This Week’s Alpha Allocation: @Uniswap

• Sector: DeFi (DEX infrastructure)

• Token: $UNI

→ Project Insight

Uniswap remains the liquidity backbone of DeFi, having settled $2.75 trillion+ in lifetime volume with zero protocol-level exploits.

The January-launched v4 upgrade slashed pool-creation gas costs by 99 % and introduced Hooks; plug-in smart-contract modules that let builders add dynamic fees, MEV-resistant curves and on-chain limit orders to any pool, turning Uniswap into a “DEX operating system.”

→ Catalyst

1. Fee-Switch Countdown:

The Uniswap Foundation won community approval for a $165 million Unichain & v4 growth fund, reviving plans to route a slice of protocol fees to $UNI holders. Yield-bearing UNI would be a game-changer.

2. Hook Ecosystem Snowball:

150+ hooks (Aegis, Bunni, Dynamo) are live or in audit, expanding Uniswap’s moat with custom liquidity curves and automated LP strategies.

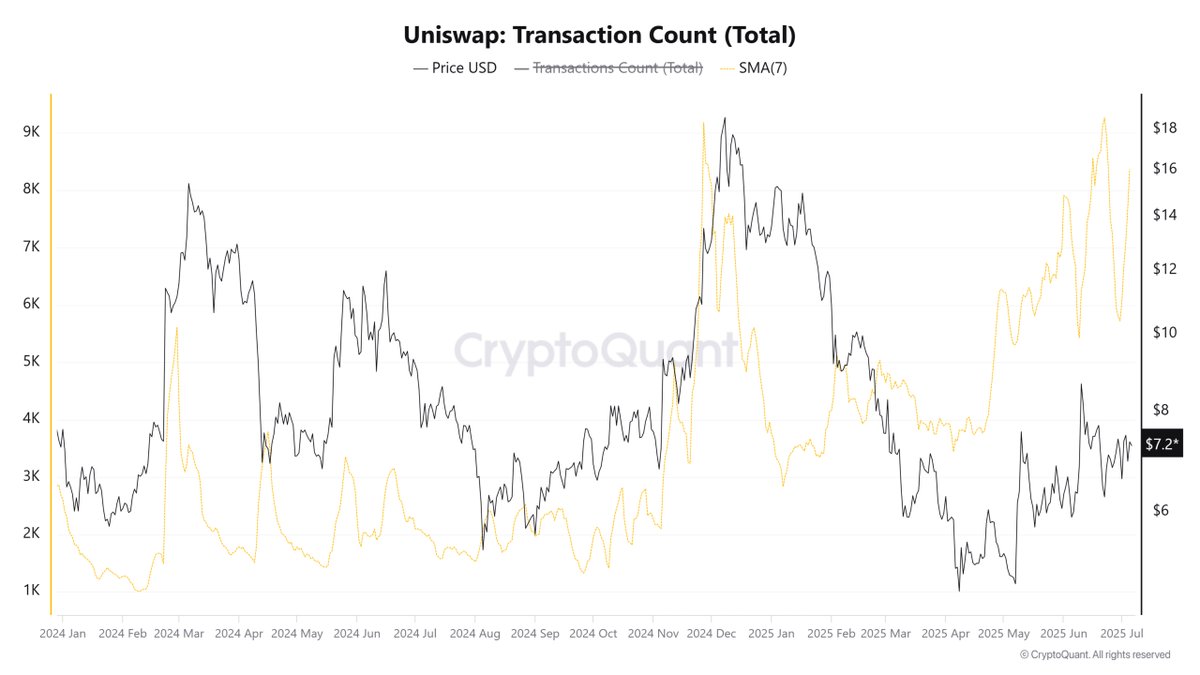

3. On-Chain Demand Rising:

$UNI transaction count has climbed steadily since mid-April, signalling growing spot demand.

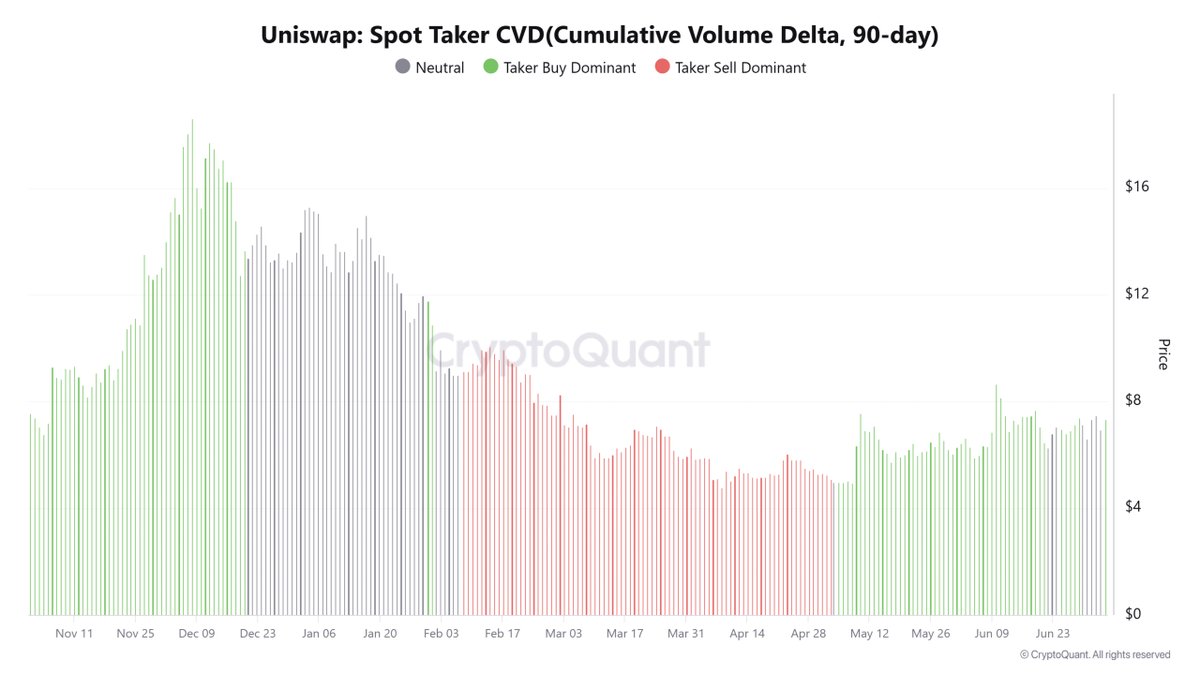

4. Bullish Spot vs. Cautious Futures:

Spot-taker CVD has been positive and rising since May (aggressive buys), even as retail futures activity flashes “overheated.” Mixed flows = fertile ground for breakout volatility.

→ Why You Should Buy Now

• Asymmetric Re-rating: $UNI still trades ~63 % below the December ’24 high despite v4 going live and the fee switch on deck.

• Token-to-Revenue Alignment: Once fees stream to stakers, UNI becomes a cash-flow asset, not just governance fluff.

• Modular Network Effect: Hooks lock builders, and their liquidity-in, turning Uniswap into the default router across 10+ chains. Gas savings deepen LP depth and swap volume, reinforcing the loop.

→ My Price Prediction

$UNI is consolidating around $7.20–7.50. A daily close above $8 flips December resistance to support and opens a run toward $12–14 (≈ +90 %).

Failure to reclaim $8 likely leads to a liquidity sweep toward the 50-day MA near $6.20 before another attempt.

→ Rotation Narrative

The market is rotating from ultra-spec L2 memes back into cash-flow DeFi.

With fee income pending and modular DEX innovation exploding, $UNI is the “dividend stock” of on-chain liquidity; a markedly different risk-reward than high-FDV, no-revenue L2 tokens.

If you want exposure to sustainable DeFi yield plus upside from a token-model overhaul, $UNI is the clearest bet on the board right now.

4.21K

39

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.