Reinsurance Investment Protocol Re, Pendle Pool Emerges

Re is a project that generates profits through reinsurance and returns them to holders. It had a $21M investment and collaborated with Ethena, and for more details, please refer to the previous post ().

This Re has launched a reUSDe pool on Pendle.

With a TVL of $142M and deposits of Ethena USDe / sUSDe assets, it seems like their progress is good, so I deposited the idle sUSDe to convert it into reUSDe and then staked it as LP on Pendle.

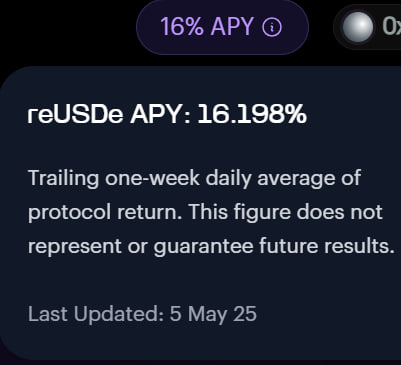

They don't have a point system yet, but last week's interest rate was as high as 16%.

Unless there are major insurance-related incidents, I think they can consistently generate steady interest regardless of the crypto market situation.

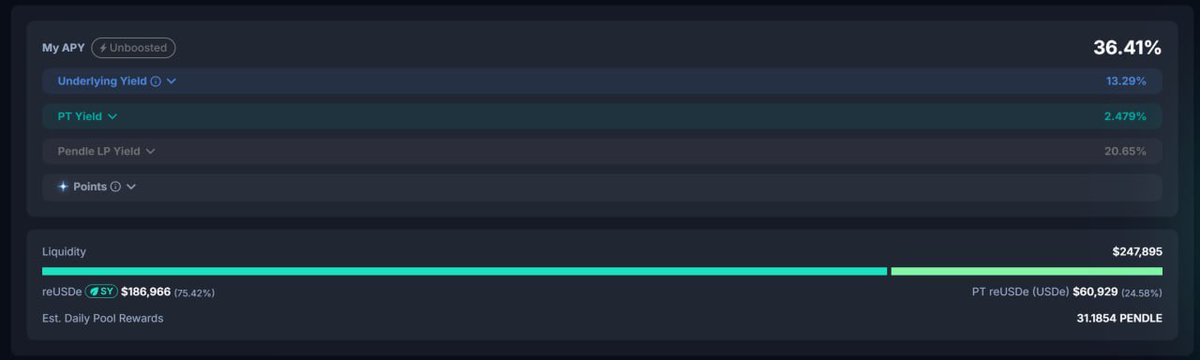

Currently, the Pendle Pool has only about $248K, which might be why the initial LP interest rate is 80% including boosting, and mine is about 36% unboosted.

If you're interested, please check out @re.

However, they require KYC. I was surprised to see that KYC is required for deposits, but fortunately, it only takes about 5 minutes, and then they give it right away.

Ethena x Re

$USDe / $sUSDe of @ethena_labs now can be deposited to @re

What is Re?

- 'Reinsurance' RWA Protocol

- $21M investment from Electric Capital, Framework, and others

- TVL $135M (but not tracked on @DefiLlama yet)

- Website claims to offer additional interest of up to 23%.

- KYC required for deposits

- 40 days lockup on deposits

According to the docs, the deposited assets are invested in risk pools that invest in various reinsurance contracts and earn interest based on fees and premiums

First of all, the current contract is with Ethena, which seems to insure Ethena's assets.

Other reinsurances in the real world, such as vehicle insurance, liability insurance, and property insurance, seem to be the original targets.

The surplus assets that are not used for insurance earn interest at $sUSDe for $USDe / $sUSDe, and the rest of the general stable is invested in assets that generate the highest interest at their own discretion.

In addition, they select reinsurance contracts to earn stabilized interest by excluding catastrophic risk contracts such as fires and typhoons.

It seems like a pretty interesting project.

I don't know much about the yield or stability of reinsurance field, but I remember when I interviewed for my first job at Korean reinsurance company "Korean Re" (wow the name Re is becoming interesting now), it was a very profitable and stabilized sector.

Of course, if there is a disaster-level accident due to a wrong contract, you may lose money.

Let's dig down more as it goes!

192

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.