MiCA is setting a new standard for regulated digital asset access across Europe 🏛️

@CoinSharesCo has introduced a staked SEI ETP, giving institutional investors a compliant path to @SeiNetwork through a familiar, exchange-listed format backed by real yield

$SEI is no longer limited to crypto-native circles. It now sits within the infrastructure of traditional finance

Here’s why that matters 🧵👇🏻

1/ A compliant gateway for institutional capital

@CoinSharesCo has launched a physically backed SEI ETP under the ticker CSEI, listed on the SIX Swiss Exchange

It provides direct SEI exposure within a structure compatible with leading brokerages and custodians across Europe

$SEI can now be allocated like an equity inside traditional investment portfolios

2/ Built-in staking yield with no operational friction

The ETP delivers a 2 percent annualized staking yield, paid directly to holders

There is no delegation, no validator setup, and no token lockup required

$SEI becomes a passive income asset that fits seamlessly into institutional custody flows

You can check full guide here:

3/ Multi-issuer landscape signals confidence

Valour was the first to bring a SEI ETP to market earlier this year

With @CoinSharesCo now involved, institutions have multiple regulated onramps into Sei exposure

The expansion of structured access reflects growing conviction in $SEI as an investable asset

4/ Infrastructure purpose-built for performance

@SeiNetwork was designed from day one to serve high-throughput, latency-sensitive applications

It achieves ~300 millisecond finality and processes up to 12,500 transactions per second using Twin Turbo consensus

$SEI supports real-time use cases where execution speed directly impacts outcome

5/ Layer 1 order-matching at protocol level

Sei integrates a native matching engine into the base layer of the chain

This enables onchain DEXs to execute trades with lower latency and more deterministic performance

$SEI brings deep infrastructure innovation that directly enhances decentralized markets

6/ The first parallelized EVM in production

With its v2 upgrade, @SeiNetwork deployed the world’s first parallelized EVM execution layer

Ethereum-native apps can deploy without modification while benefiting from parallel processing and faster finality

$SEI now powers an EVM-compatible environment capable of scaling high-volume applications

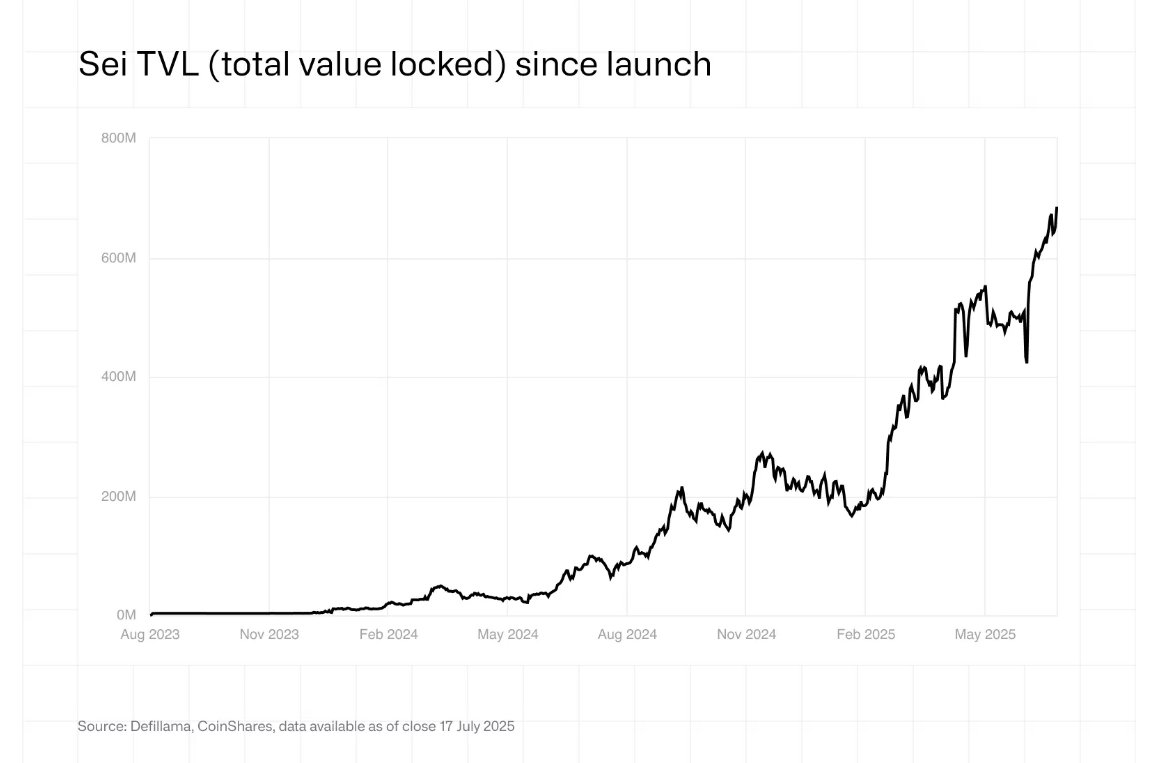

7/ Strong growth in onchain activity

Sei’s Total Value Locked has nearly tripled in 2025, now exceeding $600 million

It leads Aptos, Sui, Cardano, and Polygon PoS in daily active addresses as of June

$SEI activity is driven by real usage, not speculation

8/ Gaming and DeFi apps are gaining traction

Games like World of Dypians and Europe Fantasy League now record over 50,000 daily transactions

Trading platforms and lending protocols like Sailor Finance and Yei are live and scaling

$SEI is proving its value through consistent, high-volume execution across verticals

9/ A focused transition to EVM architecture

In June, the community advanced a proposal to phase out Cosmos-based accounts

@SeiNetwork is now prioritizing full EVM alignment to consolidate liquidity, tooling, and developer adoption

The $SEI roadmap is centered on performance, compatibility, and long-term scalability

10/ Backed by strategic capital and public interest

Sei was shortlisted by Wyoming’s Stable Token Commission for potential stablecoin issuance

It is supported by Coinbase, Circle, GSR, and Flow Traders, firms aligned with performant, compliant infrastructure

$SEI is gaining recognition across both institutional and sovereign actors

11/ MiCA unlocks distribution at scale

@CoinSharesCo is the first crypto asset manager in Europe to receive full MiCA authorization

The SEI ETP is passported across jurisdictions, allowing cross-border distribution within regulated frameworks

$SEI is now positioned for inclusion in professional and institutional strategies across the EU

12/ The financialization of performant blockchains

Sei has crossed a critical threshold where high-speed infrastructure meets regulatory readiness

It is no longer just a fast L1. It is a yield-bearing, compliance-aligned asset class

$SEI is now available to allocators seeking scalable exposure through public markets

Final thoughts

Most blockchains aim for adoption first and legitimacy later

@SeiNetwork built the infrastructure first, scaled real usage, then opened the gates to institutional capital through compliant structures

$SEI is no longer just a network token. It is now an investable asset inside the architecture of global finance 🧠

36.25K

148

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.