Since the concept of DeFAI was born at the beginning of the year, I initially thought it was just about "having the chat box help you click on DeFi a few times and provide some strategies." I didn't expect that half a year later, several "AI fund managers" have already delivered impressive results. While it's bustling, it's also time for our mid-year evaluation 🤔

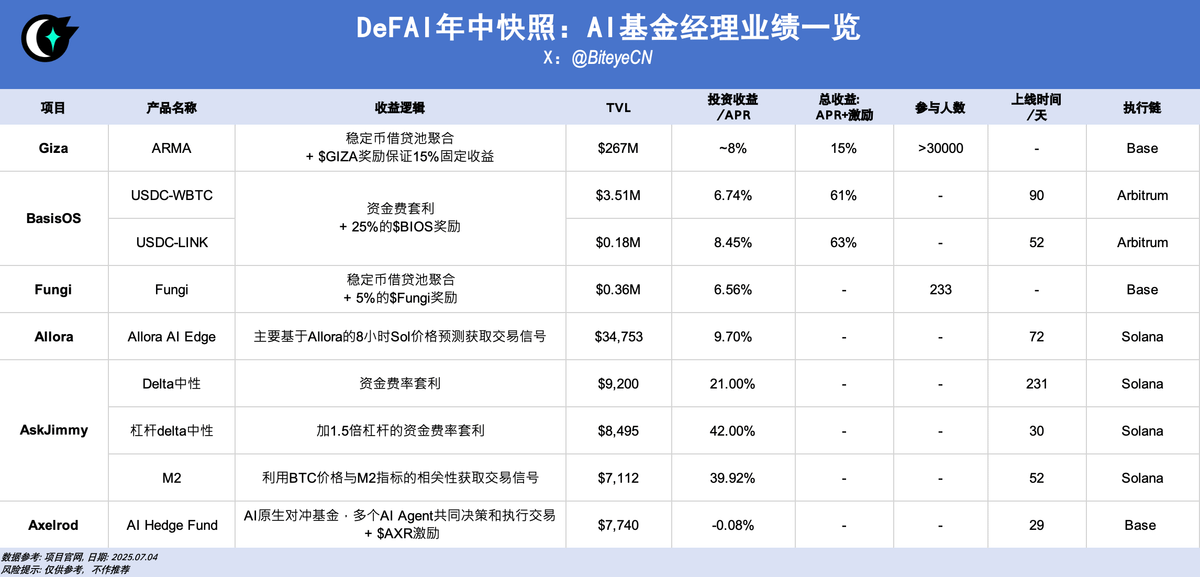

Here we have compiled several DeFAI projects with publicly available performance, with an APR as high as 42%! A table to directly view returns + scale + strategies, strengths and weaknesses are clear at a glance 👇

‼️ Wait, the information on the table isn't enough? Want to dig deeper into their strategy details & project gossip? Click on the thread for a detailed discussion 🧵

Giza @gizatechxyz has a huge ambition to create a decentralized "quantitative backend". The first test bomb is ARMA, and so far, the results look quite good.

In simple terms, ARMA is a 24/7 AI brick mover that helps you put stablecoins into the most profitable lending pools to earn interest.

The operation process is roughly as follows:

- Network scanning — Real-time monitoring of all stablecoin lending pools, calculating APR, incentive tokens, and Gas costs.

- Careful selection — If returns > costs? Adjust positions immediately; if returns lag? Turn around and run.

- Automatic compounding — Reinvest the earned interest, allowing returns to snowball.

Worried about insufficient returns? The official has set a bottom line:

- Guaranteed annualized return of 15%.

- If the actual return is < 15%, the system will airdrop $GIZA tokens weekly to make up the difference.

The result is — a stable strategy + a 15% floor price, allowing ARMA to quickly grow into the largest DeFAI vault by TVL.

Is that all? ARMA is probably just the appetizer served by Giza; what will the next course be? It's worth keeping an eye on.

The gameplay summary of @BasisOS (one of the star projects launched by the @virtuals_io ecosystem) is as follows:

"Buy spot with your left hand, short perpetuals with your right hand, and no worries even if the market goes crazy—just profit from the fee difference."

Breaking it down, this is classic "basis arbitrage":

- Spot side—buy the underlying asset (currently WBTC, LINK);

- Derivatives side—open a short position on the same asset at a decentralized perpetual exchange;

- Automatic rebalancing—AI scripts continuously adjust the long-short ratio to lock in a market-neutral position with Δ=0;

- Cash harvesting—capture funding fees & price deviations; market fluctuations don't affect me, the bigger the volatility, the happier I am.

There’s also a powerful token incentive: 25% of the total supply of $BIOS will be gradually released to investors over 12 months. The earlier you enter, the more you mine; the later it gets, the scarcer it becomes (typical halving curve). Currently, with early accumulation, the price of $BIOS is high, and total returns exceed 60%.

In summary: BasisOS provides you with an automated money printer that allows for "long and short holding, guaranteed returns"—ensuring stable income flows in both bull and bear markets.

@FungiAgents and Giza's ARMA belong to the same type of "on-chain brick mover," currently focusing on optimizing USDC yields on the Base chain, diligently moving funds to the pools with the highest net APR.

The difference lies in the token incentive measures, with the team releasing 5% of the native token $Fungi to reward LPs. The rules are very DeFi: the more you deposit and the longer you stay, the higher your points weight, and the more rewards you earn.

Currently, the strategy for stablecoin arbitrage is somewhat like a money market fund: low directional risk and moderate volatility. However, a low threshold also means it's easy to get "rolled in," and when similar strategies cluster together later, whether it can continue to steadily profit from the price difference will depend on its rebalancing efficiency and gas control.

@AlloraNetwork is an open AI network built on Cosmos. In simple terms, it aims to change the traditional ML approach of "everyone doing their own thing" and initiate a "model collaboration" mode, allowing multiple AI models to work together, check each other's work, and reward one another. Theoretically, this will lead to models becoming smarter and more efficient over time.

Based on this concept, Allora has already developed predictive models for mainstream assets like BTC and SOL, and has officially launched the product Allora AI Edge on Vectis:

- It primarily focuses on providing an 8-hour price prediction for SOL based on the Allora model, with automatic rebalancing every 3 hours according to backend data;

- When high volatility is predicted, it hedges using futures, options, or inverse positions, aiming to maintain a neutral/low exposure;

- Self-evolution: multiple models continuously learn from each other, with real-time data flowing back into the network, forming a self-evolving closed loop of "real money teaching models."

Objectively speaking, this is a strategy that dares to step out of the "stablecoin comfort zone": directly throwing AI trading models into the real market, feeding data with real money, which is commendable courage. After two months, it has achieved an annualized return of over 9% and a maximum drawdown of 1.12%. The results are not flashy but quite acceptable.

However, with a TVL of only over $30,000 compared to the hundreds of thousands of dollars in stable arbitrage funds, it is clear that there are more "onlookers" than "actual participants."

The next step is to see if it can attract onlookers into the market with a longer time frame and a more attractive curve—if it succeeds, funds will naturally flow in; if not, it may just remain a small experimental field for research, sharpening its algorithms first.

@askjimmy_ai is an AI investment platform under the @arcdotfun framework that was once highly regarded by the market. Currently, it has three strategies available:

- Delta Neutral: Capture inefficiencies in the market to perform funding rate arbitrage: open a position in perpetual contracts with liquidity daily trading > 1 M USD and hourly funding rate > 0.007%; if the average rate over the past 24 hours turns negative, close the position.

- Leveraged Delta Neutral: Apply 1.5× leverage to the above strategy, amplifying both returns and risks.

- M2: Study the historical correlation between BTC prices and global M2 supply: go long during liquidity easing and short during tightening.

The TVL of all three strategies is still in the "four-digit dollar" range, but the APR is far ahead on our leaderboard. However, if you take a closer look at the rebalancing operations in the backend, you'll find that the trading frequency is quite limited. The leveraged Delta Neutral strategy, which has the highest APR of 42%, has not had any public rebalancing records since April of this year, so whether the APR is inflated needs to be considered.

The headliner @AIxVC_Axelrod is another project daring to step out of its comfort zone, also part of the @virtuals_io ecosystem, and tasked with running the ACP (the protocol responsible for Agent interconnectivity within the Virtuals ecosystem). Officially positioned as an "AI-native hedge fund": it coordinates over 20 AI Agents, including AIXBT, WachXBT, and Gigabrain, to assess the best entry and exit points, and automate spot and contract trading.

Axelrod AI Hedge Fund has the shortest launch time but the biggest ambition—it aims to create a professional investment team composed of AI Agents with clear roles and smooth communication: for example, WachXBT handles security checks, Gigabrain provides entry price coordinates, MCP manages internal processes, and ACP connects to external highways.

Currently, the project has been public for less than a week, but it has already set an investment threshold: staking/holding 500,000 $AXR is required for subscription.

The person in charge has given a warning: let the Agents acclimate first, and only after running the ACP will they discuss making profits.

So, although the net value is still negative, the TVL is showing good growth. On one hand, the Virtuals ecosystem is already thriving, and $AXR can be considered a leader among leaders; on the other hand, the official statement clearly mentions that early participants will receive $AXR rewards. With these two factors combined, bold investors have jumped in.

Overall, Axelrod carries a significant vision and is not lacking in popularity, making it worthy of long-term attention; however, before the net value turns positive, whether you are willing to invest real money to support its development depends on how much faith you have in this blueprint.

Conclusion:

The above are the few DeFAI yield strategies we've uncovered and that have publicly available performance reports. Overall, they focus on stability, but there are also some aggressive pioneers. After reading this, do you think that just a few more lines of code or a little more courage is all that's needed to let AI handle your investments and watch the profits roll in?

If you have a more powerful AI investment portfolio, feel free to share it in the comments—let's help each other avoid pitfalls and make more money together 👇🏻

19.78K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.