1/

USD₮0 brings omnichain mobility to @Tether_to via @LayerZero_Core OFT standard (no wrapping, no synthetics).

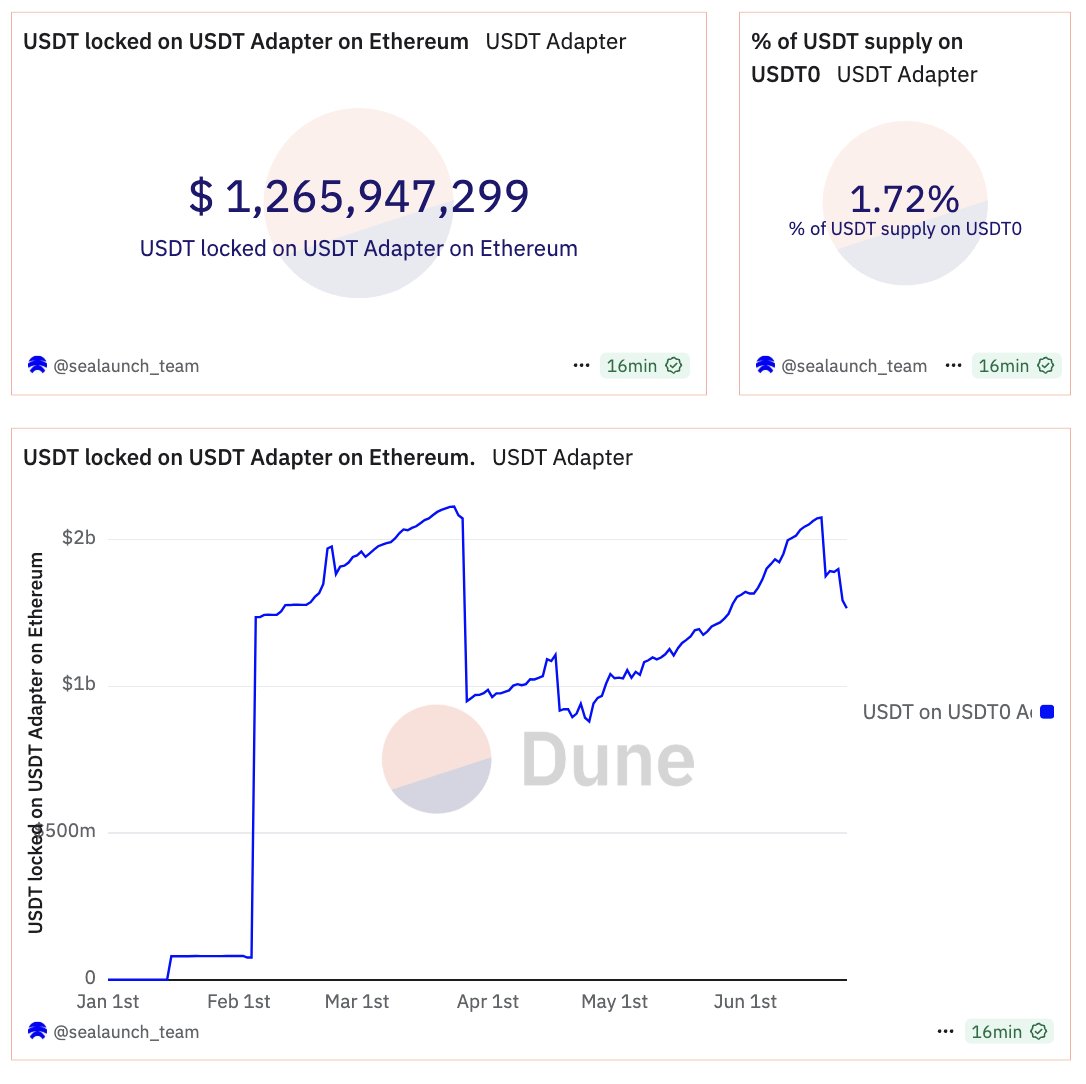

The mechanism is simple: USDT is locked or burned on one chain and minted 1:1 on another.

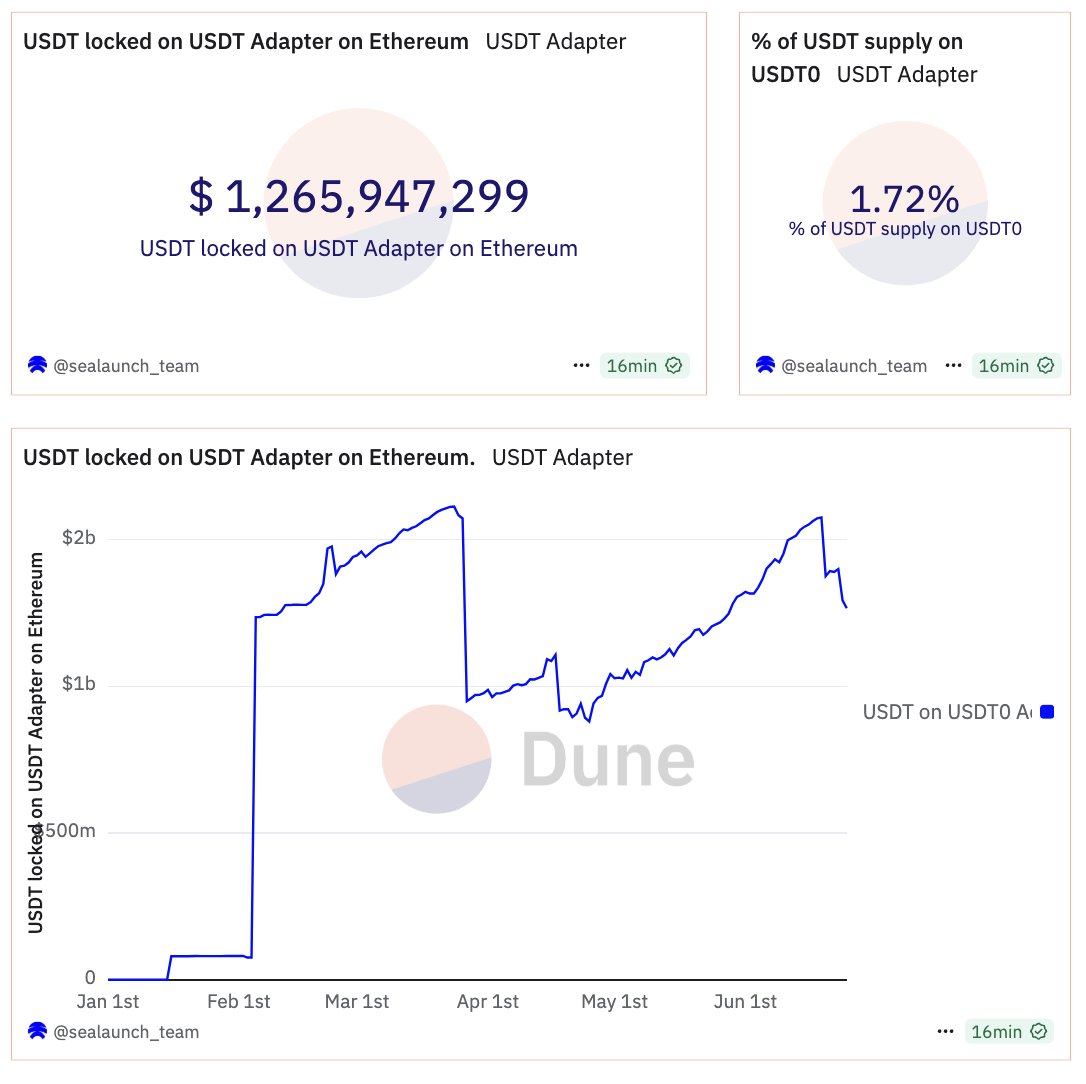

→ On Ethereum, $1.27B in USDT is currently locked via the USDT Adapter smart contract.

→ That’s 1.72% of all USDT supply on Ethereum ($73B), serving as the liquidity base for @USDT0_to.

→ Check USD₮0 @Dune dashboard here:

2/

When a user sends USD₮0 from Ethereum to another chain, USDT is locked in the adapter contract. That action triggers minting on the destination chain. Redemption works in reverse—burn, then release. This ensures native USDT moves securely without duplication.

3/

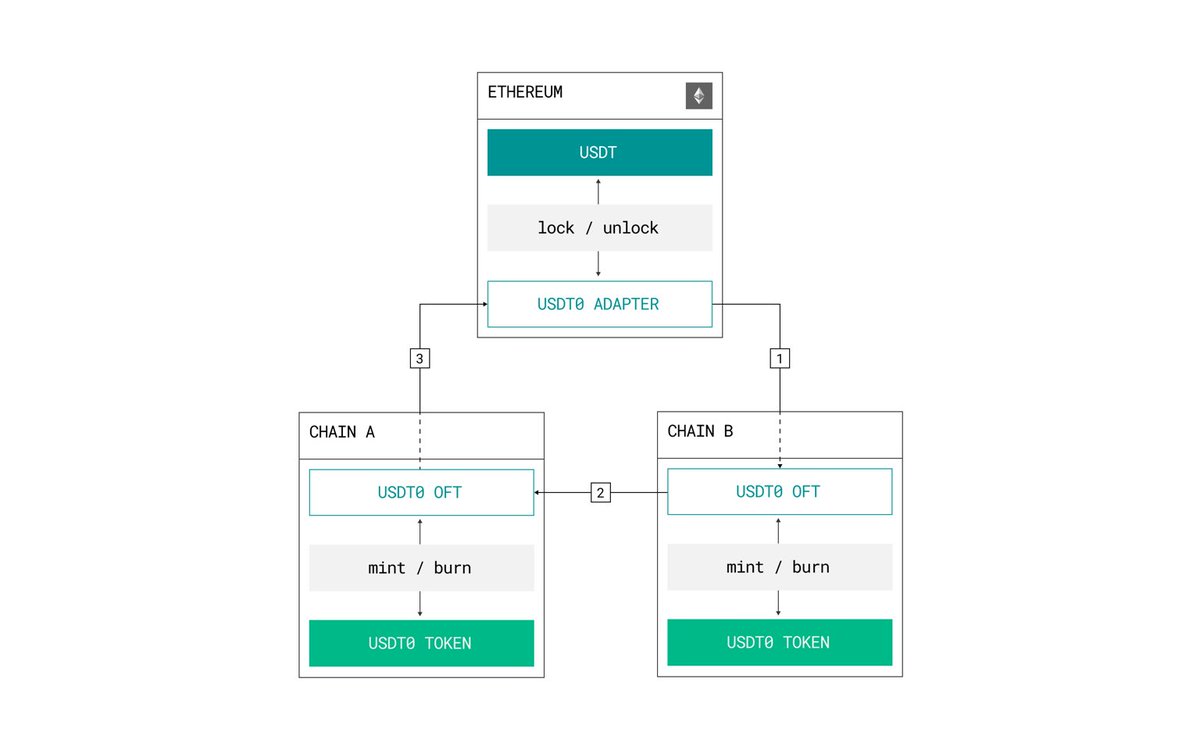

In terms of supply per chain, Arbitrum leads followed by Unichain Flare and Ink.

→ Transfer volume has surged, weekly volume across all chains now exceeds $8B, led by Arbitrum and Unichain. → Unichain alone now drives over 50% of total USD₮0 transfer volume.

→ 2.16M addresses have transacted in the past 30 days (9.3% increase MoM).

4/

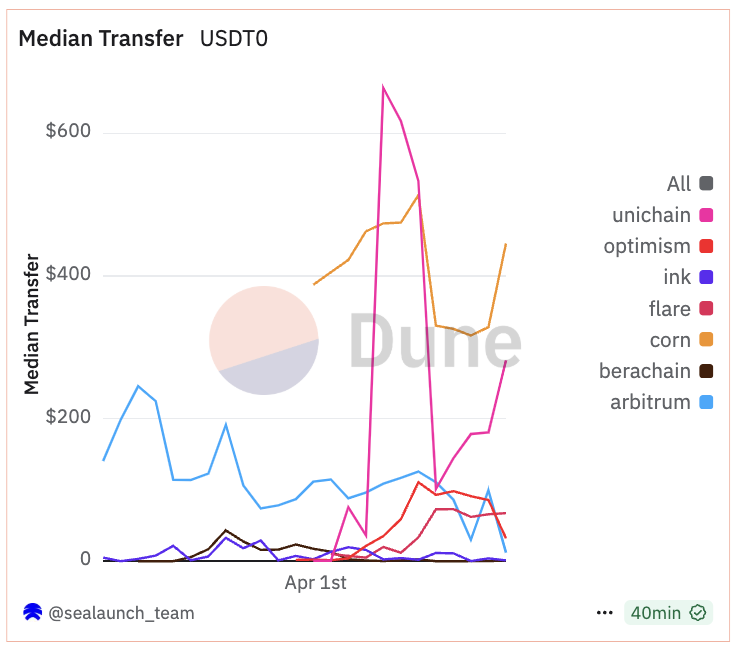

Median transfer size varies widely across chains. Arbitrum, Flare, and Corn show the largest medians, often between $300–$600.

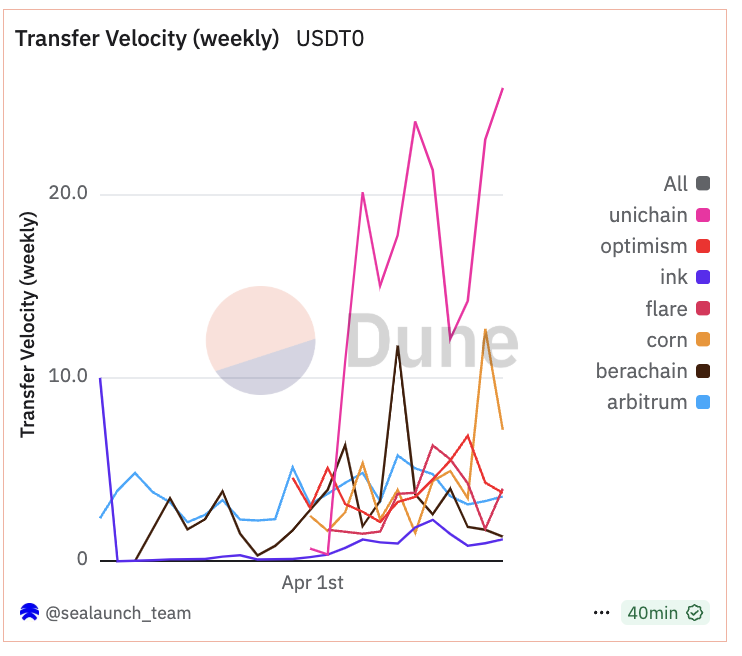

Transfer velocity, which measures how often tokens circulate weekly, is highest on Unichain (>20x), followed by Flare and Corn. High velocity implies efficient capital reuse and active liquidity.

5/

Check USDT0 @Dune dashboard here:

cc @zerolore @paoloardoino @PrimordialAA

4.28K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.