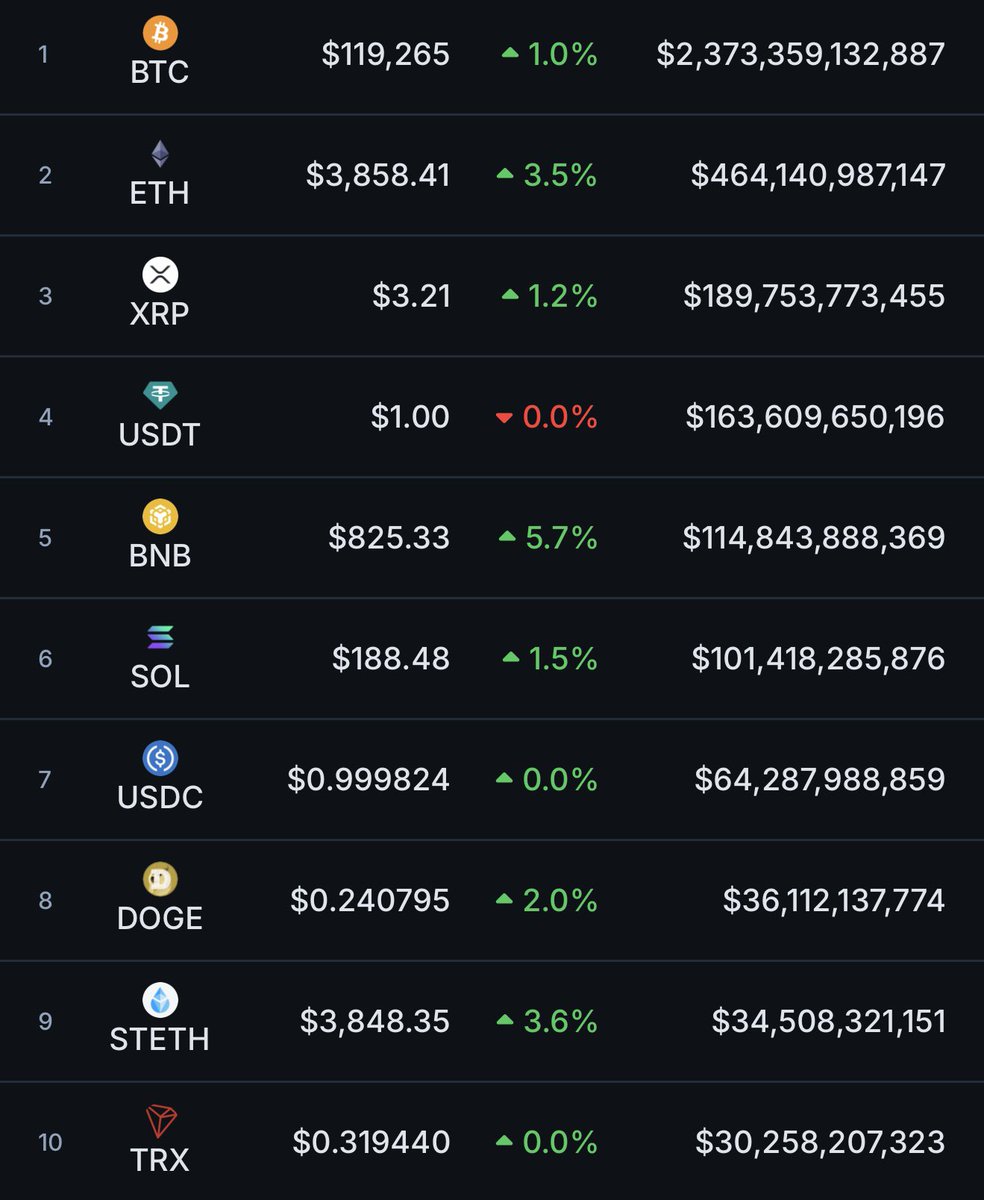

Lido Staked Ether price

in USD$3,805.03

-$8.3300 (-0.22%)

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

Market cap

$34.15B

Circulating supply

8.98M / 8.98M

All-time high

$4,100.91

24h volume

$74.00M

3.6 / 5

About Lido Staked Ether

Lido Staked Ether’s price performance

Past year

+16.47%

$3.27K

3 months

+109.80%

$1.81K

30 days

+56.03%

$2.44K

7 days

+0.07%

$3.80K

Lido Staked Ether on socials

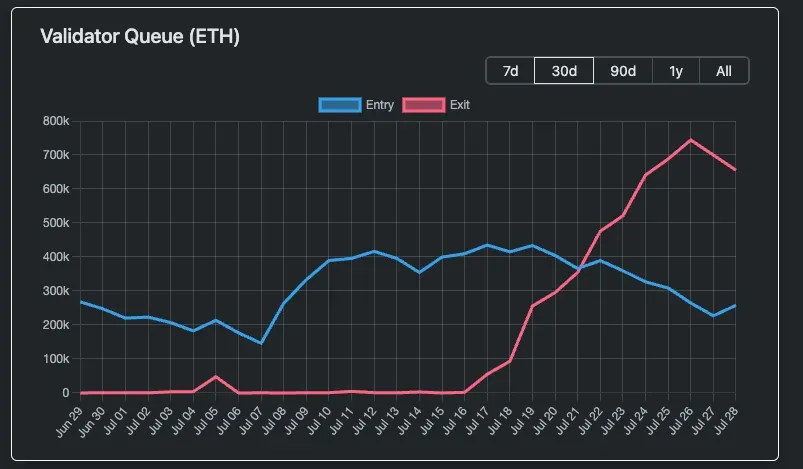

Let's update on the recent issue of Ethereum staking queues that many people are paying attention to, as well as my subsequent thoughts.

The starting point of all this was when @justinsuntron made a large withdrawal of his $ETH deposit on @aave, which directly led to a sharp increase in the platform's lending rates.

This change in rates was a fatal blow to the big players engaging in "circular lending." Let me explain their strategy: they deposit stETH, then borrow ETH, and immediately stake the borrowed ETH to get new stETH... and they keep repeating this, pushing the leverage to the extreme.

So, when borrowing costs skyrocketed, their only option was to "unwind the leverage," which means they had to liquidate urgently. This meant they had to sell a large amount of stETH on the secondary market to repay their loans.

This wave of concentrated selling pressure naturally led to a temporary "decoupling" of the stETH and ETH exchange rates. At this point, arbitrageurs bought stETH at a discount and then queued up at the official platform to unstake and exchange it back for $ETH at a 1:1 ratio.

This is the direct reason we saw a surge in the number of people queuing to exit.

However, there is a crucial time lag here. According to the current queue numbers, the official unstaking takes an average of 11-12 days. If the event started to unfold on July 16, then the $ETH that these arbitrageurs applied to redeem won't actually unlock until at least July 27. This also means that from the 16th to the 27th, the number of people in line will only increase, not decrease, so the red line on the data chart will appear to keep rising.

Therefore, I believe the real indicator will be the trend after July 27. And indeed, we have seen that since that day, the trend of people queuing to exit has started to slow down and gradually decline.

From this perspective, I personally tend to believe that this wave of unlocking pressure is indeed coming from market behavior to deleverage, rather than big players lacking confidence in the future and wanting to dump before $ETH hits $4,000. If it were the latter, then logically, the number of people queuing to exit should remain high.

Thus, in the coming days, everyone can continue to observe this chart to see whether the red line continues to drop or flattens out (which would require extra caution) 📈.

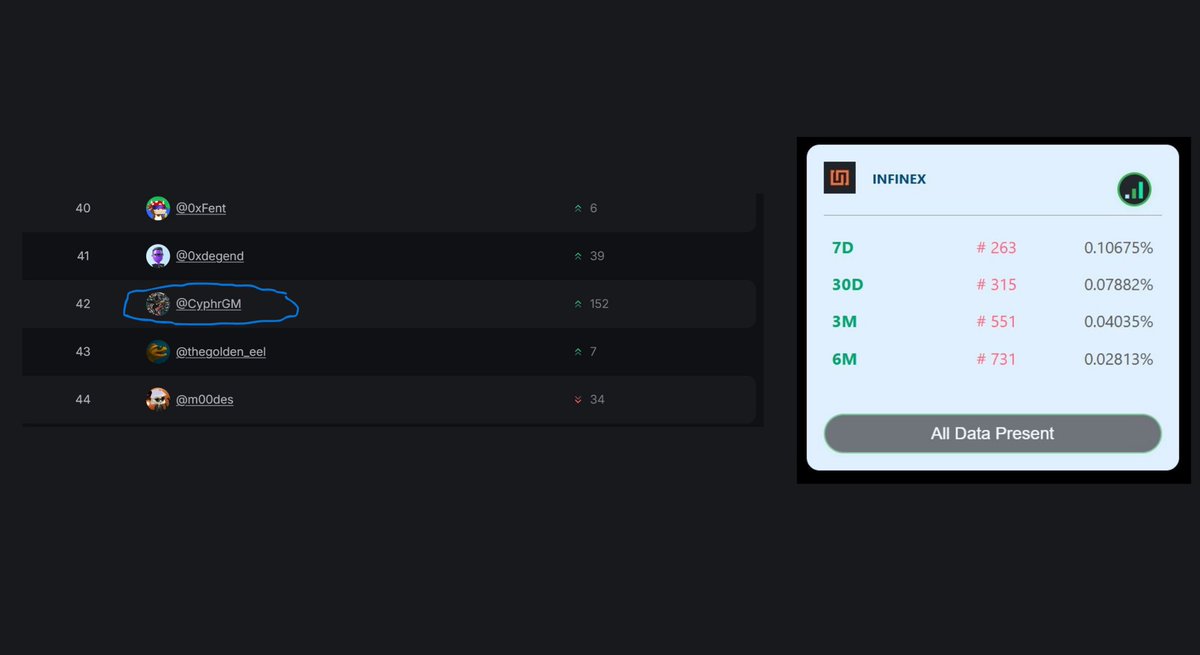

Interesting analysis of my Infinex Yaprun climb.

I hadn't honestly made the connection between my bullrun performance & the jump in ranking but it does make sense.

Takeaway: get good at bullrun as per my last Infinex tweet.

King Arthur

I’m trying to understand the @infinex Yaprun algorithm – Day 2

While reviewing the Yaprun Leaderboard, I noticed that @cyphrGM has climbed 152 places this week, which caught my attention

There’s a huge difference between the @KaitoAI and Infinex rankings

Assuming that the data is updated with a 1-week delay, I checked @cyphrGM’s tweet history over the past 14 days.

He has shared around 7 tweets, and his engagement is quite low.

However, during these 2 weeks, CYPHR managed to place in the Bullrun game twice 👇👇

Based on this analysis, I still have doubts about whether Bullrun and Swidge activities affect the ranking

Either Infinex values originality a lot, or Bullrun and Swidge activities are indeed important factors in the Infinex Yaprun leaderboard

What do you think about this?

If you want me to continue this series, you can support it by liking and commenting

Guides

Find out how to buy Lido Staked Ether

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict Lido Staked Ether’s prices

How much will Lido Staked Ether be worth over the next few years? Check out the community's thoughts and make your predictions.

View Lido Staked Ether’s price history

Track your Lido Staked Ether’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

Own Lido Staked Ether in 3 steps

Create a free OKX account

Fund your account

Choose your crypto

Lido Staked Ether FAQ

Currently, one Lido Staked Ether is worth $3,805.03. For answers and insight into Lido Staked Ether's price action, you're in the right place. Explore the latest Lido Staked Ether charts and trade responsibly with OKX.

Cryptocurrencies, such as Lido Staked Ether, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Lido Staked Ether have been created as well.

Check out our Lido Staked Ether price prediction page to forecast future prices and determine your price targets.

Dive deeper into Lido Staked Ether

stETH, an innovative transferable utility token, embodies a portion of the aggregate ETH staked within the protocol and comprises both user deposits and staking rewards. The token's daily rebasing feature ensures real-time reflection of its share's value each day, facilitating enhanced communication of its position.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Market cap

$34.15B

Circulating supply

8.98M / 8.98M

All-time high

$4,100.91

24h volume

$74.00M

3.6 / 5