Superseed is the first L2 to use its revenues to enable self-repaying loans at the chain level.

Through Supercollateral, users can unlock liquidity without selling, while protocol fees automatically pay off debt.

Today, we've released a new Deep Dive report on Superseed 👇

Today, DeFi borrowers face 2 key challenges:

1. Users incur interest costs & need to manage repayments & collateral ratios themselves.

2. Value accrued from protocols goes to lenders, token treasuries, etc. (not users)

@Superseed is designed to solve both of these problems.

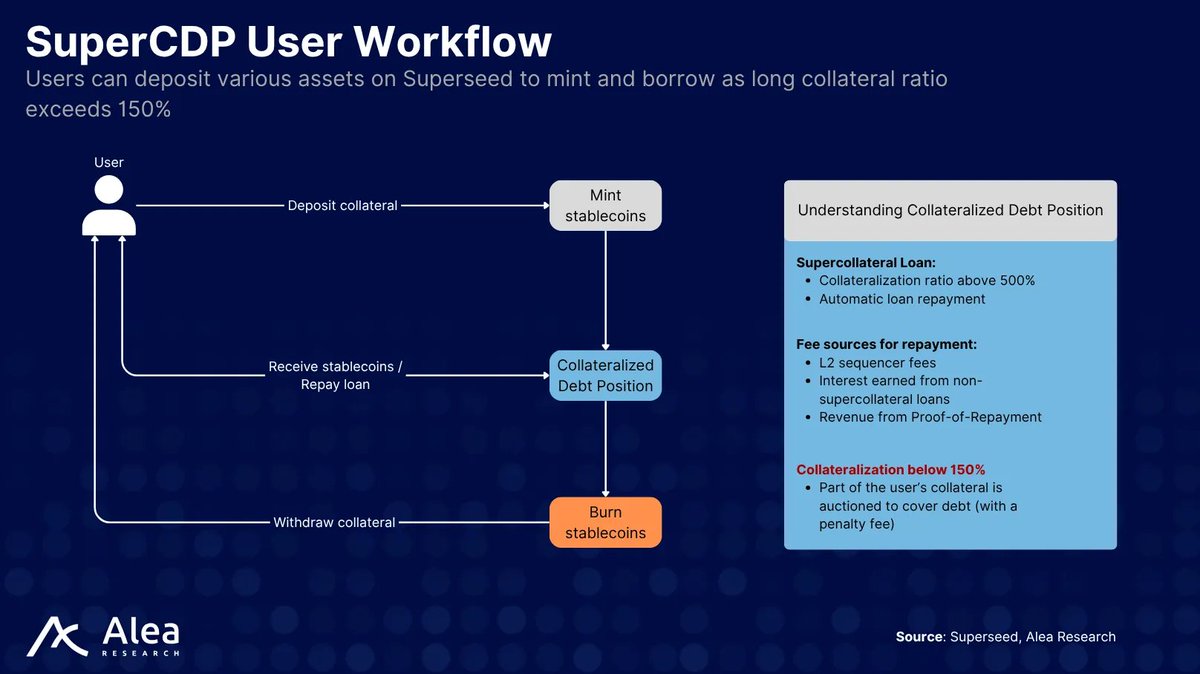

At the core of the protocol mechanics is the SuperCDP, a native Collateralized Debt Position protocol.

Users can mint the Superseed stablecoin by locking assets, including:

- $SUPR (Superseed native governance token)

- $WBTC

- $ETH

The value of locked collateral must exceed 150% of the stablecoin amount borrowed.

Borrowers who lock $SUPR at a 500% collateralization ratio incur no interest and see their principal automatically amortize over time as protocol earnings flow into CDP vaults.

Superseed’s protocol earnings consist of:

- L2 sequencer fees

- Interest from non-Supercollateral loans

- Proof-of-Repayment revenue

- Native yield staking bridge revenue

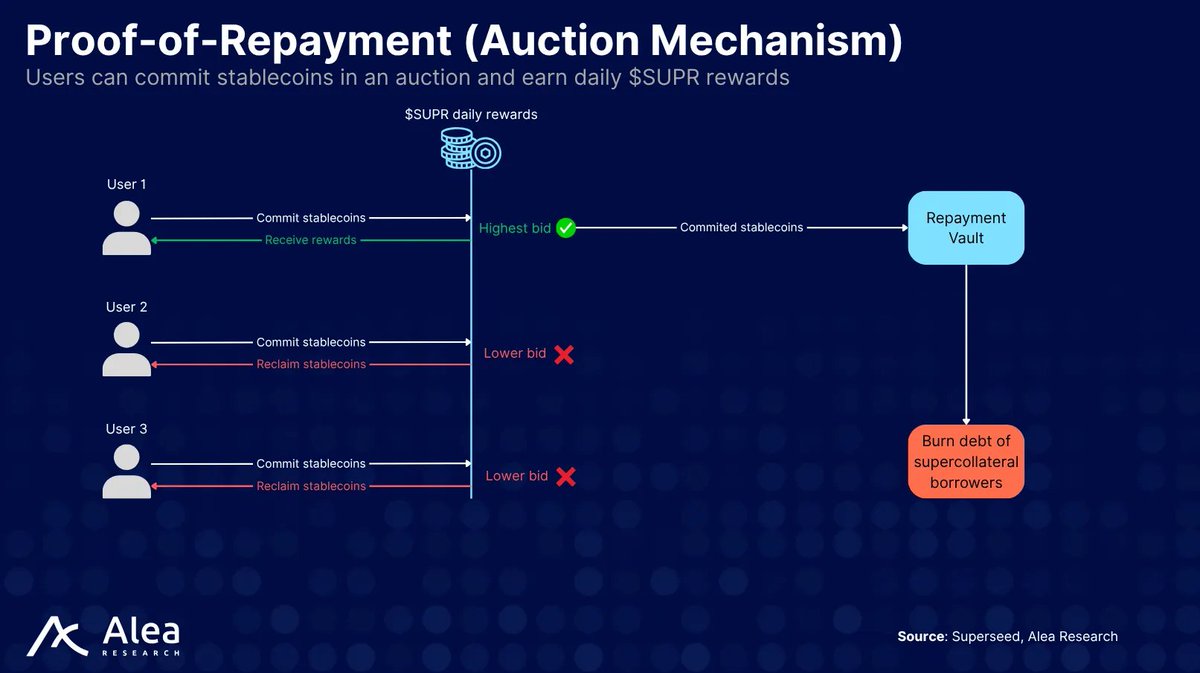

Proof of Repayment

Daily auctions allow users to commit stablecoins to repay the loans of borrowers using Supercollateral.

Participants bid to offer the highest amount of stablecoins, with the auction winner earning $SUPR rewards.

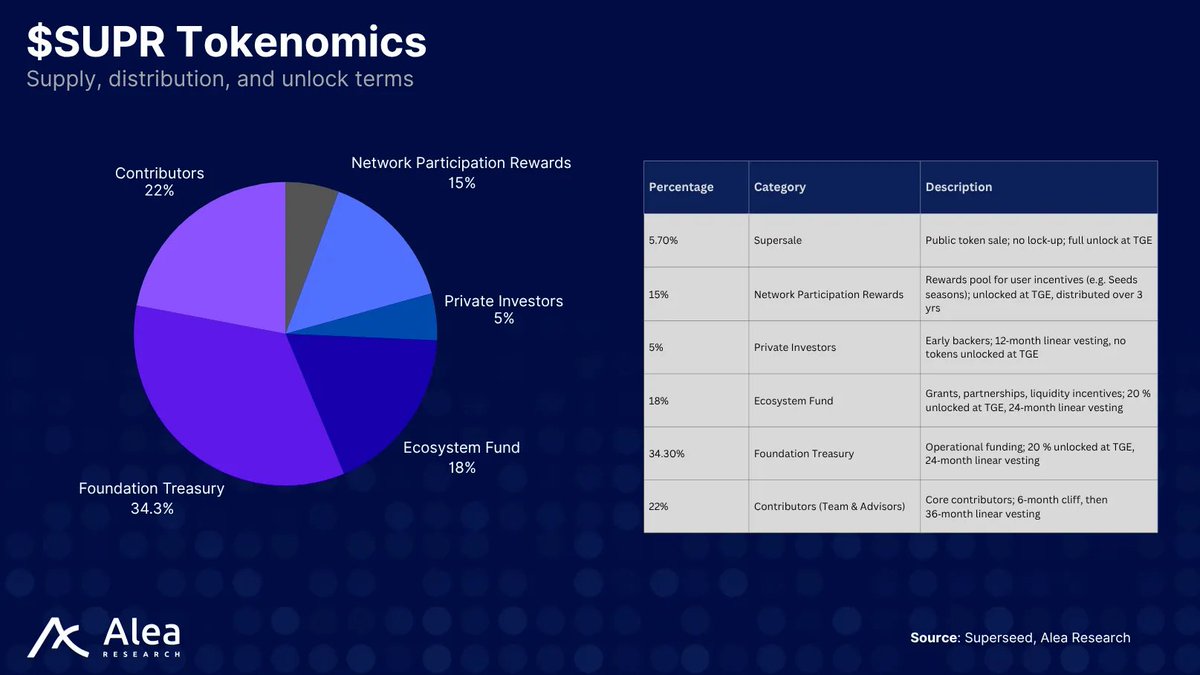

At the heart of Superseed is its native token, $SUPR.

By minimizing reliance on VCs, Superseed implements a token distribution system that puts users first, especially those active in the onchain ecosystem.

$SUPR prioritizes public sale participants, with no token lockup post-TGE.

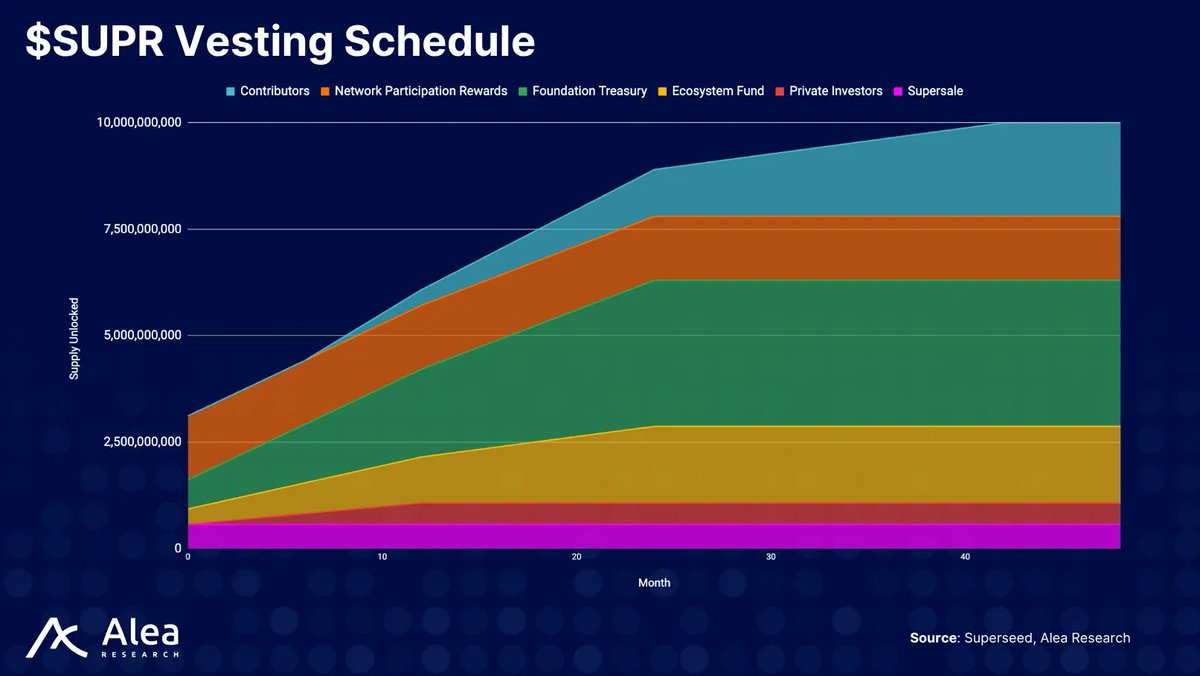

The token has an initial supply of 10B, with 2% annual inflation to come into effect via the PoR mechanism.

If you found this thread informative, our full-length @SuperseedXYZ Deep Dive report explores the chain's architecture and embedded DeFi capabilities, $SUPR tokenomics & more.

Access here 👇

8K

41

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.