Check out the super detailed analysis article that the official GMX Chinese account @GMXCNofficial has retweeted!

Why is GMX called a reliable tool-based protocol?

In the fiercely competitive DeFi space, where new projects are emerging constantly, what allows GMX to remain a perennial favorite? 👇

GMX: A Small but Powerful DeFi "Leverage Engine"

Can this on-chain "trading artifact" support the next DeFi bull market?

After experiencing the highs and lows of DeFi, today we take another look at GMX and find that it is not a flash in the pan. This decentralized trading platform, which has been around since 2021, has firmly established itself on Arbitrum, Avalanche, and even Solana thanks to its unique design.

The strength of GMX lies not in how fast it runs, but in how long it lasts. Amidst the ups and downs of many DeFi derivatives platforms, it has attracted millions of traders worldwide with its low fees, high leverage, and user self-custody. Let's break down this star project to see where its strengths lie, what risks it faces, and how far it can go.

🌸 ⋆。゚🐾。⋆。 ゚☾ ゚。⋆ 🌸

1️⃣ Non-custodial, low slippage, high leverage: It has everything DeFi players want.

The biggest highlight of GMX is that it is not a traditional "market maker exchange." You won't see it hanging a bunch of order books, nor do you need to deposit coins; users connect directly with their wallets, and all trading happens on-chain, ensuring top-notch security.

In terms of trading experience, GMX focuses on zero slippage spot + perpetual contract trading, with leverage up to 100 times and fees as low as 0.08% to 0.12%, cheaper than Binance. Moreover, you can set stop-loss/take-profit orders and even build positions in batches through TWAP, with even veteran players saying the "experience is very smooth."

It supports many chains, not only its main venue Arbitrum but also Avalanche and Solana, and plans to connect more chains in the future through LayerZero, such as BTC Layer 2 like Botanix, showcasing its ambition.

🌸 ⋆。゚🐾。⋆。 ゚☾ ゚。⋆ 🌸

2️⃣ The liquidity mechanism is very smart: Being an LP is no longer a "losing money fool."

GMX's liquidity mechanism has evolved significantly from V1 to V2:

V1's GLP pool is a multi-asset pool composed of ETH, BTC, and USDC, where liquidity providers (LPs) can earn trading fees and market-making profits. The annualized return rate has consistently remained between 10%-20%, which is already considered stable and high-quality compared to the "air profits" of other DeFi projects.

V2's GM pool + GLV treasury further introduces an asset isolation mechanism to match trading risks as needed. In simple terms, it uses hot money where it counts, improving capital efficiency.

On the price oracle side, GMX relies on Chainlink's low-latency data stream, enabling real-time price feeds and reducing arbitrage risks, which is crucial in high-frequency trading.

🌸 ⋆。゚🐾。⋆。 ゚☾ ゚。⋆ 🌸

3️⃣ Data doesn't lie: $300 billion in trading volume, who dares to say it's small?

Let's look at some solid data:

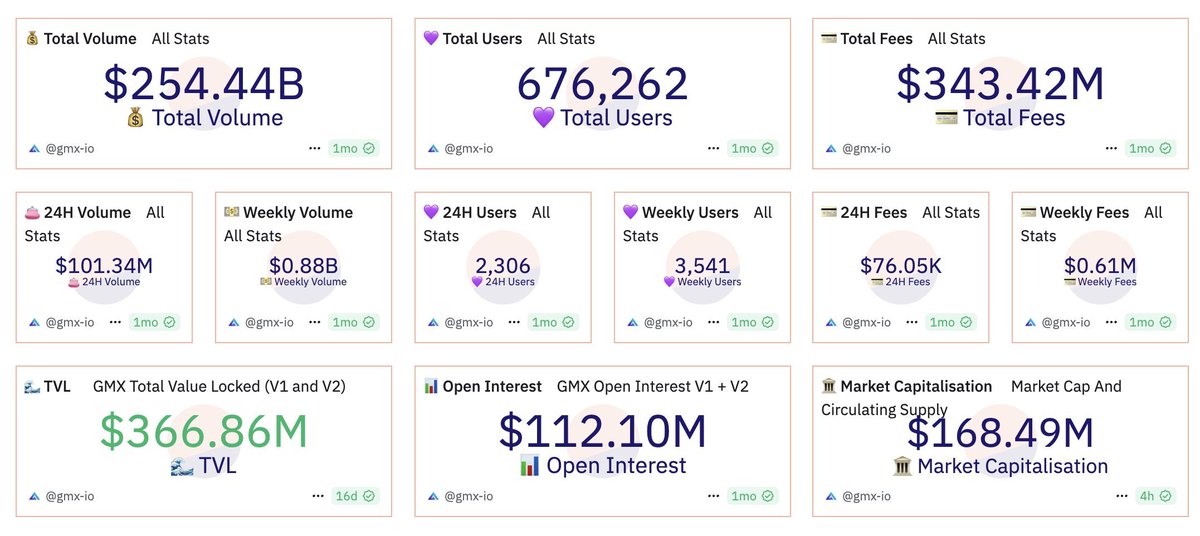

Cumulative trading volume: Surpassing $300 billion, consistently holding the leading position in derivatives on Arbitrum;

User base: About 700,000 people, accounting for 10%-15% of Arbitrum's total active addresses; not monopolizing, but certainly a significant share;

Average daily trading volume: Approximately $120 million in April 2025, still "flowing blood" in a bear market, indicating strong user stickiness;

LP yield: In both GLP and GLV models, annualized returns generally maintain between 10%-20%, higher than most liquidity mining projects.

What do these data points indicate? GMX is not a project that survives on hype; it is a truly "product-oriented DeFi" with real use cases, a user base, and cash flow.

🌸 ⋆。゚🐾。⋆。 ゚☾ ゚。⋆ 🌸

4️⃣ The token mechanism is not complicated, but very "useful."

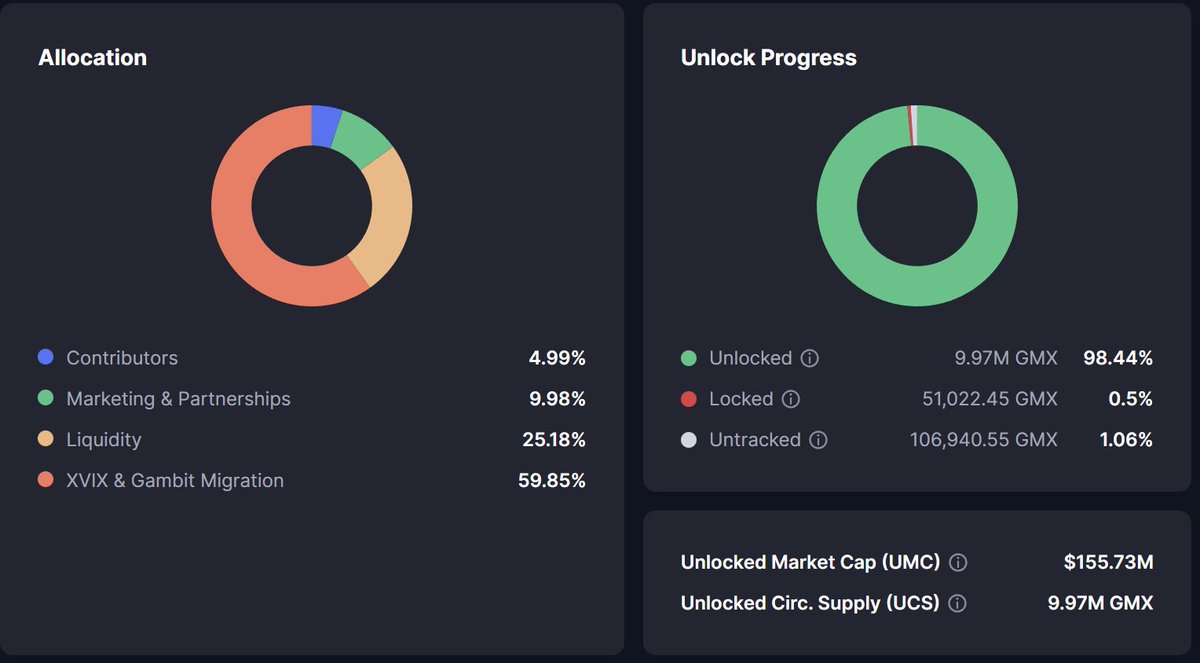

GMX's native token is also called GMX, with a total supply of 13.25 million tokens, of which about 10.1 million are currently in circulation, accounting for 76% of the total supply. The distribution mechanism is also quite restrained, with not much reserved for "cutting leeks":

45.3% is reserved for early migration projects;

15.1% is for providing liquidity to Uniswap;

15.1% is for incentives, and another 15.1% is for the price stability fund;

The team only holds 1.9%, and there is a 2-year linear unlocking period.

GMX holders can participate in governance and stake to earn rewards (including ETH dividends), with an annualized return in the range of 5%-15%, fitting the logic of "investing well and holding on."

🌸 ⋆。゚🐾。⋆。 ゚☾ ゚。⋆ 🌸

5️⃣ "The strong get stronger"? Or "hanging by a thread"? Let's look at the risks.

✅ Clear advantages:

Low fees + good experience: This is GMX's biggest competitive edge, especially after dYdX migrated to Cosmos and the user experience changed, many users have returned to GMX;

Multi-chain layout: The addition of Solana can open up a new user market;

High capital efficiency: V2 introduces a treasury model, preventing LPs from becoming "cannon fodder."

⚠️ But challenges are also significant:

High leverage = high risk: 100x leverage makes GMX a "gamblers' paradise," easily liquidated during large market fluctuations;

Insufficient fee transparency: Some users report that the closing fee rates fluctuate too much, affecting the experience;

Anonymous team: Although open-source + audits are fine, it may not be favorable for institutional funds in the long run;

Intense market competition: dYdX and Hyperliquid are rapidly evolving, especially the latter, which has quickly risen based on market-making experience.

🌸 ⋆。゚🐾。⋆。 ゚☾ ゚。⋆ 🌸

6️⃣ Outlook for 2025: Can GMX on Solana become a new pivot?

By the end of 2025, GMX is expected to complete its ecological deployment on Solana, aiming to increase its trading volume share to 20%-30%. If the Solana ecosystem can continue to expand (from DePIN to gaming to stablecoins), GMX may welcome a second wave of growth.

Additionally, through cross-chain protocols like LayerZero, GMX is also attempting "on-chain traffic redistribution," and even integrating the BTC ecosystem in the future (like Botanix) could bring new trading vitality to the relatively isolated Bitcoin assets.

🌸 ⋆。゚🐾。⋆。 ゚☾ ゚。⋆ 🌸

✅ Summary: It's time to take a serious look at GMX.

GMX is not the trendiest DeFi project, but it is one of the few truly "reliable" tool-oriented protocols. In the current market downturn, fragmented liquidity, and increasing regulatory pressure, it has delivered a solid performance with the simplest combination of "low cost + high leverage + self-custody."

It is not perfect, has risks, but also carries the flavor of long-termism.

For LPs focused on stable returns, traders seeking efficient experiences, or investors looking for undervalued opportunities, GMX is worth adding to your watchlist.

2

15.62K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.