Why Jupiter's JLP premium is cooked:

As many of you know from past posts and livestream I was a huge advocate for JLP

Here are the reasons why I'm rotating out of it and where I'm reallocating that liquidity

1/ failed to build a perps product that hit escape velocity and appealed to traders / users

UI is not great compared to now new existing other alternatives, last main airdrop allocation to traders using perp product was poor

we can see this take backed by the fact that the entire product currently has only ~$400M in OI currently

this may sound like a lot but for context the OI of just FARTCOIN on Hyperliquid is ~$270M, and on bigger pairs like BTC its ~$2.9B

Less trading / OI = less fees to the Jup perps platform = less fees to JLP holders, thus why the APY return is now in the negative

2/ Current weighting isn't ideal at this stage in the market

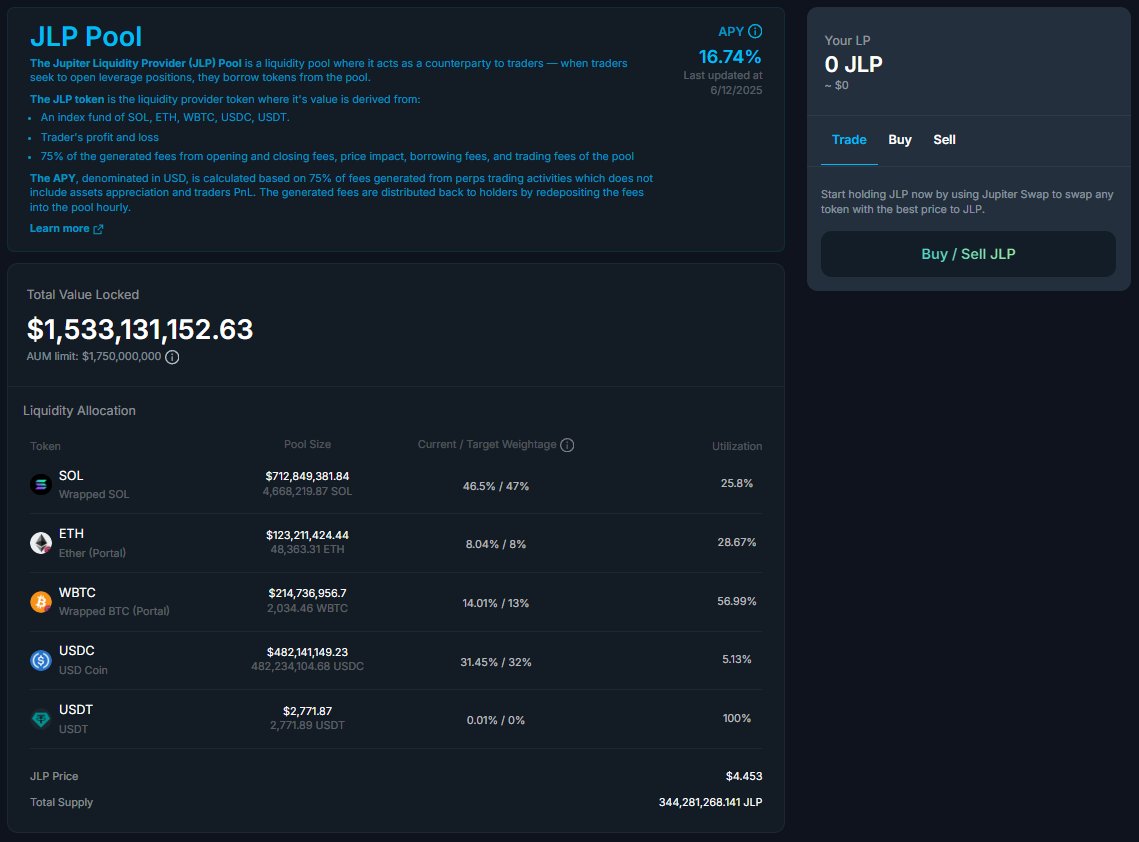

SOL = ~47%, ETH =~8%, BTC = ~14%, USDC = ~31% USDT = 0.01%, TLDR very high SOL and USDC weighting

If I want SOL exposure - I either just hold SOL or borrow it against something correlated to it like BTC

I would like the BTC exposure for JLP to be at least 30% from its current 14%

Stables can be more productive by depositing it in things like Openeden or level

Or deposited into a vault in a tokenless perps protocol like Paradex and Lighter where I can farm yield and easy "passive points"

3/ Opportunity costs + lack of future catalysts

Makes more sense to do a few clicks + get exposure to airdrops on new protocols > than holding onto $JLP

There's no Jupiter Season 3 (Jupuary) in sight

Even if there were, based on how S2 went users are unlikely to bother farming JUP perps again when they could be doing HyperEVM or other tokenless perp DEXs like Extended, Paradex, Lighter, Ostium, Variational, ect..

For all the reasons mentioned I think it's unlikely that a sudden rebound in Jup perps volume and OI will happen anytime soon and is more likely to keep bleeding from here

Post inspired by @katexbt posts from around a week ago

6.74K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.