Drips Season 10

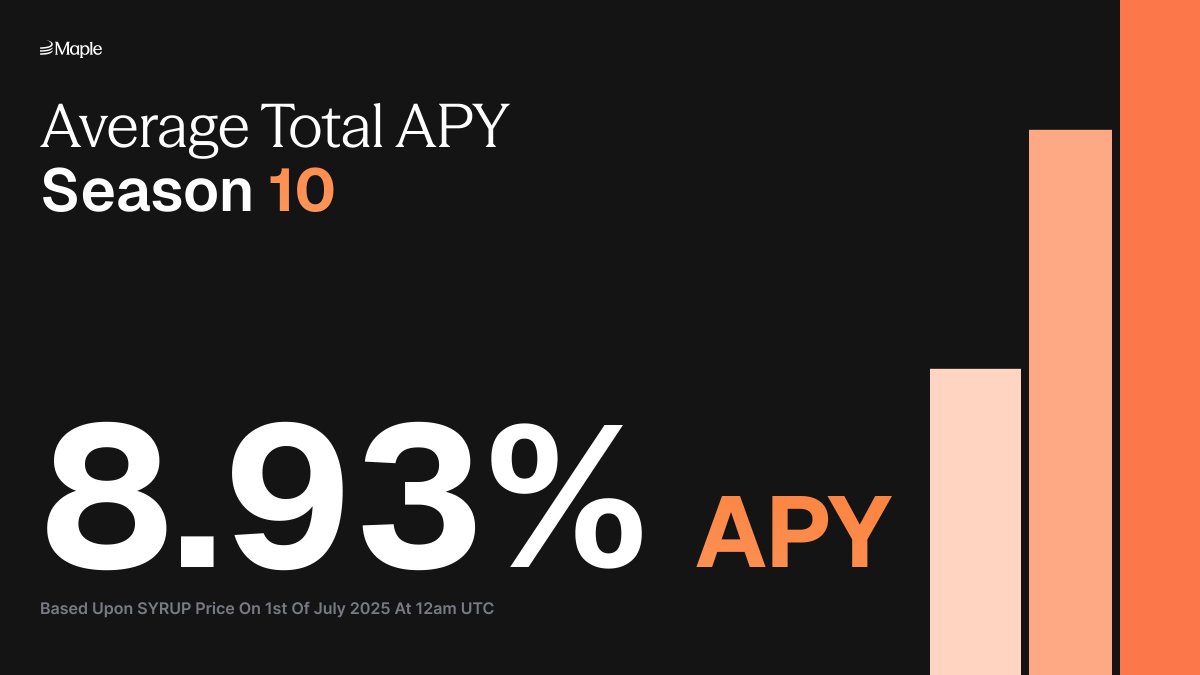

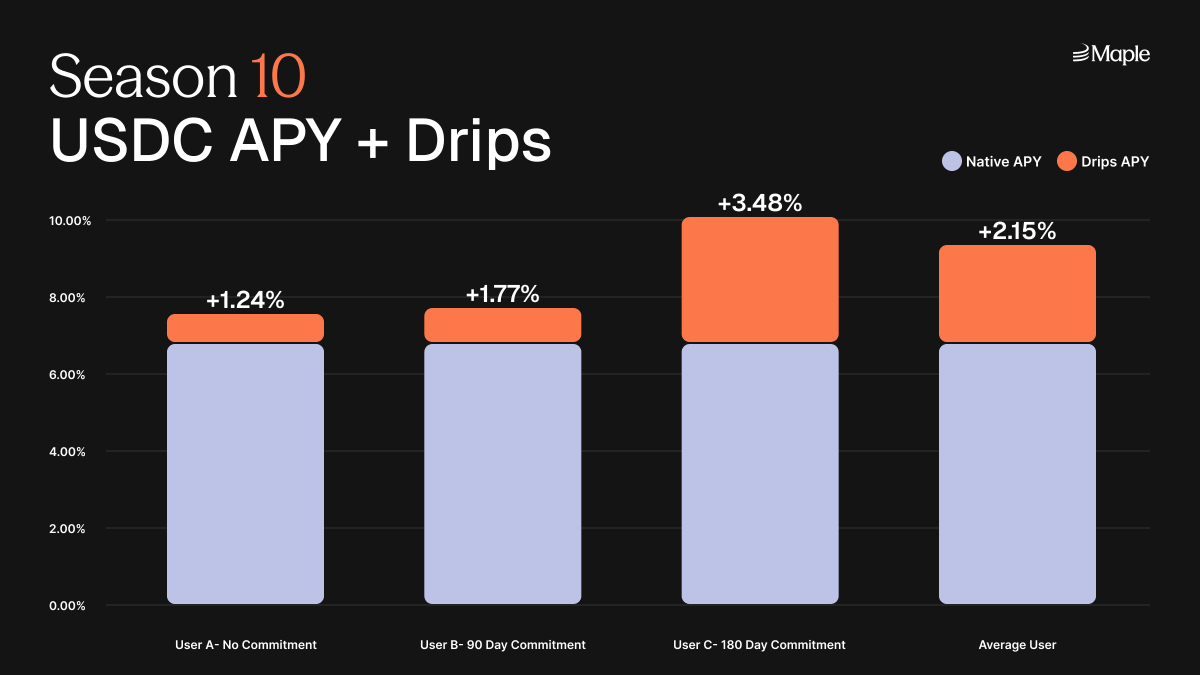

syrupUSDC delivered 8.93% average total APY for users, outpacing DeFi peers by 2-3%.

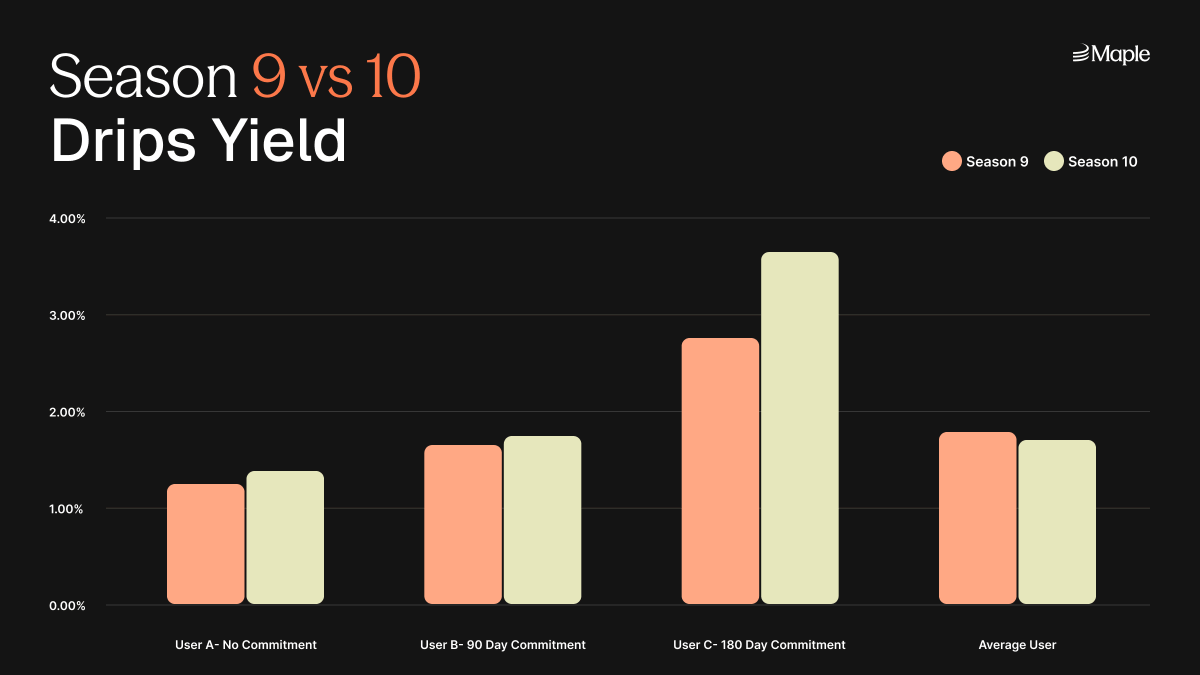

Drips APY increased for all users compared to season 9, showing Maple's growth flywheel in full effect.

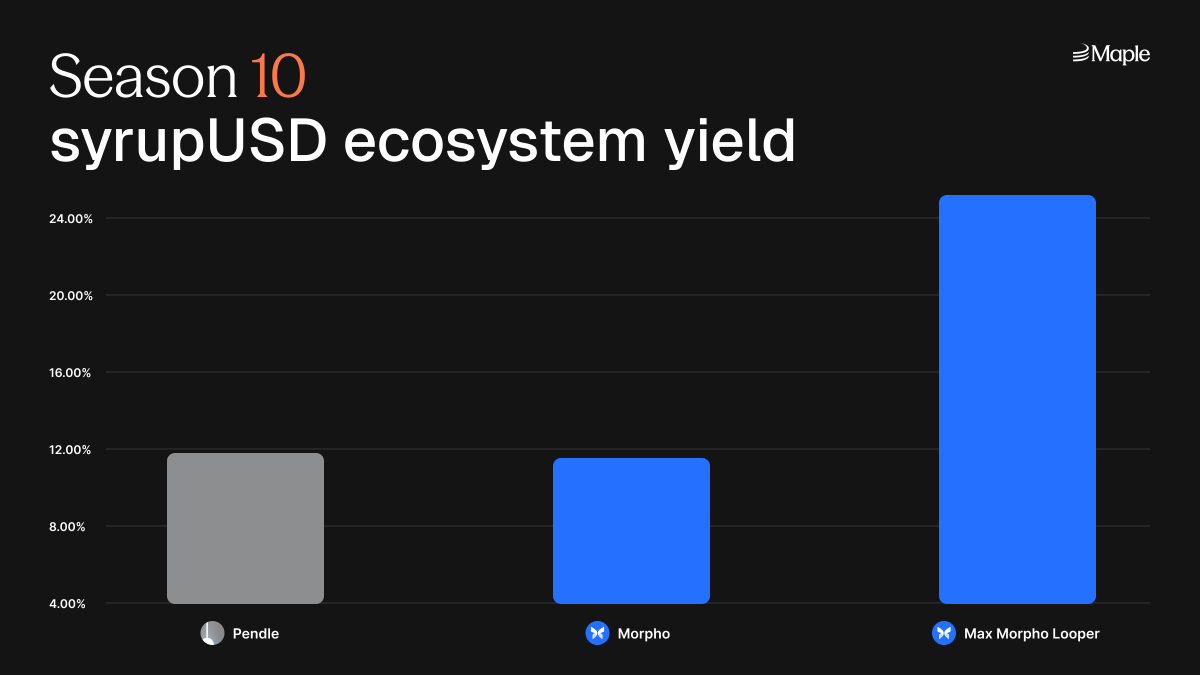

Users earned up to 30% with DeFi strategies.

All details below:

Season 10 was the strongest season in syrupUSDC history.

syrupUSDC scaled to $1.8B+ in AUM with almost $1B in deposits, making it a top 3 yield bearing dollar asset.

Drips APY was higher for all users in different categories.

syrupUSDC has established itself as a premier DeFi asset through its partnerships with top DeFi apps.

@sparkdotfi has an allocation of $400M+ into syrupUSDC, with an additional $150M+ in @MorphoLabs, $125M+ in @pendle_fi and $45M+ in @KaminoFinance.

syrupUSDC also passed the temperature check on @aave.

Users earned between ~12% and ~25% through the variety of DeFi use cases powered by syrupUSDC.

37.45K

188

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.