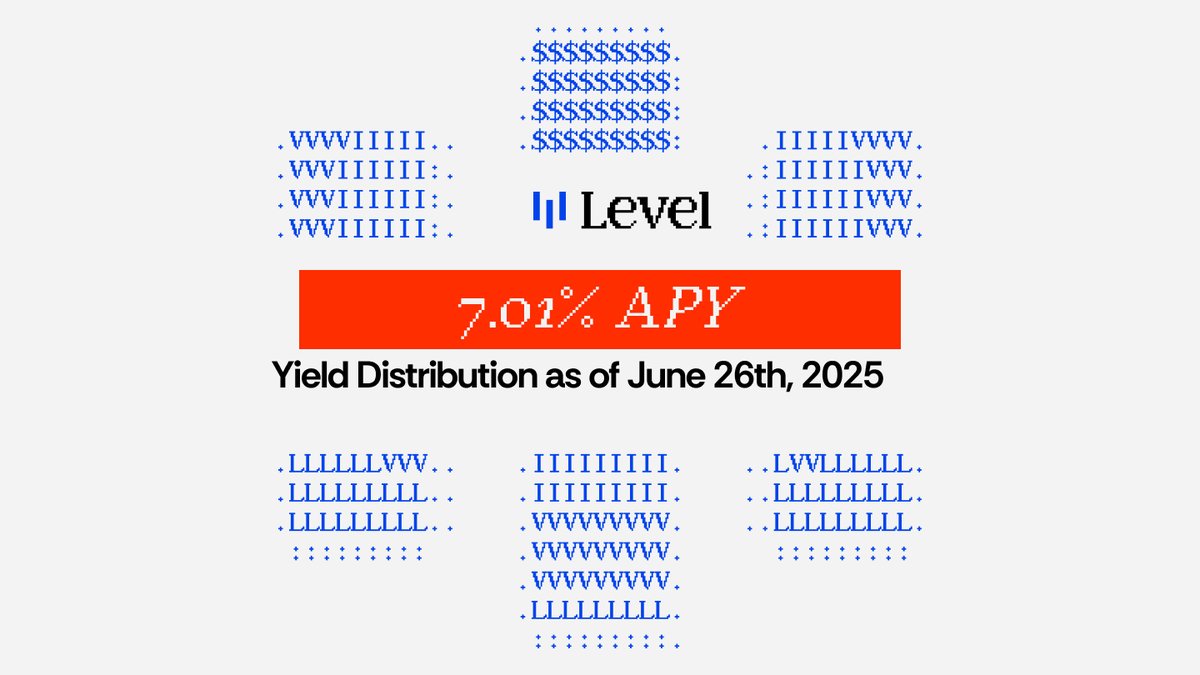

🚨 slvlUSD Weekly APY Update: 7.01%

Level's latest distribution is here👇

How to earn:

1️⃣ Mint lvlUSD →

2️⃣ Stake for yield → Convert to slvlUSD + track rewards

3️⃣ Unstake anytime → Redeem after 7-day cooldown

🧬 Bonus XP Farming

• @pendle_fi: 40x XP (lvlUSD) / 20x XP (slvlUSD)

• @CurveFinance: 60x XP for LPs

• @MorphoLabs: 40x XP using lvlUSD as collateral

📌 Protocol revenue is distributed to slvlUSD based on daily average market cap since the last distribution, annualized with compounding. Past performance does not guarantee future results. Not available for US persons

6.68K

4

Equilibria

slvlUSD isn’t just earning — it’s built to do more.🔥

On Equilibria, it goes beyond passive yield with boosts powered by our vePENDLE treasury, full composability, and 20x Level XP.

Simple to hold, powerful on Equilibria.✅

Level 🆙

Why Composability Turns slvlUSD from a Yield Source into a Strategy Layer

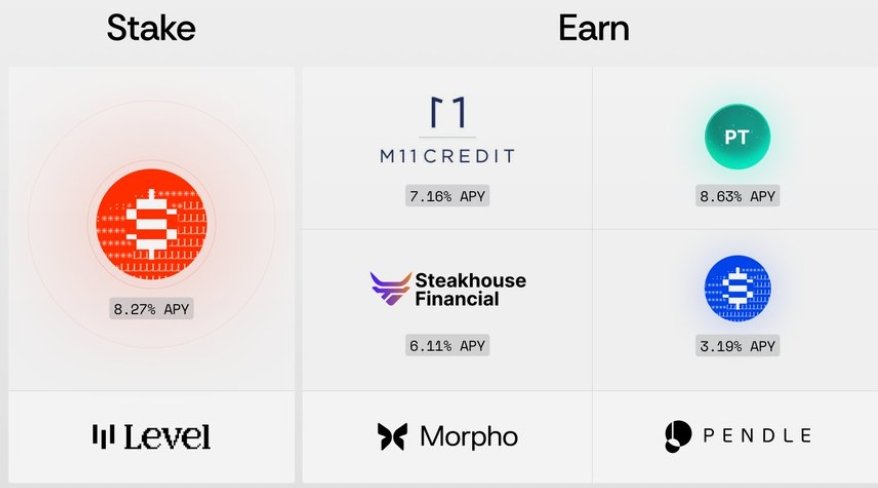

slvlUSD distributes real yield to holders, powered by Level’s reserve allocation across AAVE and Morpho Steakhouse USDC vault. With an average APY of 9.13% during Q2, it already stands out as one of the most appealing yield-bearing stablecoins.

But its value isn’t just in what it earns, it’s in what it enables.

In Level’s ecosystem, lvlUSD acts as a checking account: composable, liquid, and usable across DeFi. slvlUSD, by contrast, functions like a savings account, accruing passive income from lending strategies in a transparent, onchain vault.

But unlike traditional savings products, it remains fully usable while it earns.

slvlUSD is integrated across @MorphoLabs, @pendle_fi, @Penpiexyz_io, @Equilibriafi, @CurveFinance and @spectra_finance where users can deploy their position further, layering new strategies on top of the base lending yield without needing to exit the system.

The vault stays active, even in motion.

Risk-averse users can stake slvlUSD and earn passively.

Strategic users can route it through fixed yield vaults, LPs, or boosted staking positions.

In both cases, the lending yield keeps accruing, and users stay in control of how much exposure they want to take on.

Composability turns slvlUSD from a static vault into a programmable savings layer, one that supports simple holding, active deployment, or anything in between.

This is savings, engineered for DeFi.

This is the kind of infrastructure onchain banking is built on.

Level 🆙

4.26K

15

Pendle

Been replaying and frame freezing 0:08 🥰

Level 🆙

Why Composability Turns slvlUSD from a Yield Source into a Strategy Layer

slvlUSD distributes real yield to holders, powered by Level’s reserve allocation across AAVE and Morpho Steakhouse USDC vault. With an average APY of 9.13% during Q2, it already stands out as one of the most appealing yield-bearing stablecoins.

But its value isn’t just in what it earns, it’s in what it enables.

In Level’s ecosystem, lvlUSD acts as a checking account: composable, liquid, and usable across DeFi. slvlUSD, by contrast, functions like a savings account, accruing passive income from lending strategies in a transparent, onchain vault.

But unlike traditional savings products, it remains fully usable while it earns.

slvlUSD is integrated across @MorphoLabs, @pendle_fi, @Penpiexyz_io, @Equilibriafi, @CurveFinance and @spectra_finance where users can deploy their position further, layering new strategies on top of the base lending yield without needing to exit the system.

The vault stays active, even in motion.

Risk-averse users can stake slvlUSD and earn passively.

Strategic users can route it through fixed yield vaults, LPs, or boosted staking positions.

In both cases, the lending yield keeps accruing, and users stay in control of how much exposure they want to take on.

Composability turns slvlUSD from a static vault into a programmable savings layer, one that supports simple holding, active deployment, or anything in between.

This is savings, engineered for DeFi.

This is the kind of infrastructure onchain banking is built on.

Level 🆙

7.5K

37

Charles💤🎶

To be honest, in this DeFi world where even "stablecoins" are starting to roll out yields, I rarely feel that a protocol is "not simple." But this time, @levelusd's lvlUSD really made me stop in my tracks, and I couldn't help but take a closer look and dive deeper into it.

Web3 DeFi players often say "stablecoins are the lifeblood of the chain," but in reality, most stablecoins are just passing liquidity around, and few really pay attention to "is it working for you, making you money?" Level is rewriting that narrative.

Level @levelusd is a protocol backed by Dragonfly and Polychain, but its ambitions go far beyond "who's behind it." The core stablecoin it issues, lvlUSD, is an asset fully backed by USDC and USDT, with each one continuously working and generating yields in blue-chip lending protocols (like Aave, Morpho). It sounds very DeFi 101, but what truly impressed me is that it achieves low risk, high yield, and on-chain transparency all at once—very rare, very valuable.

Even better, Level hasn't locked the yields "in a closed system." It further launched slvlUSD, a yield vault (based on the ERC-4626 standard), where you can stake lvlUSD and directly participate in yield distribution—what's even more amazing is that currently only about 30-45% of lvlUSD is staked, meaning fewer people are sharing all the yields, so the annual yield of slvlUSD naturally "rolls up."

I don't like to talk about yields without substance because many projects behind them carry uncontrollable high risks. But I agree with Level's strategy—all yields come solely from blue-chip lending protocols like Aave and Morpho, without the anxiety of "if something goes wrong, everything collapses" that comes from excessive DeFi Lego stacking. As an old Web3 user who has struggled through a bear market, this sense of security is, to be honest, more important than the yield.

Not to mention, Level's integration capabilities are also exceptional. lvlUSD and slvlUSD have deeply integrated into core ecosystems like Morpho, Pendle, Spectra, and Curve, making this "stablecoin + yield" system truly possess DeFi-native liquidity and application capabilities. For example, you can use lvlUSD as collateral on Morpho to borrow USDC, then go back and mint more lvlUSD, forming a stable cycle of compounding strategies. Or on Pendle, you can use slvlUSD and PT/YT product combinations to achieve yield locking + secondary trading, and in some pools, Level's liquidity depth has already surpassed aUSDC.

I haven't seen a project with such a system, planning, and yet not flashy or relying on airdrops to cut leeks in a long time. It doesn't attract attention through emotional hype but rather impresses you through product mechanisms and actual integration.

Ultimately, Level gives me the impression of not being a short-term spike but rather a stable yield infrastructure with depth and future potential. In this new cycle of "wanting stability but not being able to lie flat," Level's value may still be far from being truly discovered.

🌟🌟🌟 The next wave of truly "tech-driven" stable yield narratives may just start from lvlUSD. If you're ready, don't just "watch from the sidelines"; getting positioned on-chain is always better the earlier you do it.

After reading Lao Cha's introduction, you probably want to start understanding Level and get involved. Below, Lao Cha has put together a simple tutorial for reference: Minting and Staking Tutorial:

1: You only need to prepare an EVM-compatible wallet (like MetaMask), deposit a small amount of ETH as gas fees, and prepare USDC, USDT, ETH, WBTC, or any other asset, then visit the official website to start.

2: First, click "Sign In" in the upper right corner to connect your wallet, then select "Buy" from the left menu to exchange your assets for lvlUSD. After the transaction is completed, the system will pop up three options: you can choose to stake lvlUSD to earn yield (Earn Yield), participate in XP farming (Farm), or provide LP on Curve to get more incentive points (20x XP).

3: If you choose to stake for yield, just click "Earn Yield," enter the amount of lvlUSD you want to stake, first click "Approve" to authorize, then click "Stake" to confirm the transaction, and you will receive slvlUSD, with compounded yields automatically received every Thursday (⚠️⚠️ Note: Unstaking requires a 3-day cooling period).

4: If you prefer the points gameplay, click "Farm" on the left, find the row for lvlUSD, click the "+" sign, enter the amount, authorize, and deposit to start earning XP at a 10x multiplier (if you provide LP, you can also enjoy a 20x reward). Finally, if you want to see the rankings, just go to the "Leaderboard" page to check your farming results and current ranking.

Staking for yield, farming for points, providing LP rewards maximized, so easy? Now visit

Lastly, I saw they announced a collaboration between Level and Morpho @MorphoLabs, where users can use lvlUSD as collateral to borrow USDC on Morpho, with a maximum borrowing ratio of 91.5%, but it's recommended to keep it lower to avoid liquidation. The borrowing rate is about 1.2% annualized, so be mindful of costs and risks. The borrowed USDC can also be used to mint more lvlUSD, achieving circular utilization. Through staking, liquidity mining, and other methods, you can also earn high multiples of Level XP, greatly enhancing asset utilization efficiency. This cross-protocol integration not only enhances the utility of lvlUSD but also brings users more opportunities to earn yields, which is worth trying!

Show original

37.81K

155

Morpho 🦋

Earn Yields + Unlock Liquidity

Savings products built on DeFi infrastructure is different

Powered by Morpho

Level 🆙

Why Composability Turns slvlUSD from a Yield Source into a Strategy Layer

slvlUSD distributes real yield to holders, powered by Level’s reserve allocation across AAVE and Morpho Steakhouse USDC vault. With an average APY of 9.13% during Q2, it already stands out as one of the most appealing yield-bearing stablecoins.

But its value isn’t just in what it earns, it’s in what it enables.

In Level’s ecosystem, lvlUSD acts as a checking account: composable, liquid, and usable across DeFi. slvlUSD, by contrast, functions like a savings account, accruing passive income from lending strategies in a transparent, onchain vault.

But unlike traditional savings products, it remains fully usable while it earns.

slvlUSD is integrated across @MorphoLabs, @pendle_fi, @Penpiexyz_io, @Equilibriafi, @CurveFinance and @spectra_finance where users can deploy their position further, layering new strategies on top of the base lending yield without needing to exit the system.

The vault stays active, even in motion.

Risk-averse users can stake slvlUSD and earn passively.

Strategic users can route it through fixed yield vaults, LPs, or boosted staking positions.

In both cases, the lending yield keeps accruing, and users stay in control of how much exposure they want to take on.

Composability turns slvlUSD from a static vault into a programmable savings layer, one that supports simple holding, active deployment, or anything in between.

This is savings, engineered for DeFi.

This is the kind of infrastructure onchain banking is built on.

Level 🆙

8.61K

36

lvlUSD price performance in USD

The current price of level-usd is $0.99988. Over the last 24 hours, level-usd has decreased by -0.01%. It currently has a circulating supply of 125,208,851 lvlUSD and a maximum supply of 125,208,851 lvlUSD, giving it a fully diluted market cap of $125.19M. The level-usd/USD price is updated in real-time.

5m

+0.00%

1h

-0.02%

4h

+0.00%

24h

-0.01%

About Level USD (lvlUSD)

Learn more about Level USD (lvlUSD)

4 tips to level up your USDT with Shark Fin

OKX Shark Fin offers a great opportunity to earn USDT without putting your principal at risk. If you are new to Shark Fin, be sure to check out our beginner's guide here . Here are four tips to help you level up your earnings using Shark Fin.

Jun 16, 2025|OKX|

Beginners

lvlUSD FAQ

What’s the current price of Level USD?

The current price of 1 lvlUSD is $0.99988, experiencing a -0.01% change in the past 24 hours.

Can I buy lvlUSD on OKX?

No, currently lvlUSD is unavailable on OKX. To stay updated on when lvlUSD becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of lvlUSD fluctuate?

The price of lvlUSD fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Level USD worth today?

Currently, one Level USD is worth $0.99988. For answers and insight into Level USD's price action, you're in the right place. Explore the latest Level USD charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Level USD, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Level USD have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.