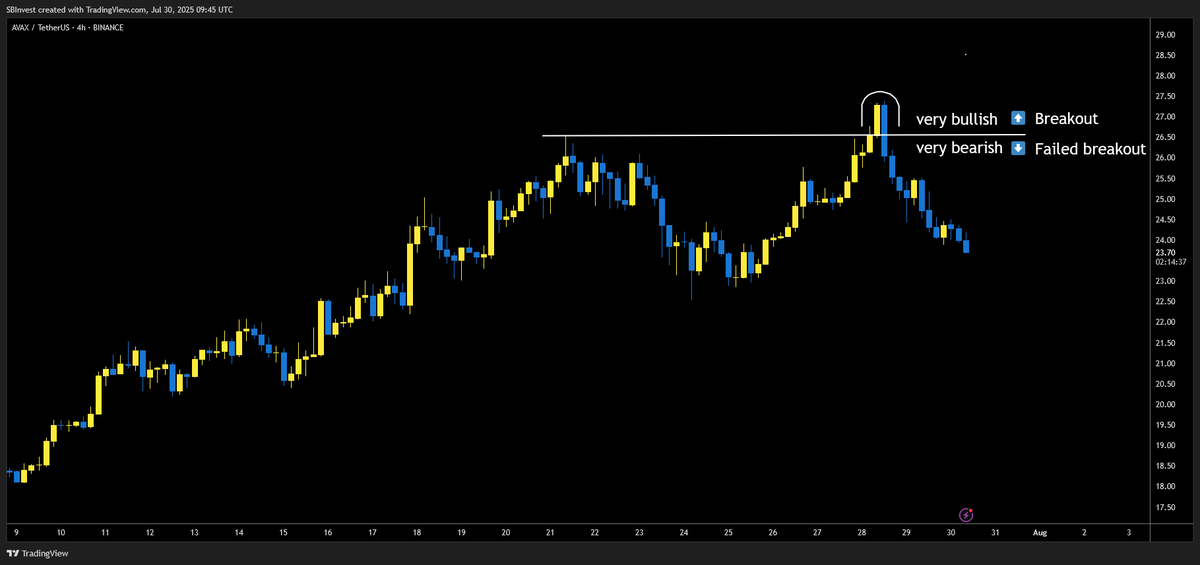

Since I'm occasionally asked how it's possible that I'm very bullish on a coin one day and very bearish the next, I'll explain it to you using $AVAX as an example.

Two days ago, there was a horizontal breakout. A very bullish pattern. As long as the coin stays above the resistance and turns it into support, it's very bullish 📈

But as soon as it loses support, it becomes a failed breakout or fakeout. And that, in turn, is a very bearish pattern 📉

Many new traders don't react in this situation, thinking, "Okay, it will just break out again tomorrow." Professionals, however, recognize the signal and react quickly, flipping short.

For long-term investors, reacting to short-term movements isn't important.

But for short-term traders, it's even more important to be able to switch quickly and calmly from bullish to bearish and bearish to bullish.

I hope this helps a little bit.

9.89K

46

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.