[ Daily News #961 ]

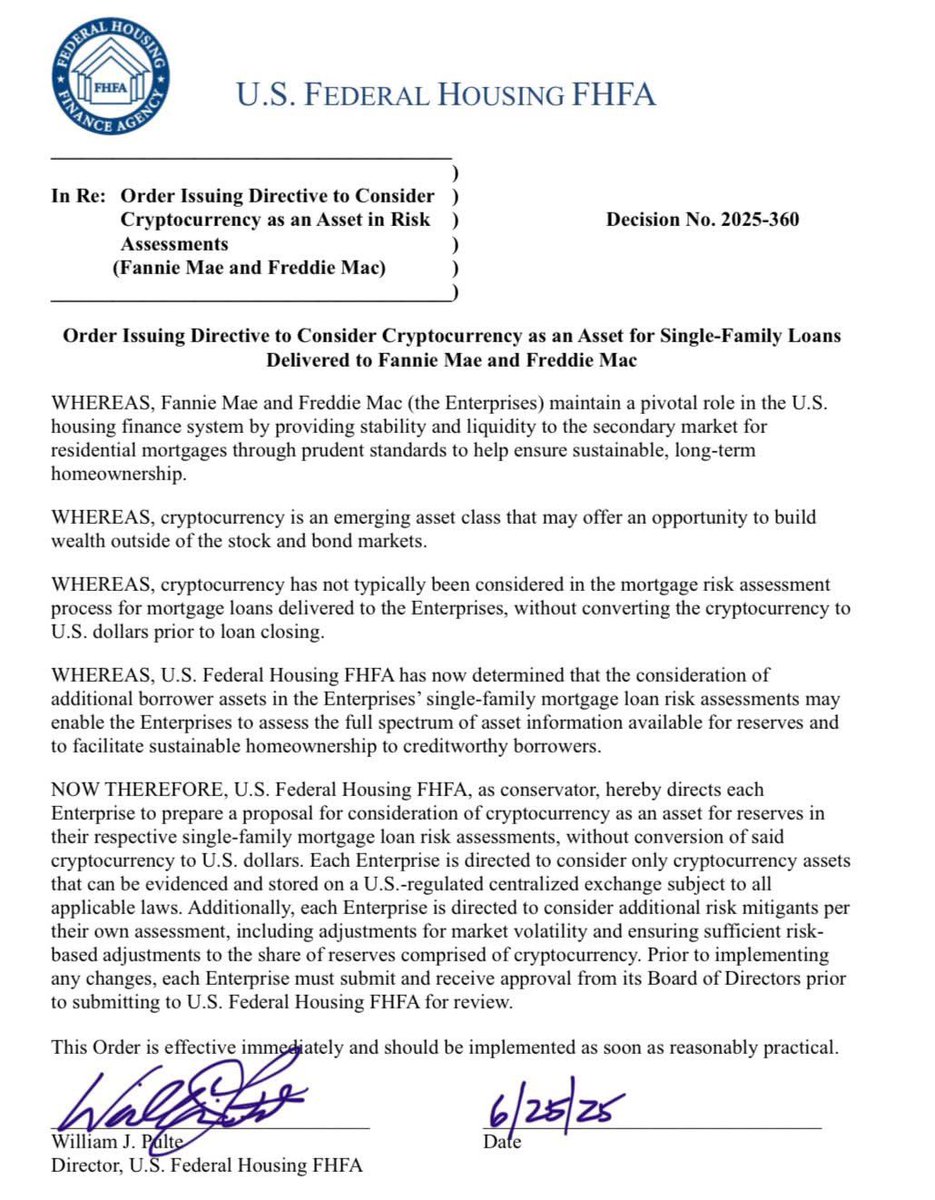

Based on the newly issued directive by the U.S. Federal Housing Finance Agency (FHFA), crypto may soon be considered in the same class as structured assets , a massive leap from its previous speculative nature. It’s still under review, but if this becomes reality, it would be absolutely wild.

In modern financial history, it’s extremely rare for an asset class to be institutionalized this quickly. Crypto, barely two decades old since Bitcoin’s birth, is moving at a speed traditional assets never did. Gold took centuries. Stocks took decades. Crypto? It’s moving in years.

This might just be the beginning of a whole new chapter.

—

👉 Follow Jason on X: @Jasoncoin68

📍 Check more insights on Binance Square:

Personal opinion. Not financial advice.

3.37K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.