Binance just listed $Syrup + $KMNO with seed tag.

Both are lending protocols that have grown a lot recently thanks to the expanding yield market.

$Syrup has made an epic comeback from maple by it's cDeFi design so I want to give some background info.

--------------------------------------

A TLDR 🟠:

> Syrup is an institution facing lending market built by @maplefinance, USP are institutional custody and customized loans.

> $SyrupUSDC is the major product. It is the supplied token on Syrup backed by 170% collateral (87% BTC + 13% of other majors + alts).

> Average Yields is 10% (7% real + 3% points) at $650M AUM, outperforming Aave's at 3.3%. TVL is sitting at $1.2B, ~10x since Jan 2024.

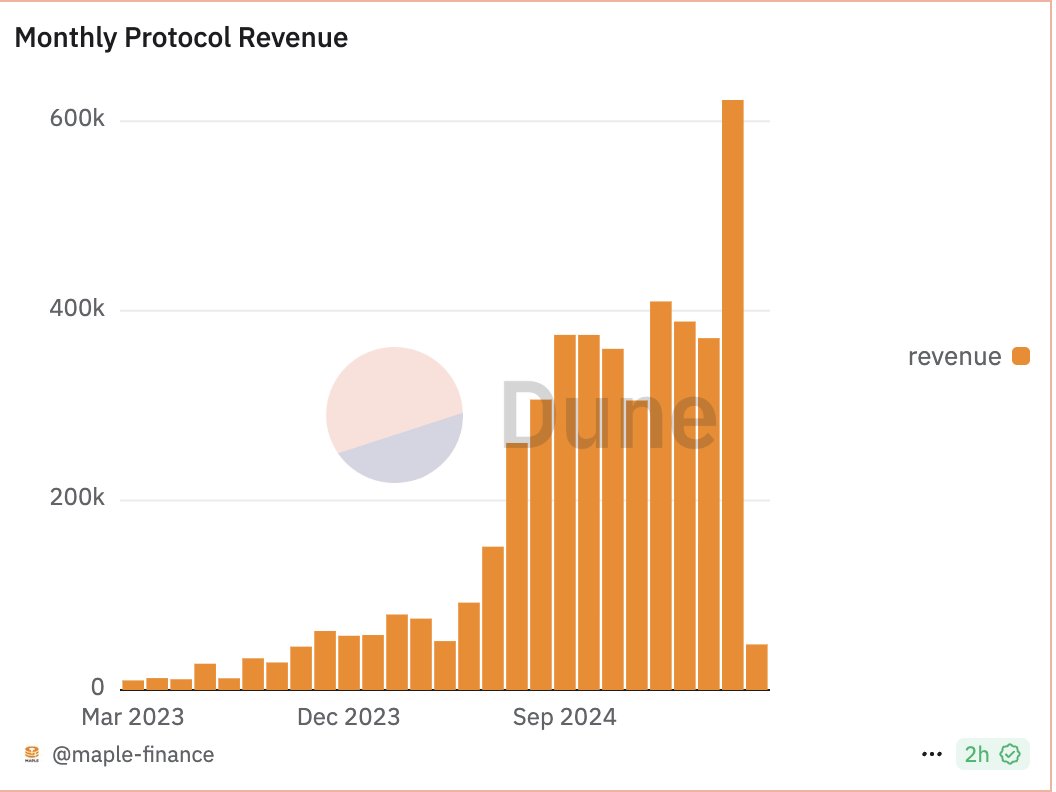

> Revenues comes from 1.0-2.5% of platform loan interest, total revenue is ~$4M since syrup launch and it is growing MoM.

> Partnership including @sparkdotfi that staked $50M in $syrupUSDC for yield, and @BitwiseInvest for defi lending via maple.

> Buyback: 20% of Q1 2025 protocol revenues is used to buyback Syrup and give it back to stakers.

> Total supply is 1.23B token by 2026 (~$266M), with an annual emission of 5% from 2023.

> FDV is ranked 10th in lending category, right behind @eulerfinance but ~40% away from @0xfluid.

--------------------------------------

As everyone knows, onchain lending has been growing since the end of 2023 with new players such as @MorphoLabs .

However, for the onchan lending market to grow even further, I agree with @glxyresearch that it depend on 3 key factors.

1) Expanding on chain yield opportunities

2) More institutional participation

3) Even better capital efficiency

To gain long term market share, Maple needs to establish a clear competitive moat in at least one of these factor, especially lending like @aave building it's own institutional facing product too etc.

Hope the infos help and DYOR. Here are the key supporters: @GLC_Research, @kenodnb, @SquirrelRWA .

9.02K

61

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.