This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

CRCL

Circle price

4peEkZ...pump

$0.00021129

+$0.00018142

(+607.25%)

Price change for the last 24 hours

How are you feeling about CRCL today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

CRCL market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$211,292.70

Network

Solana

Circulating supply

1,000,000,000 CRCL

Token holders

172

Liquidity

$178,992.51

1h volume

$9.30M

4h volume

$9.30M

24h volume

$9.30M

Circle Feed

The following content is sourced from .

Wall St Engine

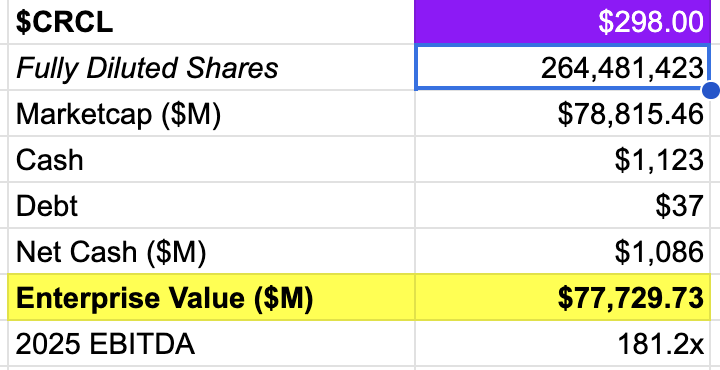

Compass Point Initiates Coverage on $CRCL with Neutral Rating, PT $205; cites long-term promise of stablecoins but near-term risks and valuation concerns

Analyst comments: "We believe stablecoins can disrupt the financial system as blockchains disintermediate banks and payments networks. CRCL provides pure-play exposure to this disruptive technology as the largest issuer of regulated stablecoins.

USDC's leading tech and liquidity provide long-term advantages; however, distribution is also a key driver of stablecoin market share. While Circle’s current distribution partners are large players in crypto, mainstream businesses have much broader connectivity to end users.

With CRCL trading at over 100x EBITDA, it's clear investors aren’t valuing the stock on near-term earnings. However, given the threat of new entrants and declining gross margins, we initiate with a Neutral rating and $205 PT."

Analyst: Ed Engel

5.24K

0

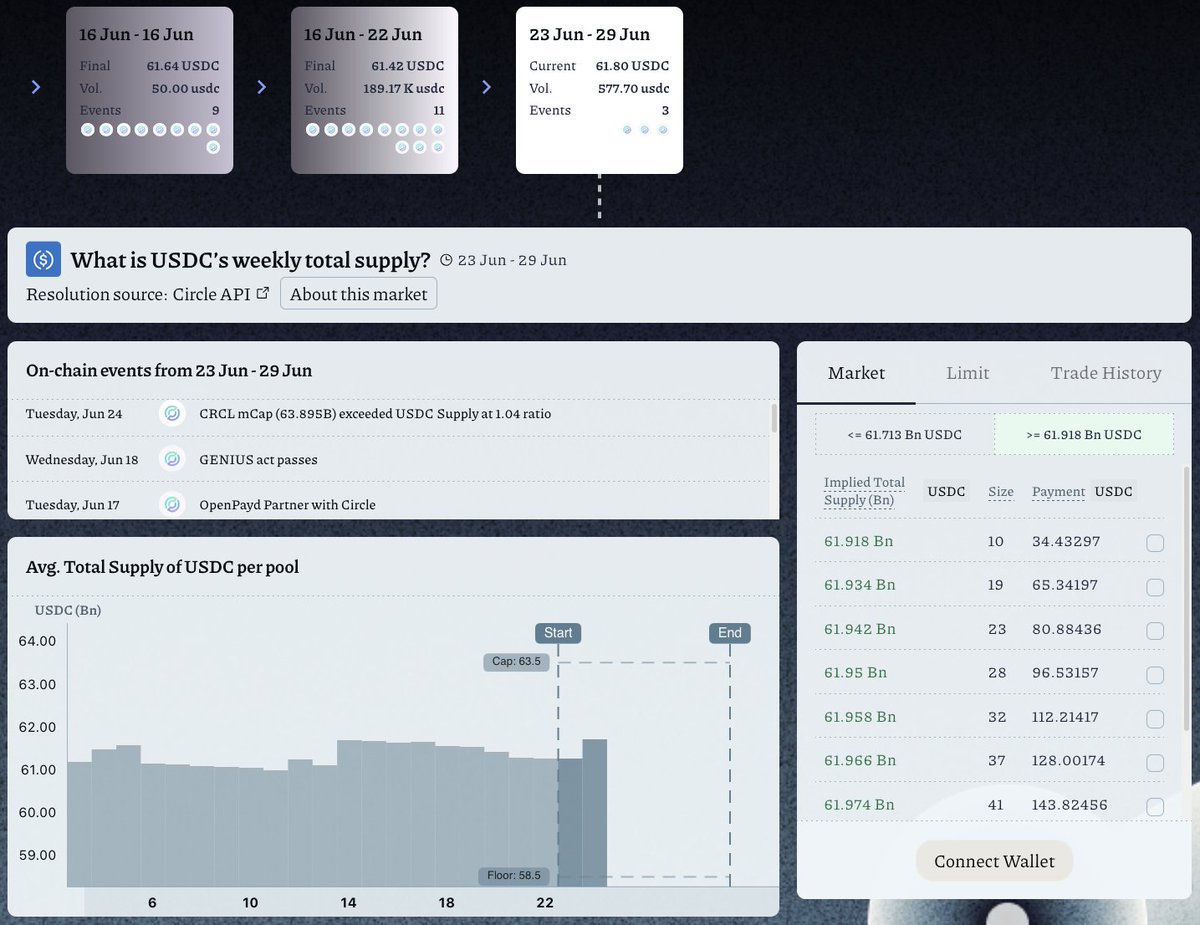

Alkimiya⌛

$CRCL 💰 may be higher than $USDC 💰,

but it does not offer the most direct exposure to $USDC supply trajectory.

Alkimiya’s USDC Supply Market bares USDC’s underlying dynamics and delivers clean exposure to its monetary base.

Only available on Alkimiya’s Forecast.

P.S. Don’t miss out on updates with our onchain events calendar!

5.06K

0

孤鹤.hl (((+)))

Less than a month after the mainnet was launched, the minting volume of @yalaorg's BTC-collateralized stablecoin YU reached the upper limit of 30M, so they opened the second season on the 13th, which was full yesterday and took only ten days. Now the whole network has more than 75M supply, and we will study why the momentum is so strong.

1. Main force analysis

First of all, it can be seen on the YBTC chain that as soon as the BTC debt ceiling was opened, it was stuffed, with a total of 970 BTC, but in fact, there were only 93 addresses.

The logic behind it is not simply the endorsement of trusting @Polychain, @EtherealVC and other institutions, but the triple guarantee of CDP + self-custody + CRSM provided by yala for large investors in the early stage of the protocol.

CDP means that you can use WBTC on EVM, mainstream LST assets, or use native BTC for self-custody deposits, and the native BTC has its own address after adding a time lock, at this time the corresponding vault is created and minted YU for use, and before the time expires, the YBTC of the corresponding vault will be destroyed to ensure that the assets are anchored.

If the vault is close to the liquidation line during the time, CRSM will automatically withdraw part of the position from the YU yield scenario to repay the debt and maintain the collateral ratio, and yala's collateral system has remained stable during the sharp fluctuations of BTC in the past few days.

2. Popular tracks

Only halfway through 2025, the top 3 most out-of-the-circle topics of crypto have been locked in a seat in advance by the excellent performance of Circle after its listing: now the stablecoin war is not only concerned by the circle, but also by the outside circle.

The GENIUS bill has been passed, and @chromitemerge summarizes the current camps: the offshore faction of usdt and the secretary of commerce's son, 21 capital;

Compliance, mainly USDC and Coinbase;

The upstart USD1 is supported by the Trump family, Binance, and MGX in the United Arab Emirates, and is bound to get a piece of the pie;

Coupled with the staring of banks and technology giants, it is obvious that the whole track will get bigger and bigger, and it will not be limited to pricing digital assets.

yala's co-creation @VickyXAI is out of Circle, so why do you want to make yala? Just as USDC's profits before the listing are completely incomparable with USDT, the bigger these traditional players make the track, the more they will benefit, the more stable coin projects native to the cryptocurrency circle.

After all, the on-chain will return to the on-chain, whether it is CEX and DEX or stablecoins.

In addition to the stronger composability on the chain, the main reason is that there is too much room for compliance arbitrage and there are no additional costs brought by various regulations, so most of YU's profits will be distributed to the participants of the community, which makes YALA expand very quickly.

Even PayPal, which is as strong as the payment leader, gave a 20% subsidy annualized when it entered the stablecoin market to do pyusd in the early days, and it took 9 months to achieve about 70M supply.

3. How to participate

At present, the second phase of minting is full, but you can still get on the bus, and it is very simple for retail investors to participate, just buy some YU directly through swap, and then pledge it in the stability-pool to eat 10% interest.

Join the team:

For large investors, opening a vault to mint YU requires an annualized interest of 9%, but for retail investors, it is not necessary, and it can be exchanged with USDC 1:1, which is basically not worn.

Just look at the APR itself, which is also a stablecoin wealth management with relatively high returns at present, because the income of the debt ceiling will not be diluted too much.

In addition, in addition to apr, there are also liquidation proceeds paid by YBTC and subsequent exchange of airdrop Iceberry points, the number of addresses stored in the mainnet is thousands, and the cost of mainnet gas is not high now, so I divided several numbers to participate, and there may be surprises.

On the whole, it is a better farm choice, and the funds that have not been deposited in Plasma can participate in yala, and there are more than 400,000 YU in LP, teachers can hurry up and buy them, don't wait for the same premium as huma.

If you are free, you can also sign in every day and socially interact to receive iceberry points, but the testnet and interaction points are separated, and I don't know how they will be distributed in the future.

4. The big one is coming

I recommended yala when I was on the mainnet, but there are so many things that have happened in this month, especially the CRCL continues to reach new highs, and my confidence in yala has been further improved.

In the past, in traditional stablecoins such as USDT/USDC, retail investors contributed liquidity to institutions, and they steadily earned the yield of treasury bonds, and in many DeFi protocols, retail investors had to bear most of the smart contract risks to make some money.

In yala, it is completely different, point 3 mentions that the source of APR profit for retail investors is the interest paid by large investors on collateral BTC lending stablecoins, this model allows retail investors and institutions to form a decentralized creditor-debt relationship, that is, retail investors can become institutional creditors by holding the pledged YU, and the interest is measured in YU real-time, which is very comfortable.

I and Yala Guantui have been closed to each other from the beginning, and seeing that the ceiling of these two phases is quickly filled, it is estimated that TGE will be soon, otherwise they would not need to set the debt ceiling.

Show original

508

0

Jonah

We discuss crypto x geopolitics and try to figure out how to make money while the rally is on hold

1000x

New episode out now! @AviFelman @jvb_xyz

We discuss:

- Crypto's IPO frenzy ($CRCL)

- Trading this market: BTC vs alts

- What Happened to joyful June?

- Will treasury companies unwind?

- Geopolitical impact on markets & more!

Timestamps:

00:00 Intro

02:16 Is The Market Fading Geopolitical Conflict?

10:07 Ads (Kraken OTC, Katana)

11:48 What Happened To Joyful June?

20:30 Why Is Circle Ripping?

30:25 Ads (Kraken OTC, Katana)

32:07 Crypto’s IPO Frenzy

42:23 Will Treasury Companies Unwind?

45:32 Is Tokenization Real?

48:58 Ads (Ledger)

49:45 Tron Is Going Public

52:34 How To Trade This Market

Links below ↓

591

1

Thomas Braziel

$COIN is a clear buy here, long $COIN <> short $CRCL

@coinbase can spin up a tracking stock linked to its USDC rev-share with @circle - It could surface a steady, rate-driven cash machine the market’s burying inside $COIN—yet management keeps the core empire intact. 🧐 #USDC #Stablecoins #FinTwit

10.34K

14

CRCL price performance in USD

The current price of circle is $0.00021129. Over the last 24 hours, circle has increased by +607.25%. It currently has a circulating supply of 1,000,000,000 CRCL and a maximum supply of 1,000,000,000 CRCL, giving it a fully diluted market cap of $211,292.70. The circle/USD price is updated in real-time.

5m

-8.36%

1h

+607.25%

4h

+607.25%

24h

+607.25%

About Circle (CRCL)

Latest news about Circle (CRCL)

Circle Hits New Record With Market Cap Nearing That of Coinbase

Circle’s blistering rally reflects investor hunger for stablecoin exposure, but lofty valuation multiples are raising eyebrows.

Jun 24, 2025|CoinDesk

Fintech giant Fiserv to launch FIUSD stablecoin and digital asset platform with Circle, Paxos, and Solana

Fiserv, a top-ranked payment processing company, plans to launch a new digital asset platform and...

Jun 23, 2025|Crypto Briefing

Fiserv Joins Stablecoin Fray, Teaming Up With Circle, Paxos, PayPal for Launch on Solana

The Fortune 500 fintech provider plans to roll out its digital asset platform with U.S. dollar stablecoin FIUSD to 10,000 institutions and 6 million merchants.

Jun 23, 2025|CoinDesk

Learn more about Circle (CRCL)

Circle’s Explosive IPO: ARK Invest’s $243M Sell-Off and Strategic Portfolio Shift

Circle’s IPO Performance: A Historic Surge in the Crypto Industry Circle, the issuer of the USDC stablecoin, has achieved a groundbreaking milestone in the financial world with one of the most explosive IPO performances in U.S. history. Within just two weeks of its public debut, Circle’s stock soared by approximately 670%, climbing from its IPO price of $31 to an impressive $240.28. This remarkable growth has solidified Circle’s position as a key player in the crypto and fintech sectors, raising over $500 million during its IPO.

Jun 23, 2025|OKX

Circle IPO Crypto: A Game-Changer for Public Markets and Stablecoin Regulation

Circle IPO Crypto: A Milestone in Public Markets The Circle IPO has emerged as a defining moment for the cryptocurrency industry, marking a significant shift in how crypto-native companies are perceived in traditional equity markets. With CRCL stock soaring nearly 290% within days of its NYSE debut, the event has set a new benchmark for crypto IPOs and ignited a wave of interest among investors and other crypto firms eyeing public listings.

Jun 17, 2025|OKX

Circle IPO Sparks Crypto IPO Wave: What Investors Need to Know

Circle IPO Crypto: A Defining Moment for the Industry The recent IPO of Circle, the issuer of the USDC stablecoin, has marked a pivotal moment in the cryptocurrency industry. With CRCL stock soaring nearly 290% above its initial offering price, Circle’s debut on the New York Stock Exchange (NYSE) has ignited a wave of interest in crypto IPOs. This article explores the implications of Circle’s IPO, the emerging trend of crypto companies going public, and what investors should watch for in this evolving landscape.

Jun 17, 2025|OKX

Circle IPO: A Game-Changer for Crypto Companies and Investors

Circle IPO Crypto: A Milestone in Public Markets Circle, the company behind the USDC stablecoin, made headlines with its groundbreaking IPO on June 5. Listed on the New York Stock Exchange (NYSE) under the ticker CRCL, Circle’s debut was nothing short of spectacular. Priced initially at $31 per share, the stock surged to $82.84 by the end of its first trading day—a remarkable 167% gain. Over the next two days, the momentum continued, with shares peaking at $120.96, marking a 256.44% increase in just three days.

Jun 17, 2025|OKX

CRCL FAQ

What’s the current price of Circle?

The current price of 1 CRCL is $0.00021129, experiencing a +607.25% change in the past 24 hours.

Can I buy CRCL on OKX?

No, currently CRCL is unavailable on OKX. To stay updated on when CRCL becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of CRCL fluctuate?

The price of CRCL fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Circle worth today?

Currently, one Circle is worth $0.00021129. For answers and insight into Circle's price action, you're in the right place. Explore the latest Circle charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Circle, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Circle have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.